As of 2025, German companies will have to create and send their invoices in electronic format for B2B business. One of the most common is the hybrid ZUGFeRD invoice.

In this article, you will learn what a ZUGFeRD invoice is, how it works, and what advantages it offers. We also explain who should issue ZUGFeRD invoices and how to use them.

What’s in this article?

- What is ZUGFeRD?

- What is a ZUGFeRD invoice?

- How does the ZUGFeRD invoice work?

- Who should issue e-invoices?

- How do companies create ZUGFeRD invoices?

- What are the advantages of ZUGFeRD invoices?

What is ZUGFeRD?

The abbreviation ZUGFeRD stands for “Central User Guide of the Forum for Electronic Invoices Germany.” It is a standardized, hybrid invoice format for e-invoices. The name indicates this is a central user guide, which the Forum for Electronic Invoicing Germany (FeRD) developed in 2014.

FeRD, founded in Berlin in 2010, simplifies and digitizes the exchange of invoices between companies, authorities, and other organizations. Various ministries, associations, and companies helped create FeRD. The Federal Ministry for Economic Affairs and Climate Action (BMWK) continues to support FeRD and also played a significant role in the development of ZUGFeRD.

The ZUGFeRD format is based on the EU Directive 2014/55/EU from April 16, 2014, which regulates the introduction of electronic invoicing in public contracts, as well as the standard EN16931, published on June 28, 2017.

As of version 2.0, ZUGFeRD also integrates the international standard for invoices, the Cross Industry Invoice (CII) of the United Nations Centre for Trade Facilitation and Electronic Business (UN/CEFACT). In addition, ZUGFeRD takes International Organization for Standardization (ISO) standard 19005-3:2012 into account, which specifies the use of PDF/A-3 format for long-term archiving of documents.

What is a ZUGFeRD invoice?

A ZUGFeRD invoice is an electronic invoice based on the ZUGFeRD standard. Humans and machines can read it because it combines two elements in a document: a portable document format (PDF) file and an extensible markup language (XML) record.

ZUGFeRD invoices comply with EU Directive 2014/55/EU, which obliges companies and authorities to process electronic invoices to reduce administrative burdens and increase efficiency. ZUGFeRD invoices also offer companies of all sizes—from small businesses to international corporations—an easily implementable and standardized invoice format.

PDF/A-3 document: This is the visual representation of the invoice humans can read that looks like a traditional invoice.

XML dataset: This is machine-readable data that accounting or enterprise resource planning (ERP) systems can process automatically.

Companies can use the hybrid invoice format in B2B, B2C, and business-to-government (B2G) transactions. It is particularly suitable for companies that want to make their invoicing processes more efficient without having to immediately switch to complex e-invoicing platforms.

How does the ZUGFeRD invoice work?

Before ZUGFeRD, companies mostly sent invoices in the form of scanned copies or as PDF attachments in emails. Then, they had to manually transfer the copies to the accounting software—a time-consuming and error-prone process.

The ZUGFeRD format greatly simplifies this process, as the invoice combines visible and nonvisible data. Both contain information such as the invoice date, invoicing party, amounts, and bank details.

Thanks to the fixed positioning of this data in XML format, accounting programs recognize the exact location of each piece of information. This enables further automatic processing of the invoice data by appropriate software and reduces manual interventions. However, since they can also view ZUGFeRD invoices without special software, companies have the option of processing the invoice manually or mechanically.

Who should issue e-invoices?

Since November 2020, all contracting authorities in Germany have been able to receive and process invoices in an electronic format. This requirement aims to promote the dissemination of e-invoices in business transactions. On the other hand, the obligation to invoice electronically serves to improve transparency and efficiency in the public sector. The previous regulation primarily concerned companies that issue invoices to public administrations and federal authorities.

As of January 1, 2025, an e-invoice obligation applies to the B2G and B2B sectors in Germany. As of 2025, companies that create invoices for other companies and send them through must do so in electronic form. This is a result of the Growth Opportunities Act passed by the Federal Council in March 2024. Among other things, it aims to increase the digitization of business processes and efficiency in the tax system.

However, the obligation to e-invoice is not the same as the obligation to issue a ZUGFeRD invoice. It is just one of many possible invoice formats. Another widely used standard is, for example, the XRechnung, based exclusively in XML format and consisting only of lines of code machines read.

A special rule for e-invoicing applies to small-scale entrepreneurs. In order to allow them a more flexible transition to digital systems, the Annual Tax Act 2024 stipulated that small business owners can continue to send invoices in conventional form. This means, among other things, paper documents or PDF files. However, they must be able to receive and process electronic invoices from other companies. You can find detailed information in our article on the small business owner rule for 2025.

How do companies create ZUGFeRD invoices?

Creating a ZUGFeRD invoice requires a combination of appropriate software and a basic understanding of the format’s structure. It is not advisable to use services that convert PDF files to the ZUGFeRD format. These require you to transfer the invoice data from the PDF via text recognition. This process can introduce errors, so it is generally a better choice to rewrite the invoices.

