The OSS payment is a central part of the One Stop Shop procedure that helps businesses efficiently fulfil their VAT obligations for cross-border sales within the EU.

This article explains OSS payments, how they work, their deadlines, and how you can record them.

What’s in this article?

- What is an OSS payment?

- What is OSS?

- How do OSS payments work?

- How can companies make OSS payments?

- What are the deadlines for OSS payments?

- Tips for meeting OSS deadlines

- Posting OSS payments

What is an OSS payment?

An OSS payment is the transfer of value-added tax (VAT) amounts declared to the relevant tax authority under the OSS procedure. It allows businesses to pay the tax due on their cross-border sales within the EU at the same time, rather than having to make separate payments to each country. The reported VAT amounts are transferred centrally to the national tax authority of the country of registration. This authority then distributes them to the tax authorities of the other EU countries.

What is OSS?

The OSS scheme is an EU-wide system designed to simplify VAT processing in cross-border online sales. It allows businesses to report their taxable receipts from B2C sales via a central online portal without having to register individually in each relevant EU country. The name “One Stop Shop” refers to a single point of contact and describes this centralised approach.

Participation in the OSS is voluntary for online retailers. However, the use of the OSS is recommended for companies that sell goods or services to private individuals in several EU countries. It can significantly reduce their administrative burden. The procedure was introduced as part of the VAT Digital Package on April 1, 2021 and is seen as an evolution of the Mini One Stop Shop (MOSS) system. Beginning in 2027, the current rules will be extended by the VAT in the Digital Age (ViDA) reforms.

How do OSS payments work?

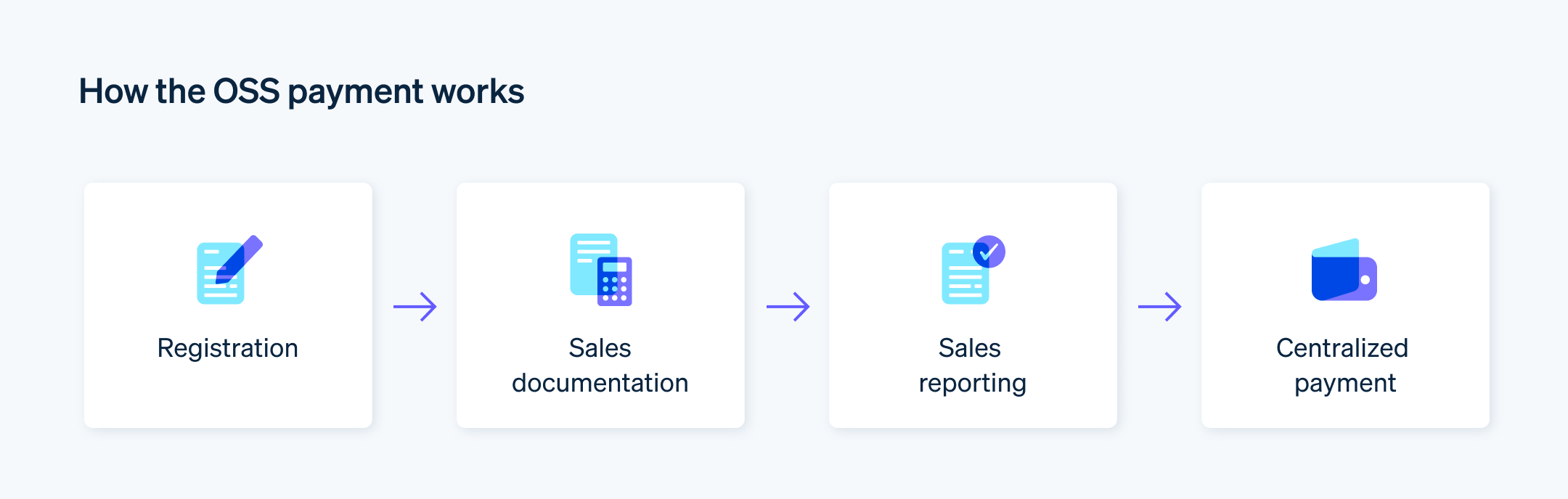

Paying the VAT due is the final step for online businesses when using the OSS procedure. Below is an overview of the whole process:

Registration: EU-based businesses that wish to use the OSS register in their home countries. They can register online via the national tax portal. In Germany, for example, they can register via the Federal Central Tax Office (BZSt) at the BZSt Online Portal (BOP).

Documentation of sales: All relevant sales must be documented in detail—including net amounts, tax rates of each destination country, and calculated VAT for each line item.

