Businesses monitor monthly recurring revenue (MRR) to understand their performance and yield insights for strategic decision making. MRR is an especially important metric for subscription businesses. We’ll cover what MRR is, how it’s calculated, different types of MRR, and how they’re used. We’ll also examine how subscription-based businesses can use MRR to drive growth and optimize business strategy, as well as tips for using MRR data to maximize financial health.

What’s in this article?

- What is monthly recurring revenue (MRR)?

- Types of MRR

- How to calculate MRR

- Why MRR is important for businesses

- Relationship to other key metrics

- Customer insights

- Relationship to other key metrics

- How to increase MRR

- Optimize pricing strategy

- Upsell and cross-sell

- Focus on customer retention

- Acquire more customers

- Diversify revenue streams

- Optimize pricing strategy

- See how Stripe Billing measures up

What is monthly recurring revenue (MRR)?

MRR measures the predictable recurring income generated from customers on a monthly basis. It’s an important metric for subscription-based companies because it helps them forecast future revenue, identify growth trends, and make strategic decisions.

Types of MRR

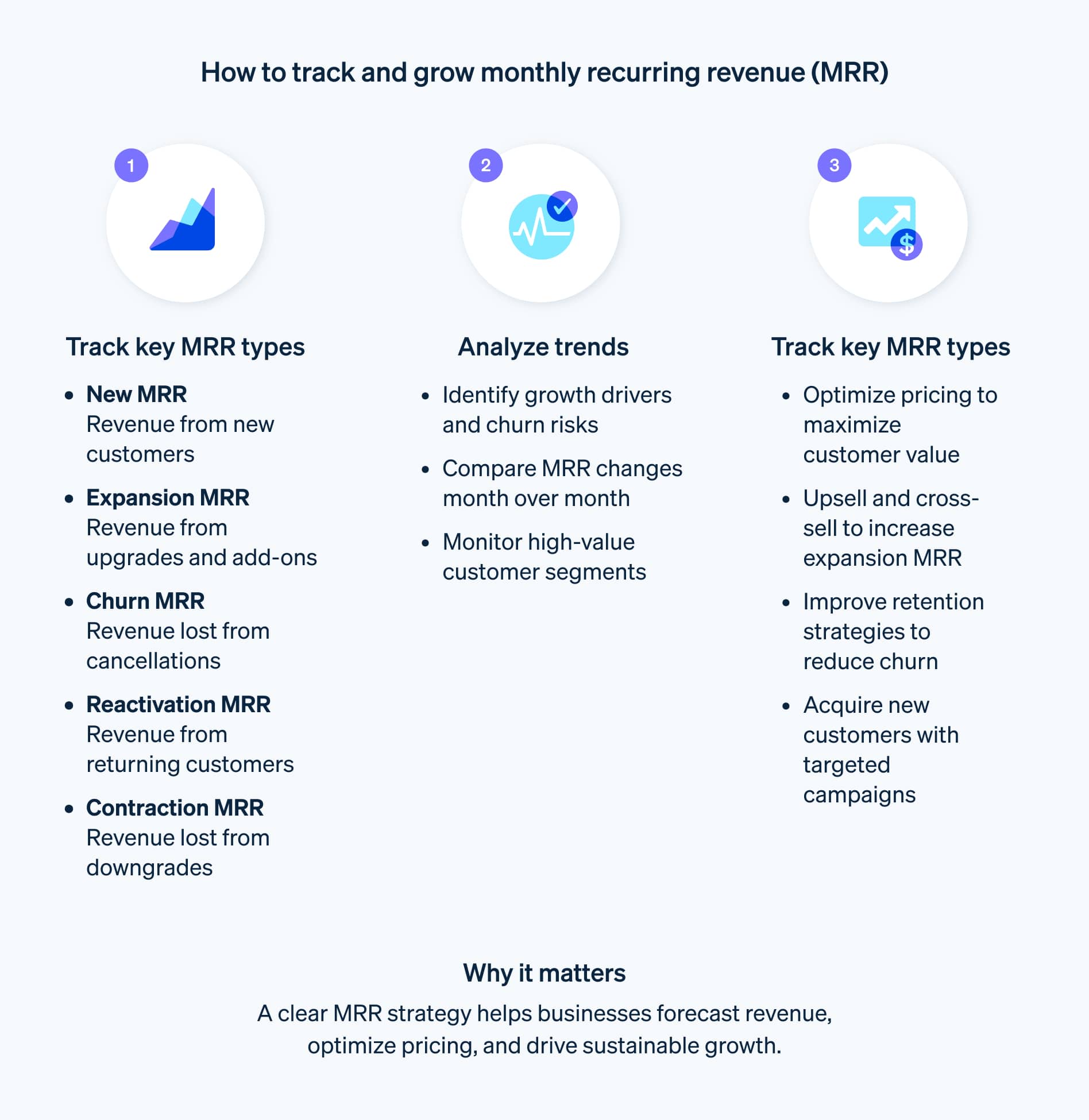

Subscription-based businesses can track different types of MRR to gather insight into their performance, gain a deeper understanding of their revenue growth, and identify areas for improvement:

New MRR

MRR generated by new subscribers who have recently signed up for a product or service, representing the growth that occurred in the customer base.Expansion MRR

MRR generated by existing subscribers who have upgraded their subscription or added additional services or features, representing the increase in revenue per customer.Churn MRR

MRR lost due to customers canceling their subscriptions, representing the loss of revenue due to customer attrition during that month.Reactivation MRR

MRR from subscribers who had previously canceled their subscription but have now returned, representing the regained revenue due to customer retention.Contraction MRR

MRR lost due to existing subscribers downgrading their subscription or removing services or features, representing the loss of revenue per customer.Net New MRR

The sum of New MRR and Expansion MRR, minus the Churn MRR and Contraction MRR, representing the overall growth in monthly recurring revenue.

