Nivåbaserad prissättning är en strategi som företag använder för att fastställa kostnaderna för produkter eller tjänster baserat på de olika nivåer eller kvantiteter som kunderna köper. Ju mer en kund köper, desto mindre betalar de per enhet. Denna struktur, som är vanlig i alla branscher, är ett sätt för företag att belöna kunder som gör större köp.

Vissa företag som kanske inte har övervägt nivåbaserad prissättning tidigare utnyttjar nu denna modell för att frigöra potential för intäktstillväxt och kundengagemang. Attraktionskraften är tydlig: nivåbaserade prisstrukturer gör det möjligt för företag att vända sig till en bred kundbas, med olika nivåer av värde och service till olika prispunkter. Som noteras i Harvard Business Review är sådana nivåer ofta ett exempel på prissättningstypen Good-Better-Best (eller G-B-B) – ett enkelt sätt att tänka på prissättningsnivåer. Denna strategi maximerar marknadstäckningen och tillgodoser även en kunds betalningsvilja, vilket kan öka den totala försäljningsvolymen.

Nivåbaserade prissättningsmodeller erbjuder företag stabilitet. Genom att erbjuda kunderna alternativ kan företag omvandla kunder som gör ett enda köp till återkommande köpare på olika nivåer. Denna variation bidrar till mer exakta ekonomiska förutsägelser, samt förbättrad resursfördelning. De flera ingångspunkterna för nivåbaserade priser gör det möjligt för kunder att skala upp sitt engagemang för ett varumärkes produkter eller tjänster, vilket kan leda till att kunder uppgraderar till högre nivåer när deras behov växer.

Nivåbaserad prissättning kan gynna företag på betydande sätt. Utmaningen med nivåbaserad prissättning ligger i dess genomförande: att skapa en prisstruktur involverar många intressenter. Denna process kräver att man analyserar produkt- eller tjänsteerbjudanden och förstår kundbasen och marknadens specifika krav. Nedan tar vi upp vad företag bör veta om nivåbaserade prissättningsmodeller, inklusive vilka företag som kan använda dem mest effektivt och hur man väljer rätt modell för att möta affärsmål och marknadsbehov.

Vad innehåller den här artikeln?

- Hur fungerar nivåbaserad prissättning?

- Hur du beräknar nivåbaserad prissättning för ditt företag

- Fördelar med att använda nivåbaserad prissättning

- Utmaningar med att använda nivåbaserad prissättning

- Nivåbaserad prissättning jämfört med andra prismodeller

- Hur man maximerar vinstmarginaler med nivåbaserad prissättning

- Bästa praxis för nivåbaserad prissättning

Hur fungerar nivåbaserad prissättning?

Med nivåbaserade priser sätter ett företag priset för den första nivån av en produkt till ett visst pris. När kunderna köper mer går de vidare till nästa nivå, där priset per enhet är lägre. Om en kund till exempel köper programvarulicenser kan de första 10 kosta 100 USD vardera, men om de köper 20 kanske alla licenser kostar 90 USD vardera.

Varje prisnivå representerar ett steg på en stege. I takt med att kunderna klättrar på stegen ökar det totala priset – tillsammans med produktkvantiteter eller fördelar för köparen. Ett programvaruföretag kan till exempel erbjuda ett grundläggande paket på den lägsta nivån med standardfunktioner. Nästa nivå kan innehålla mer avancerade funktioner och högre användningsgränser för ett högre totalpris. Den översta nivån kan innehålla alla möjliga funktioner, de högsta användningsgränserna och premiumsupporttjänster.

Hur du beräknar nivåbaserade priser för ditt företag

Att beräkna nivåbaserade priser för ditt företag är en strategisk process där du matchar dina produkter eller tjänster med olika kundsegments betalningsvilja – samtidigt som du täcker kostnader och uppnår önskade vinstmarginaler. Eftersom detta kan vara ett stort åtagande avsätter många företag specifika resurser till detta projekt: 63 % av cheferna som svarade på EY:s 2023 Software Pricing Survey har särskilda team för prissättning. Så här fungerar det att utveckla prisnivåer:

