O ACH routing number é um código de nove dígitos que instituições financeiras usam para identificar a unidade responsável por transferir valores entre contas bancárias dentro dos Estados Unidos. Funciona como um endereço bancário, direcionando corretamente os fundos transferidos eletronicamente (EFTs) para o banco e agência certos.

Esses códigos são fundamentais para configurar depósitos diretos, pagamentos automáticos e transferências bancárias (wire transfers). Cada banco ou cooperativa possui um código único. Você pode encontrá-lo de várias formas: na parte inferior de um cheque, por meio do sistema online do seu banco ou entrando em contato diretamente com a instituição.

Empresas que enviam ou recebem pagamentos via ACH precisam saber o routing number correto para garantir que os valores sejam direcionados à conta certa. Somente no primeiro trimestre de 2025, a rede ACH processou 8,5 bilhões de pagamentos, e a demanda por pagamentos via ACH continua crescendo. A seguir, os principais pontos que você precisa entender:

Neste artigo:

- O que é um número ACH?

- Para que servem os ACH routing numbers?

- Como localizar um ACH routing number?

- Diferença entre ABA e ACH routing numbers

- Origem e evolução dos ACH routing numbers

- Como o Stripe Payments pode ajudar

O que é um número ACH?

ACH significa Automated Clearing House (Câmara de Compensação Automatizada), uma rede que movimenta dinheiro e informações eletronicamente entre bancos e instituições financeiras nos Estados Unidos. Um número ACH é um tipo de número de roteamento usado especificamente para transações eletrônicas, como depósitos diretos e pagamentos de contas.

Os ACH routing numbers são formados por nove dígitos, e cada um deles tem uma função específica dentro da codificação. Os dois primeiros dígitos indicam o distrito do Federal Reserve Bank em que a instituição está situada. A dupla seguinte representa a filial regional — ou centro de processamento — do Federal Reserve atribuída àquela instituição. Os dígitos de cinco a oito correspondem ao identificador exclusivo da instituição dentro de seu respectivo distrito do Federal Reserve. Já o último dígito funciona como um dígito verificador (checksum), calculado com base nos oito anteriores para confirmar a validade do número completo.

Para que servem os ACH routing numbers?

Esses códigos numéricos de nove dígitos são usados em diferentes contextos para direcionar corretamente os fundos à instituição financeira apropriada. Veja a seguir os principais usos dos ACH routing numbers:

- Empregadores os utilizam para fazer o depósito direto dos salários dos funcionários em suas contas bancárias.

- Pessoas físicas e empresas configuram pagamentos recorrentes de empréstimos, contas ou serviços usando esses números.

- Os ACH routing numbers também são usados para transferir valores entre contas bancárias distintas — tanto pessoais quanto empresariais.

- Empresas fornecedoras de serviços públicos dependem deles para receber pagamentos mensais dos consumidores.

- São usados no envio e no recebimento de pagamentos e restituições de impostos estaduais e federais.

- ONGs e empresas os utilizam para receber doações ou valores por serviços prestados.

Em todas essas situações, os ACH routing numbers garantem que o dinheiro seja enviado e recebido pelas partes certas, com organização e no tempo adequado.

Como encontrar um ACH routing number?

Você pode localizar o número de roteamento ACH por diversos meios:

