Todas las empresas o los profesionales que realizan actividades remuneradas regulares en la Unión Europea están sujetos al impuesto sobre el valor añadido (IVA). Esta obligación se aplica a las empresas que venden productos, alquilan bienes o prestan servicios. Se incluye en el precio y lo recaudan las empresas o los profesionales antes de pagarlo al Estado. Algunos regímenes y operaciones en Francia no exigen la declaración ni el pago del IVA. En esta guía se explica lo que significa estar sujeto al IVA en Francia.

¿De qué trata este artículo?

- Determinar si estás sujeto al IVA

- Las ventajas de estar sujeto al IVA

- Estar sujeto al IVA frente a estar obligado a pagarlo: comprender las diferencias

- Estar sujeto al IVA y ser responsable de pagarlo

- Estar sujeto al IVA y no ser responsable de pagarlo

- No estar sujeto al IVA

Determinar si estás sujeto al IVA

Las empresas y los profesionales trabajadores por cuenta propia dados de alta en el IVA deben cobrarlo en sus ventas, incluirlo en sus facturas y remitirlo a las autoridades tributarias siguiendo los procedimientos legales y reglamentarios vigentes.

La obligación de pagar el IVA es independiente del régimen fiscal general de una empresa. Todas las empresas, independientemente de si están sujetas al impuesto de corporaciones o al impuesto sobre la renta, pueden estar sujetas al IVA cuando realizan actividades que se encuentran dentro de la jurisdicción correspondiente. Existen diversas excepciones y regímenes especiales, entre ellos la opción básica de exención del IVA.

Esta obligación se extiende más allá de las operaciones particulares o de las empresas individuales. En 2023, Francia introdujo el régimen de persona sujeta a impuestos única. Este régimen está disponible para grupos de entidades relacionadas que desempeñan funciones estrechamente relacionadas. Permite designar a un representante para que se encargue de las declaraciones del IVA de todo el grupo de empresas.

Es importante tener en cuenta que el sistema del IVA cambia continuamente. Las empresas deben estar al día de los últimos cambios legislativos y normativos.

Las ventajas de estar sujeto al IVA

Determinar si una empresa está sujeta al IVA es clave para comprender sus derechos y obligaciones, y aprovechar los beneficios fiscales.

- Deducción del IVA: los profesionales pueden deducir el IVA de sus impuestos para las compras de bienes o servicios relacionadas con la empresa.

- Reclamación del IVA: por lo general, las empresas sujetas al IVA pueden recuperar el IVA que han pagado por las compras a otras empresas.

- Imagen profesional: el registro del IVA puede mejorar la imagen profesional de una empresa y su credibilidad. Esto refleja su adherencia a las leyes fiscales y a la estructura organizativa general. Además, las empresas registradas a efectos del IVA pueden mostrar sus precios sin impuestos, lo que mejora la transparencia de sus transacciones comerciales.

Estar sujeto al IVA frente a estar obligado a pagarlo: comprender las diferencias

