欧州連合 (EU) 域内で定期的に有償取引を行っているすべての企業または専門家は、付加価値税 (VAT) の課税対象となります。この義務は、商品の販売やレンタル、またはサービス提供を営む企業または個人事業主に適用されます。VAT は対価に含まれ、企業が徴収した後、州へと納付されます。適用される制度または営む事業によっては、フランスでの VAT 申告や納付は不要です。本ガイドでは、フランスで VAT 課税対象となることの意義について解説します。

本記事の内容

- VAT 課税対象の判定

- VAT 課税対象となるメリット

- VAT 課税対象と納税義務の違い

- VAT 課税対象として納税を行う場合

- VAT 課税対象であるが、納税義務がない場合

- VAT 課税の回避

VAT 課税対象の判定

VAT 登録を受けた企業や自営業者は、VAT を売上額に応じて徴収し、請求書に記載し、現行の法令手続きに従って税務当局に納付する義務があります。

VAT の納税義務は、一般税制の義務と性質が異なります。法人税や所得税の課税対象であるかどうかにかかわらず、すべての企業は特定の税管轄区域で VAT 課税対象となる活動を行う場合、VAT の納税義務を負う可能性があります。また、基本免税をはじめ、VAT にもさまざまな免除措置や特例制度が適用されます。

この義務が適用されるのは、個人事業や単一企業にとどまりません。2023 年、フランスは単一課税者制度を導入しました。この制度は、密接に業務を営む関連企業グループに適用されます。これにより、企業グループ全体を代表して VAT 申告を行う会社を 1 社に限定することができます。

VAT 制度は絶えず変化しているという点に注意しましょう。法律や規制の最新の変更は常に把握しておく必要があります。

VAT 課税対象となるメリット

企業が VAT 課税対象となるかどうかを判断することは、会社が持つ権利と義務を理解し、税制優遇措置を利用するためのカギとなります。

- VAT 控除:専門事業者は、業務関連の商品またはサービスの購入について、納税額から VAT を差し引くことができます。

- VAT 還付:通常、課税対象の企業は、他の企業からの購入に対して支払った VAT を回収できます。

- プロフェッショナルとしての心証:VAT 登録を受けている企業は、プロフェッショナルとして信頼できるイメージを取引先に与えられます。VAT に登録しているということは、税法や組織構造を遵守しているという証明になります。また、VAT 登録企業は税抜き価格 (HT) を提示することもできます。これにより、商取引における価格の透明性が保証されます。

