An ACH routing number is a nine-digit code that banks and financial institutions use to identify the specific facility responsible for transferring money between accounts within the United States. Like a home address, an ACH routing number directs electronically transferred funds (EFTs) to the correct bank and branch.

ACH routing numbers are necessary for setting up direct deposits, automatic payments and wire transfers. Each bank or credit union has a unique code. You can find this code in multiple ways: by checking the bottom of a cheque from the bank, by searching for it on the bank's online banking systems, or by contacting the bank directly.

Businesses sending or receiving payments via ACH need to know the correct routing number to ensure the funds reach the right bank account. In the first quarter of 2025, the ACH network saw a total volume of 8.5 billion payments and demand for ACH payments is growing. Here's what you should know.

What's in this article?

- What is an ACH number?

- What are ACH routing numbers used for?

- How can you find an ACH routing number?

- ABA vs ACH routing numbers

- History of ACH routing numbers

- How Stripe Payments can help

What is an ACH number?

ACH stands for Automated Clearing House, a network that moves money and information electronically between banks and financial institutions within the United States. An ACH number is a type of routing number used specifically for electronic transactions, such as direct deposits and bill payments.

ACH routing numbers have nine digits, each of which serves a specific purpose. The first two digits indicate the Federal Reserve Bank district where the institution is located. The second pair of digits are the Federal Reserve Bank's district branch – or processing centre – assigned to the bank. The fifth, sixth, seventh and eighth digits represent the institution's unique identifier within its Federal Reserve district. The final digit is a checksum, which is a mathematical sum used to verify that the first eight digits are correct.

What are ACH routing numbers used for?

These nine-digit numbers are used in various ways to direct funds to the correct financial institution. Here are some of the main uses for ACH routing numbers:

- Employers use them to direct-deposit employee salaries into their bank accounts.

- Individuals and businesses use them to set up scheduled payments for loans or bills.

- ACH routing numbers facilitate the transfer of funds between different bank accounts – both personal and business accounts.

- Utility companies rely on them for receiving monthly payments from customers.

- They are used for sending and receiving state and federal tax payments and refunds.

- Businesses and nonprofits use them to receive contributions or payments for services rendered.

In each case, ACH routing numbers help ensure that the correct parties send and receive the funds in an organised and timely manner.

How can you find an ACH routing number?

There are several ways to locate an ACH routing number:

