In 2023, nearly 62% of retail sales in Germany were conducted through card payments—that’s up around 20 percentage points from just 10 years earlier. As a result, fewer and fewer payments are being made in cash. However, card payments are not just a good option for businesses to benefit from the advantages of cashless transactions. In this article, we’ll break down how associations can also accept card payments and what the costs and benefits are of doing so.

What’s in this article?

- Are associations allowed to accept card payments?

- What are the advantages of card payments for associations?

- How can associations accept card payments?

- What are the related costs for associations?

Are associations allowed to accept card payments?

Associations in Germany have the same entitlement as businesses to accept card payments, both with girocards and with credit cards. Card payments can be used for accepting membership fees, donations, and other transactions.

Additionally, associations can use card payments for various other sources of income, such as event tickets, food and beverage sales, raffle tickets, merchandise, handicrafts, or sporting goods.

For membership fees and other recurring transactions in particular, there are alternative payment options in addition to card payments: these include cash, direct debit, individual bank transfers, standing orders, or SEPA Direct Debit.

What are the advantages of card payments for associations?

Accepting card payments offers several advantages to associations. These include:

- Convenient payments for members and customers: Many people prefer card payments because they’re quick and easy. If associations take card payments, members don’t have to carry cash. The same applies to people who buy association products or visitors at association events.

- Reduced risk: Card payments reduce the risk of theft or loss of cash. This benefits both the association and its members and customers. During festivals or events, associations do not need to implement additional security measures to manage and secure cash if they accept card payments.

- Increased revenue: Accepting card payments can increase customers’ willingness to make purchases, thereby boosting the association’s income. For instance, attendees at events might not carry sufficient cash or any cash at all when thinking about buying from the association’s products. Therefore, card payments are useful for enabling spontaneous purchases and larger expenses, among other things. Additionally, donors might be more likely to donate if they can make spontaneous and easy payments using a card.

- Efficient, flexible payment processing: Processing card payments is typically faster and more efficient compared to manual cash processing. This helps to reduce queues and to improve service at events. Especially with modern card terminals, customers can pay not only with girocard and credit cards, but also with mobile wallets.

- Simplified bookkeeping: Electronic payments are automatically documented, simplifying bookkeeping for associations, saving time, and providing a clearer financial overview. The risk of bookkeeping errors also decreases, since calculations are automated, rather than done by hand. Card payments can also be tracked transparently at any time. Many payment service providers offer interfaces to common accounting software, enabling seamless integration and quick import of transaction data. This data can be used for detailed reporting and can improve the association’s financial planning. Additionally, electronically recorded transactions streamline the preparation of financial reports and tax returns, since they are already structured.

- Professional image: Nowadays, most people expect to have modern payment options to choose from. Associations that offer card payments as a payment method in addition to cash are adapting to current payment habits. This can have a positive effect on their public image: associations with modern facilities will typically be viewed as more professional.

How can associations accept card payments?

To accept card payments, associations in Germany must meet several requirements. These concern technical, organizational, and legal factors.

First, the technical requirements must be met. Stripe supports associations in enabling card payments to be processed. An association enters into a contract with Stripe, which stipulates the terms and fees for using the payments services. Once the formalities are agreed upon, the association receives a precertified card reader—such as the S700 through Stripe Terminal, or a mobile reader such as the BBPOS WisePad 3—enabling card payments. Alternatively, the association can use Tap to Pay on Android. Associations can supplement modern point-of-sale (POS) systems with the payment options mentioned above. If this can’t be done, purchasing a new POS system might be a better option.

Since most card payment systems require an internet connection, it’s important to ensure a reliable internet connection is available at the locations where payments are accepted. To ensure accurate accounting, you can also directly integrate card payments into your association’s accounting software. Furthermore, automated accounting processes can help reduce manual work.

Association staff responsible for processing payments should be trained. This will ensure a smooth process and help prevent errors when using the card terminal. It’s also a good idea to inform association members and customers about the card payment option. This can be done at the general meeting, at events, or on the association’s website.

When implementing card payments, it’s also important to understand the legal framework, particularly regarding tax law, the Payment Services Supervision Act (ZAG), and the Money Laundering Act (GwG), and how these laws impact the association. In any case, it is key to ensure compliance with the General Data Protection Regulation (GDPR). This involves securely processing and storing personal data, such as bank details. Additionally, members and customers must be informed about the type and purpose of data processing, as per Article 13 of the GDPR.

