Since the establishment of the One Stop Shop (OSS) in July 2021, value-added tax (VAT) processing for cross-border B2C sales in the EU has been made much simpler. A recent decision has been made by the EU Council to expand the OSS system in the future. In this article, we’ll discuss the One Stop Shop, including how it works, which businesses can use it, and under what conditions they can use it. We’ll also discuss the new rules that will apply to the OSS in the future.

What’s in this article?

- What is the One Stop Shop?

- What requirements must businesses fulfill to participate in the OSS?

- When are businesses unable to use the OSS?

- How does the One Stop Shop work?

- How will the OSS change in the future?

- What are the advantages of OSS?

What is the One Stop Shop?

In EU tax law, the One Stop Shop (OSS) refers to a system for processing VAT in cross-border ecommerce. Under certain conditions, it enables businesses to report their sales via a central online portal instead of having to register separately in each country. Participation in the OSS is voluntary for online retailers but recommended—especially for those that sell goods or services to several EU countries.

The OSS was first introduced on April 1, 2021 as an improvement to the previous Mini One Stop Shop (MOSS) system. The OSS was part of a series of measures known collectively as the “VAT in the Digital Age,” or ViDA, package. ViDA is set to expand current OSS regulations in 2027.

What is ViDA?

VAT in the Digital Age (ViDA) is an EU Commission initiative to modernize the existing European VAT system. The EU Commission adopted this package of measures in November 2024. ViDA introduced new provisions regarding digital reporting obligations and the platform economy based on the existing Value-Added Tax Directive, and it expanded the OSS system.

What requirements must businesses fulfill to participate in the OSS?

A business in the EU can voluntarily participate in the OSS if it meets at least one of the following requirements:

- It supplies goods or services to customers (i.e., private individuals) in other EU member states. Note that the business cannot have a warehouse in any member state to which it sells.

- It provides an electronic interface through which it supports the supply of goods within a member state by a taxable entity not established in the EU. In this case, the EU tax authorities treat the EU business as if it had supplied the goods itself.

Delivery threshold

Since July 2021, online retailers in the EU have had to comply with a delivery threshold. If a business has sales of less than €10,000 net per calendar year, its country of origin levies sales tax. If a business exceeds this threshold, it must pay sales tax in the countries in which it delivers goods or services. In the latter case, a business can either register and pay the applicable VAT in each individual country it delivers to, or it can register once for the One Stop Shop and pay VAT in one place.

Businesses not based in the EU can also use the OSS. However the prerequisite is a warehouse in the EU from which the business makes intracommunity deliveries to private individuals.

When are businesses unable to use the OSS?

When they sell to other businesses

Businesses that sell their goods and services exclusively to other businesses are excluded from the OSS. The OSS is only for businesses that sell to private individuals (i.e., B2C).

When they use the small-scale entrepreneur rule

Businesses that make use of the small-scale entrepreneur rule pursuant to Section 19 of the VAT Act (UStG) are also exempt from the OSS. The prerequisite for applying the small-scale entrepreneur rule is an annual turnover of less than €22,000 in the previous year and an expected turnover of less than €50,000 in the current year. Businesses that qualify are exempt from VAT and therefore do not need the OSS.

When they benefit from differential taxation

The OSS cannot be used by businesses that benefit from differential taxation. Online retailers that purchase goods from private individuals in order to resell the used products, for example, are not charged VAT by the tax authority on the full sales price. Instead, due to a special regulation, an EU country levies VAT only on the difference between the purchase price and the sales price. This differential taxation cannot be paid through the OSS.

Similarly, goods subject to excise duty are exempt from the OSS. These include coffee, alcohol, and tobacco.

When they have warehouses in EU countries they sell to

The OSS also can’t be used by businesses that deliver goods to EU countries they have warehouses in. When a business does this, no cross-border delivery occurs, but rather a local delivery.

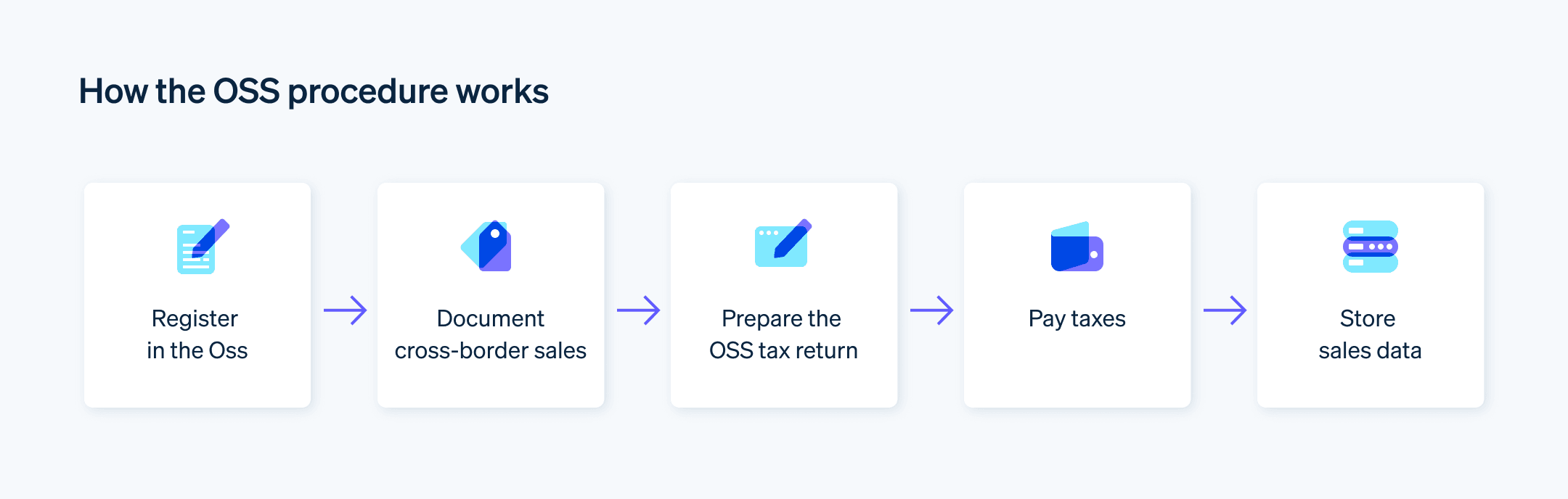

How does the One Stop Shop work?

