Challenge

When Todd Dickerson helped launch ClickFunnels in 2014, the goal was simple: to help internet entrepreneurs drive sales through optimized marketing funnels. Dickerson and his team built ClickFunnels on Stripe. ClickFunnels used Stripe’s technology initially to provide white-labeled payment capabilities to customers through Stripe Connect and later to manage its own subscription billing through Stripe Billing—taking advantage of the continual improvements that Stripe made to those technologies.

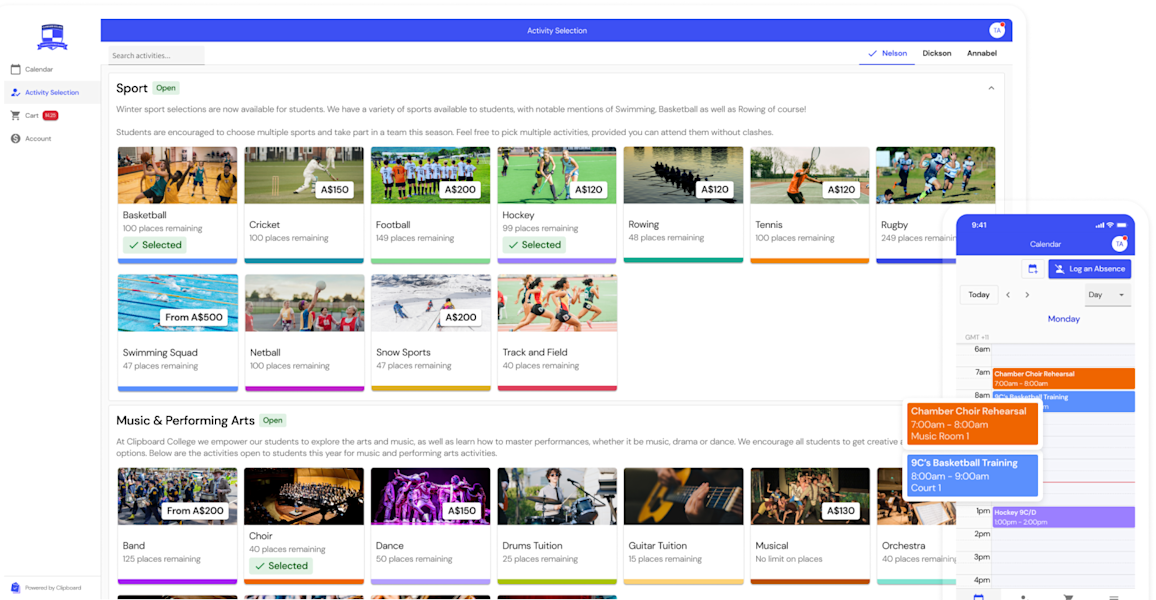

As it matured, ClickFunnels established itself as a leader in the space, so much so that “click funnel” became industry shorthand for any sales funnel, even those built on other platforms. By 2023, ClickFunnels was ready to build on that success by launching two new ventures. The first, ClickFunnels 2.0, would transform the original platform into an all-in-one online business solution, adding capabilities like stores, courses, community hosting, drop shipping, fulfillment, email, direct messaging, affiliates, automations, appointments, and customer relationship management.

To build these features, ClickFunnels needed more sophisticated payment and financial technology. For example, it wanted to expand the number of payment methods available on the platform and make checkout easier, while also supporting customers’ tax calculations and invoicing. Yet early attempts to deliver those features with other third-party integrations proved costly and time-consuming. “As we were working on 2.0, trying to do some of this stuff ourselves without Stripe being the core infrastructure piece, we were literally spending millions of dollars a year,” said Dickerson, ClickFunnels’ cofounder.

The company also faced growing pressure from some international customers who wanted to use all the features of the ClickFunnels platform, but with an alternative payment processor. Meeting those demands was costing the company millions a year. So for ClickFunnels 2.0, ClickFunnels wanted the flexibility to accommodate multiprocessor arrangements.

Meanwhile, ClickFunnels was also creating a second new product called OfferLab, a sales page template library and funnel-building platform that enables collaborative commerce among creators. To fulfill its mission of enabling as many entrepreneurs as possible, ClickFunnels wanted to make OfferLab available to users without a subscription—but that meant finding other creative ways to monetize.

Finally, both ClickFunnels 2.0 and OfferLab would require sophisticated tools to optimize checkout, streamline the payment experience, and fight more complex kinds of fraud. For ClickFunnels, every friction point in the checkout process can lead to abandoned carts and lost revenue. And since ClickFunnels serves entrepreneurs handling customer payments, fraud protection is important for protecting users’ businesses and maintaining trust in the platform.