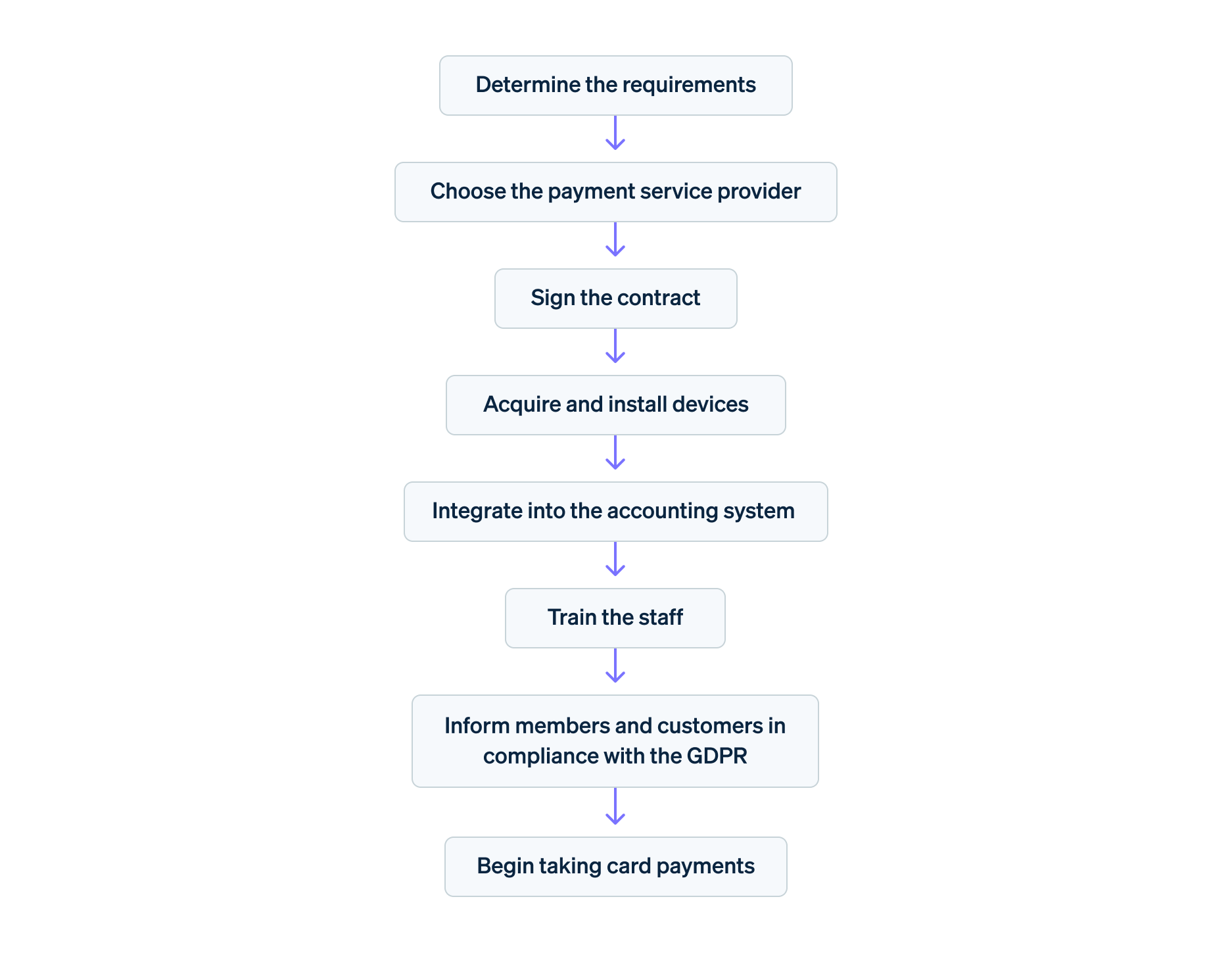

Flowchart: Implementing card payments for associations

What are the related costs for associations?

Associations incur various costs when they decide to offer card payments. These costs vary depending on the specific needs of the association, the scope of the payment service, and the model of card reader chosen.

First, the association should decide whether a wired card terminal or a mobile card reader better suits its needs. Mobile devices are generally more expensive, but they offer greater flexibility. For associations that want to offer card payments outside of their premises, a wireless device makes sense.

There will be additional costs for any accessories such as a docking station, case, or hub. These costs are not incurred with the Tap to Pay solution. In addition to fixed costs, there are variable costs that depend on the number and type of transactions conducted. Learn more about transaction fees using Stripe Terminal, which are the costs incurred for processing each transaction.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.