Top ecommerce companies leave money on the table with basic checkout errors

- Ninety-five percent of the leading ecommerce sites make five or more basic errors in their checkout.

- The average checkout takes more than three minutes, yet 60% of shoppers say they’ll abandon a checkout that requires more than two.

- Eighty-five percent of online shoppers abandon a purchase if their preferred payment method is not offered.

SAN FRANCISCO AND DUBLIN—A new study from Stripe, a financial infrastructure platform for businesses, reveals that many of the world’s most visited ecommerce websites have error-ridden checkouts, which frustrate customers and cost businesses revenue.

Stripe reviewed 1,600 leading ecommerce sites and surveyed 1,600 consumers about their online shopping preferences. “The state of checkouts in 2022" shows how eradicating basic errors will enable businesses to make more money for less effort—a simple, efficient way of boosting sales during the economic downturn.

“People expect simple checkout processes. One too many inconvenient clicks, or a payment that doesn’t work, and we’ve lost a sale," said Peter Bodum, ecommerce manager at kitchen and household accessories maker Bodum, which has recently turned to ecommerce as its primary distribution channel.

Websites are losing money in onerous checkouts

Online shoppers expect the checkout process to be fast—and they leave when it’s not. Sixty percent said they would abandon a purchase if the checkout process took two minutes, yet the average checkout takes more than three. Ninety-five percent of ecommerce sites make five or more basic errors that slow the checkout process.

- In North America, only 40% of sites support one-click checkout, though 75% of consumers are more likely to complete a purchase if it is offered.

- In Europe, more than one-third of checkouts permit users to submit payments with invalid card numbers.

- In Asia Pacific, 45% of websites allow customers to attempt to pay with an expired card, increasing the likelihood of payment errors.

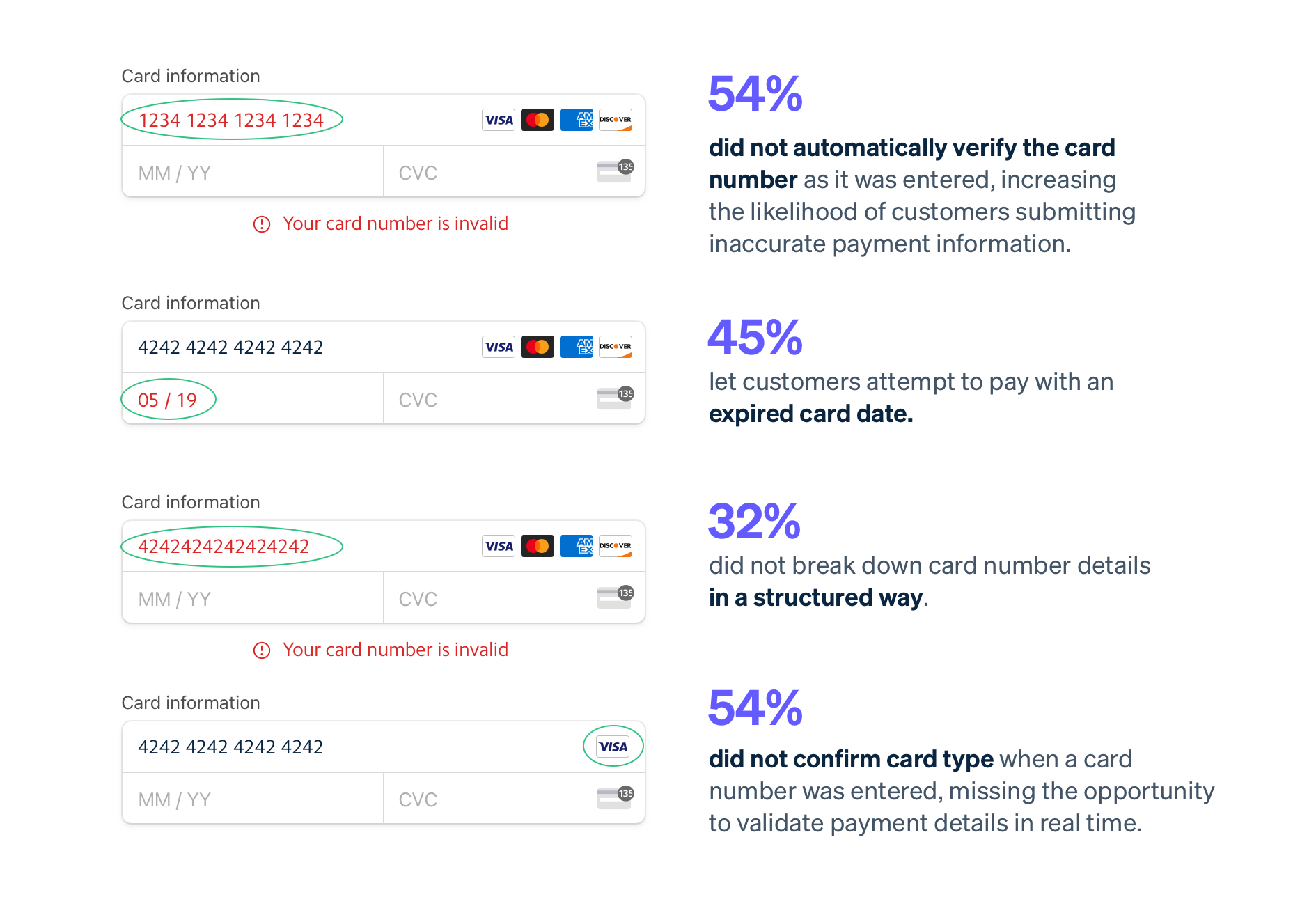

Checkout errors on leading Asia-Pacific websites

Payment methods matter

Customers expect websites to offer their preferred payment methods: 85% said they would abandon a checkout that doesn’t. The report found that while most websites offer multiple payment options, they’re often the wrong ones.

- In North America, 51% of customers are more likely to complete a purchase if buy now, pay later methods are offered, but only 33% of websites provide them.

- In France, 20% of ecommerce sites don’t offer customers the option of paying with CB, the country’s most popular payment method.

- In Malaysia, 56% of consumers prefer using FPX, but fewer than half of businesses offer it.

Businesses can optimize their checkout flows with Stripe

Stripe offers businesses two ways to improve their checkout flows. Stripe Checkout is a prebuilt, Stripe-hosted checkout that businesses can customize to their brand. Businesses that want a more bespoke payment flow can use Stripe Elements, prebuilt component parts they can insert into their own checkout pages. Both Checkout and Elements make it easy for businesses to provide customers with a friction-free checkout, including one-click purchasing with Link (formerly known as “Remember Me”), 50 payment methods, and 135 currencies. Recent updates include:

- An enhanced algorithm that more accurately anticipates the payment method buyers want to use, increasing checkout conversion by 3%

- More global payment methods, including Blik in Poland, Konbini in Japan, and Affirm, a leading buy now, pay later option around the world

- The Stripe Payment Element, which supports 25 payment methods with a single integration and automatically updates as Stripe adds support for additional payment methods

“An error-ridden checkout is like driving with the handbrake on: It’s completely avoidable and slows your business down,” said John Collison, cofounder and president of Stripe. “Fixing checkout errors is easy and delivers more revenue instantly.”

Read the North America, Europe, and Asia Pacific reports.