Chargebacks have increased by 20% annually, representing billions of dollars in lost revenue for businesses. These transactional disputes have the potential to disrupt a business’s cash flow, damage its reputation, and impose additional financial burdens.

Recognizing the nuances of the different types of chargebacks and implementing effective prevention strategies can help businesses maintain customer satisfaction and establish a strong foundation for sustainable growth.

What’s in this article?

- What are chargebacks?

- Types of chargebacks

- Merchant error chargebacks

- Chargeback fraud

- Friendly fraud

- Merchant error chargebacks

- How to prevent chargebacks

What are chargebacks?

Chargebacks are a financial transaction reversal that a cardholder or financial institution initiates. Typically, chargebacks are used as a consumer protection mechanism when there is a dispute or fraudulent activity related to a credit or debit card transaction. When a chargeback occurs, the funds that were initially transferred from the cardholder’s account to the business’s account are returned to the cardholder.

There are many reasons why a cardholder might initiate a chargeback, including:

Unauthorized transactions

If a cardholder notices a transaction on their account that they did not authorize or do not recognize, they can request a chargeback to dispute the charge.Fraudulent activity

Chargebacks are often used to address cases of fraud, in which a cardholder’s account information is stolen or used without their consent.Dissatisfaction with goods or services

If a customer is dissatisfied with the quality of goods or services they ordered, they might initiate a chargeback to receive a refund.Nondelivery of goods or services

When a cardholder pays for goods or services but does not receive them as promised, they might request a chargeback to reclaim their funds.

Chargebacks can have serious financial consequences for businesses. In addition to losing the disputed amount(which is returned to the cardholder),businesses may also incur additional fees and penalties associated with the chargeback process. Excessive chargebacks can negatively impact a business’s reputation, increase scrutiny from payment processors, and even cause a company to lose its ability to accept card payments.