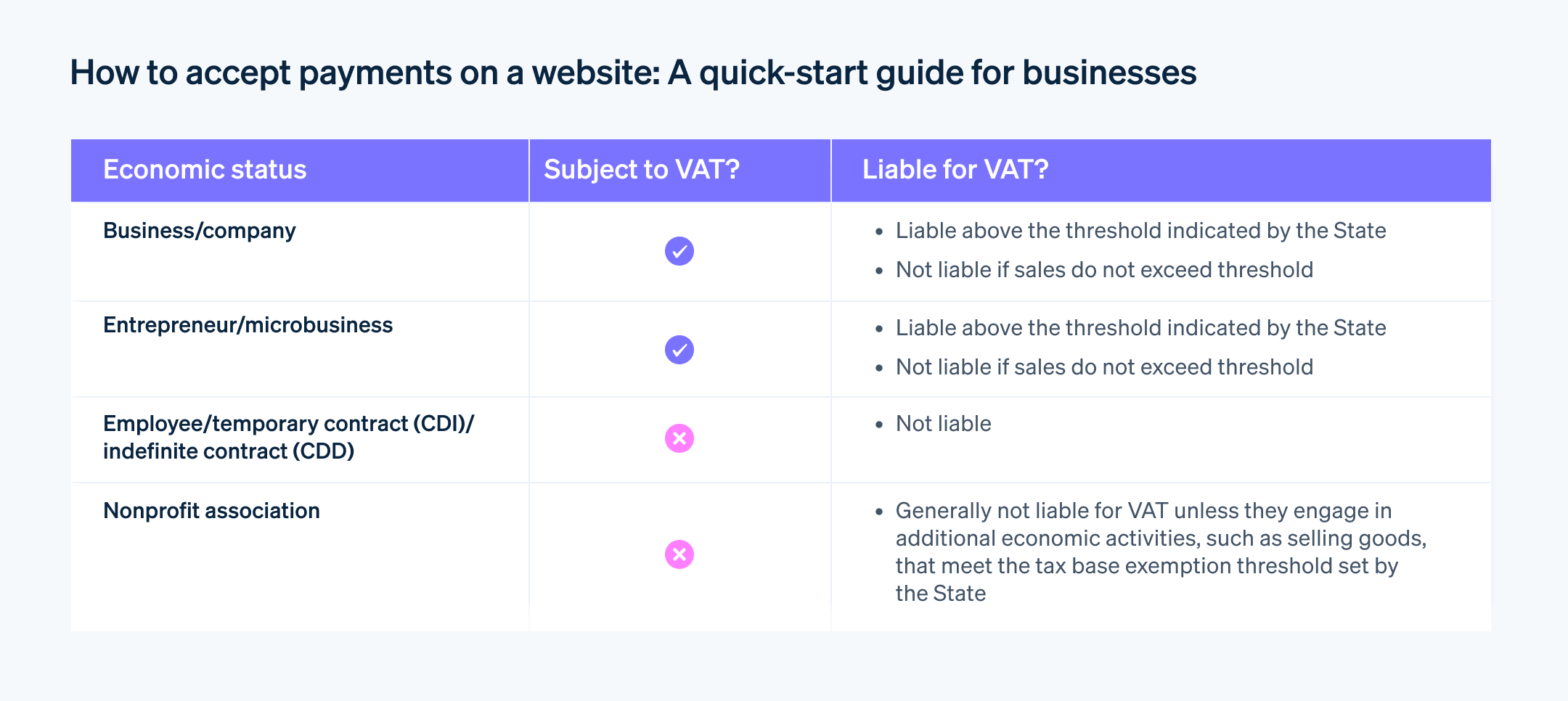

Es imprescindible diferenciar entre estar sujeto al IVA y estar obligado a pagarlo. Por lo general, una empresa que debe cobrar el IVA es responsable de pagarlo, excepto cuando las transacciones están exentas. Por otro lado, una persona responsable debe pagarlo al estado.

Esta distinción es clave para entender el derecho a la deducción del IVA, que se aplica exclusivamente a las operaciones sujetas a impuestos.

Estar sujeto al IVA y ser responsable de pagarlo

A la hora de iniciar un nuevo negocio, es fundamental elegir el régimen fiscal y de IVA que mejor se adapte a tus actividades. La obligación de pagar el IVA suele aplicarse a las empresas comerciales o industriales, tanto si se elige el régimen de tributación normal como el régimen de tributación simplificada. Una empresa o un particular pasa a ser responsable del IVA si sus ventas superan determinados umbrales.

Una empresa que vende bienes, por ejemplo, se convierte en responsable si sus ventas superan los 91.900 €. Un empresario que preste servicios de redacción o traducción estará obligado a pagar el IVA cuando sus ganancias superen los 36.800 €.

Los umbrales de ventas pueden cambiar cada año, por lo que es importante mantenerse actualizado con las últimas revisiones de las autoridades.

Stripe Tax permite a las empresas obligadas y responsables la opción de declarar y pagar el IVA en línea. Además de calcular y cobrar automáticamente el IVA sobre las ventas, Stripe Tax también puede generar informes sobre los impuestos recaudados para verificar y facilitar los reembolsos.

Estar sujeto al IVA, pero no ser responsable del pago

Si una empresa o profesional no cumple con estos umbrales, no está sujeta al IVA. En este caso, se aplica el régimen básico de exención.

Las empresas acogidas al régimen básico de exención son ejemplos de contribuyentes no sujetos pasivos del IVA. Este régimen fiscal permite a las pequeñas entidades operar sin recaudar ni deducir el IVA en sus transacciones, y suele aplicarse a las empresas cuyas operaciones se mantienen por debajo de umbrales específicos, que difieren según el sector y que se reevalúan periódicamente.

En Francia, las microempresas y las sociedades unipersonales se acogen con frecuencia, aunque no siempre, a la exención fiscal básica. Una vez que superan el umbral establecido por el Estado, pasan a ser responsables del impuesto.

No estar sujeto al IVA

Los empleados con contrato de trabajo y los que no realizan actividades comerciales regulares no suelen estar sujetos al IVA.

