Företag övervakar månatliga återkommande intäkter (MRR) för att förstå sina resultat och generera insikter för strategiskt beslutsfattande. MRR är ett särskilt viktigt nyckeltal för abonnemangsföretag. Vi går igenom vad MRR är, hur det beräknas, olika typer av MRR och hur de används. Vi kommer också att undersöka hur abonnemangsbaserade företag kan använda MRR för att driva tillväxt och optimera sin företagsstrategi, samt tips om hur du använder MRR-data för att maximera företagets ekonomiska hälsa.

Vad innehåller den här artikeln?

- Vad är månatliga återkommande intäkter (MRR)?

- Typer av MRR

- Så beräknas MRR

- Därför är MRR viktigt för företag

- Relation till andra nyckeltal

- Insikter om kunder

- Relation till andra nyckeltal

- Så ökar man företagets MRR

- Optimera prisstrategin

- Upp- och korsförsäljning

- Fokusera på att behålla kunderna

- Skaffa fler kunder

- Diversifiera intäktsströmmarna

- Optimera prisstrategin

- Se hur Stripe Billing står sig

Vad är månatliga återkommande intäkter (MRR)?

MRR mäter de förutsägbara återkommande intäkterna som genereras från kunder på månadsbasis. Det är ett viktigt mått för abonnemangsbaserade företag eftersom det hjälper dem att förutse framtida intäkter, identifiera tillväxttrender och fatta strategiska beslut.

