2023 年,德国近 62% 的零售商通过银行卡支付,这比 10 年前提高了约 20 个百分点。因此,现金支付越来越少。然而,银行卡支付并不仅仅是企业享受无现金交易优势的好选择。在本文中,我们将分析协会如何也能接受银行卡支付,以及这样做的成本和好处。

本文内容有哪些?

- 协会是否可以接受银行卡支付?

- 银行卡支付对协会有什么好处?

- 协会如何接受银行卡支付?

- 协会的相关费用是多少?

协会是否可以接受银行卡支付?

德国的协会与企业一样有权接受银行卡支付,既可以使用 girocards,也可以使用信用卡。银行卡支付可用于接受会员费用、捐款和其他交易。

此外,协会还可以将银行卡支付用于其他各种收入来源,如活动门票、餐饮销售、抽奖券、商品、手工艺品或体育用品等。

特别是对于会员费和其他经常性付款交易,除银行卡支付外,还可选择其他支付方式:包括现金、直接借记、个人银行转账、定期订单或 SEPA 直接借记。

银行卡支付对协会有什么好处?

接受银行卡支付为协会带来了多项优势。这些优势包括:

- 方便会员和客户支付: 许多人喜欢银行卡支付,因为快捷方便。如果协会接受银行卡支付,会员就不必携带现金。这同样适用于购买协会产品的人或参加协会活动的访客。

- 降低风险: 银行卡支付降低了现金被盗或丢失的风险。这对协会及其会员和客户都有好处。在节日或活动期间,如果协会接受银行卡支付,就无需采取额外的安全措施来管理和保护现金。

- 增加收入: 接受银行卡支付可以提高客户的购买意愿,从而增加协会的收入。例如,参加活动的人在考虑购买协会的产品时,可能不会携带足够的现金或任何现金。因此,银行卡支付有利于实现自发购买和大额支出等。此外,如果捐赠者可使用银行卡进行自发和便捷地支付,他们可能会更愿意捐赠。

- 高效、灵活的支付流程: 与人工处理现金相比,处理银行卡支付通常更快、更高效。这有助于减少排队时间,改善活动服务。特别是使用现代银行卡终端,客户不仅可使用银行卡和信用卡支付,还可以使用移动钱包支付。

- 简化记账: 电子支付自动记录,简化了协会的记账工作,节省了时间,并提供了更清晰的财务概览。由于是自动计算而非手工操作,记账出错的风险也会降低。银行卡支付也可以随时进行透明的路线跟踪。许多支付服务提供者都提供与通用会计软件的接口,可实现无缝集成应用并快速导入交易数据。这些数据可用于详细报告,并能改善协会的财务规划。此外,因其已结构化,电子记录的交易可简化财务报告和收税申报表的准备工作。

- 专业形象:如今,大多数人都希望有现代化的支付方式可供选择。除现金外,还提供银行卡支付作为支付方式的协会正在适应目前的支付习惯。这会对其公众形象产生积极影响:拥有现代化设施的协会通常会被视为更专业。

协会如何接受银行卡支付?

要接受银行卡支付,德国的协会必须满足几项要求。这些要求涉及技术、组织和法律因素。

首先,必须满足技术要求。Stripe 支持协会实现银行卡支付流程。协会与 Stripe 签订合同,规定使用支付服务的条款和费用。一旦就相关手续达成一致,协会就会收到预先认证的读卡器,如 S700,通过Stripe 终端,或移动读卡器,如BBPOS WisePad 3,实现银行卡支付。另外,协会还可以使用 Tap to Pay on Android。协会可用上述支付方式对现代销售点 (POS) 系统进行补充。如果做不到这一点,购买新的销售点系统可能是更好的选择。

由于大多数银行卡支付系统都需要互联网关联,因此必须确保接受付款的工作地点有可靠的互联网。为确保准确记账,您还可直接将银行卡支付集成应用到协会的会计软件中。此外,自动化的账户流程也有助于减少人工操作。

负责处理支付流程的协会工作人员应接受培训。这将确保流程顺畅,并有助于防止使用银行卡终端时出错。告知协会会员和客户银行卡支付方式也是一个好主意。这可以在会员大会、活动中或协会网站上进行。

在实施银行卡支付时,了解法律框架也很重要,尤其是关于收税法、《支付服务监督法》(ZAG)和《反洗钱法》(GwG)以及这些法律对协会的影响。无论如何,关键是要确保监管合规,遵守《欧盟通用数据保护条例》(GDPR)。这涉及到安全处理和已存储个人数据,如银行账户详情。此外,根据《欧盟通用数据保护条例》第 13 条,必须告知会员和客户数据处理的类型和目的。

