Microdeposit verification is a method for verifying bank account ownership. Verification methods such as microdeposits mitigate fraud risks by confirming that the person trying to connect a bank account to a financial service is the authorized owner of that account. Nearly two-thirds of consumers reported being very or somewhat concerned about online security, which emphasizes the high demand for security measures such as microdeposit verification.

This guide will explain how microdeposit verification works and how you can implement it for your business.

What’s in this article?

- How microdeposit verification works

- Benefits of using microdeposit verification

- Microdeposits vs. alternative verification methods

- How microdeposit verification works with Stripe

- A step-by-step guide to implementing microdeposit verification

- Best practices for the verification process

How microdeposit verification works

When a user sets up a new link between their bank account and a financial service (e.g., PayPal, investment platforms, peer-to-peer payment apps), the service prompts them to enter their bank account details, such as the account number and routing number. The service makes one or more small deposits—usually, each is less than a dollar—in their bank account. A user might receive one or two small sums in their account (for example, $0.05 and $0.15).

After the microdeposits appear in the user’s account, the user logs in to their bank account and notes the exact amounts deposited. They return to the financial service’s platform and enter those amounts to confirm they have access to the bank account. If the entered amounts match the amounts deposited, the verification is successful, and the financial service will fully activate the user’s account for transactions.

Benefits of using microdeposit verification

Microdeposit verification prevents fraud by ensuring that the person trying to link a bank account is the owner of that account. It also helps fulfill Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance requirements. While there are other verification methods, microdeposit verification has major benefits, including:

Cost: Microdeposits are a low-cost, straightforward verification method.

Applicability: Microdeposits can be used with almost any bank account that can receive transfers, regardless of the bank’s size or technological capabilities.

User trust: The microdeposit verification process can increase user trust by actively involving the customer in the verification process and using a familiar routine.

Process: Unlike other verification methods that might require a user to submit personal documents or undergo a credit check, microdeposit verification is less invasive, and doesn’t require the customer to do more work than check their bank transactions.

Flexibility: Microdeposits do not require the account holder to be present at a specific location or use specific devices. They can complete the verification anywhere they can access their online or mobile banking.

Microdeposits vs. alternative verification methods

Microdeposit verification is one of several methods for verifying bank account ownership. Each method serves different needs and presents trade-offs between security, speed, user convenience, and privacy. The choice of method often depends on the specific requirements and priorities of the financial service and its customers.

Here’s how microdeposit verification compares with other verification methods.

Microdeposits

The financial service makes one or more small deposits (usually less than a dollar) in a user’s bank account. The user confirms the exact amount of the deposits to verify account ownership. This method is highly secure, broadly applicable, noninvasive, and affordable. But it’s slower than some alternatives, since deposits can take 1–2 business days to appear in the user’s account, and it requires action from the user to check their account and report back the amounts to the financial service.

Instant account verification (IAV) via login credentials

Users provide their online banking credentials to a third-party service, which logs in on their behalf to instantly verify account details. This is a fast and convenient method, but users might be wary of sharing login credentials, and there are potential security risks if the third-party service is compromised.

Bank API integration

APIs integrate directly with banks to fetch account details and verification in real time. This is a fast and highly secure method that provides detailed account information. But it requires banks to have compatible APIs, which limits it to certain banks or regions, and implementation can be complex.

Pre-validated or pre-noted checks

Users write a check to themselves or a service, and the details (account and routing numbers on the check) are used to verify the account. The speed of this process varies depending on how quickly the check processes. This is a familiar and traditional method for some users, but it’s slower than electronic methods, susceptible to fraud, and increasingly outdated as fewer people use checks.

Credit pulls

A soft or hard credit pull is conducted to verify financial information and identity through consistency of credit information with account details. Usually, this happens instantly, or within the same business day, and provides comprehensive information on the user’s financial standing. But a hard pull can affect the user’s credit score, and this method raises some privacy concerns.

