The movement of goods between businesses within the European Union should be as smooth as possible. For this reason, EU member states have agreed on special tax rules for cross-border transactions. Intracommunity acquisition is a key part of this process.

In this article, you will learn what intracommunity acquisition is and its requirements. We also explain how intracommunity acquisitions are taxed and how value-added tax (VAT) is reported.

What’s in this article?

- What is intracommunity acquisition?

- What are the requirements for intracommunity acquisition?

- How is intracommunity acquisition taxed?

- How is VAT reported on intracommunity acquisitions?

What is intracommunity acquisition?

As defined in Section 1a of the German VAT Act (UStG), an intracommunity acquisition occurs when a company or taxable person within the EU purchases goods from another EU country. The goods are physically delivered from one EU country to another.

The introduction of intracommunity acquisition replaced the import sales tax in 1993 and abolished European internal borders. This eliminates customs duties. In commercial transactions, companies themselves calculate the tax due. The assessment basis of the acquisition and the amount of tax must be recorded in the accounting records.

The calculation of acquisition tax allows EU member states to match intracommunity supplies with the income generated by businesses and to ensure all transactions are correctly recorded. Intracommunity acquisitions are also intended to promote the free movement of goods and prevent double taxation of companies.

What are the requirements for intracommunity acquisition?

An intracommunity acquisition must meet certain requirements:

Delivery from one EU country to another: The goods must be physically delivered from one member state of the EU to another member state. Deliveries from a non-EU country to an EU member state are not subject to VAT.

Status of the purchaser: Buyers must be entrepreneurs or legal entities registered for VAT purposes. Private individuals are not subject to VAT with one exception: the purchase of new vehicles. New vehicle purchases are always treated as an intracommunity acquisition, regardless of the buyer’s status.

Use of the acquisition: Entrepreneurs must purchase the goods for their business, and legal entities can only make purchases for private purposes.

Status of suppliers: Suppliers must be companies that make deliveries in return for payment as part of their business. According to Section 19 of the UStG, tax-exempt small scale entrepreneurs are excluded.

VAT identification number (VAT ID): Both parties—the buyer and the seller—must have a valid VAT ID. This enables the supply to be allocated and ensures the transaction is treated as an intracommunity acquisition.

According to Section 1a, Para. 3 of the UStG, an intracommunity acquisition generally does not exist if one of the following conditions is met:

The purchasers are entrepreneurs who only carry out tax-free sales that lead to exclusion from input tax deduction.

The purchasers are entrepreneurs whose sales are not charged VAT in accordance with the small business entrepreneur regulation.

The purchasers are farmers and foresters subject to flat-rate taxation, according to Section 24 of the UStG.

The purchasers are nonentrepreneurial legal entities.

However, in the above cases, the exemption from acquisition tax applies only if the total volume of all intracommunity purchases of goods in the previous year and the current year is expected to be less than €12,500. If this income threshold is exceeded, these generally tax-exempt groups of persons are also subject to income tax.

In addition, even if the income threshold is not exceeded, it is possible to voluntarily switch to income tax liability. To do so, the purchaser must use their VAT ID. Exercising this option binds the purchaser to the acquisition tax liability for at least two calendar years.

Excise goods—such as alcoholic beverages, tobacco, or mineral oil—are an exception. They are always treated as intracommunity acquisitions for the above categories of persons.

How is intracommunity acquisition taxed?

According to Section 3d of the UStG, an intracommunity acquisition is generally taxed in the EU member state in which the purchasers (i.e. the recipients of the goods) are established. In the case of an intracommunity acquisition, the purchasers declare and pay the VAT in their own country. However, they can claim the tax as input tax if they are entitled to input tax deduction. This means if a German company buys goods from another EU country, the acquisition tax is levied in Germany. Depending on the product, the tax rate is 7% or 19%.

According to Section 13, Para. 1, No. 6 of the UStG, the turnover tax for intracommunity acquisitions is incurred when the supplier issues the invoice. This is intended to prevent a VAT-free period between delivery and purchase. However, purchasers do not know the date of issue of the invoice until they receive it. Therefore, the latest date for the acquisition tax event to occur is the month following the receipt of the goods. This is particularly relevant when there is a significant time lag between the receipt of the goods and the receipt of the invoice.

Special case: Catchall provision

If buyers use a VAT ID issued by another member state when placing an order, the tax is due in that country. In this case, buyers are not entitled to deduct input tax until they can prove the tax has already been paid in the destination country. This case is called a “catchall” case. It requires VAT registration in the destination country. In this case, it is possible to correct the acquisition tax. However, the buyer will have to pay any interest incurred.

For businesses that want to be on the safe side when it comes to processing international payments and taxing their cross-border sales, Stripe can help. With Stripe Payments, you can offer your customers access to more than 100 payment methods and a smooth, secure payment process. All payments can be easily accepted and managed. Stripe Tax also gives you the ability to collect and report taxes on global payments. The correct tax amount is automatically determined, and you have access to all the documentation you need for your tax matters.

How is VAT reported on intracommunity acquisitions?

Companies that sell goods and services to other European countries must report cross-border sales to the tax authorities in the form of a recapitulative statement. The recapitulative statement is a cross-border system that enables the authorities to check quickly and reliably whether an intracommunity acquisition has been correctly taxed.

Under Section 18a of the UStG, German companies must report their cross-border turnover on a quarterly basis by the 25th of the following month—unless the total turnover of the intracommunity deliveries during this period exceeds €50,000. In this case, the business must submit the recapitulative statement by the 25th day following the end of the calendar month in which this amount was exceeded.

