Businesses tend to become more dynamic and complex as they grow, which can mean increased payment volumes, diversification of payment methods, and additional revenue streams through new products and services. These changes can significantly impact a business’s financial statements and require an agile, nuanced approach to accounting that can accommodate numerous intricacies at each stage of growth.

Revenue recognition is a concept with practical applications for all businesses. But for certain types of businesses, a particular method of revenue recognition is necessary to maintain compliance with ASC 606 accounting standards. Here’s what you need to know about ASC 606, including what it is, why it’s important for businesses, and the five-step process that can help you stay compliant within the ASC 606 framework.

What’s in this article?

- What is revenue recognition?

- What is ASC 606?

- Why does ASC 606 compliance matter for businesses?

- The five-step model for ASC 606 revenue recognition

- Identify the contract with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price

- Recognize revenue when the entity satisfies a performance obligation

- Identify the contract with a customer

- Revenue Recognition with Stripe

What is revenue recognition?

Revenue recognition is a generally accepted accounting principle (GAAP) that defines when and how a business’s revenue should be recognized. Revenue recognition defines the accounting period to which a business’s revenue and expenses are attributed. However, given the complexities and variations in revenue due to factors such as timing and certainty, correctly recognizing revenue can be a challenging process. In fact, 40% of finance leaders surveyed in our recent study reported their finance teams spending over 10 hours each month correcting errors or discrepancies to reconcile their data.

This highlights the importance of accurate revenue recognition, which aims to standardize how businesses structure their revenue accounting, dictating that revenue should be recognized in the accounting period during which the revenue is earned and realized (or realizable), which might happen before or after the payment is received.

What is ASC 606?

Accounting Standards Codification (ASC) 606 provides businesses with a universal framework for recognizing revenue from customer sales. The ASC 606 standards affect pricing and customer contracts for both private and public businesses and describe how to recognize the revenue from those contracts.

In May 2014, the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) jointly released ASC 606. They designed ASC 606 to solve the complicated challenge of aligning the revenue reporting practices of businesses across industries, despite variations in how revenue functions within different sectors and businesses. ASC 606 creates a shared understanding of revenue recognition that accommodates revenue’s inherent complexities.

Why does ASC 606 compliance matter for businesses?

Revenue recognition in compliance with ASC 606 is a useful way for many businesses to get a clear picture of their financial health. By following ASC 606, businesses can ensure that revenue is recognized in accordance with the actual delivery of goods or services. This prevents premature or delayed revenue recognition, which can distort financial performance.

ASC 606 also provides standardization that makes it easier to compare financial statements, offering guidance for investors, analysts, and other stakeholders. Investors and analysts rely on financial statements to make informed decisions, and ASC 606 compliance assures them that the company’s revenue figures are reliable and comparable with those of other companies, facilitating better investment decisions.

ASC 606 is especially important for the following types of businesses:

- Public companies or large businesses with over $25 million in annual revenue; these businesses are legally required to comply with ASC 606, GAAP, and International Financial Reporting Standards (IFRS)

- Startups that might need to follow accrual accounting principles to raise money from investors or apply for a bank loan

- Subscription- and service-based businesses selling digital or physical goods that customers pay for up front, before receiving the goods or services

