Electronic invoicing (e-invoicing) is mandatory for most businesses in Italy. To issue such an invoice, you need to have the appropriate software or web service and specific information such as the business name, address, value-added tax (VAT) number, and the business’s recipient code, which is one of the key elements that distinguishes an electronic invoice (e-invoice) from a paper invoice. This article explains what the recipient code is, what its purpose is, where to find a customer’s recipient code, and how to get your own.

What’s in this article?

- What is a recipient code for electronic invoicing?

- Recipient code for invoices to individuals

- Recipient code for foreign customers

- How do I get a recipient code for my business?

- Where do I find a customer’s recipient code?

- What are the differences between a unique code and a recipient code?

What is a recipient code for electronic invoicing?

The recipient code—also known as the SdI consignee code or SdI code—is a 7-character alphanumeric identifier linked to the Italian Revenue Agency’s (Agenzia delle Entrate’s) Exchange System. It is used to ensure the correct delivery of an e-invoice to a private professional or business operator. The recipient code identifies the software or web service used by the invoice recipient, letting them receive invoices in their e-invoicing management system.

Can an e-invoice be delivered without a recipient code?

You can still send an e-invoice in these ways:

Use the certified email address (PEC), if it’s available: when filling in the invoice, enter “0000000” in the recipient code field and the PEC address provided by the customer in the PEC recipient field. If the PEC address is unknown, you can use the INI-PEC portal to find the PEC address of businesses and professionals by entering other known customer information.

Enter the recipient code “0000000” if the client is an individual without an electronic address (PEC or recipient code). In this case, inform the client that the e-invoice can be accessed in their restricted “Consultation” area on the Italian Revenue Agency’s Invoices and Receipts (Fatture e Corrispettivi) portal.

What happens if I enter the SdI recipient code wrong?

If the customer’s tax code or VAT number is entered correctly, they will still receive the invoice. However, instead of viewing it in their management software, they will need to retrieve it from their dashboard in the Invoices and Receipts portal.

Recipient code for invoices to individuals

Individuals without a VAT number don’t need to have a recipient code or PEC address. Here’s how to issue an e-invoice without a recipient code for private individuals:

- In the recipient code field, enter “0000000.”

- Leave the VAT number field blank because the customer does not have one, and instead complete only the tax identification number field.

- Leave the PEC field blank.

The Exchange System will then deliver the e-invoice to the customer, who can view it in their dashboard on the Italian Revenue Agency website. At that point, you’ll need to:

- Inform the customer that they can view the e-invoice in their dashboard on the Italian Revenue Agency website.

- Provide the customer with a copy of the invoice, as a paper printout or in a digital format, such as a PDF sent by email.

Recipient code for foreign customers

For foreign customers—whether they are businesses or individuals without a VAT number and whether they are within the European Union (EU) or in a non-EU country—the recipient code to specify is “XXXXXXX.”

Note that e-invoices in extensible markup language (XML) format are not delivered directly to foreign customers because they are outside the country. In this case, it’s important to provide a paper or digital copy of the invoice.

As your business grows, managing the invoicing process can become complex. Some tools can help automate this process, such as Stripe Invoicing, a comprehensive and flexible invoicing platform that lets you create and send invoices for one-time and recurring payments. With Stripe Invoicing, you can save time and get paid faster—87% of Stripe invoices are collected within 24 hours. Thanks to third-party integrations, you can also use Stripe Invoicing for mandatory e-invoicing.

How do I get a recipient code for my business?

If your business is required to receive invoices electronically, your recipient code is assigned to software or web services that have an accredited electronic link with the Italian Revenue Agency for sending and receiving e-invoices. This code is provided by the business that supplies the e-invoicing software or service.

Once you have received the recipient code, you should immediately register it with the Italian Revenue Agency by going to the Invoices and Taxes section and selecting “Register the electronic address for receiving all electronic invoices.” This will ensure the Italian Revenue Agency can correctly deliver the invoices issued by the e-invoicing software, even if the recipient code is missing or incorrectly entered.

Where do I find a customer’s recipient code?

It is advisable to ask customers for their recipient code if they have not provided it. Alternatively, if you have a VAT number, you can go to the Italian Revenue Agency’s Invoices and Receipts portal and log in with the Public Digital Identity System (SPID), Electronic Identity Card (Carta di Identità Elettronica, CIE) or National Service Card (Carta Nazionale dei Servizi, CNS). Next, create an invoice, input the customer’s VAT number, and click on “Retrieve Master and Registration Data.” The software will automatically pull the customer’s details, including the recipient code, from the tax registry.