Genomför en kostnadsanalys

Börja med att analysera kostnaderna för att producera din produkt eller tjänst. Denna siffra bör inkludera direkta kostnader som material och arbete och indirekta kostnader som omkostnader. Hitta det lägsta pris du kan ta ut för att täcka dina kostnader.Genomför marknadsundersökningar

Genomför marknadsundersökningar för att förstå dina kunders priskänslighet och konkurrenternas prissättningsstrategier. Detta hjälper dig att bestämma realistiska prisnivåer för marknaden.Definiera kundsegment

Identifiera kundsegment som sannolikt har olika behov och betalningsvilja. Så småningom kommer du att rikta in dig på varje prisnivå i ett specifikt segment, från de mest priskänsliga till de som söker premiumalternativ.Bestäm värdeerbjudande

Definiera värdeerbjudandet för varje kundsegment. Vad kommer kunderna på varje nivå att värdera mest? Möjligheterna inkluderar fler funktioner, större kvantiteter eller bättre service. Detta hjälper dig att designa nivåer som kunderna tycker är värda priset.Ställ in prisnivåer

Bestäm antalet nivåer och sätt priset för varje nivå så att det finns en tydlig skillnad i värde mellan var och en. Den lägsta nivån bör täcka alla kostnader för att producera din grundläggande produkt eller tjänst, medan de övre nivåerna bör öka i pris i enlighet med mervärdet och kostnaden för att betjäna.Ange funktioner eller kvantiteter för nivåer

Ange funktioner, kvantiteter eller tjänster för varje nivå. Lägre nivåer kan ha grundläggande funktioner eller begränsade kvantiteter, medan högre nivåer kan innehålla ytterligare funktioner, större kvantiteter eller förbättrade tjänster.Genomför en nyttokostnadsanalys

Utför en nyttokostnadsanalys för varje nivå. Se till att kostnaden för att tillhandahålla produkten eller tjänsten på varje nivå är lägre än det pris du planerar att debitera.Granska och justera

Granska den nivåbaserade prismodellen för att se till att den är rimlig och att fördelarna stiger på lämpligt sätt med priset. Justera efter behov baserat på feedback och ytterligare analys.Kommunicera värdet

Kommunicera värdet av varje nivå till dina kunder. Det ska vara tydligt för kunderna vad de vinner på att betala mer.Övervaka och förfina

Efter implementeringen övervakar du prestanda för varje nivå. Hittar kunderna värde på de högre nivåerna? Väljer de flesta kunder det billigaste alternativet? Använd dessa data för att förfina dina nivåer och priser.

Under hela denna process bör du hålla kundens uppfattning om värde i förgrunden. Målet är att erbjuda alternativ som kunderna anser vara rättvisa och i linje med det värde de erhåller, vilket i sin tur kan stödja ett starkt intäktsflöde för ditt företag.

Fördelar med att använda nivåbaserad prissättning

Nivåbaserade priser ger företag flera fördelar, både på kort och lång sikt. Här är de största fördelarna med den här modellen:

Marknadspenetration

Du kan locka en bredare kundbas med priser på basnivå, samtidigt som du även kan nå kunder som söker premiumalternativ. Denna flexibilitet innebär att du inte lämnar pengar på bordet från kunder som skulle vara villiga att betala mer för extra funktioner eller tjänster.Kundtillväxt

Nivåbaserade priser uppmuntrar kundtillväxt inom ditt företag. Kunder kan börja med en grundläggande nivå, men när deras behov växer kan de flytta upp på en högre nivå. Denna naturliga utveckling kan leda till ökade intäkter utan att ständigt behöva skaffa nya kunder.Inkludering

Nivåbaserade priser kan skapa en känsla av inkludering eftersom den rymmer olika budgetnivåer utan att utesluta potentiella kunder. Varje potentiell kund kan hitta en nivå som passar deras budget, vilket kan bredda din marknadsräckvidd.Enkla beslut

Prisnivåer förenklar köpbeslutet för kunderna. Tydliga alternativ gör det lättare för kunderna att jämföra funktioner och bestämma vilken nivå som passar dem bäst, vilket minskar beslutsbördan och potentiellt förkortar försäljningscykeln.Skalbarhet