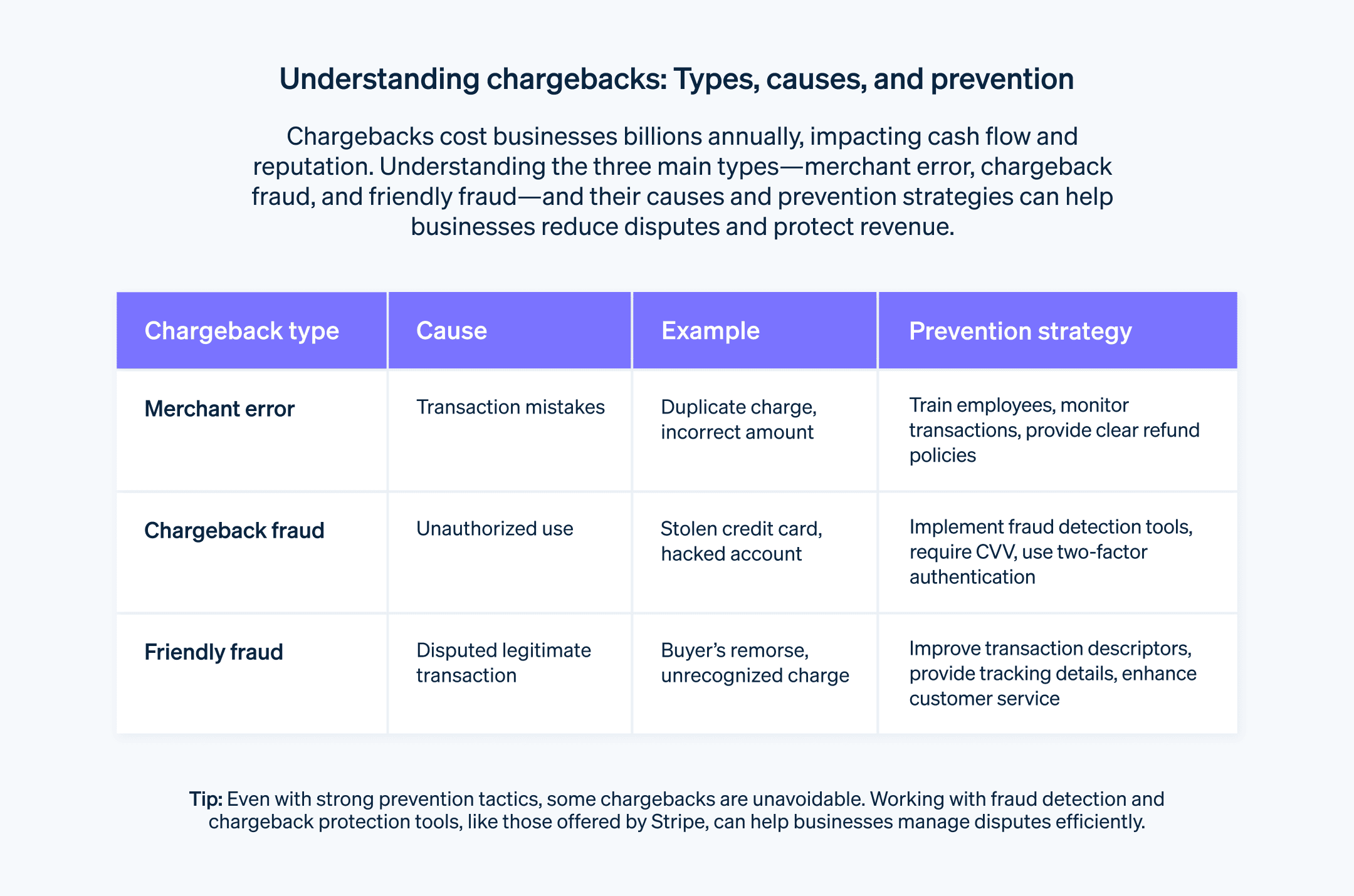

Types of chargebacks

While the mechanism behind every chargeback is the same, the reasons why they happen vary. Understanding these distinctions is a vital step in taking the right measures to prevent them and responding effectively when they do happen. Here are the main categories of chargebacks that affect businesses:

Merchant error chargebacks

Merchant error chargebacks occur when the business makes a mistake during the transaction process, leading the cardholder to dispute the charge. These errors can range from human errors to technical issues. Since the business is responsible for the error, the cardholder initiates a chargeback to rectify the situation.

Here are a few examples of business error chargebacks:

Duplicate charge

In this case, the business accidentally processes the same transaction more than once, charging the customer multiple times for a single purchase. When the cardholder notices the duplicate charges on their account statement, they can initiate a chargeback to dispute the extra charges and request a refund.

Example: A customer makes a purchase at an online store but encounters an error during the checkout process. Assuming the transaction failed, they retry the purchase, resulting in two charges appearing on their credit card statement for the same item.

Incorrect amount charged

If the business charges an incorrect amount for a transaction, whether intentionally or by mistake, the cardholder can dispute the charge through a chargeback. This may happen due to a pricing error, typo, or miscommunication during the transaction process.

Example: A customer agrees to purchase a product for $50, but the business charges $500 for the item by mistake. When the customer notices the overcharge on their credit card statement, they can initiate a chargeback to correct the error.

Noncompliance with card network rules

Card networks like Visa, Mastercard, and American Express have specific rules and regulations that businesses must follow during the transaction process. If the business fails to comply with these rules, the cardholder can initiate a chargeback. Noncompliance can include not obtaining proper authorization, not following proper refund procedures, or breaching the card network’s guidelines.

Example: A business fails to obtain proper authorization for a transaction and proceeds to charge the cardholder’s account without their consent. Upon discovering the unauthorized charge, the cardholder can initiate a chargeback to dispute the transaction.

In business error chargebacks, the responsibility lies with the business to rectify the mistake and resolve the dispute with the cardholder. Businesses should take steps to minimize errors during transactions, maintain accurate records, and promptly address any customer complaints or discrepancies to avoid these chargebacks.

Chargeback fraud

Chargeback fraud occurs when a cardholder’s account is compromised, and a third party makes unauthorized transactions without the cardholder’s knowledge or consent. In these cases, the cardholder is not held liable for the fraudulent charges, and they can initiate a chargeback to reclaim their funds. Here are some examples of chargeback fraud:

Stolen card

When a cardholder’s physical card is stolen and the thief uses it to make unauthorized transactions, the cardholder can report the fraudulent charges to their card issuer and initiate a chargeback.