How microdeposit verification works with Stripe

Microdeposit verification is one of the methods Stripe uses to verify bank accounts. It’s particularly useful in scenarios that involve high-risk transactions or in regions where instant verification options are not available or widely supported, and it’s often used to verify accounts for ACH payments. Here’s how the process works.

Account information: The user inputs their bank account details on the Stripe platform. This typically includes the bank account number and the routing number.

Deposits: Once the user submits the bank account information, Stripe makes two small deposits into the bank account, usually less than a dollar each. These deposits are generally processed within 1–2 business days.

Deposit verification: The user checks their bank account via their bank’s website, app, or a bank statement to see the exact amounts that Stripe deposited. The user returns to their Stripe Dashboard and enters the two deposit amounts in the verification field provided by Stripe.

Account verification: After confirming that the amounts the user entered match the microdeposits, Stripe verifies the bank account. The user can now use this bank account to facilitate ACH transactions.

Security: Stripe uses additional security checks to confirm that the bank account details are valid and belong to the user making the request.

Error handling: If the amounts entered do not match the microdeposits, the user has a limited number of attempts to enter the correct amounts before additional security measures are required.

Fallback options: If microdeposit verification fails or is not an option, Stripe might offer alternative verification methods such as instant account verification using bank login credentials through a third-party service.