How to calculate MRR

To calculate MRR, multiply the total number of paying customers by the average revenue per user (ARPU) per month. For example, if a company has 100 customers paying $100 per month, their MRR would be $10,000.

The formula for MRR looks like this:

MRR = (number of customers) x (average monthly revenue per customer)

Alternatively, you can calculate MRR by summing up the revenue generated by each subscription plan or product offered by your business.

For example, suppose a business has three subscription plans: Plan A costs $10/month, Plan B costs $20/month, and Plan C costs $30/month. In a given month, the business has 100 customers subscribed to Plan A, 50 customers subscribed to Plan B, and 30 customers subscribed to Plan C. The MRR for the business in that month would be $2,900.

MRR = (100 x $10) + (50 x $20) + (30 x $30) = $2,900

The formula for calculating MRR can vary depending on the type of MRR you’re tracking.

Why MRR is important for businesses

MRR is a powerful metric for companies who use a subscription-based business model, because it allows them to predict future revenue, identify growth trends, pinpoint problem areas, and make strategic decisions. For example, if a company has a steady MRR growth rate of 10% per month, they can predict that their revenue will double every seven months. This information can inform decisions on hiring, product development, and marketing strategy. Similarly, if a company sees a decrease in MRR, it might indicate that they are losing customers. The company can then investigate the cause of the problem and make changes to improve retention.

Here are a few ways businesses can use MRR to its maximum advantage:

Relationship to other key metrics

MRR on its own can give important insights into the health of a business, but its value increases when businesses consider it in the context of other metrics. MRR can be used to calculate important metrics, such as customer acquisition cost (CAC), lifetime value (LTV), and gross margin.

CAC is the cost of acquiring a new customer, calculated by dividing the total cost of sales and marketing by the number of new customers. LTV is the projected revenue that a customer will bring to a company over their lifetime, calculated by multiplying the ARPU by the average customer lifetime. Gross margin is the profit a company makes after subtracting the cost of goods sold from the revenue, calculated by multiplying MRR by the gross margin percentage.

Customer insights

Businesses can also use MRR to track the performance of different customer segments to help identify which segments are the most profitable and where to focus sales and marketing efforts. For example, a company could measure MRR for enterprise customers, small businesses, and individual customers.

Companies can also measure and analyze customer acquisition and retention to drive efficient, successful acquisition efforts. For example, companies can track how many new customers they’re acquiring each month and where those customers are coming from and compare those findings to sales and marketing spend. Businesses can also use MRR to track how long customers stay with the company and which factors contribute to customer retention.

How to increase MRR

There are multiple ways to increase MRR, including optimizing pricing strategy, upselling and cross-selling, focusing on high-performing customer acquisition and retention tactics, diversifying revenue streams, and implementing subscription management and billing solutions, like those offered by Stripe.

Optimize pricing strategy

This is one of the most effective ways to increase MRR. Businesses can determine the best pricing strategy by conducting market research or A/B testing. They can also use these insights to offer different pricing plans—such as basic, standard, and premium—to appeal to different customer segments.

Upsell and cross-sell

Upselling means offering customers a higher-priced product or service, while cross-selling is offering customers related products or services. For example, a company that sells a monthly subscription for a software service might upsell customers to a yearly subscription or cross-sell them features and add-ons like additional storage, advanced reporting and analytics, or integration with other software.

Focus on customer retention

Customer retention is a key priority for recurring revenue businesses. Excellent customer service, a strong customer loyalty program, and continuously improving products and services will typically improve retention. By keeping customers happy, businesses can reduce churn rate, which increases MRR.

Acquire more customers

Customer acquisition is important for MRR, and strategies vary depending on your industry and past successes. Strategies might include expanding the customer base through targeted marketing campaigns, creating new product or service packages to appeal to new market segments, rethinking your company’s online presence, or offering referral incentives to current customers to encourage them to bring in new business.

Diversify revenue streams

Diversifying revenue streams is a powerful way to increase MRR and build additional resiliency into the business. For example, a business that currently generates revenue from only one product or service may expand its offerings to include additional products or services. This can help to mitigate risk and provide a more stable source of revenue.

Read our guide for a deeper dive into proven ways you can boost your company’s MRR.

Visit Stripe Billing to learn how it’s powering subscription-based businesses to efficiently scale, drive more revenue, and streamline operations around recurring payments and invoicing.

More resources

See how Stripe Billing measures up

See how Stripe compares to other recurring billing providers in the 2025 Gartner® Magic Quadrant™ for Recurring Billing Applications.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.