Nivåbaserad prissättning ger en enkel struktur för att skala upp dina tjänster eller produkter. När efterfrågan ökar eller när du utvecklar dina produkter kan du lägga till nya nivåer eller justera befintliga – enligt en logik baserad på den befintliga strukturen.Lämpliga förväntningar

Med prisnivåer kan du matcha kundernas förväntningar med servicenivåerna. Kunderna ser att om de betalar mer får de bättre service eller fler funktioner, vilket kan bidra till deras övergripande tillfredsställelse.Uppfattning om varumärket

En högre prisnivå kan höja ditt varumärkes status – även om de flesta av dina kunder väljer lägre nivåer – genom att man associerar ditt varumärke med premiumprodukter och -tjänster.Konkurrenskraftig strategi

Med flera prisklasser kan du konkurrera med pris och värde samtidigt, vilket potentiellt kan överträffa konkurrenter som bara arbetar med en enda prisklass.Insikter om kunder

Nivåbaserade priser gör att du kan samla in värdefull data om kundernas preferenser och priskänslighet. Du kan spåra vilka nivåer som är mest populära och anpassa dina produktutvecklings- och marknadsföringsstrategier därefter.

Utmaningar med att använda nivåbaserad prissättning

Nivåbaserad prissättning kommer med sina egna utmaningar. Dessa inkluderar:

Komplex hantering

Att hantera flera prisnivåer kan orsaka hinder för affärsverksamheten. Företag måste hålla reda på olika servicenivåer, kundrättigheter och faktureringsarrangemang, vilket kan påfresta de administrativa resurserna.Förvirring hos kunderna

För många alternativ eller dåligt definierade nivåer kan överväldiga kunderna, vilket leder till att de får svårt att ta beslut. Om kunderna inte enkelt kan avgöra skillnaderna mellan nivåerna eller se värdet i en högre prisnivå kan de välja den lägsta nivån – vilket minskar din intäktspotential.Utebliven försäljning av högre nivåer

Om din nivåbaserade prissättningsmodell inte är utformad med omsorg kan lägre prisnivåer förhindra försäljningen på högre prisnivåer. Kunder kan nedgradera om de uppfattar att den lägre nivån ger bättre värde för deras behov, vilket påverkar din totala lönsamhet.Förutsägelse av intäkter

Att förutsäga intäkter kan vara mer utmanande med nivåbaserad prissättning, särskilt om dina prognoser bygger på att kunder uppgraderar till högre nivåer. Det kommer alltid att finnas en viss osäkerhet kring hur många kunder som kommer att flytta högre upp på prisstegen och hur snabbt detta kommer att ske.Prissättningsbalans

Det kan vara svårt att hitta rätt balans för priset av varje nivå. Om du sätter priset för lågt riskerar du att lämna pengar på bordet, och om du ställer in det för högt kan du skrämma bort potentiella kunder.Värdeuppfattning

Du måste bevisa värdet av högre nivåer kontinuerligt. Om kunderna inte uppfattar fördelarna som värda den extra kostnaden ser de ingen anledning att uppgradera, vilket kan begränsa effektiviteten i den nivåbaserade prismodellen.Risk för varumärket

Om dina premiumnivåer är för dyra kan det skada ditt varumärkes rykte. Kunderna kan tycka att ditt företag är för dyrt eller inte uppfyller deras behov, vilket leder till förlorat förtroende och eventuellt förlust av marknadsandelar.Marknadsanpassning

Det är inte alla produkter eller tjänster som passar in i en nivåbaserad prismodell. Modellen fungerar bäst för produkter med differentierade erbjudanden och för vilka marknaden visar en rad olika behov och budgetar.Utmaningar med omställning

När kunderna väl har vant sig vid en viss prisnivå kan de reagera negativt på förändringar. Om du bestämmer dig för att justera funktioner eller priser riskerar du att göra din kundbas upprörd.

Var och en av dessa utmaningar kräver genomtänkta överväganden och kontinuerlig hantering för att säkerställa att den nivåbaserade prissättningen tjänar sitt avsedda syfte och bidrar till affärstillväxt och kundnöjdhet.