A step-by-step guide to implementing microdeposit verification

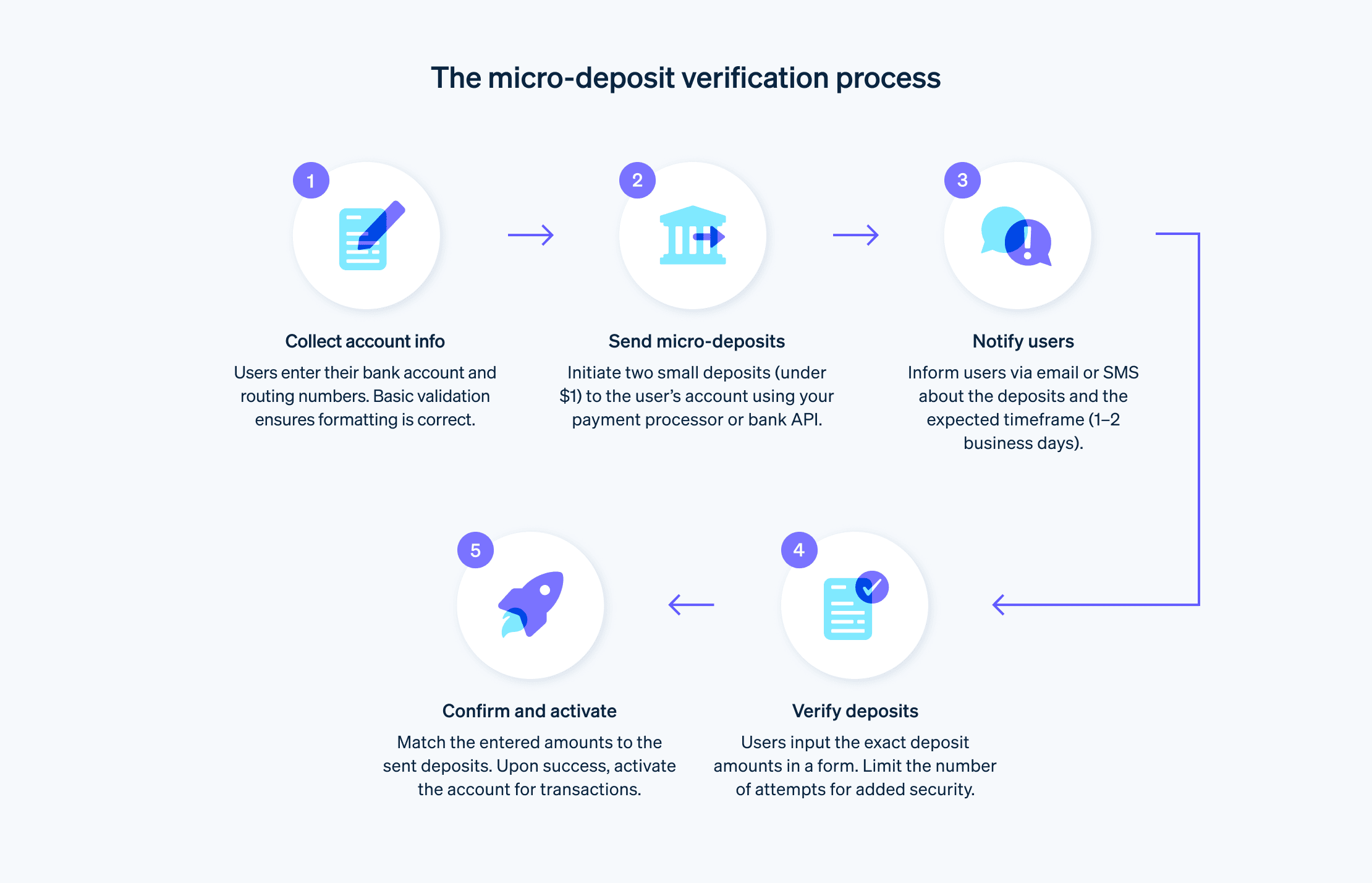

While the specific steps of the verification process can vary based on the technical environment, regulatory requirements, and business needs of the organization, the basic steps for implementing microdeposit verification are outlined below.

Collect bank account information

Create a form in which users can input their bank account information (account number and routing number). Implement basic validation checks to verify that the account and routing numbers are in the correct format, and provide instructions on how many transactions users should expect to receive, and in what amount.

Initiate microdeposits

Use your payment processor or bank’s API to initiate two small deposits (generally less than $1 each) into the user’s bank account. Ensure that these transactions are clearly labeled to indicate their purpose (e.g., “Verification deposit”). Implement security measures to prevent abuse, such as limiting the number of times a user can trigger microdeposits.

Notify users

Notify users via email or SMS when the microdeposits have been initiated, and inform them of the expected timeframe in which the deposits should appear in their bank accounts (typically 1–2 business days).

Verify deposit amounts

Provide a form in which users can enter the exact amounts of the microdeposits they received in their bank account. To improve security, set a limit on the number of attempts a user can make to enter the correct deposit amounts.

Confirm and activate

Once the user enters the deposit amounts, use an algorithm to check if they match the amounts you sent. If the amounts match, confirm the verification and activate the user’s bank account for transactions. If they don’t match, provide guidance on how the user can try again, or offer alternative verification methods.

Best practices for the verification process

The following best practices can help you build an effective verification process.

User experience

Straightforward design: The verification process should be intuitive and straightforward. Every step should be easy to navigate.

User guidance: Create detailed user guides and FAQ pages to help users understand the verification process and what steps they need to take if they encounter issues. Display helpful error messages for common issues such as incorrect input or system errors.

User feedback: Offer immediate feedback during the verification process so users know exactly what’s happening at every step. Regularly update users on their verification status, especially if it’s a lengthy process.

User options: Provide several verification methods to suit different preferences and needs. If microdeposits aren’t ideal, consider options such as instant bank verification.

Backup plans: Always have an alternative method in place for those times when the primary option isn’t suitable or available.

Security

Data protection: Securely transmit and store all sensitive data such as personal information and bank details.

Layered security: Integrate two-factor authentication (2FA) to add an extra layer of security for sensitive operations.

Compliance: Keep up with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) that affect how you handle user data. Maintain logs and audit trails for all verification attempts and transactions for compliance and troubleshooting purposes.

Privacy: Be transparent about your data use and protection policies and make them easy for users to access.

Accessibility

Global standards: Ensure your verification interface adheres to global accessibility standards to support all users, including those with disabilities.

Mobile-friendly: Optimize the process for mobile devices.

Customer support

Support channels: Ensure users can get help when they need it, whether through live chat, phone, or detailed FAQs.

Support staff: Train your support team so they can assist users during the verification process.

Resolution processes: To improve user confidence and reduce frustration, provide users with easy-to-follow steps for troubleshooting.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.