VAT 課税対象と納税義務の違い

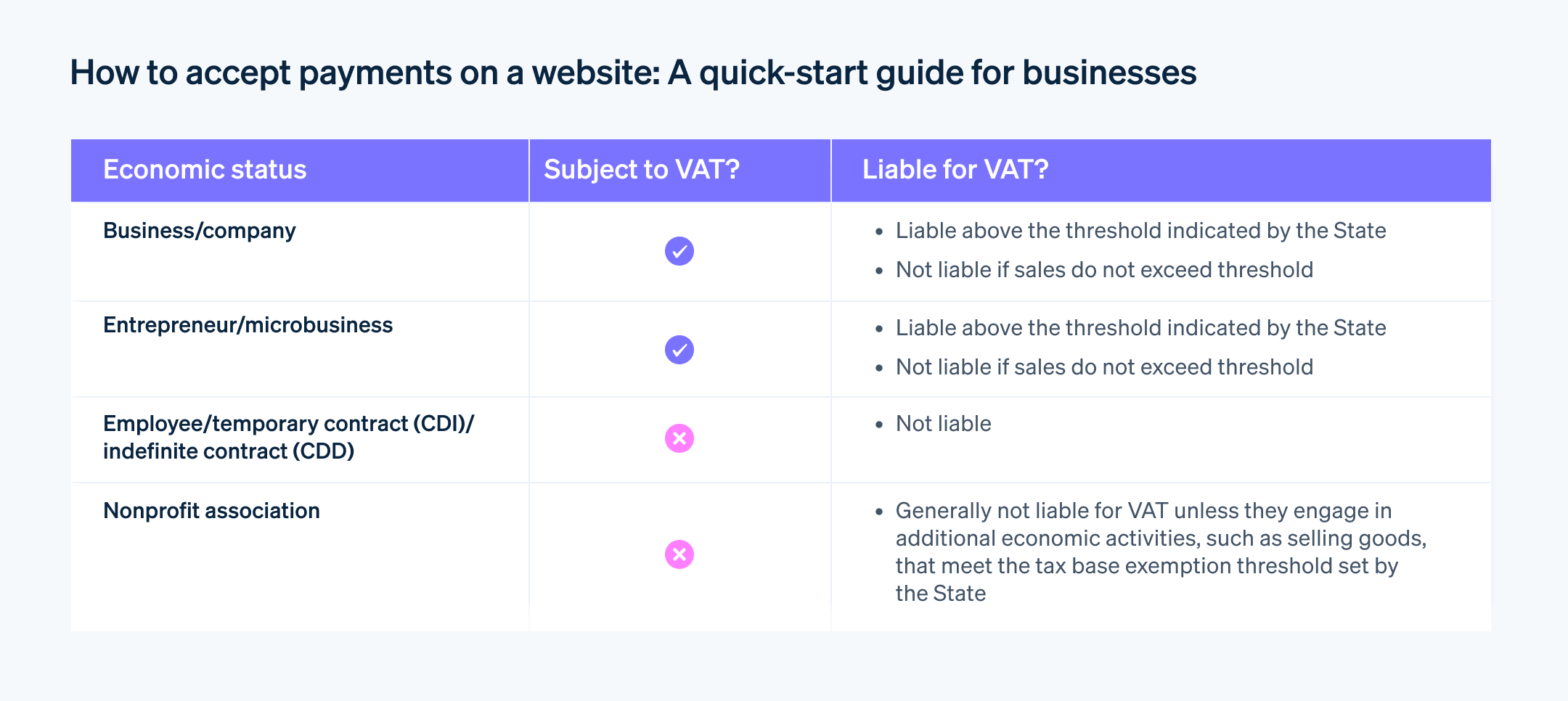

VAT の課税対象になることと、VAT の納税義務があることの違いについて必ず理解しておきましょう。通常、VAT を徴収する必要がある企業は、取引が免除される場合を除き、VAT を納付する義務があります。一方、納税義務者は VAT を州へと納付します。

この区別は、課税対象取引にのみ適用される VAT を控除する権利を理解する上で重要です。

VAT 課税対象として納税を行う場合

新しいビジネスを始める場合、会社の活動に最も適した税制と VAT 制度を選択することが重要です。VAT の納税義務は、一般税制と簡易税制のどちらを選択した場合でも、通常、営利事業または工業事業に適用されます。企業または個人は、売上が特定の基準額を超えた場合、VAT の納税義務を負います。

たとえば、商品を販売する企業で売上高が €91,900 を超える場合はその義務を負います。コピーライティングや翻訳などのサービスを提供する個人は、収益が €36,800 を超えると VAT の納税義務を負います。

売上の基準額は毎年変更される可能性があるため、当局からの最新の改訂を常に把握しておくことが重要です。

Stripe Tax を使用すれば、納税義務を負う企業はオンラインで VAT の申告・納付が可能になります。Stripe Tax では、売上に対する VAT の自動計算と徴収に加えて、徴収された税金に関するレポートを生成して、還付の確認や手続きを円滑に行うこともできます。

VAT 課税対象であるが、納税義務がない場合

企業または専門事業者が上記の売上基準を満たしていない場合、VAT の納税義務を負いません。この場合、基本免除制度が適用されます。

基本免税制度が適用される企業は、VAT の納税義務を負わない課税対象者に当たります。この税制は、中小企業が取引に際して VAT を徴収または控除することなく事業運営を行うことを可能にするもので、通常、売上が特定の基準額以下 (業種によって異なる) に留まる企業を対象としており、基準額も定期的に再評価されます。

常にではありませんが、フランスでは零細企業や個人事業主が基本免税を利用することがよくあります。州の定める売上基準額を超えると、その企業は納税義務を負うことになります。