Example: A thief steals someone’s wallet, which contains their credit card. The thief uses the stolen card to make purchases at various stores. Once the cardholder discovers the card has been stolen and used to make unauthorized charges, they contact their card issuer to report the theft and initiate a chargeback for the fraudulent transactions.

Account hacking

In cases where a cardholder’s account information is obtained through hacking or phishing techniques, fraudulent actors can use the stolen information to make unauthorized purchases. The cardholder can dispute these fraudulent charges by initiating a chargeback.

Example: A cardholder falls victim to a phishing scam and unwittingly provides their account details to a fraudulent actor who then gains access to the cardholder’s account and makes unauthorized online purchases. Once the cardholder discovers the fraudulent activity, they notify their card issuer, who helps the cardholder initiate a chargeback to reverse the charges.

Counterfeit card

Fraudulent actors sometimes create counterfeit cards using stolen account information. These cards resemble real credit cards but are not issued by legitimate financial institutions. Fraudulent actors use these counterfeit cards to make unauthorized purchases, which the legitimate cardholder can dispute through a chargeback.

Example: A fraudulent actor obtains a cardholder’s account information and creates a counterfeit card with the stolen details. The fraudulent actor then uses the counterfeit card to make purchases at different businesses. Once the cardholder notices the unauthorized charges on their account statement, they contact their card issuer and initiate a chargeback to dispute the fraudulent transactions.

In true fraud chargebacks, the cardholder is considered a victim of fraudulent activity. It is the card issuer’s responsibility to investigate the fraud, reverse the unauthorized charges, and take necessary actions to prevent further fraudulent transactions. Cardholders should promptly report any unauthorized activity to their card issuer to ensure a timely resolution and protect themselves from liability for the fraudulent charges.

Friendly fraud

Friendly fraud, also known as chargeback fraud or first-party fraud, occurs when a cardholder initiates a chargeback for a legitimate transaction, either intentionally or due to a misunderstanding or dispute. Unlike true fraud chargebacks, friendly fraud means the cardholder initiates the chargeback, often without a valid reason. Here are some examples of friendly fraud:

Buyer’s remorse

In this scenario, a cardholder makes a purchase but later regrets it or decides they no longer want the product or service. Instead of following the business’s return or refund policy to get a refund, the cardholder initiates a chargeback even if the purchase was legitimate and there was nothing wrong with the product or service.

Example: A cardholder purchases an expensive electronic device but changes their mind after a few days. Instead of going through the proper return process, they dispute the charge and initiate a chargeback to get a refund.

Unauthorized family member

Friendly fraud can occur when a family member or authorized user on a cardholder’s account makes a purchase without the cardholder’s knowledge or consent. In such cases, the cardholder disputes the charge, claiming they did not authorize the transaction.

Example: A cardholder’s teenage child, who is an authorized user on the account, makes a purchase without permission. When the cardholder notices the charge on their statement they dispute it through a chargeback, claiming they did not authorize the transaction.

Digital goods

Friendly fraud is particularly prevalent with digital goods, such as digital downloads, subscriptions, or online services. With the intention of obtaining a refund, cardholders may claim that they did not receive the item or that when it did arrive it was different than advertised, even if the cardholder has already received or used the service.

Example: A cardholder subscribes to an online streaming service, enjoys access to the content for several months, and then initiates a chargeback, claiming they never received the service.

Friendly fraud can be challenging for businesses to combat because it often involves the cardholder making a dispute based on a subjective claim. However, there are steps businesses can take to prevent, detect, and respond to these types of disputes.

How to prevent different types of chargebacks

Different kinds of chargebacks require different preventative tactics. While most businesses will incur some volume of chargebacks no matter what preventative measures they take, you’re not powerless against chargebacks. For a deeper dive into preventing chargebacks, read our guide.

Below is a rundown of some important steps businesses can take to minimize chargebacks of all kinds.

Preventing business error chargebacks

Preventing business error chargebacks involves implementing robust systems and practices to minimize mistakes during the transaction process. By focusing on accuracy, communication, and customer satisfaction, businesses can reduce the number of chargebacks that result from their own errors. Here are some effective strategies to prevent business error chargebacks:

Accurate transaction processing

Train employees

Train your staff on payment processing systems and procedures. They should be familiar with how to accurately process transactions, including how to verify payment details, check for potential errors, and obtain proper authorization.Implement quality control measures

Establish internal checks and balances to review transactions before they are processed. This can involve requiring multiple individuals to verify the accuracy of transaction details and ensure that all necessary information is entered correctly.