Solution

ClickFunnels expanded its relationship with Stripe, rebuilding its payment infrastructure on ClickFunnels 2.0 and creating OfferLab through direct integrations with nearly the entire Stripe product suite. Having built its classic platform on Connect with Stripe-hosted onboarding to handle KYC requirements, the company knew Connect would be the foundation for both of its new offerings as well.

For ClickFunnels 2.0, Stripe provides a comprehensive set of tools to help businesses monetize their online presence. Users can use Billing for subscription management, increase conversion with Link, create and send invoices through Stripe Invoicing, process payments through Stripe Payments, handle tax calculations and reporting with Stripe Tax, and access detailed reporting and analytics—all within a single platform.

To serve its international customers more effectively, ClickFunnels is taking advantage of Stripe’s new multiprocessor support for payments. This capability gives businesses access to third-party payment providers, addressing what Andrew Culver, ClickFunnels’ chief product officer, called “the final objection” some customers had to using the platform. “Now we can come to our entire audience and say we’ve solved everything,” he said.

For OfferLab, ClickFunnels is using Stripe's embedded finance features to support new entrepreneurs. Through Stripe Financial Accounts for platforms, OfferLab allows users to hold funds, pay bills, and manage cash flow directly in their Stripe connected account. The company also uses Stripe Issuing to provide expense cards to OfferLab businesses. These features—combined with the ability to monetize payments made on the OfferLab platform through Connect—allow ClickFunnels to make OfferLab completely free to users.

“This product literally exists due to, and is monetized completely by, Stripe,” said Dickerson. “We can roll it out for free because we’re able to benefit from the monetization on the payments processing side through our Stripe Connect partnership.”

Across all its products, ClickFunnels implemented Stripe’s Optimized Checkout Suite to boost conversion rates and prevent involuntary churn. The Optimized Checkout Suite includes a set of embeddable UI components through Stripe Elements; access to more than 100 payment methods, including cards, digital wallets such as Apple Pay and Google Pay, and buy now, pay later options such as Klarna; and Link, Stripe’s accelerated checkout solution that autofills customer payment details for a fast, easy checkout experience.

As another tool to fight involuntary churn, Stripe’s billing integration includes Smart Retries, which uses machine learning to choose the optimal time to retry failed payments, and Card Account Updater, which automatically attempts to update saved card details when a customer receives a new card.

The company also uses Stripe Radar for fraud protection, which is especially useful since Stripe has expanded Radar’s multiprocessor capabilities. Now, businesses can manage subscriptions and prevent fraud with Stripe even when transactions are processed by other providers.

Results

Stripe saves ClickFunnels time and money on engineering and integration

By building its new products with Stripe, ClickFunnels eliminated costly custom solutions and multiple integrations. For example, Stripe’s comprehensive billing engine means ClickFunnels can offer sophisticated, ready-to-use subscription management out of the box, without custom development.

Multiprocessor support expands global reach and saves millions

Stripe’s multiprocessor capabilities have resolved a long-standing hurdle to ClickFunnels’ international expansion. The feature addresses “98% of customers’ concerns,” said Culver, since it allows them to bring their own preferred banking partnerships when needed.

According to Culver, Stripe saves the company several millions of dollars a year. “If we were in an earlier internet era, that’s what we would be spending. And now we don’t have to,” said Culver.

Low-fee and reduced-price product offerings enabled through payment monetization

With Stripe's Financial Accounts and Issuing integrations, ClickFunnels can bring OfferLab to users at no up-front cost while still maintaining a sustainable business model. “The closest network competitors in the space are in the range of 10% fees, and we’re coming out with 0.1% fees,” said Dickerson.

Similarly, ClickFunnels 2.0 is now sold at a lower price point than it was when ClickFunnels had fewer capabilities.

Adoption of Optimized Checkout Suite introduces 16 payment methods, with roadmap to offer 100+ total

ClickFunnels now supports 16 different payment methods across its platforms, including Apple Pay, Google Pay, and Klarna, with a clear path to offering more than 100 payment methods through Stripe. This expansion helps the company serve customers globally with local payment methods, while also helping increase conversion rates and reduce checkout friction.

Anybody who can use Stripe should use Stripe. And don’t worry about the future, because Stripe has, for 10-plus years, always proven that they’re ready to handle the future. And they’ll do it better than you can.