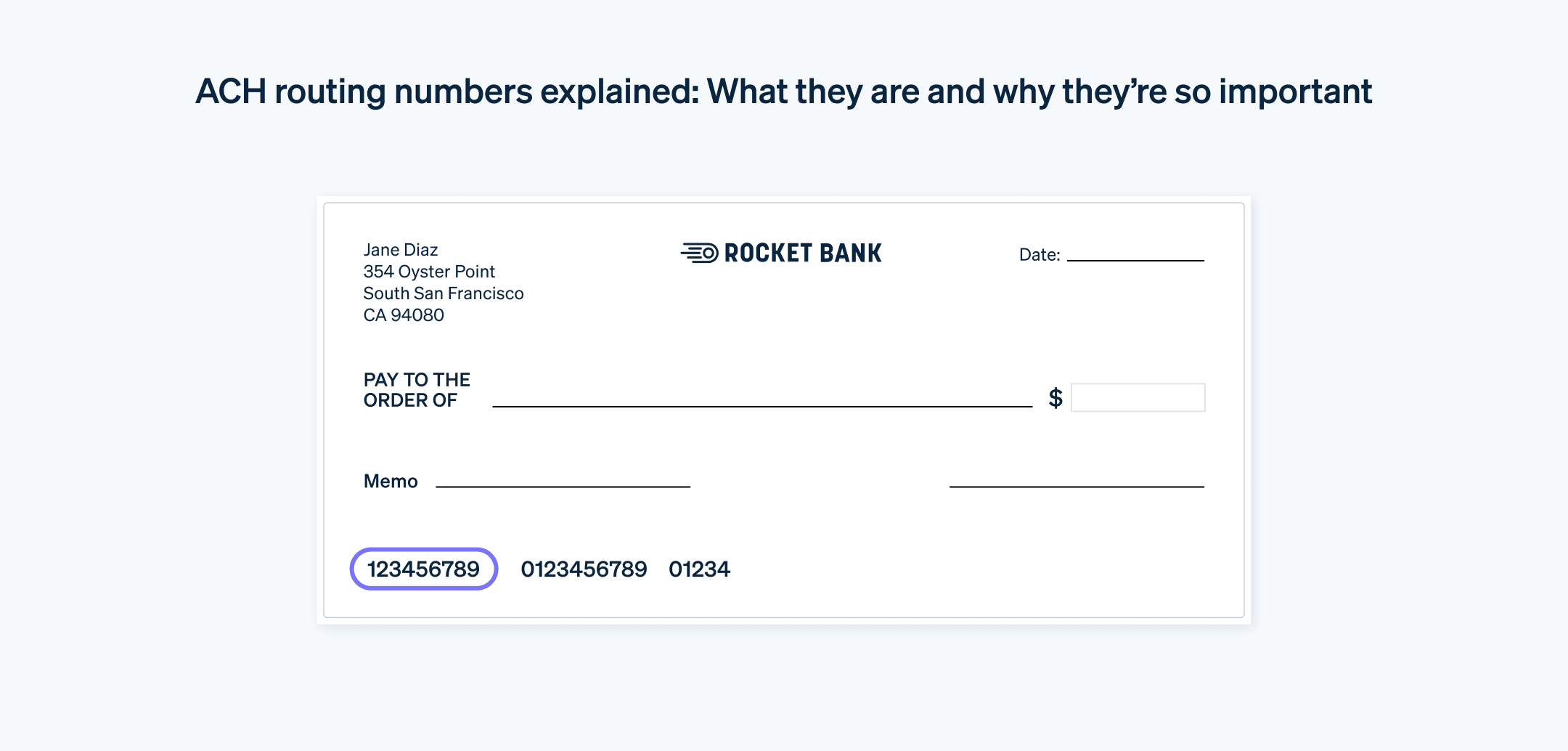

- Confira a parte inferior de um cheque vinculado à sua conta. Tradicionalmente, o routing number é o primeiro conjunto numérico impresso no lado esquerdo do cheque.

- Analise um extrato bancário. Diversos bancos costumam incluir o routing number nos documentos de movimentação da conta.

- Faça login na plataforma de internet banking ou no aplicativo da instituição financeira. Costuma-se encontrar o routing number na área de informações da conta ou nas configurações do perfil.

- Acesse o site do banco. É comum que os bancos disponibilizem uma seção de perguntas frequentes ou uma página específica dedicada à divulgação do routing number.

- Entre em contato com a central de atendimento da instituição. Um representante poderá informar o routing number correto, desde que a identidade do titular da conta seja confirmada.

- Utilize a ferramenta oficial de busca da American Bankers Association. Qualquer pessoa pode usá-la para localizar ou validar um routing number quando necessário.

Um exemplo de routing number usado para transações via ACH é 021000322 — número frequentemente adotado pelo Bank of America em pagamentos automáticos e operações eletrônicas realizadas por meio da rede ACH.

O routing number atribuído a transações ACH pode variar conforme a localização geográfica, o tipo de conta ou a natureza da transferência. Algumas instituições adotam códigos distintos para operações via wire transfer e para movimentações ACH, enquanto outras utilizam múltiplos routing numbers, de acordo com a região. Para evitar problemas como atrasos ou falhas, é fundamental confirmar previamente com seu banco qual routing number deve ser usado em cada caso.

Diferença entre ABA e ACH routing numbers

Embora os números de roteamento ABA e ACH estejam ambos relacionados ao processamento de pagamentos, eles são aplicados a finalidades distintas.

Os ABA routing numbers — também chamados de routing transit numbers (RTN) — foram criados originalmente para viabilizar a separação, organização e envio físico de cheques em papel. Ainda hoje, são utilizados na compensação de cheques físicos e em transferências bancárias via wire transfer. Esses códigos podem ser encontrados no canto inferior esquerdo dos cheques impressos.