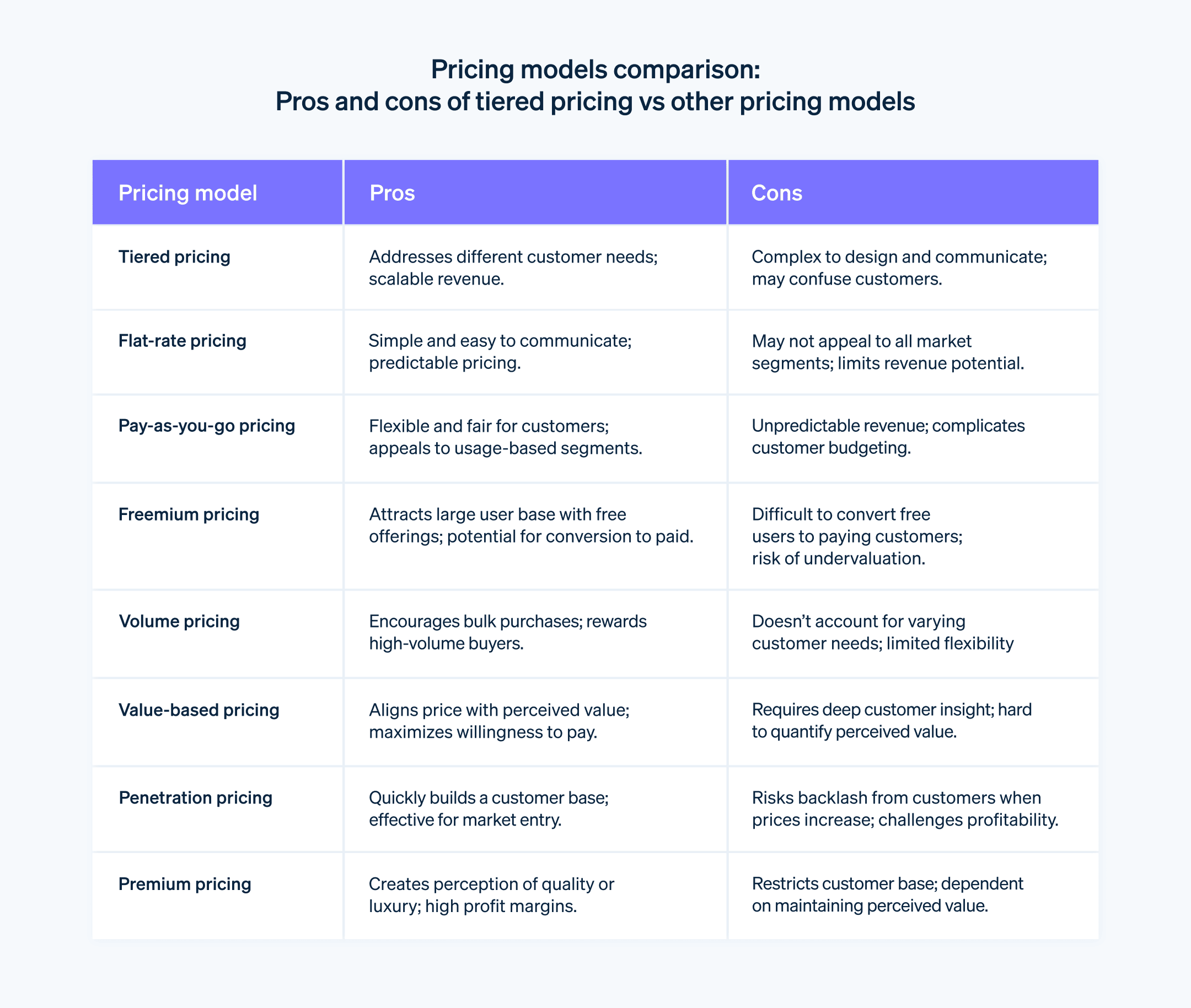

Nivåbaserad prissättning jämfört med andra prismodeller

Som strategi har nivåbaserad prissättning egenskaper som gör att den skiljer sig från andra prismodeller. Men det är långt ifrån det enda sättet att skapa en prismodell för ditt företag. Här är några alternativ:

Fasta priser

Till skillnad från nivåbaserad prissättning debiterar fast prissättning ett enda pris för en produkt eller tjänst, oavsett användning eller kundtyp. Den här modellen är enkel och lätt att kommunicera till kunderna, men den kanske inte tilltalar alla marknadssegment och kan begränsa intäktspotentialen.Pay-as-you-go-priser

