As transferências bancárias são uma forma comum de movimentação de recursos entre duas partes. Mais de 200 milhões de transferências foram realizadas nos EUA em 2024, representando um aumento de 9% em relação ao ano anterior. Vale a pena incluir as transferências bancárias na estratégia financeira da sua empresa? Abaixo, explicamos como elas funcionam e os possíveis benefícios e desvantagens.

Neste artigo:

- O que é uma transferência bancária?

- Como funcionam as transferências bancárias?

- Diferenças entre transferências bancárias e ACH

- Transferências bancárias internacionais

- Quanto tempo leva uma transferência bancária?

- As transferências bancárias são seguras?

- É possível reverter ou cancelar uma transferência bancária?

- Quais são as tarifas aplicadas?

- Vantagens e desvantagens das transferências bancárias para empresas

- Como a Stripe pode ajudar

O que é uma transferência bancária?

Uma transferência bancária é uma forma de movimentar dinheiro eletronicamente de uma pessoa ou entidade para outra, seja diretamente entre contas bancárias ou entre indivíduos. Essas transferências podem ser realizadas por meio de serviços especializados fora do sistema bancário, como a MoneyGram ou a Western Union. Elas são consideradas rápidas, confiáveis e seguras tanto para transações nacionais quanto internacionais.

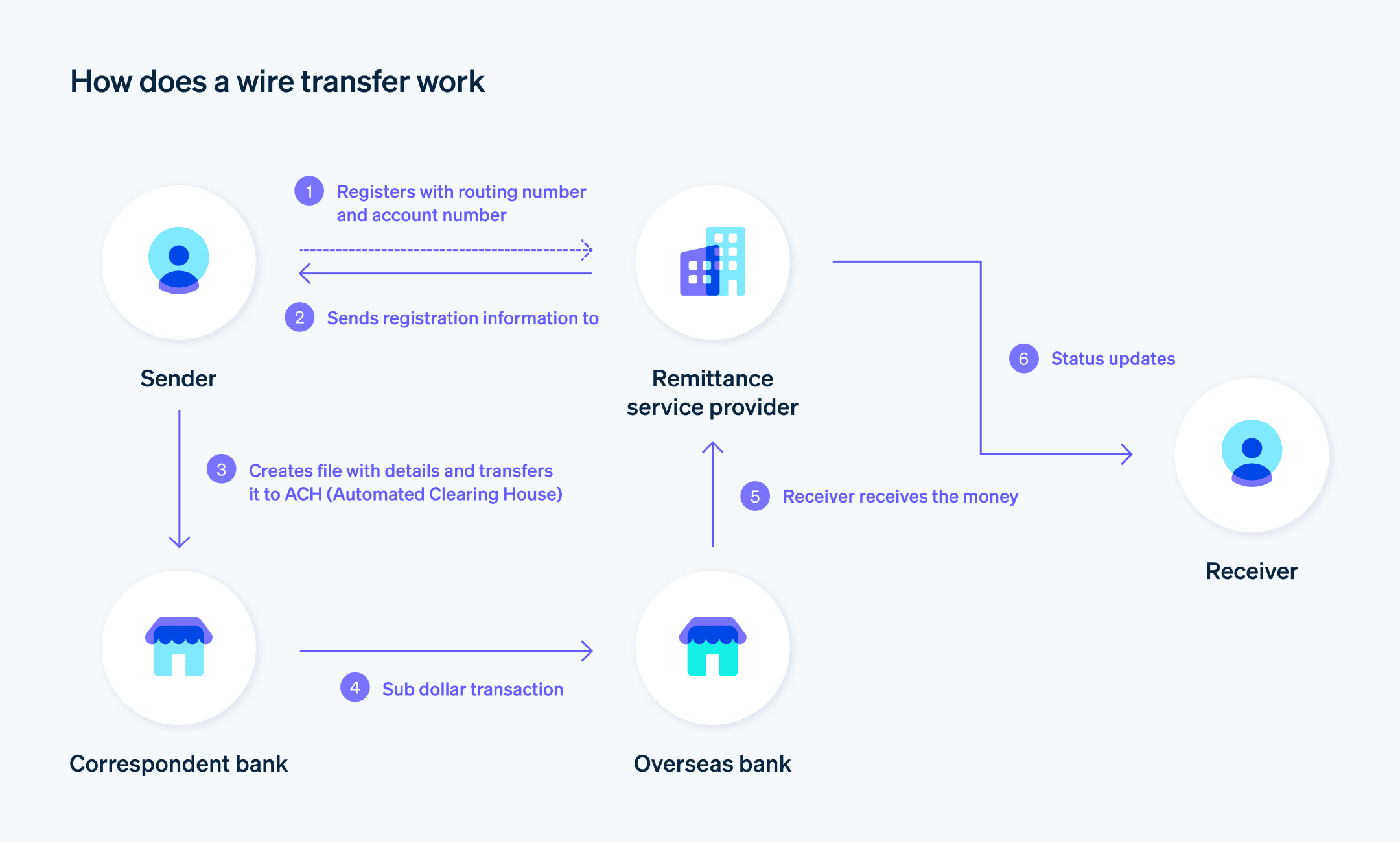

Como funcionam as transferências bancárias?