Os ACH routing numbers são exclusivos para transferências e pagamentos realizados de forma eletrônica. Em alguns bancos, o mesmo número é usado tanto para operações ACH quanto para ABA, mas há instituições que adotam códigos distintos especificamente para transações via ACH. Essa diferenciação permite que os bancos encaminhem cada movimentação pelo sistema de processamento adequado — seja depósito direto, pagamento de contas ou outras transferências automatizadas. Utilizar o número incorreto pode resultar em atrasos ou até mesmo falhas na transação.

A seguir, os principais contrastes entre ABA e ACH routing numbers:

|

ABA routing number |

ACH routing number |

|

|---|---|---|

|

Também chamado de |

Routing transit number (RTN) |

Electronic routing number |

|

Finalidade |

Aplicado em cheques físicos e transferências via wire |

Utilizado em transferências eletrônicas, como depósitos diretos e pagamento de contas |

|

Formato |

Sequência de 9 dígitos |

Número com 9 dígitos (frequentemente idêntico ao ABA, mas pode variar) |

|

Onde localizar |

|

|

|

Utilizado por |

Bancos, cooperativas de crédito e Federal Reserve |

Instituições bancárias e a rede Automated Clearing House |

Alguns bancos utilizam o mesmo número tanto para ABA quanto para ACH, enquanto outros atribuem routing numbers diferentes dependendo do tipo de transação. Por isso, é sempre importante confirmar com o seu banco qual número deve ser utilizado no seu caso específico.

Origem e evolução dos ACH routing numbers

O sistema de ACH routing numbers surgiu no contexto de automação bancária no século XX, com o objetivo de organizar e acelerar o processamento de cheques e outras transações financeiras. A American Bankers Association (ABA) criou esse sistema em 1910 para facilitar o encaminhamento e triagem de cheques em papel. Com o crescimento das transações eletrônicas, o mesmo sistema passou a ser usado para processar valores digitalmente.

Com o avanço contínuo dos pagamentos eletrônicos, a rede ACH se expandiu para acompanhar essa demanda crescente. O sistema de routing number foi adotado como um meio confiável e eficiente para executar essas transações, permitindo que as instituições financeiras movimentem valores entre contas sem precisar emitir ou processar documentos em papel.

Ao longo do tempo, o uso das transferências via ACH se diversificou, passando a abranger uma variedade extensa de serviços financeiros. Isso inclui o depósito direto de salários, o pagamento automático de hipotecas e outras contas recorrentes, além de transações realizadas por empresas e entidades governamentais. A infraestrutura da rede ACH lida com grandes volumes de transações de crédito e débito, englobando tanto depósitos automáticos quanto pagamentos diretos feitos a partir de contas bancárias.

A robustez e a organização do sistema de routing numbers dentro da rede ACH foram fundamentais para impulsionar a expansão das transferências digitais e a transição para um ecossistema financeiro sem papel. À medida que o número de transações digitais continua crescendo, os routing numbers permanecem como um componente indispensável para as operações financeiras do dia a dia.

Como o Stripe Payments pode ajudar

Stripe Payments oferece uma solução de pagamentos unificada e com alcance global, permitindo que qualquer empresa — desde startups em fase de crescimento até grandes corporações internacionais — aceite pagamentos via débito direto pela rede ACH.

O Stripe Payments oferece suporte nas seguintes frentes:

- Otimização da experiência de checkout: Proporcione uma jornada de pagamento sem atrito para seus clientes, economizando milhares de horas de desenvolvimento com interfaces de pagamento pré-construídas e integração rápida para o débito direto por ACH.

- Acesso acelerado ao mercado dos EUA: Alcance clientes localizados em todos os estados norte-americanos, reduzindo os custos e a complexidade da gestão de múltiplas moedas ao receber em dólares americanos.

- Simplificação dos mandatos ACH: Mostre automaticamente ao cliente o mandato obrigatório como parte natural do fluxo de pagamento, utilizando o Stripe Checkout, o Stripe Payment Element ou as páginas de fatura hospedadas.

- Melhoria no desempenho dos pagamentos: Aumente sua receita com ferramentas de pagamento flexíveis e de fácil configuração, incluindo um fluxo completo hospedado para a coleta e verificação de dados bancários por meio de microdepósitos.

- Cresça com agilidade em uma plataforma confiável e flexível: Baseie sua operação em uma infraestrutura preparada para acompanhar sua evolução, com 99,999% de disponibilidade e confiabilidade reconhecida no setor.

Saiba mais sobre como o Stripe Payments pode impulsionar seus pagamentos online e presenciais ou comece agora mesmo.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.