Businesses that wish to use the OSS can do so in just a few steps.

Register in the OSS

Each EU country has its own version of the OSS. It is therefore important that registration takes place via an electronic portal in a seller’s home country. German businesses, for example, can register for the OSS via the online portal of the Federal Central Tax Office (BZSt). A VAT identification number is required to register, and a business must complete registration before its first taxable transaction and no later than the end of the previous quarter.

Document cross-border sales

Businesses must precisely document all transactions relevant to the OSS. Information that is particularly important includes: the individual sales amounts, the respective countries that goods or services were sold to, the applicable tax rates, and the calculated VAT.

Stripe Tax can help when it comes to processing VAT. Tax allows businesses to collect and report their taxes for global payments. Stripe Tax calculates the correct tax amount automatically; it is possible to quickly determine, for example, whether businesses have exceeded delivery thresholds. Stripe Tax also offers access to all relevant tax documents, allowing businesses to apply for tax refunds quickly and easily.

Prepare the OSS tax return

Businesses that use the OSS must report their recorded cross-border sales in a quarterly tax return. Information should be provided in euros and based on the European Central Bank’s exchange rate on the last day of the quarter.

Businesses need to submit their tax returns by the end of the month following the tax assessment period. The submission deadlines for each quarter are April 30, July 31, October 31, and January 31 of the following year. Businesses must submit the OSS tax return even if they made no cross-border sales in the quarter in question. In this case, they should submit what is known as a “zero declaration.”

Businesses must prepare separate tax returns for sales generated in their home countries.

Pay taxes

Businesses need to transfer their outstanding VAT amounts to the Federal Treasury in Trier. The tax authorities in Germany will then forward the individual VAT amounts to the respective target countries (i.e., the countries businesses sold to).

Store sales data

Businesses must store all sales data attributable to the OSS for ten years. They must also make relevant documents available to the tax authorities upon request.

How will the OSS change in the future?

In the future, the implementation of ViDA is set to expand the OSS. The aim is to enable even more businesses to report their VAT for cross-border B2C deliveries using just one online portal in their respective countries and national languages.

This expansion will include businesses that sell goods aboard ships, aircraft, or trains; goods requiring installation or assembly; and gas and electricity. Businesses might also report intra-community warehouse movements (i.e., transfers of goods from warehouses in one EU member state to warehouses in other member states) via the OSS starting July 2028.

In the future, ViDA will allow third country businesses to process transactions via the One Stop Shop if they have a warehouse in the country they are selling to. So, for example, if a non-EU business sells goods from a warehouse in Germany to private individuals in Germany, that business could use the OSS. Starting in January 2027, ViDA will also allow businesses from third countries to report their taxable services within the EU via the OSS. This applies to services they provide to customers outside the EU, as long as they are subject to taxation in the EU.

In the future, sellers will also be able to make corrections to OSS tax returns immediately—as long as they do so before the VAT declaration deadline. Currently, businesses have to make corrections in future declarations. But with ViDA, the EU Commission has decided that users can correct OSS reports up until the submission deadline.

What are the advantages of the OSS?

The OSS offers numerous advantages to both businesses and tax authorities. Here is an overview of the most important ones.

Advantages for businesses

Central registration: Instead of registering for VAT in each country in which they have taxable sales, online retailers only have to register with the OSS once.

Uniform tax returns: Instead of multiple returns, a single quarterly tax return via the OSS portal covers all cross-border B2C sales in the EU. This means that businesses no longer have to report sales tax individually in each EU country.

Simplified tax payments: Instead of multiple payments, a business makes a bundled tax payment to the tax authority in their home country, which distributes the respective amounts to the target countries.

Time and cost savings: Instead of using multiple platforms, one centralized website for processing VAT makes accounting easier and can save businesses time. Retailers can also save money; for example, less complexity in VAT filing reduces the need to hire tax consultants.

Simplified compliance: Instead of complicated regulations and procedures, the OSS’s clear rules and standardized processes make it easier for businesses to comply with tax regulations in all EU countries. This also reduces the risk of tax penalties and fines.

Advantages for tax authorities

More efficient tax collection: National tax authorities receive the taxes from cross-border sales centrally via the registration authorities of the seller’s country. This reduces the administrative burden on the national tax authorities.

Standardization and transparency: The OSS’s uniform procedure and clear reporting obligations make tax processing more transparent. The tax authorities can record all data centrally and analyze it quickly.

Increased tax revenues: The OSS also makes tax evasion more difficult because tax authorities get a better overview of businesses’ cash flows. This improved transparency can help reduce cases of fraud and increase tax revenues.

Coordination between member states: The exchange of information between the tax authorities of EU member states improves international cooperation. This can help reduce administrative burden and simplify audits for all authorities involved.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.