Om du någonsin har använt ett kredit- eller bankkort för att göra ett köp har du varit involverad i kortauktoriseringsprocessen. Detsamma gäller om du har ett företag som tar emot kredit- och bankkortsbetalningar från kunder. Över en miljard kreditkortstransaktioner behandlas runtom i världen varje dag, och alla kräver auktorisering för att slutföras. Men trots att det är en rutinmässig aspekt av de flesta människors dagliga liv och en viktig del av att göra affärer, vet de flesta inte så mycket om kortauktoriseringsprocessen.

Kortauktorisering är mycket mer komplicerat och betydelsefullt än att bara kontrollera om en kortinnehavare har de medel som krävs för att slutföra ett köp. Denna process är en kraftfull säkerhetsåtgärd som ger kortutfärdare och företag ett rutinmässigt sätt att kontrollera potentiella bedrägerier innan de förvandlas till en framgångsrik transaktion. Om du som företagsägare förstår hur kortauktorisering fungerar och varför vissa auktoriseringar misslyckas kan du skapa ditt företag och ge dina kunder en så smidig transaktionsupplevelse som möjligt.

Vad innehåller den här artikeln?

- Vad är kortauktorisering?

- Hur fungerar kortauktorisering?

- Vad är debitering?

- Vad är avräkning?

- Vad är ett auktoriseringsformulär för kreditkort?

- Är auktoriseringsformulär för kreditkort säkra?

- Vad är förauktorisering?

- Varför går det inte att auktorisera kort?

- Säkerhetsskäl

- Ekonomiska skäl

- Tekniska skäl

- Säkerhetsskäl

Vad är kortauktorisering?

Kortauktorisering är ett godkännande från en kredit- eller bankkortsutfärdare (vanligtvis en bank eller kreditförening) som anger att kortinnehavaren har tillräckliga medel eller tillgänglig kredit som behövs för att täcka kostnaden för en transaktion som de använder ett kort för att genomföra.

På ett sätt kan termen "kortauktorisering" hänvisa till själva auktoriseringen, som i: "Vi har kortauktorisering för det här köpet". Det kan också betyda den process genom vilken auktorisering söks, som i: "Vi är mitt uppe i kortauktorisering just nu".

Hur fungerar kortauktorisering?

Innan vi går in på själva processen för kortauktorisering, låt oss snabbt gå igenom alla nyckelaktörer som är inblandade. Fyra parter är inblandade i kortauktoriseringen:

- Kunden, i detta sammanhang ofta kallad kortinnehavaren

- Verksamheten

- Utfärdaren, eller den utfärdande banken

- Inlösaren, eller den inlösande banken

Kortauktorisering sker vanligtvis via en betalleverantör som en del av de tjänster de tillhandahåller för företag. Många betalleverantörer spelar flera roller för företag när det gäller betalningshantering, inklusive att fungera som företagets inlösare. Stripe erbjuder till exempel betalningshantering för företag, liksom funktionerna för företagskonto och inlösare. En inlösare – även kallad inlösande bank – är en bank eller ett finansinstitut som behandlar kredit- eller bankkortsbetalningar för företags räkning. Detta sker i samband med kommunikation med kortinnehavarnas banker – så kallade utfärdare eller utfärdande banker – för att godkänna transaktioner.