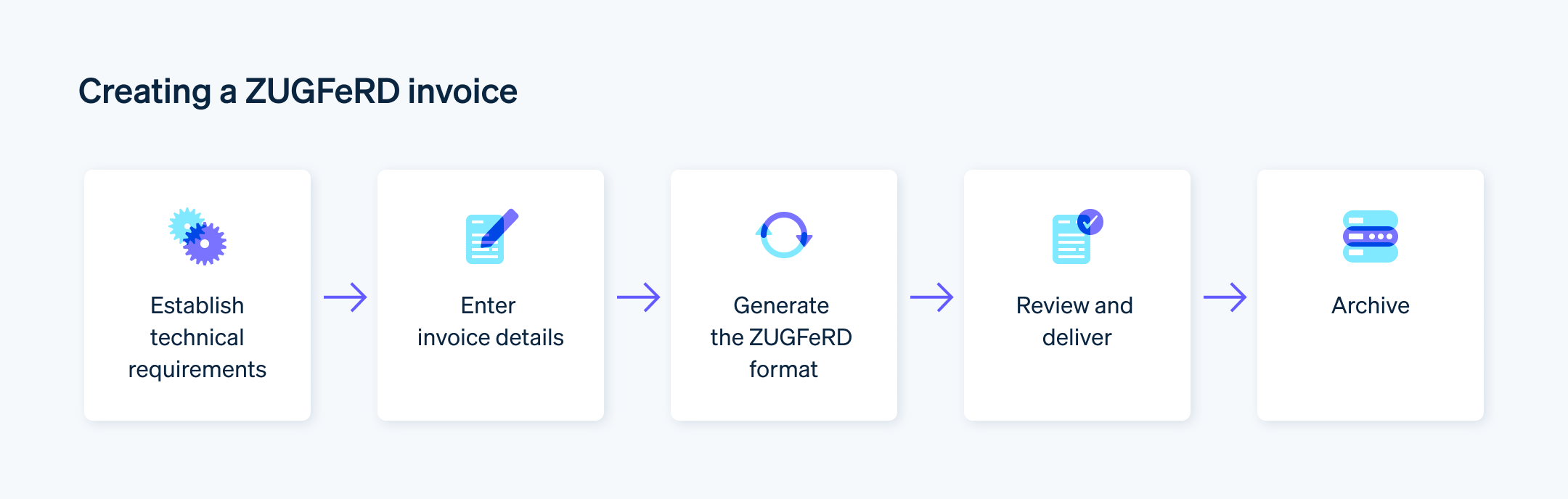

The most important steps when creating a ZUGFeRD invoice are below:

Establish the technical requirements

To create a ZUGFeRD invoice, you need suitable software that supports the format. This can be specialized invoicing software, an ERP solution, or an extension to existing programs.

Enter billing information

The creation of the invoice begins with entering the relevant invoice data. This must include all mandatory information according to Section 14 of the German Value-Added Tax (VAT) Act (UStG):

Complete name and address of the company providing the product or service

Complete name and address of the recipient of the product or service

Date of the invoice

Date of delivery of the product or service

Tax number issued to the supplying company by the tax office or the VAT identification number (VAT ID) issued by the Federal Central Tax Office (BZSt)

Consecutive, unique invoice number

Quantity and type of products delivered or the scope and type of service provided

Applicable tax rate and the corresponding tax amount or a reference to the tax exemption

In addition, you must provide your bank details. Enter this data into the system just like in a classic invoice.

Generation of the ZUGFeRD format

The software generates a hybrid document from the entered data, which contains a PDF document as well as XML data. The XML data complies with the UN/CEFACT international standard and contains the same information as the PDF invoice.

Review and deliver

Before you send the invoice, you should check that all information is correct and the XML data is complete. After that, you can deliver the invoice. Various options are available for this: a file upload, email attachment, or special transmission platform.

Stripe Invoicing can help here: With a Stripe account, you can send electronic invoices quickly, easily, and in a legally compliant manner using the app from Stripe partner Billit. Dispatch is automatic after a one-time setup. In addition, you can view the delivery status of all your invoices at any time and will receive a notification in the event of an error.

Archive

The “Principles for the proper management and storage of books, records, and documents in electronic form” (GoBD) also apply to ZUGFeRD invoices. You must archive the invoices in an audit-proof manner so they are available unchanged at all times during the ten-year retention period.

What are the advantages of ZUGFeRD invoices?

ZUGFeRD invoices offer companies a variety of advantages. Here are the most important ones:

Legal compliance

ZUGFeRD complies with both German and European directives. This means companies can avoid legal risks when they use this e-invoice format.

Compatibility and internationality

ZUGFeRD is based on the international standard UN/CEFACT, which makes it compatible within the EU and worldwide. This is particularly advantageous for companies with international business partners.

Flexibility for companies

The ZUGFeRD invoice is readable as a classic PDF for humans, while the XML data allows automatic processing. This offers companies flexibility, as they can decide how they want to process the invoice. This also means that any human or any machine can read the invoices without special software, unlike, for example, Xinvoices.

In addition, companies can design ZUGFeRD invoices in their corporate branding, unlike XRechnung, which cannot contain graphical elements or individual fonts.

Integration into existing systems

Companies can easily integrate ZUGFeRD into existing ERPs and accounting systems. Many common software solutions already support the format. With ZUGFeRD, companies of all sizes can benefit from digitization without having to introduce complex information technology (IT) structures.

Improved data quality

A fixed standard defines all invoice data, which practically eliminates transmission errors. This enhances data quality.

Time and cost savings

ZUGFeRD can help companies make their invoicing more efficient. The machine-readable XML data allows companies to automatically transfer the invoice data to accounting programs. This reduces manual effort and minimizes errors in data entry. In addition, companies can save on material costs if they no longer print their invoices on paper.

Sustainability

Abandoning paper and physical mail reduces the environmental footprint of companies and promotes more sustainable business.

In summary, ZUGFeRD invoices offer companies an efficient and future-proof solution for invoicing and processing. They combine flexibility with standardization and help streamline administrative processes, reduce costs, and comply with legal requirements.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.