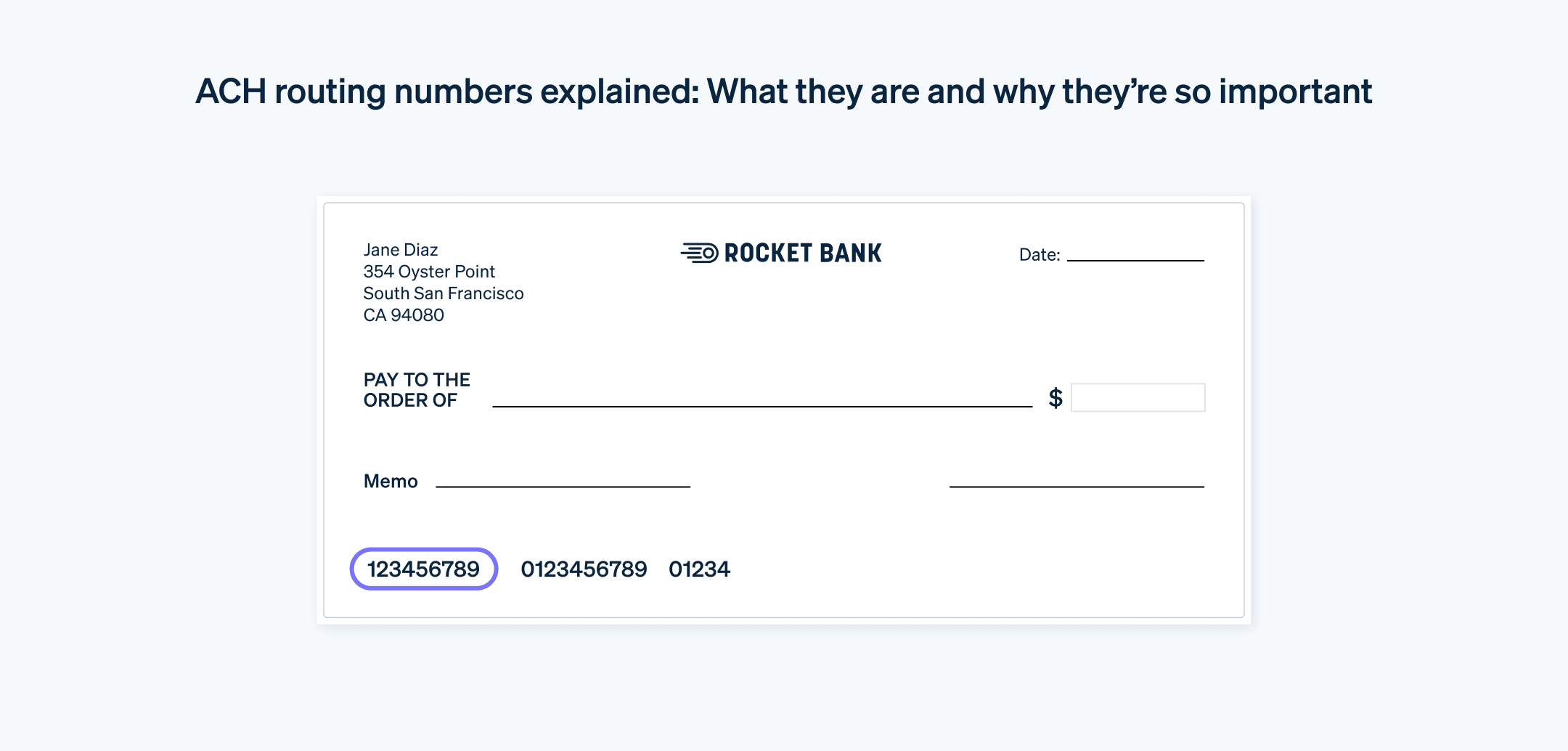

- Check the bottom of a cheque associated with the account. Traditionally, the first set of numbers printed on the left side is the routing number.

- Look at a bank statement. Some banks include the routing number on statements.

- Log in to the financial institution's online banking platform or mobile app. Typically, the routing number is listed in the account information or account settings section.

- Visit the bank's website. Most banks have an FAQ section or a dedicated page where they list their routing number.

- Call the bank. A representative can provide the routing number after verifying the account holder's identity.

- Use the official American Bankers Association routing number look-up tool. Anyone who needs to find or verify a routing number can access this.

An example of an ACH routing number is 021000322, which Bank of America frequently uses for automatic payments or ACH electronic transactions.

ACH routing numbers can vary based on your region, account type or transaction type. Some banks use different routing numbers for electronic transfers and ACH transactions, while others have multiple numbers for different geographic areas. Always confirm the correct routing number with your bank before making a transaction, to avoid any errors or delays.

ABA vs ACH routing numbers

While both ABA and ACH routing numbers facilitate payment processing, they are used for different types of transactions.

ABA routing numbers – also known as routing transit numbers (RTN) – were originally designed to facilitate the sorting, bundling and shipping of paper cheques. They are still used today for the clearing of physical cheques and for electronic transfers. These numbers can be found on the bottom left side of paper cheques.

ACH routing numbers are used only for electronic transfers and payments. For some banks, the ACH and ABA routing numbers are the same, but other banks have separate numbers specifically for ACH transactions. This differentiation helps institutions to route the transactions through the correct processing systems – whether for direct deposit, bill payment or other automated transfers. Using the wrong number can cause delays or failed transactions.

Here are the key differences between ABA and ACH routing numbers:

|

ABA routing number |

ACH routing number |

|

|---|---|---|

|

Also known as |

Routing transit number (RTN) |

Electronic routing number |

|

Purpose |

Used for paper cheques and electronic transfers |

Used for electronic payments such as direct deposit and bill pay |

|

Format |

9-digit number |

9-digit number (often the same as ABA, but can differ) |

|

Where to find |

|

|

|

Used by |

Banks, credit unions and the Federal Reserve |

Banks and the Automated Clearing House network |

Some banks use the same number for both ABA and ACH, while others assign different routing numbers depending on the type of transaction. Always check with your bank to confirm the correct number for your specific use case.

History of ACH routing numbers

The system for ACH routing numbers began when the banking industry started to automate and organise the processing of cheques and other financial transactions more effectively in the 20th century. The American Bankers Association (ABA) created the ACH routing number system in 1910 to facilitate the sorting, bundling and shipment of paper cheques. As electronic transactions became more common, the system was adapted for use in processing funds electronically.

As electronic payments increased in popularity, the ACH network expanded. The routing number system became a way to process these payments efficiently, allowing institutions to transfer funds without sending paper documents. Over time, the use of ACH transfers has grown to include a wide variety of payment services. These include direct deposit of pay slips, automatic mortgage and bill payments, and government and business transactions. The ACH network processes large volumes of credit and debit transactions, which include direct deposits as well as direct payments.

The reliability and organised structure of the ACH routing number system have supported the expansion of electronic money transfers and the shift towards a paperless financial system. As the volume of digital transactions continues to rise, routing numbers continue to be important in daily financial operations.

How Stripe Payments can help

Stripe Payments provides a unified, global payments solution that helps any business – from scaling startups to global enterprises – accept ACH Direct Debit payments.

Stripe Payments can help you:

- Optimise your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs and quick ACH Direct Debit integration.

- Expand to the US market faster: Reach US customers from every state and reduce the complexity and cost of multi-currency management when collecting payments in US dollars.

- Simplify ACH mandates: Present customers with a required ACH mandate as part of the payment flow through Stripe Checkout, Stripe Payment Element or hosted invoice pages.

- Improve payments performance: Increase revenue with a range of customisable, easy-to-configure payment tools, including a fully hosted flow for collecting bank account details and verifying them with microdeposits.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments, or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.