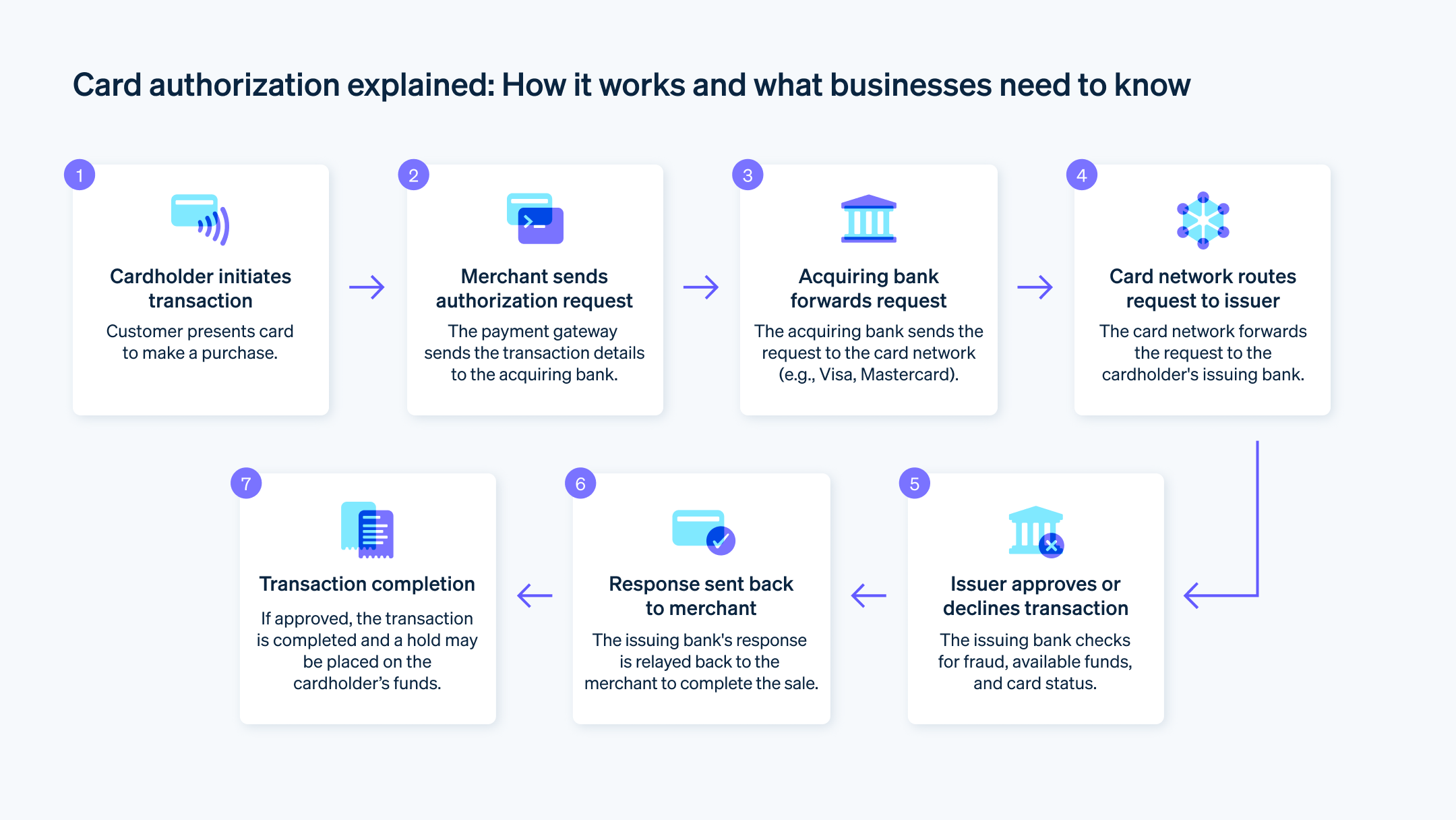

Här är processen där alla dessa parter kommunicerar med varandra för att godkänna en transaktion (eller inte godkänna den):

- Kunden visar upp ett kort för betalning i kassan. Kortauktorisering krävs för både onlinetransaktioner och fysiska transaktioner.

- Företagets POS-system (Point-of-Sale) skickar automatiskt en begäran till deras betalleverantör eller inlösare och ber dem att godkänna transaktionen.

- Inlösaren tar emot begäran och skickar den till utfärdaren, via kortbetalningsnätverket, för att begära godkännande.

- Den utfärdande banken granskar kortinnehavarens konto för att kontrollera två saker:

- För att säkerställa att själva kortet är giltigt

- För att se till att det finns tillräckligt med medel eller kredit för att täcka kostnaden för köpet

- För att säkerställa att själva kortet är giltigt

- Den utfärdande banken returnerar ett av två beslut till den inlösande banken:

- Godkänd med auktoriseringskod: Om allt ser bra ut hos utfärdaren – kortet är giltigt och det finns tillräckligt med pengar tillgängliga – svarar utfärdaren på inlösarens begäran med godkännande om att transaktionen kan fortsätta. Detta godkännande kommer att åtföljas av en auktoriseringskod.

- Nekad med en felkod: Om utfärdaren fastställer att transaktionen inte kan auktoriseras (vi kommer att täcka de möjliga orsakerna till detta inom en minut), kommer de att meddela inlösaren och skicka en felkod.

- Godkänd med auktoriseringskod: Om allt ser bra ut hos utfärdaren – kortet är giltigt och det finns tillräckligt med pengar tillgängliga – svarar utfärdaren på inlösarens begäran med godkännande om att transaktionen kan fortsätta. Detta godkännande kommer att åtföljas av en auktoriseringskod.

Kortauktoriseringsprocessen varar vanligtvis bara några sekunder. Tänk på hur lång tid det tar från det att du skickar in ett kort för betalning tills det står "godkänd" på kortterminalen – alla steg i processen som beskrivs ovan ägde rum under dessa få sekunder.

Vad är debitering?

Debiteringsfasen i kortbetalningsprocessen inträffar när företagsinlösaren begär att auktoriserade medel ska skickas över från det utfärdande kontot. Under kortauktoriseringen bekräftar utfärdaren att de medel eller den kredit som krävs för att täcka kostnaden för köpet finns tillgängliga, men själva pengarna flyttas inte under auktoriseringen. Det händer direkt efter, under debiteringen. Betalningar kan debiteras vid olika tidpunkter, men eftersom de flesta kortauktoriseringar går ut efter 5–10 dagar drar de flesta företag och deras betalleverantörer pengarna innan dess.