Clear and transparent communication

Provide detailed product descriptions

Clearly communicate product or service details, including features, specifications, and limitations, to avoid potential misunderstandings.Disclose pricing and fees

Clearly display the prices, fees, and any additional charges associated with the transaction. Avoid hidden or unclear pricing practices that can lead to customer confusion or dissatisfaction.Transparent refund and cancellation policies

Make your refund and cancellation policies easy to access and clearly state the procedures that customers should follow if they need to request a refund or cancel an order.

Prompt customer service and dispute resolution

Provide accessible customer support

Make it easy for customers to contact your customer support team through various channels such as phone, email, or live chat. Respond promptly to customer inquiries, concerns, and disputes so you can address any issues before they escalate and result in chargebacks.Resolve disputes amicably

Actively work with customers to address their concerns or complaints. Be as understanding and flexible as possible and provide fair resolutions that prioritize customer satisfaction and loyalty.

Robust order fulfillment and delivery

Accurate order processing

Ensure that orders are fulfilled accurately, from selecting the correct products to packaging them securely and including all necessary components or accessories.Reliable shipping and tracking

Use reputable shipping methods and provide tracking information to customers so they can monitor the progress of their shipment, which reduces the likelihood of disputes around nondelivery.

Documentation and record keeping

- Maintain transaction records

Keep comprehensive records of all transactions, including order details, customer information, proof of delivery, and any related communication. These records can serve as evidence in the event of a dispute or chargeback and help to resolve any issues promptly and accurately.

Payment system monitoring

Monitor for technical issues

Regularly review and monitor your payment systems for any technical glitches or errors that could result in overcharging, duplicate charges, or other inaccuracies.Conduct periodic audits

Conduct internal audits to identify and address potential errors or discrepancies in your transaction processes.

By implementing these strategies, businesses can minimize errors during the transaction process and reduce the likelihood of chargebacks resulting from business mistakes. Paying close attention to accuracy, transparency, customer satisfaction, and proactive issue resolution can contribute to a positive customer experience and mitigate the risk of chargebacks.

Preventing chargeback fraud

Preventing true chargeback fraud involves implementing measures to identify and prevent unauthorized transactions by fraudulent actors. While it is impossible to completely eliminate true fraud, businesses can take steps to minimize it, including:

Robust fraud detection systems

Use fraud prevention tools

Implement advanced fraud detection systems that employ machine learning algorithms and behavioral analytics to identify potentially fraudulent transactions. These systems can flag suspicious patterns and high-risk transactions for further review.Employ address verification

Use Address Verification Service (AVS) to verify the billing address that the cardholder provides during the transaction. Mismatched addresses can indicate potential fraud.Use card verification methods

Require customers to provide the Card Verification Value (CVV) code, which is printed on the back of the card, during the transaction. This adds an additional layer of authentication and helps ensure the customer possesses the physical card.

Strong customer authentication

Implement two-factor authentication

Require that customers go through an additional layer of authentication, such as providing a one-time password sent to their registered mobile device, to validate their identity during high-risk or seemingly suspicious transactions.Implement biometric authentication

Explore biometric authentication methods, such as fingerprint or facial recognition, for customer verification during transactions conducted through mobile devices or other compatible platforms.

Transaction monitoring and risk scoring

Monitor transaction patterns

Monitor transaction data and customer behavior for any anomalies or patterns that deviate from normal purchasing patterns. Unusual transaction volumes, multiple transactions made from different geographic locations within a short time, or inconsistent buying patterns may indicate fraudulent activity.Implement risk scoring

Assign risk scores to transactions based on different factors, such as transaction amount, location, customer history, and product type. Subject high-risk transactions to additional verification or review before you approve them.