Den här modellen debiterar kunder baserat på deras användning. Även om det är flexibelt och rättvist ur kundens synvinkel kan det göra intäkterna oförutsägbara för verksamheten och komplicera budgeteringen för kunderna.Freemium-priser

Med freemium-priser är en grundläggande version av produkten eller tjänsten kostnadsfri, medan avancerade funktioner kräver betalning. Utmaningen är att konvertera gratisanvändare till betalande kunder med premiumfunktioner som är tillräckligt övertygande för att motivera kostnaden.Volymbaserade priser

Volymbaserade priser innebär att man får rabatt baserat på hur mycket man köper. Det är effektivt för att uppmuntra till större köp, men det tar inte hänsyn till kundsegmentens olika behov på samma sätt som nivåbaserade priser gör.Värdebaserad prissättning

Denna modell sätter priser baserat på det upplevda värdet för kunden snarare än på produktens kostnad eller marknadspriser. Det kräver en djup medvetenhet om kunden och kan vara svårt att kvantifiera, men det resulterar i priser som matchar det värde som kunderna tillskriver produkten.Penetrationsprissättning

Ett företag sätter ett lågt pris för att komma in på en marknad och höjer priserna efter att ha fått fotfäste. Detta kan snabbt bygga upp en kundbas, men är riskabelt när det kommer till långsiktig lönsamhet om kunderna är motståndskraftiga mot prishöjningar.Premium-prissättning

Premiumprissättning är motsatsen till penetrationsprissättning och sätter höga priser för att skapa en uppfattning om kvalitet eller lyx. Detta kan begränsa kundbasen, men det kan generera höga marginaler från varje försäljning.

Hur man maximerar vinstmarginaler med nivåbaserad prissättning

Att maximera vinstmarginalerna med nivåbaserade priser innebär att hitta den perfekta platsen där du kan ge dina kunder maximalt värde, samtidigt som du ser god avkastning. Här är några sätt att göra det:

Ange dina nivåer med precision

Varje nivå bör ha ett värdeerbjudande som är ett steg upp från föregående nivå. När kunderna klättrar i nivå bör de känna att de får ett bra erbjudande – ett som är alldeles för bra för att missa – vid varje steg. Företag måste erbjuda tillräckligt med värde på de lägre nivåerna för att locka kunder, samtidigt som de gör de övre nivåerna oemotståndliga för de som vill ha mer.Analys av kostnadsstrukturen

Förstå exakt hur mycket det kostar ditt företag att tillhandahålla varje nivå. Priset på din lägsta nivå bör täcka kostnaderna med lite svängrum, vilket gör det möjligt att få in maximala intäkter från de högre nivåerna.Psykologiska prissättningstekniker

Att prissätta dina nivåer strax under vanliga tröskelvärden (t.ex. att ta ut 9,99 USD i stället för 10 USD) kan göra skillnad i hur kunderna uppfattar värde. Förankra dina kunder med den högsta nivån först. Detta gör att de andra nivåerna verkar mer rimligt prissatta i jämförelse.Datadrivna beslut

Utnyttja kraften i data genom att övervaka vilka nivåer som är mest populära bland dina kunder och justera allt eftersom. Kanske finns det en populär funktion på en högre nivå som du kan utnyttja för att uppmuntra uppgraderingar. Eller så kanske det finns en mindre använd funktion på lägre nivå som kan skäras ner för att minska kostnaderna.Incitament för uppgraderingar

Locka kunderna att uppgradera med välplacerade incitament. Det kan vara en rabatt på den första månaden på en högre nivå, eller exklusivt innehåll eller tjänster som kunderna endast kan komma åt med premiumalternativen. Gör övergången mellan nivåerna smidig och tilltalande.Feedbackslingor och anpassningsförmåga

Upprätta feedbackslingor och lyssna på dina kunder. Om det finns en funktion som alla vill ha som du ännu inte erbjuder, överväg att lägga till den på en högre nivå. Var anpassningsbar och villig att göra ändringar i din produkt eller tjänst.Fokus på kundens livstidsvärde