Vad är avräkning?

Avräkning är när medel från kundtransaktioner faktiskt överförs från kortinnehavarens utfärdande bank till företagets inlösande bank. Tänk på det så här:

- Betalningsauktorisering är när utfärdaren säger: "Ja, dessa medel är tillgängliga och godkända att användas för det här köpet.".

- Debitering är när företagsinlösaren säger: "OK, bra, skicka oss pengarna.".

- Avräkning är när pengarna faktiskt flyttas från Issuing-kontot till företagskontot.

Här är ett exempel från verkliga livet som hjälper dig att förtydliga: Låt oss säga att du gör en beställning på matvaror som ska levereras hem till dig. Appen du använder summerar den uppskattade kostnaden för de artiklar du valt, plus beräknad skatt, plus dricks till föraren. Appen kommer inte att veta det exakta totala beloppet förrän efter att beställningen är klar, men den måste få förhandsgodkännande från din kortutfärdare för att se till att du har tillräckligt med tillgängliga medel eller kredit för att täcka beloppet. När du först gör beställningen och skickar in din kortinformation för betalning kommer appen (eller snarare appens inlösare eller betalleverantör) att kontakta banken som utfärdade ditt kort och begära auktorisering för det uppskattade totala beloppet för din beställning, vilket förmodligen kommer att vara något högre än det faktiska totala beloppet. Förutsatt att kortutfärdaren godkänner transaktionen kommer ett belopp att reserveras på kortet. När transaktionen faktiskt har slutförts och appen vet hur mycket det slutliga beloppet för din beställning är, kommer den att begära att få dra det beloppet. Det är en liknande process som att ange ett kreditkort med en hotellbokning för att täcka oförutsedda kostnader, och att hotellet reserverar ett visst belopp på kortet, men sedan faktiskt debiterar dig bara det belopp du spenderade vid utcheckningen.

Vad är ett auktoriseringsformulär för kreditkort?

Ett auktoriseringsformulär för kreditkort är ett dokument som kunder (eller kortinnehavare) fyller i för att ge företag tillstånd att debitera deras kreditkort. Auktoriseringsformulär för kreditkort används oftare för större inköp (tänk bilar, datorer etc.) än för mindre, vardagliga föremål. De används också ofta när du skapar nya abonnemang och andra återkommande betalningar. Ibland genereras kreditkortsauktoriseringsformulär digitalt och ibland skrivs de ut. Vanligtvis använder företag de här formulären när de planerar att debitera kortet senare utan att kortinnehavaren är närvarande.

Informationen på ett sådant formulär ska innehålla följande:

- Kortinnehavarens namn

- Kortnummer

- Kortbetalningsnätverk (Visa, Mastercard, American Express, Discover etc.)

- Kortets utgångsdatum

- Kortinnehavarens postnummer för fakturering

- Företagsnamn

- Uttalande om godkännande av debiteringar

- Kortinnehavarens underskrift och datum då de skrev under

Dessutom innehåller många kreditkortsauktoriseringsformulär en del eller alla av följande uppgifter:

- Kortinnehavarens fullständiga faktureringsadress och leveransadress

- Kortinnehavarens telefonnummer

- Kortinnehavarens e-postadress

- Företagets kontaktinformation

- Inköpsbelopp

- Språk som anger att detta godkännande gäller en återkommande betalning, om tillämpligt

- Uppgifter om varor eller tjänster som omfattas av köpet

- Kund-ID, faktura- eller inköpsordernummer

Är auktoriseringsformulär för kreditkort säkra?

Säkerheten för kreditkortsauktoriseringsformulär beror helt och hållet på de skyddsåtgärder som företaget vidtar. Till exempel är digitala kreditkortsauktoriseringsformulär via tredjepartswebbplatser som DocuSign noggrant konstruerade för att vara så säkra som möjligt. Omvänt, när du har att göra med ett utskrivet formulär, beror säkerheten för känslig information i formuläret på vad företaget gör med formuläret – och kreditkortsinformationen det innehåller – efter att kortinnehavaren har fyllt i det.

Vad är förauktorisering?

När kortutfärdaren granskar en auktoriseringsbegäran för en transaktion, dvs. om det finns tillräckligt med medel för att täcka försäljningskostnaden, kommer utfärdaren att reservera ett belopp på kortinnehavarens konto. Detta kommer att minska dennes tillgängliga medel eller kredit med försäljningsbeloppet för att förhindra att denne potentiellt övertrasserar kontot innan medlen från den aktuella transaktionen flyttas och skickas till företagets bank. Reserverade belopp är en praktisk mekanism för att förhindra kortbedrägerier och återkrediteringar.