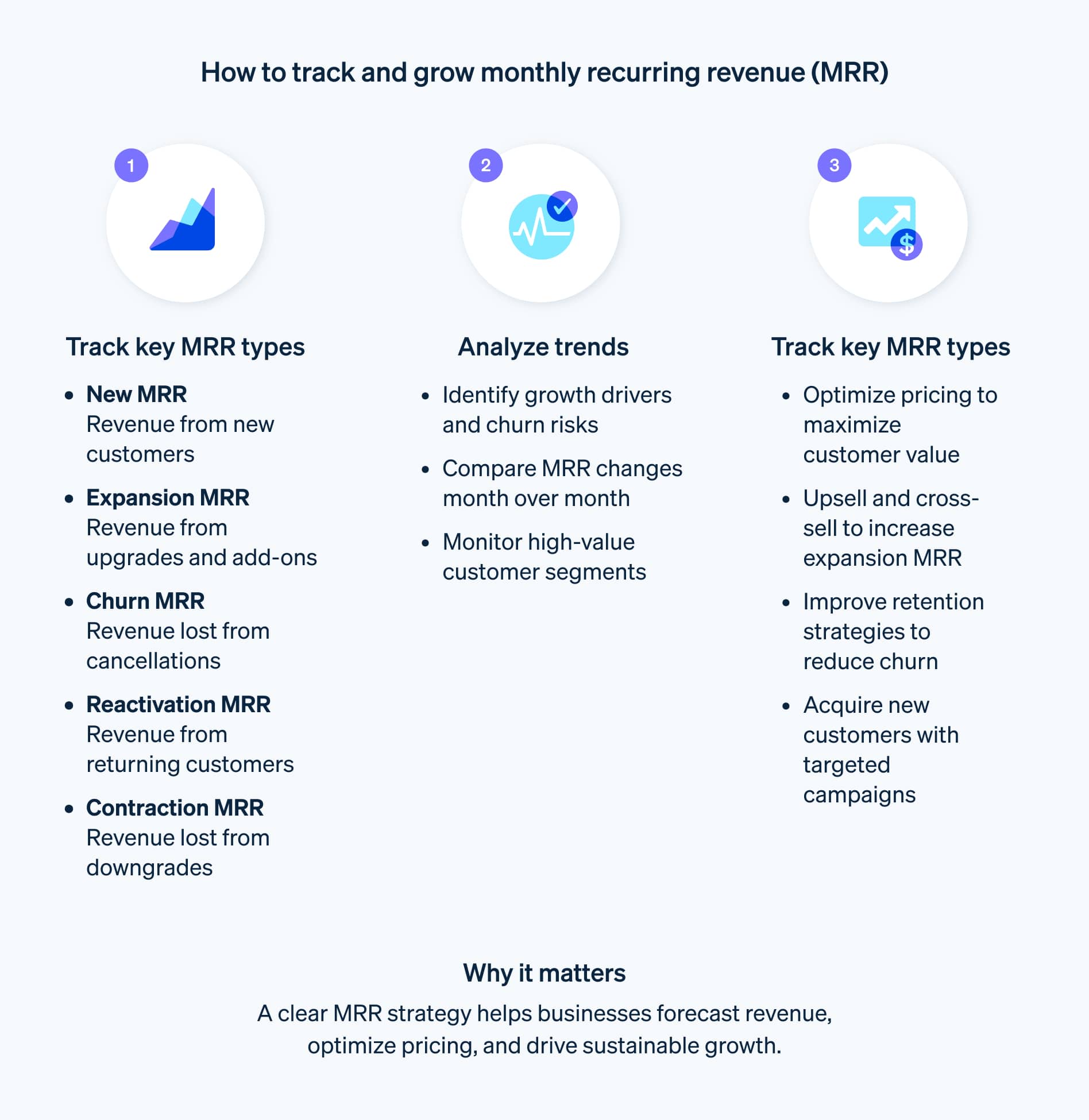

Typer av MRR

Abonnemangsbaserade företag kan spåra olika typer av MRR för att få insikt i sina resultat, få en djupare förståelse för sin intäktstillväxt och identifiera områden som kan förbättras:

Nytt MRR

MRR som genereras av nya abonnenter som nyligen har registrerat sig för en produkt eller tjänst, vilket representerar tillväxten i kundbasen.MRR-ökning

MRR som genereras av befintliga abonnenter som har uppgraderat sina abonnemang eller lagt till ytterligare tjänster eller funktioner, vilket motsvarar ökade intäkter per kund.MRR-bortfall

MRR som förloras på grund av att kunder säger upp sina abonnemang, vilket motsvarar intäktsbortfallet till följd av kundbortfall under den månaden.MRR-reaktivering

MRR från abonnenter som tidigare har sagt upp sina abonnemang men som nu har återvänt, vilket representerar de återvunna intäkterna till följd av kundlojalitet.MRR-minskning

MRR som förloras på grund av att befintliga abonnenter nedgraderar sina abonnemang eller tar bort tjänster eller funktioner, vilket motsvarar förlusten av intäkter per kund.Nytt MRR (netto)

Summan av nytt MRR och MRR-ökning, minus MRR-bortfall och MRR-reaktivering, vilket motsvarar den totala tillväxten i månatliga återkommande intäkter.

Så beräknas MRR

För att beräkna MRR multiplicerar du det totala antalet betalande kunder med genomsnittlig intäkt per användare (ARPU) per månad. Om ett företag till exempel har 100 kunder som betalar 100 USD per månad skulle deras MRR vara 10 000 USD.

Formeln för MRR ser ut så här:

MRR = (antal kunder) x (genomsnittlig månadsintäkt per kund)

Alternativt kan du beräkna MRR genom att summera intäkterna som genereras av varje abonnemangsplan eller produkt som erbjuds av ditt företag.

Anta till exempel att ett företag har tre abonnemangsplaner: Plan A kostar 10 USD/månad, Plan B kostar 20 USD/månad och Plan C kostar 30 USD/månad. Under en viss månad har företaget 100 kunder som abonnerar på plan A, 50 kunder som abonnerar på plan B och 30 kunder som abonnerar på plan C. MRR för verksamheten under den månaden skulle bli 2 900 USD.

MRR = (100 x 10 USD) + (50 x 20 USD) + (30 x 30 USD) = 2 900 USD

Formeln för att beräkna MRR kan variera beroende på vilken typ av MRR du bevakar.

Därför är MRR viktigt för företag

MRR är ett kraftfullt nyckeltal för företag som använder en abonnemangsbaserad affärsmodell, eftersom det gör det möjligt för dem att förutsäga framtida intäkter, identifiera tillväxttrender, identifiera problemområden och fatta strategiska beslut. Om ett företag till exempel har en stadig MRR-tillväxt på 10 % per månad kan de förutsäga att deras intäkter kommer att fördubblas var sjunde månad. Denna information kan ligga till grund för beslut om anställning, produktutveckling och marknadsföringsstrategi. Om ett företag likväl ser en minskning av MRR kan det tyda på att de förlorar kunder. Företaget kan sedan undersöka orsaken till problemet och göra ändringar för att förbättra behållningen av kunder.

Här är några sätt som företag kan använda MRR till sin maximala fördel:

Relation till andra nyckeltal

MRR kan för sig själv ge viktiga insikter om ett företags hälsa, men dess värde ökar när företag använder det i samband med andra nyckeltal. MRR kan användas för att beräkna andra nyckeltal, såsom kundanskaffningskostnad (CAC), livstidsvärde (LTV) och bruttomarginal.