Håll ett öga på kundens livstidsvärde. Att locka en kund på en lägre nivå är bra, men den största vinsten är när de använder och älskar tjänsten och de bestämmer sig för att uppgradera. Detta är källan till din långsiktiga lönsamhet.Tydlighet i kommunikationen

Kunderna bör veta exakt vad de får på varje nivå och förstå varför nästa nivå är värd den extra kostnaden. En kund ska aldrig behöva kämpa för att ta reda på vad de betalar för.Konkurrensanalys

Håll ett öga på konkurrenterna. Om de erbjuder mer värde på lägre nivåer måste du svara. Om de prissätter sina nivåer för högt, ta tillfället i akt att locka kunder med ett bättre erbjudande.Överväganden om dynamisk prissättning

Överväg dynamiska prissättningsstrategier där det är lämpligt. Kanske finns det tider då du kan ta ut en premie, eller speciella evenemang där kampanjpriser för högre nivåer skulle fungera.

Att använda nivåbaserade priser för att maximera vinstmarginalerna är en fråga om strategisk positionering, kundpsykologi och din vilja att kontinuerligt finjustera din produkt för att möta kundernas behov samtidigt som du förbättrar ditt resultat.

Bästa praxis för nivåbaserad prissättning

Att skapa och hantera en nivåbaserad prisplan kräver en blandning av strategisk planering och löpande underhåll för att säkerställa att ditt företag förblir relevant och lönsamt över tid. Här är de bästa metoderna för att ta fram en nivåbaserad plan:

Genomför marknadsundersökningar

Lär känna din målgrupp. Vilka är de och vad behöver de? Vad är de villiga att betala för att få det? Denna kunskap är nyckeln till att skapa nivåer som resonerar med din marknad.Genomför en kostnadsanalys

Ha koll på dina siffror. Räkna ut kostnaden för att leverera varje nivå och ställ in priset så att det inte bara täcker dessa kostnader, utan också bidrar till din vinstmarginal.Gör en konkurrensanalys

Titta på dina konkurrenters prismodeller. De kan ge värdefulla insikter om marknadsstandarder och hjälpa dig att positionera dina nivåer.Ge tydliga värdeerbjudanden

En kund ska inte behöva undra varför de skulle välja en viss nivå. Priset bör motiveras baserat på funktioner, tjänster eller andra fördelar.Erbjud skalbara funktioner

Skapa nivåer som gör att du enkelt kan skala upp eller ner tjänster baserat på kunders feedback eller marknadstrender.Ha enkla val

Valmöjligheter är bra, men för många valmöjligheter kan vara överväldigande. Se till att antalet nivåer är hanterbart så att kunderna enkelt kan välja den som passar dem.Behåll flexibilitet i strukturen

Var beredd på att justera dina nivåer när du lär dig mer om vad dina kunder värdesätter mest.

Och här är de bästa metoderna för att hantera en löpande nivåindelad prisplan:

Övervaka kundernas beteende

Var uppmärksam på hur kunderna interagerar med dina nivåer. Vilka nivåer är mest populära? Uppgraderar eller nedgraderar kunderna?Se regelbundet över kostnader och marginaler

Granska regelbundet dina kostnader och marginaler för att se till att varje nivå förblir lönsam när kostnader och marknadsförhållanden förändras.Justera baserat på feedback

Använd kunders feedback för att förbättra dina erbjudanden. Om vissa funktioner är mycket efterfrågade kan du överväga att lägga till dem på högre nivåer.Ge incitament till uppgraderingar

Enstaka kampanjer kan uppmuntra kunder att flytta till högre nivåer.Kommunicera förändringar

Se till att kunderna informeras om eventuella ändringar i din nivåbaserade plan i god tid.Använd dataanalys

Använd dataanalys för att förstå användningsmönster och kundpreferenser, vilka kan ligga till grund för strategiska beslut om priser och funktioner.Utför A/B-tester

Testa olika prisstrukturer och funktioner för att se vad som går hem hos din målgrupp och leder till att fler kunder stannar kvar och uppgraderar.Erbjud kundsupport

Ge utmärkt kundsupport på alla nivåer, men överväg premiumsupportalternativ för kunder på högre nivå.

Läs mer om hur Stripe stöder nivåbaserade prissättningsmodeller.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.