VAT 課税の回避

雇用契約を結んでいる従業員、および定期的な経済活動を行っていない従業員は、通常、VAT の課税対象にはなりません。

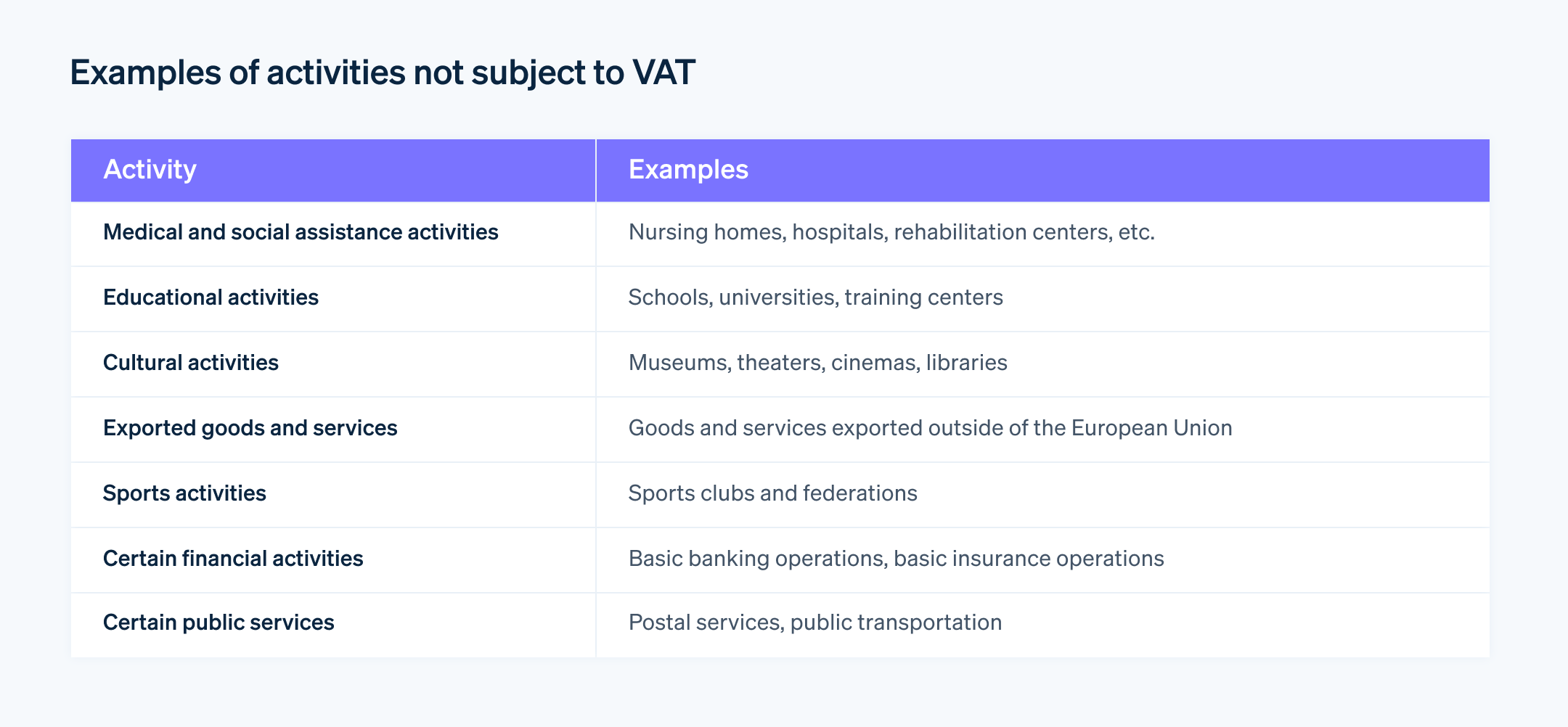

また、特定のビジネスや事業には免除や特別制度が適用される場合があります。

VAT 課税対象とならない経済活動

特定の経済活動は、特定の条件を満たす場合に VAT が免除されます。

上記のリストは、すべての対象活動を記載しているわけでなく、また決定的なものでもありません。たとえば、文化団体は、その主要な事業については VAT を免除されますが、派生商品の販売については VAT の納税義務を負う可能性があります。非課税の上限を超えると、VAT の納税義務を負うことになります。

この記事の内容は、一般的な情報および教育のみを目的としており、法律上または税務上のアドバイスとして解釈されるべきではありません。Stripe は、記事内の情報の正確性、完全性、妥当性、または最新性を保証または請け合うものではありません。特定の状況については、管轄区域で活動する資格のある有能な弁護士または会計士に助言を求める必要があります。