In addition, businesses must also submit the turnover for the calendar months of the calendar quarter that have already passed. In principle, it does not matter whether the business submits the preliminary VAT return on a monthly or quarterly basis. If there are no intracommunity sales during the reporting period, there is no need to submit a recapitulative statement to the tax office.

Special rules apply to businesses that do not submit VAT returns and make advance payments to the tax office. These so-called “annual payers” can submit the recapitulative statement every year. However, this is subject to the condition that the sum of all supplies and other services the company provided in the previous and current calendar year does not exceed €200,000 and that the sum of all intracommunity sales in the previous and current calendar year is less than €15,000.

How do you create a recapitulative statement?

Creating a recapitulative statement can be done in just a few steps. The prerequisite for this is that German companies must register with the Federal Central Tax Office (BZSt) online portal or the more commonly used portal, ELSTER. Detailed information on ELSTER can be found in our article on digital tax returns.

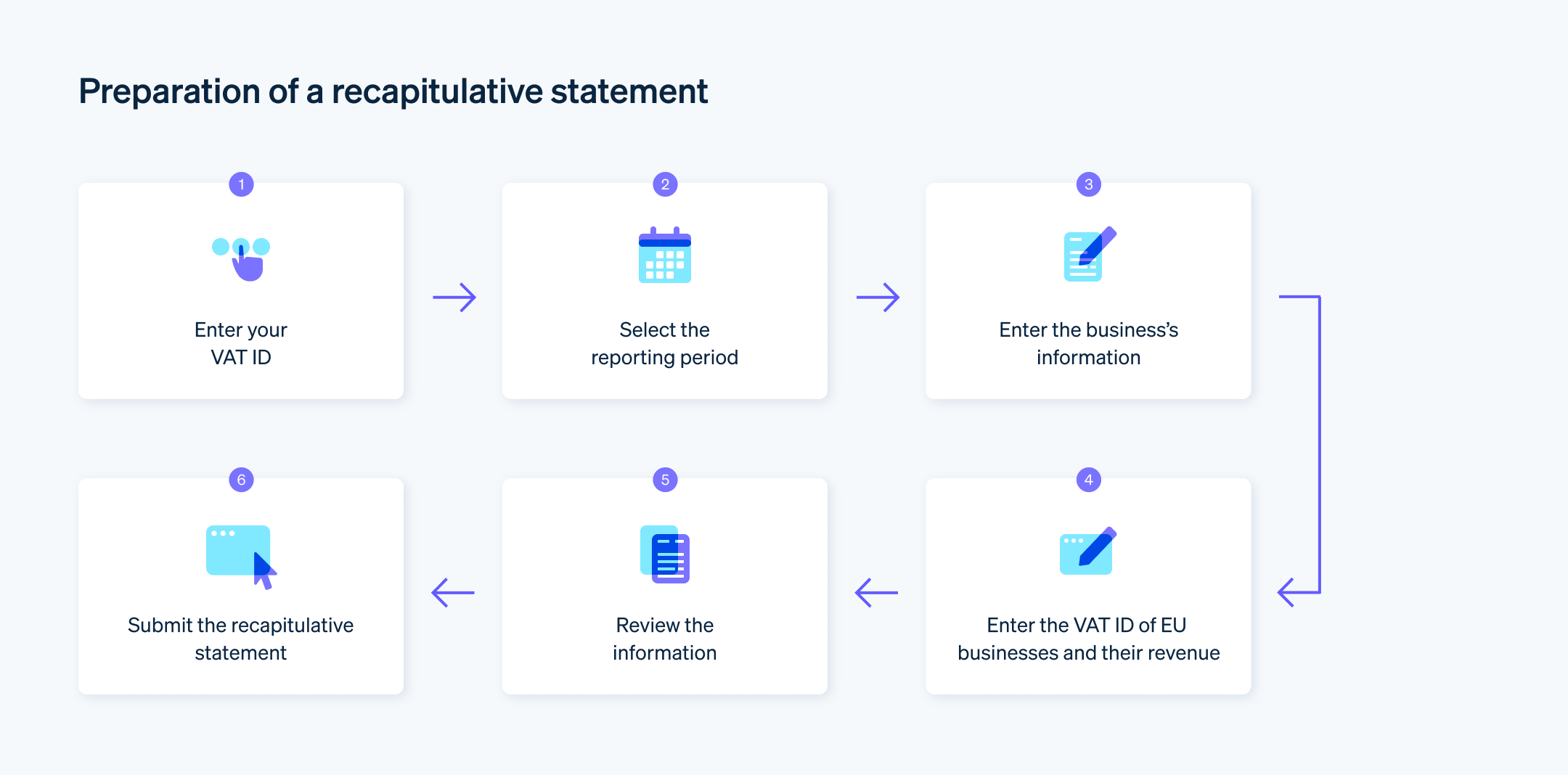

Here’s how to create your recapitulative statement:

Enter your company’s VAT number.

Select the reporting period for the recapitulative statement (i.e., the year and the month or quarter). Then, click the “Next” button.

Enter your company information, including name, address, and phone number. Then, click the “Next” button.

Enter the VAT IDs of the companies that have received intracommunity goods or services from you and the turnover generated by each of them.

Carefully check all information for completeness and accuracy.

Submit the summary report with a final acknowledgement.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.