Sin embargo, las exenciones y los regímenes especiales pueden aplicarse a determinadas empresas o emprendimientos.

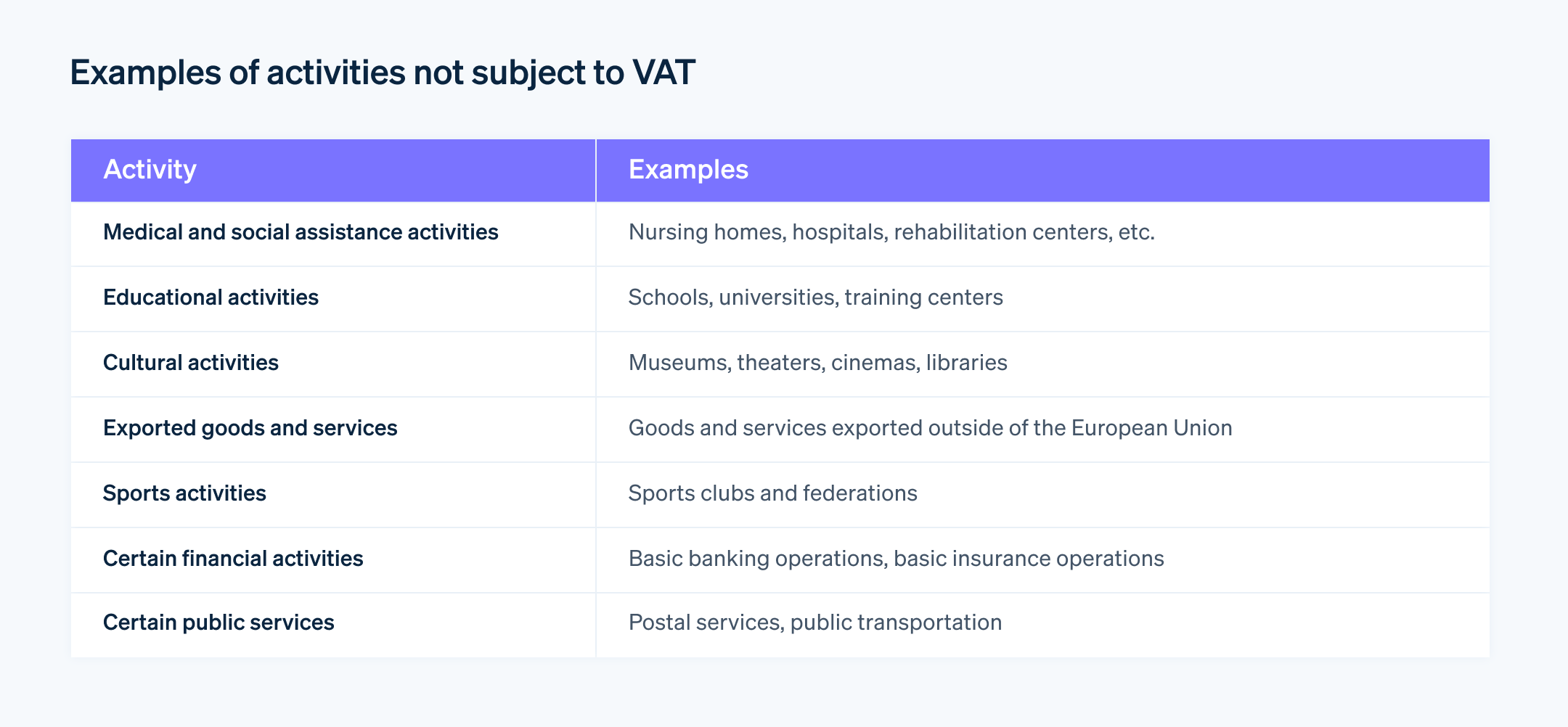

Actividades económicas no sujetas al IVA

Determinadas actividades económicas están exentas del IVA en determinadas condiciones:

Esta lista no es exhaustiva ni definitiva. Por ejemplo, una asociación cultural podría estar exenta del IVA en sus funciones principales, pero podría ser responsable del IVA en la venta de productos derivados. Si la asociación supera el umbral libre de impuestos, queda sujeta al IVA.

El contenido de este artículo tiene solo fines informativos y educativos generales y no debe interpretarse como asesoramiento legal o fiscal. Stripe no garantiza la exactitud, la integridad, la adecuación o la vigencia de la información incluida en el artículo. Busca un abogado o un asesor fiscal profesional y con licencia para ejercer en tu jurisdicción si necesitas asesoramiento para tu situación particular.