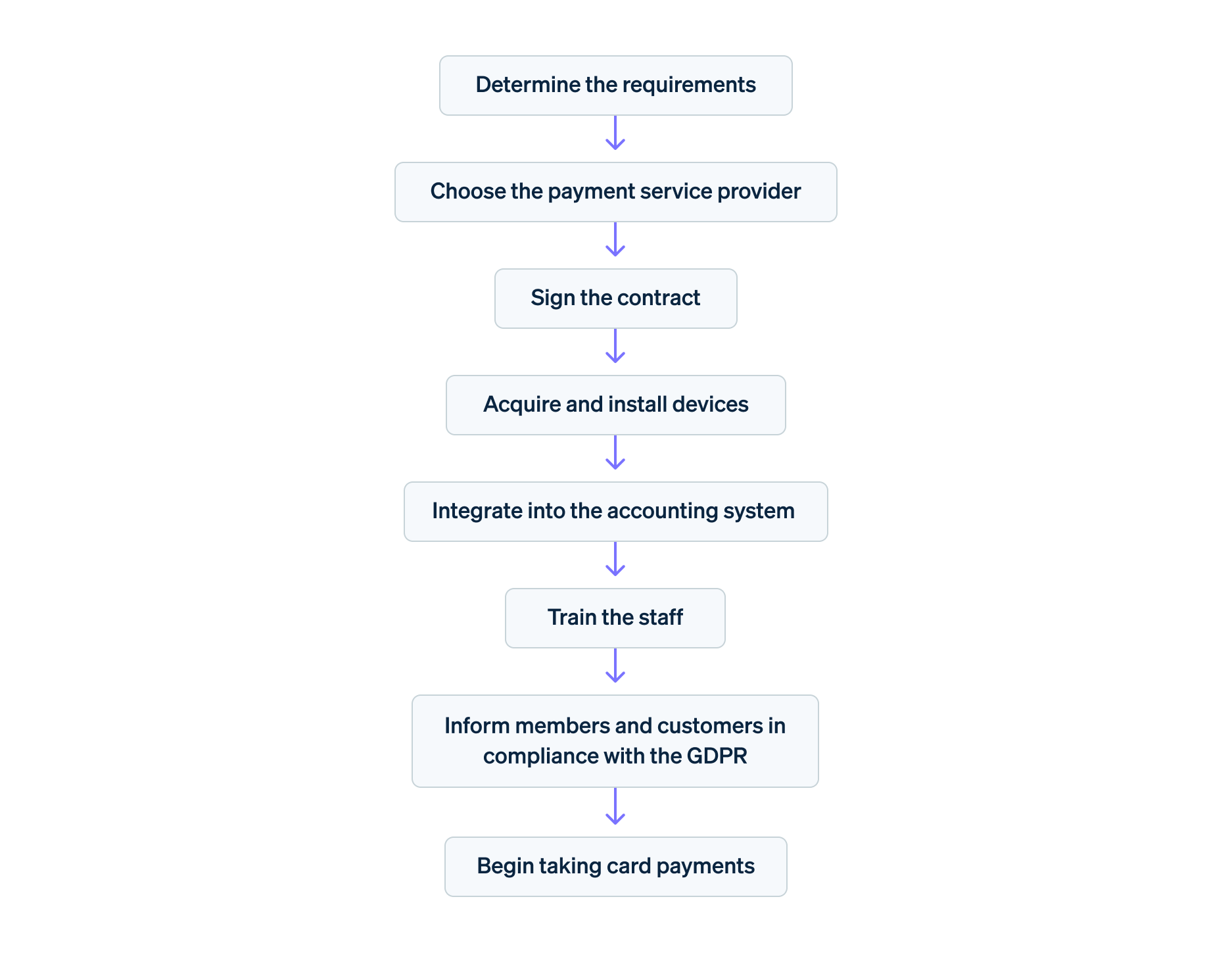

流程图:为协会实施银行卡支付_

协会的相关费用是多少?

协会在决定提供银行卡支付服务时会产生各种费用。这些成本因协会的具体需求、支付服务的范围以及所选读卡器的型号而异。

首先,协会应决定是有线银行卡终端还是移动读卡器更适合自己的需要。移动设备一般比较昂贵,但灵活性更高。对于希望在办公场所外提供银行卡支付的协会来说,无线设备更合理。

任何配件,如连接站、机箱或集线器等配件需要额外付费。Tap to Pay 解决方案不会产生这些费用。除固定成本外,还有取决于交易数量和类型的可变成本。了解有关使用 Stripe Terminal 交易费用的更多信息,这是处理每笔交易产生的费用。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。