Reporting of sales: Documented sales are reported in a quarterly tax return via the OSS portal. The taxable sales and the VAT charged are broken down for each EU country. Detailed information can be found in our article on OSS reporting.

Centralized payment: After confirmation, the total tax calculated is sent to the tax authority of the country of registration. The tax authority then distributes the amounts to the countries where the sales were made.

It is easy for businesses to make mistakes when calculating their sales because they have to take into account the different tax rates in each EU country. Stripe Tax helps by automatically calculating the correct amount of tax. This ensures businesses can quickly and easily get an overview of the taxes they need to pay to the BZSt.

How can companies make OSS payments?

Once the taxable sales have been reported via the OSS portal, the relevant tax authority checks the information. After a few days, businesses receive an email confirming whether the information is correct. If this is the case, companies can transfer the amount due to the following BZSt bank account:

Payee: Federal Treasury Trier Special Account EU/UST

Bank name: Deutsche Bundesbank branch in Saarbrucken

International Bank Account Number (IBAN): DE81 5900 0000 0059 0010 20

Bank Identifier Code (BIC): MARKDEF1590

At minimum, a company must provide its reference number when making its first OSS payment. This consists of the country code “DE,” the VAT identification number (VAT ID) of the company, and the tax period. The latter consists of the year and the quarter for which the VAT liability is settled (e.g., “Q1.2025”).

Important: The transfers must be made manually because direct debit is not possible.

What are the deadlines for OSS payments?

There are quarterly deadlines for OSS payments, which are the same throughout the EU. These correspond to the deadlines for OSS reporting. The reference date is the last day of the month following the tax period.

First quarter: April 30

Second quarter: July 31

Third quarter: October 31

Fourth quarter: January 31 of the following year

These are fixed deadlines, meaning the deadline is not postponed if it falls on a weekend or public holiday. The money must be in the tax authority’s account on the due date.

If the payment is not received on time, late payment penalties can apply. There is also a risk that the tax authorities could temporarily suspend the company from using the OSS system.

Tips for meeting OSS deadlines

To ensure compliance with deadlines, companies should consider the following points:

Submit OSS reports early

In order to meet the deadlines for OSS payments, businesses should submit their VAT returns as early as possible. The reporting process via the OSS portal can take some time, depending on the volume of sales and the complexity of the calculations.

If businesses submit their returns a few days or weeks before the end of the quarter, there will be enough time to correct any errors and prepare for payment. This also reduces stress at the end of the period and gives businesses the opportunity to clarify any uncertainties with the tax authorities in good time.

Plan for unexpected delays

Sometimes, unforeseen circumstances can arise, such as technical problems with reporting on the OSS portal or delays in bank transfers. Therefore, companies should build in buffer times and not wait until the last day to make the payment. A buffer of one or two days can help protect against unforeseen complications and ensure the payment is processed on time.

Set reminders

With so many administrative tasks to perform, it can be easy to forget the deadlines for OSS payments. To prevent this, companies can set up digital reminders in their calendars or accounting systems. These can be triggered, for example, a month before the deadline and then a week before the deadline to ensure there is sufficient lead time.

Consider bank processing times

A business must make the OSS payment before the deadline, and payments need time to process. Please note that bank processing times can vary. Companies should, therefore, ensure they initiate the payment at least a few days before the deadline so the payment is received by the due date. It is also advisable to check the transfer details carefully, as errors can result in the transfer not being made or incorrectly allocated.

Posting OSS payments

Firstly, the VAT amounts declared and payable under the OSS scheme have to be recorded as liabilities in the accounting records. As OSS payments are made in euro, this requires an exchange rate adjustment for companies in non-euro countries. Once the payment has been made to the relevant tax authority, the amount is recorded as a cash outflow. This means VAT liabilities are reduced, and the company’s bank accounts are also debited. The entry could look like this:

Debit: VAT liabilities (or tax account)

Credit: Bank account

If the business has declared VAT for several countries, the individual tax amounts for each country must be correctly allocated and accounted for as part of the payment. This is done according to the relevant tax rates and the countries where the sales were made. As part of the OSS process, the tax authorities of the country of residence will remit the amounts to the countries concerned.

It is important to keep careful records of payments and related tax documentation. Companies should keep confirmation emails from the tax authorities as well as payment receipts to prove the OSS payment processed correctly. This documentation will also be required for future audits and tax returns.

If the company has a preliminary VAT return, it should also account for the VAT amounts reported and paid in this return. In this case, companies should include the OSS payments in the preliminary return to avoid double taxation.

At the end of the quarter or relevant tax period, the business should reconcile the posting of the OSS payment with the actual tax returns. This will ensure amounts are recorded correctly and payments are made in full and on time.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.