CAC är kostnaden för att skaffa en ny kund, beräknad genom att dividera den totala kostnaden för försäljning och marknadsföring med antalet nya kunder. LTV är den beräknade intäkten som en kund kommer att tillföra ett företag under sin livstid, beräknad genom att multiplicera genomsnittlig intäkt per användare med den genomsnittliga kundlivslängden. Bruttomarginal är den vinst ett företag gör efter att ha subtraherat kostnaden för sålda varor från intäkterna, beräknat genom att multiplicera MRR med bruttomarginalprocenten.

Kundinsikter

Företag kan också använda MRR för att spåra resultatet för olika kundsegment för att identifiera vilka segment som är mest lönsamma och var man ska fokusera försäljnings- och marknadsföringsinsatser. Ett företag kan till exempel mäta MRR för företagskunder, småföretag och privatkunder.

Företag kan också mäta och analysera kundförvärv och kundlojalitet för att driva effektiva och framgångsrika förvärvsinsatser. Företag kan till exempel bevaka hur många nya kunder de får varje månad och var dessa kunder kommer ifrån samt jämföra dessa resultat med försäljnings- och marknadsföringsutgifter. Företag kan också använda MRR för att bevaka hur länge kunderna stannar hos företaget och vilka faktorer som bidrar till att behålla kunderna.

Så ökar man företagets MRR

Det finns flera sätt att öka MRR, bland annat genom att optimera prissättningsstrategin, merförsäljning och korsförsäljning, fokusera på högpresterande strategier för att skaffa och behålla kunder, diversifiera intäkterna och implementera abonnemangshantering och faktureringslösningar, som de som erbjuds av Stripe.

Optimera prisstrategin

Detta är ett av de mest effektiva sätten att öka MRR. Företag kan bestämma den bästa prisstrategin genom att genomföra marknadsundersökningar eller A/B-test. De kan också använda dessa insikter för att erbjuda olika prisplaner – som basic, standard och premium – för att tilltala olika kundsegment.

Upp- och korsförsäljning

Uppförsäljning innebär att erbjuda kunderna en dyrare produkt eller tjänst, medan korsförsäljning innebär att erbjuda kunderna relaterade produkter eller tjänster. Ett företag som säljer ett månadsabonnemang på en programvarutjänst kan till exempel sälja upp kunder till ett årsabonnemang eller korsförsälja funktioner och tillägg till dem som ytterligare lagringsutrymme, avancerad rapportering och analys eller integrering med annan programvara.

Fokusera på att behålla kunderna

Att behålla kunderna är en viktig prioritering för företag med återkommande intäkter. Utmärkt kundservice, ett starkt kundlojalitetsprogram och kontinuerligt förbättrade produkter och tjänster kommer vanligtvis att förbättra retentionen. Genom att hålla kunderna nöjda kan företag minska kundbortfallet, vilket ökar MRR.

Skaffa fler kunder

Kundförvärv är viktigt för MRR, och strategierna varierar beroende på din bransch och tidigare framgångar. Strategier kan inkludera att utöka kundbasen genom riktade marknadsföringskampanjer, skapa nya produkt- eller tjänstepaket för att tilltala nya marknadssegment, ompröva ditt företags onlinenärvaro eller erbjuda hänvisningsincitament till nuvarande kunder för att uppmuntra dem att värva nya.

Diversifiera intäktsflöden

Att diversifiera intäktsflödena är ett kraftfullt sätt att öka MRR och bygga in ytterligare motståndskraft i verksamheten. Till exempel kan ett företag som för närvarande genererar intäkter från endast en produkt eller tjänst utöka sitt utbud till att omfatta ytterligare produkter eller tjänster. Detta kan bidra till att minska riskerna och ge en mer stabil inkomstkälla.

Läs vår guide för en djupare inblick i beprövade sätt att öka ditt företags MRR.

Besök Stripe Billing för att läsa hur det hjälper abonnemangsbaserade företag att effektivt skala upp, öka intäkterna och effektivisera verksamheten kring återkommande betalningar och fakturering.

Se hur Stripe Billing står sig

Se hur Stripe står sig i jämförelse med andra leverantörer av återkommande fakturering i Gartner® Magic QuadrantTM för tillämpningar för återkommande fakturering från 2025.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.