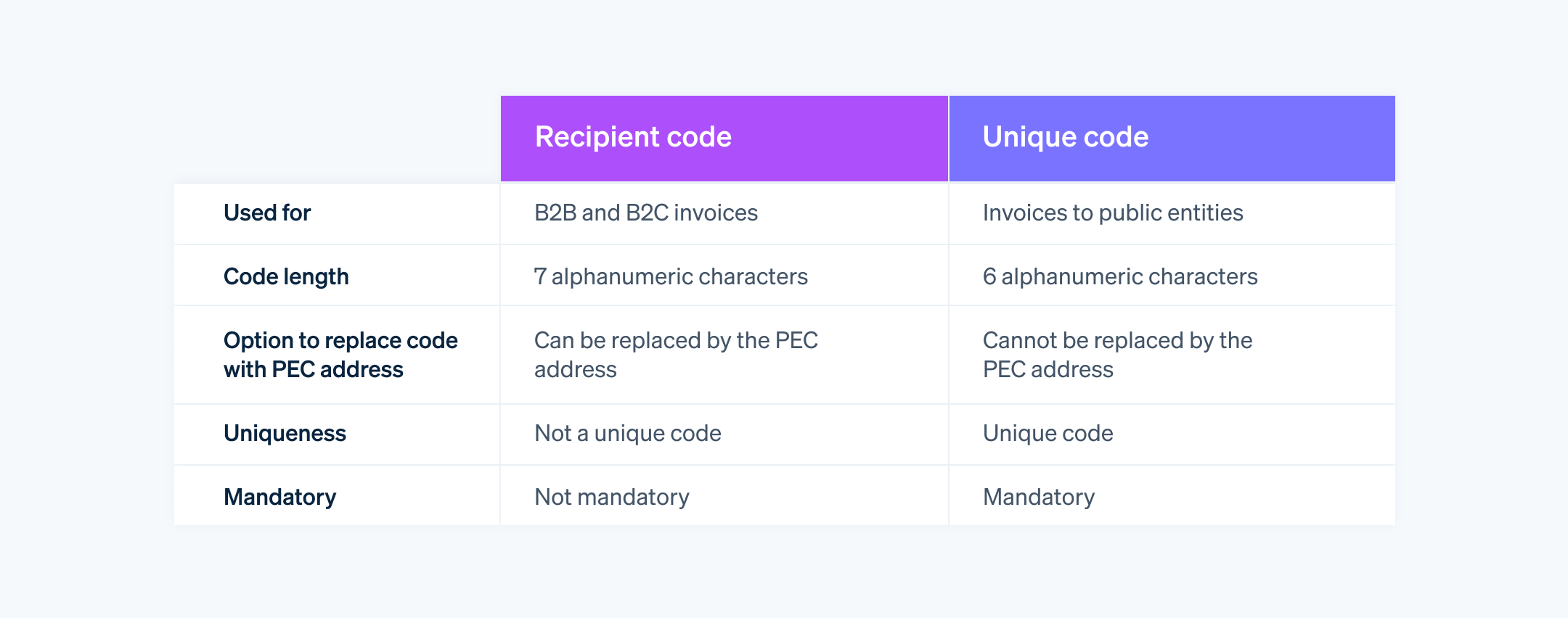

What are the differences between a unique code and a recipient code?

In addition to the recipient code, which is used to send and receive e-invoices between individuals, there is a unique code specific to e-invoicing. Are the unique code and the recipient code the same? No, the unique code is used specifically for e-invoicing to public entities. It is a 6-digit alphanumeric sequence that uniquely identifies a specific office within the public entity. It’s also known as the unique office code or the Index of Public Administrations (IPA) code.

The unique code enables the Italian Revenue Agency’s Exchange System to identify the appropriate public entity for an e-invoice and ensure it is correctly addressed. A public entity can have several unique codes, each corresponding to a different office within the organization. The unique code is mandatory for the e-invoice and must be entered in the recipient code field.

Here are the main differences between the unique code and the recipient code:

- The recipient code is used for business-to-business (B2B) or business-to-consumer (B2C) invoices (between private parties), while the unique code is used for invoices addressed to the public administration.

- The recipient code is made up of 7 alphanumeric characters, while the unique recipient code is made up of 6 alphanumeric characters.

- It is possible to replace the recipient code with a PEC address, but it is not possible to do this for the unique code.

- The recipient code is not a unique identifier for a specific business; instead, it identifies the intermediary a business chooses, such as a management software or e-invoicing service, to receive e-invoices. Different businesses might have the same consignee code if they use the same software.

- Unlike the unique code, the recipient code is not mandatory because a business can choose to receive e-invoices via PEC or access them through the Invoices and Receipts portal on the Italian Revenue Agency website.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.