In 2023, Spain achieved record value-added tax (VAT) collections of €83.9 billion. The same year, the nation’s GDP grew by 2.5%—a figure partly influenced by the country’s high inflation, which averaged 3.3% for the year—according to the Bank of Spain’s annual report.

While most VAT collected in Spain comes from the general VAT rate (54.3% of the total in 2022, per the annual tax collection report), the reduced VAT still imposes a financial burden on citizens, prompting the Spanish government to implement specific adjustments. Let’s examine how this works and the current temporary reductions.

What’s in this article?

- What is reduced VAT?

- Example of reduced VAT

- Which products and services are taxed at the reduced VAT rate?

- Comparison of reduced VAT in Spain and the EU

- Temporary cut of reduced VAT

What is reduced VAT?

Reduced VAT is one of the tax rates applied in Spain, specifically on the mainland and the Balearic Islands; it represents a percentage added to the value of goods or services. The general VAT rate in Spain is 21%, while the reduced rate is 10%. This number has gradually climbed over the decades: in 1991, it was 6%; in 2009, it was 7%; in 2011, it was 8%; and since July 2012, it has been set at 10%. It’s important to point out that there is an even lower percentage: the super-reduced VAT, set at 4%.

The reduced VAT rate, established by Directive 91 of the VAT law, is intended to make goods and services more affordable, such as promoting the use of public transport.

Example of reduced VAT

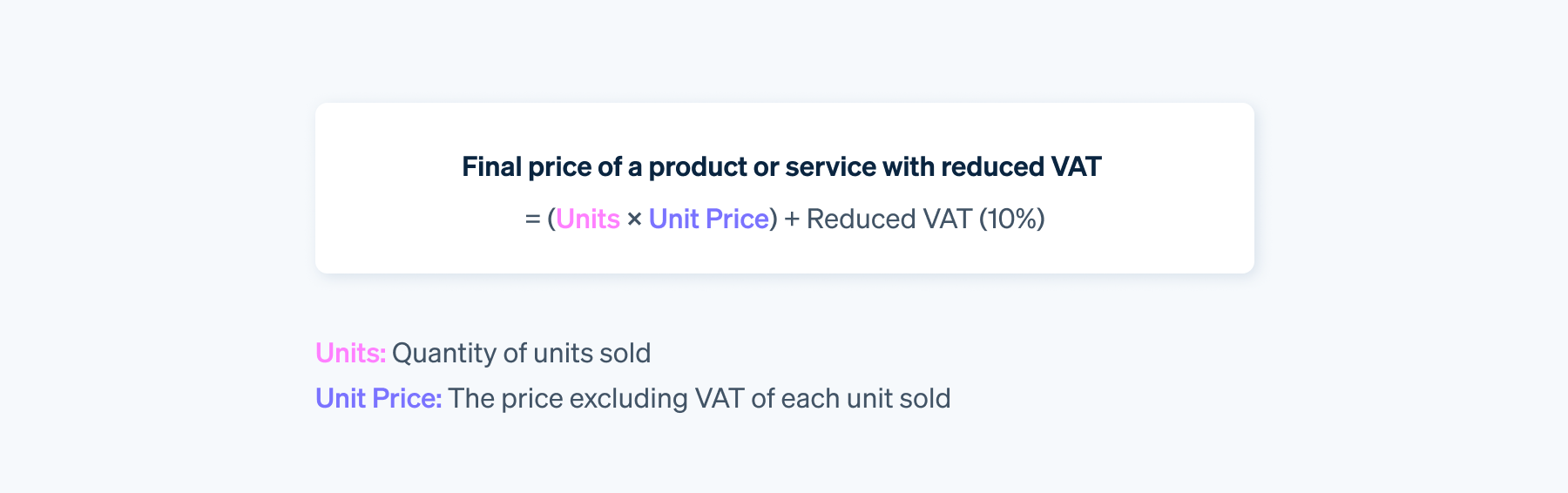

To calculate the total VAT amount, simply add a percentage to the base price, as follows:

2 Museum Tickets: €25 × 2 = €50

Reduced VAT (10%): €5

Total Price: €55

This calculation can be understood as multiplying the tax base by 1.1 (100% of the tax base plus the 10% reduced VAT). Let’s check that the result is identical:

€50 × 1.1 = €55

In this example, if the museum tickets were taxed at the standard VAT rate, the total price would be €60.50. Therefore, the lowered amount represents a savings of €5.50.