Educate and train employees

Train staff on fraud prevention

Educate your employees about common fraud indicators, warning signs, and best practices to identify potentially fraudulent transactions. Make sure they understand what steps to take when they suspect fraud.Stay updated on fraud trends

Keep your team informed about the latest fraud techniques, trends, and emerging threats through regular training sessions and industry resources. This knowledge can help them stay vigilant and adapt to evolving fraud tactics. If you work with a payment processing provider with exceptional fraud detection and prevention capabilities, such as Stripe, they will handle this responsibility for you.

Secure payment infrastructure

Maintain secure systems

Make sure your payment infrastructure is up-to-date and adheres to industry standards for data security. Use secure payment gateways and follow Payment Card Industry Data Security Standard (PCI-DSS) guidelines to protect cardholder data from unauthorized access.Encourage customer security measures

Educate your customers about the importance of maintaining strong passwords. Regularly monitor their account activity and promptly report any suspicious transactions to the card issuers.

Collaboration with payment processors and networks

- Stay informed about fraud alerts

Regularly communicate with your payment processor and card networks to stay updated on fraud alerts, industry best practices, and recommended fraud prevention measures. Work with them to implement additional security measures and risk mitigation strategies.

These strategies enable businesses to enhance their fraud prevention capabilities and reduce the likelihood of true fraud chargebacks. But it’s important to strike a balance between fraud prevention and providing a frictionless customer experience. Strong fraud prevention measures should not create unnecessary hurdles for legitimate customers.

Preventing friendly fraud chargebacks

Preventing friendly fraud can be challenging since this type of chargeback means the cardholder is intentionally exploiting the chargeback process. However, businesses can implement certain measures to minimize the occurrence of friendly fraud, including:

Clear and transparent communication

Provide detailed product descriptions, terms of service, refund policies, and delivery/shipping information on your website. Make sure that the cardholder has a clear understanding of what they are purchasing and what to expect to minimize misunderstandings that could lead to unwarranted chargebacks.Robust customer service

Establish reliable customer support channels, such as email, phone, and live chat to address any concerns or disputes promptly. Responding to customer inquiries and complaints in a timely and helpful manner can help resolve issues before they escalate to chargebacks. Excellent customer service can discourage cardholders from resorting to chargebacks as their first course of action.Order confirmation and delivery tracking

Send automated order confirmation emails to customers immediately after they make a purchase, including details such as order number, product description, and shipping information. Provide tracking numbers for shipped orders so that customers can monitor the delivery status. These measures can help establish proof of purchase and delivery, making it harder for cardholders to falsely claim nonreceipt of goods.Enhanced transaction descriptors

Make sure your business name or transaction descriptors on card statements are easily recognizable by cardholders. Clear and recognizable descriptors can reduce the chances that a customer will initiate a chargeback because they do not recognize the transaction on their statements.Customer authentication

Implement additional security measures to verify the cardholder’s identity during the transaction process. This can include requesting CVV codes, implementing two-factor authentication, or using advanced fraud detection systems to detect suspicious or high-risk transactions. These measures can help deter fraudulent actors and make it more difficult for unauthorized individuals to make fraudulent purchases.Evidence collection

Maintain detailed records of transactions, customer interactions, order confirmations, shipping information, and any other relevant data. In the event of a dispute or chargeback, you can use this documentation to help prove a charge is legitimate and potentially refute unwarranted chargebacks.Chargeback representment

If you believe a chargeback is unjustified or falls under the category of friendly fraud, consider disputing the chargeback through the representment process. Provide all relevant evidence, such as transaction records, communication logs, and delivery information to support your case. Learn more about how Stripe works with businesses to navigate the representment process.Data analysis and pattern recognition

Monitor transaction data and look for patterns or anomalies that may indicate friendly fraud. Analyze customer behavior, purchase history, and other relevant data to identify red flags. Identifying suspicious patterns early can help you take strong and effective steps to prevent chargebacks. Since much of this tracking and reporting is built into Stripe solutions for businesses, working with Stripe streamlines this scope of work for businesses.

While these strategies can help reduce the occurrence of friendly fraud, it’s important to remember that friendly fraud is often the product of existing inadequacies or inefficiencies in a business, such as failure to communicate terms and return policies with customers and inaccessible customer service. Businesses cannot manage chargebacks successfully without also considering the broader conditions that might contribute to them. Learn more about Stripe’s Chargeback Protection.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.