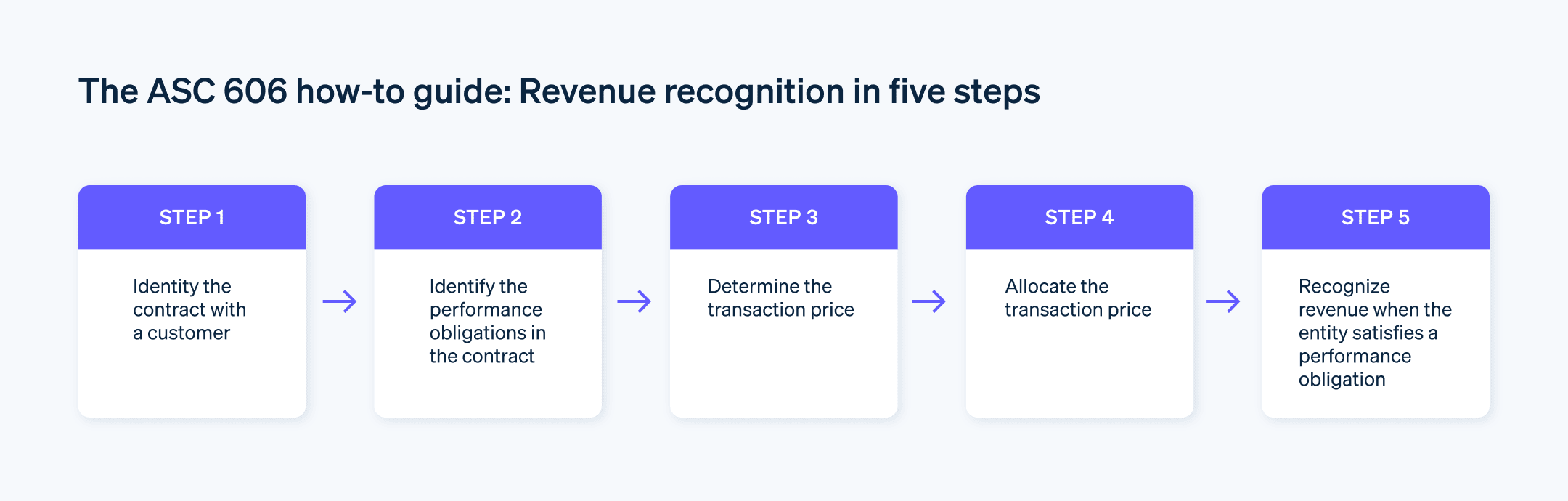

The five-step model for ASC 606 revenue recognition

For subscription businesses that need to manage changes to customers’ subscriptions, refunds, disputes, and prorations, revenue recognition can be especially complex. Updates to customer subscriptions can complicate the process of recognizing and deferring revenue accurately. To help cut through this complexity, the following steps are useful for helping subscription businesses recognize revenue consistently and methodically.

1. Identify the contract with a customer

This step details the criteria that must be met when a business first enters into a contract with a customer to deliver goods or services. Per ASC 606, the key components of the contract are:

- The parties to the contract have approved the contract (in writing, orally, or in accordance with other customary business practices) and are committed to perform their respective obligations.

- Both the business and customer can identify each other’s rights regarding the goods or services to be transferred.

- Both parties can identify the payment terms for the goods or services to be transferred.

- The contract has commercial substance—that is, the risk, timing, or amount of the entity’s future cash flows are expected to change as a result of the contract.

- The business is likely to collect the payment to which it’s entitled in exchange for the goods or services it will transfer to the customer.

2. Identify the performance obligations in the contract

Performance obligation is the promise the business makes to transfer goods or services to the customer. During this step, businesses should itemize every distinct performance obligation. A good or service is considered distinct when it’s of value to the customer and can stand alone and be transferred independently of other goods or services in the contract.

3. Determine the transaction price

The next step is to calculate the transaction price. The transaction price can include cash and non-cash compensation that the business will receive from the customer, per the contract. Businesses should factor in any discounts, prorations, upgrades, or pricing customizations.

4. Allocate the transaction price

In this step, businesses distribute the total transaction price across the unique performance obligations in the contract. For subscription-based transactions that use recurring payments, the performance obligation is continuous, which makes proper deferment and allocation especially complex—and important.

5. Recognize revenue when the entity satisfies a performance obligation

This step specifies that revenue should be recognized as each performance obligation is met, as opposed to when the contract is initiated or when the funds associated with the contract are received. Here are two examples:

For a single performance obligation:

If a customer purchases a made-to-order sofa that will take 12 weeks to build and ship, the revenue from that contract should be recognized in the accounting period when the order is fulfilled, not when the order was originally placed.For a continuous performance obligation:

If a customer signs a contract committing to a year of subscription software service at a rate of $29 per month, then the business should attribute each month’s payment to its respective accounting period. The business should not treat the entire year’s worth of fees as a lump sum to be recognized in the period during which the contract was signed.

Revenue Recognition with Stripe

Even though the five-step process makes ASC 606 compliance straightforward in theory, its execution can be messy and error-prone. It’s difficult to manually manage revenue recognition without making mistakes. For most businesses, the best way to tackle this process is finding an automated solution to manage the details of revenue recognition and prepare audit-ready financial statements.

Stripe Revenue Recognition helps businesses streamline accrual accounting and untangle the process of recognizing revenue, without the need for engineering resources or intricate configurations. With minimum effort, you can customize and automate your reporting to stay compliant with ASC 606 and IFRS 15.

Stripe Revenue Recognition gives you access to:

- Recognized and deferred revenue summaries at a glance

- Downloadable accounting reports and waterfall reports

- Interactive revenue numbers for full audit transparency

- Configurable revenue recognition rules and accounting period controls

To learn more about Stripe Revenue Recognition, start here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.