Which products and services are taxed at the reduced VAT rate?

The reduced VAT rate can only be utilized to the goods and services on this list:

- Cultural activities (such as visiting a museum, attending a concert, or using a document center or library)

- Water used for irrigation or food for humans or animals

- Hospitality services (hotels, bars, etc.)

- Any product used to produce food for humans or animals (animal feed, etc.)

- Utilities such as electricity, natural gas, and any biofuel

- Transportation (international flights, train and subway tickets, etc.)

- Pharmaceutical items (surgical masks, bandages, gauze, etc.)

- Vision correction items (eyeglass frames and lenses, contact lenses and lens solutions, etc.)

- Renovation of houses or apartments (although the reduced VAT rate applies exclusively in certain cases, as indicated by the OCU)

- Real estate (including houses, apartments, warehouses, and garages)

- Livestock or agricultural products (fertilizers, animal feed, insecticides, etc.)

- Any service to clean a street, garden, or public park

When you sell a good or service, you can only apply the reduced VAT rate if it falls within the specified list. Otherwise, you would be committing irregularities that could result in VAT penalties. To ensure that you always implement the correct amount, it can be highly beneficial to use an automation tool such as Stripe Tax, which automatically calculates and collects VAT on your sales. In addition, Tax allows you to generate reports on the tax collected to simplify your filings and stay up to date on rate changes in more than 50 countries, subject to certain exceptions.

Comparison of reduced VAT in Spain and the EU

The differences between European Union countries are not limited to the products taxed at reduced VAT rates; the percentage also varies between countries. Spain is at a moderate level, as shown below, comparing it alongside three other member states for reference:

- Spain: 10%

- Italy: 10%*

- France: 10%*

Germany: 7%

Unlike Spain, France and Italy have four different VAT levels. In France, the “intermediate VAT” rate is 10%, and in Italy, the “first reduced VAT” rate is 10%, generally applied when Spain does so. Still, food or social services are taxed lower at 5.5% in France and 5% in Italy. There is also a super-reduced VAT rate in Spain, France, and Italy.

Note that in some EU countries, such as Denmark, the VAT amount is not lowered; only the standard rate applies.

Temporary cut of reduced VAT

To mitigate the impact of the economic crisis in Spain, a set of anti-inflation measures took effect on January 1, 2023, including a cut in the reduced VAT rate for two specific product categories: oils (olive and seed oils) and pasta.

Before implementing these measures, both items were subject to a reduced VAT rate of 10%. However, it was dropped to 5% in response to the economic context and the sharp increase in wheat prices caused by the Russian invasion of Ukraine.

At the Council of Ministers on June 25, 2024, a decision was made to introduce a new VAT rebate on food. This adjustment introduced several new changes:

- Olive oil: Reduced to 0% from 5%. All other oils remained at the reduced VAT rate of 5%.

- Deadlines: Both cuts were extended until September 30, 2024.

- Percentage: The reduced VAT rate for seed oils and pasta remained at 5% until that date, but from October 1 until the end of 2024, it was increased to 7.5%.

The European Commission, aiming to ensure compliance with the Stability and Growth Pact in all EU member states, issued a directive calling for the gradual unwinding of measures introduced to counter the effects of the economic crisis. Starting in 2025, the reduced VAT rate is expected to return to its standard 10%.

As we have observed, these figures can vary depending on the political, social, and economic circumstances. Accordingly, it is advisable to check the current VAT amounts from a reliable source such as the Agencia Tributaria, which outlines certain exemptions subject to a 0% or 5% VAT rate.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.