Om någon till exempel hade 300 USD tillgängligt på en kredit och de köpte något för 260 USD, och det inte fanns något reserverat belopp på deras kort efter att transaktionen hade godkänts, skulle det vara möjligt för dem att snabbt köpa något annat för till exempel 100 USD innan 260 USD från det första köpet överfördes från deras konto. När alla transaktioner är avräknade skulle de vara över sin gräns med 60 USD, vilket inte är en idealisk situation för utfärdaren eller kortinnehavaren. Reserverade belopp är i praktiken ett sätt för utfärdare att se till att kortinnehavarnas konton omedelbart återspeglar deras verkliga tillgängliga saldo, redan innan alla väntande transaktioner har avräknats.

Förauktoriseringar kan vara allt från ett par minuter till 31 dagar och tas bort när företaget får medlen eller när auktoriseringen löper ut.

Varför går det inte att auktorisera kort?

Om en kortutfärdare nekar en transaktion beror det nästan alltid på en av följande tre kategorier.

Säkerhetsskäl

Det är i kortauktoriseringsprocessen som alla röda flaggor relaterade till potentiella bedrägerier oftast höjs. Om utfärdaren upptäcker att ett kort har markerats som stulet, förlorat eller spärrat kommer de att neka transaktionen och sannolikt utlösa en djupare titt på kontot för att se om det har förekommit annan misstänkt aktivitet. På samma sätt, om kortet har passerat sitt utgångsdatum, kommer transaktionen inte heller att auktoriseras.

Ett sätt för företag att minska förekomsten av säkerhetsrelaterade nekade auktoriseringar är att vidta kraftfulla motverkande åtgärder mot bedrägerier överlag. Stripe-användare har tillgång till Stripe Radar som använder maskininlärning för att förhindra bedrägerier utan att hindra dina riktiga kunder från att göra betalningar och tillämpar dynamisk 3D Secure-autentisering på betalningar med hög risk. Radar kräver ingen ytterligare konfiguration eller integration om du redan använder Stripes produkter.

Ekonomiska skäl

Om utfärdaren tittar på kortinnehavarens konto och upptäcker att det inte finns tillräckligt med pengar eller tillgänglig kredit, kommer de att neka auktoriseringen och transaktionen. Vissa utfärdare erbjuder övertrasseringsskydd som gör att transaktioner kan fortsätta även när tillräckliga medel inte finns tillgängliga, men den här funktionen kostar vanligtvis och är inte tillgänglig på alla konton. I de flesta fall hindrar otillräckliga medel att en transaktion auktoriseras.

Tekniska skäl

Det finns också tekniska orsaker till att en betalningsauktorisering kan misslyckas. Detta är vanligare vid onlineköp, där det finns mer utrymme för användarfel när betalningsinformation matas in. Onlinetransaktioner tenderar att vara känsligare för tekniska fel på grund av den ökade risken för bedrägerier med dessa transaktioner när kort ej är närvarande. Faktum är att bank- och kreditkortstransaktioner online har en 10 % lägre godkännandefrekvens än personliga transaktioner med kort närvarande. Om något i betalningsinformationen som skickas in för ett onlineköp är felaktigt eller misstänkt kommer det sannolikt att nekas av utfärdaren.

Ibland får företaget och kunden en specifik anledning till varför en debitering nekades, och ibland är den helt enkelt inte godkänd. Mängden information som följer med en nekad auktorisering beror på olika faktorer, till exempel vem kortutfärdaren är, vem företagets betalleverantör är, vilken typ av POS-system de har och om transaktionen skedde online eller personligen.

Kortauktoriseringar kan nekas av flera olika anledningar, oavsett var de behandlas, men det finns åtgärder företag kan vidta för att förbättra sin auktoriseringsfrekvens. Att dina betalningar stöds av Stripe är ett starkt steg i den riktningen: Stripes plattform erbjuder intelligent inlösenfunktionalitet med direkta integrationer mot stora kortbetalningsnätverk globalt, vilket minskar latens och förbättrar tillförlitligheten för korttransaktioner. Stripes användare har tillgång till insikter på utfärdarnivå och förbättrade datafält, som svarskoder i råformat, för att ge dig större insyn i vad som händer med dina betalningar. Med sin moderna inlösarplattform lär sig Stripe kontinuerligt av miljarder datapunkter för att optimera routing och meddelanden för varje transaktion – det är en betalningsinfrastruktur i sig som är förberedd för att fungera till förmån för bättre auktoriseringsfrekvens. Stripes lösningar har genererat miljarder i intäkter för företag genom att förhindra att legitima betalningar blockeras. Läs mer här för mer information om hur Stripe fungerar för företag för att optimera auktoriseringar.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.