Nas transferências diretas entre bancos, os fundos são movimentados por meio de redes eletrônicas. Nos Estados Unidos, o sistema responsável por isso é a Rede de Transferência Bancária do Federal Reserve (conhecida como Fedwire), gerida pelo próprio Federal Reserve. Essa é uma infraestrutura de liquidação em tempo real, baseada em dinheiro do banco central, que possibilita transações eletrônicas entre instituições financeiras. Essa rede é usada por empresas, consumidores, bancos e órgãos públicos para realizar transferências de forma rápida e segura.

Transferências bancárias são populares por sua praticidade e rapidez, e a rede Fedwire processa um volume significativo dessas operações. Em 2024, houve uma média de mais de 800 mil transferências por dia.

Titulares de conta podem iniciar transferências bancárias diretamente através de sua instituição financeira. Para realizar esse tipo de operação, o remetente deve fornecer as seguintes informações:

- Número da conta bancária e número de roteamento ABA do remetente

- Nome completo do destinatário

- Nome do banco do destinatário

- Número da conta bancária e número de roteamento ABA do destinatário

- Endereço do destinatário

- Valor a ser transferido

Como o banco apenas aprova a operação se houver saldo disponível para cobrir o montante, o destinatário não precisa aguardar por uma liberação. Na maioria dos casos, transferências bancárias internas saem da conta do remetente no mesmo dia da solicitação.

Transferências bancárias vs. transferências via ACH

As transferências bancárias e as via ACH são modalidades comuns de transferências eletrônicas de recursos (EFTs), que permitem o envio e o recebimento de dinheiro sem usar papel-moeda, cheques físicos ou cartões de crédito. Ambas dependem de uma rede intermediária para transferir recursos entre contas de instituições financeiras diferentes.

Contudo, essas duas formas de operação não são equivalentes e apresentam diferenças importantes:

1. Utilizam redes distintas

Transferências via ACH funcionam por meio da Automated Clearing House (ACH), uma rede financeira centralizada dos Estados Unidos para transmissão de valores entre contas. Essa rede é gerida pela National Automated Clearing House Association (Nacha), uma organização independente formada por bancos, cooperativas de crédito e empresas de tecnologia de pagamentos. Já as transferências bancárias circulam pela rede Fedwire.

2. Transferências bancárias são geralmente mais rápidas

Transferências bancárias são liquidadas em tempo real, podendo levar de algumas horas até dois dias úteis para serem processadas — normalmente com mais agilidade do que as via ACH. As transferências ACH, por sua vez, demoram de um a quatro dias úteis, embora os pagamentos no mesmo dia estejam se tornando mais comuns.

3. Transferências bancárias tendem a ser mais caras

As transferências via ACH são gratuitas ou possuem um custo bastante reduzido. Já transferências bancárias dentro dos EUA podem custar até US$ 35, e as internacionais variam entre US$ 35 e US$ 50.

4. Transferências bancárias permitem envio internacional

Transferências ACH só podem ser feitas entre contas bancárias dos Estados Unidos. Já as transferências bancárias são adequadas tanto para envios nacionais quanto para internacionais.

|

Transferências ACH |

Transferências bancárias |

|

|---|---|---|

|

Rede |

Nacha (National Automated Clearing House Association) |

Rede de Transferência Bancária do Federal Reserve, também conhecida como Fedwire |

|

Velocidade |

De 1 a 4 dias |

De algumas horas a 2 dias |

|

Custo para enviar |

Geralmente gratuito, às vezes alguns dólares |

Nacionais: até US$ 35 |

Transferências bancárias internacionais

As transferências bancárias internacionais também são chamadas de “remessas internacionais” ou “envios internacionais de dinheiro”. Esses dois termos referem-se a transferências eletrônicas de fundos (EFTs) feitas por alguém nos Estados Unidos para outra pessoa ou empresa localizada em outro país. Em outubro de 2012, o Bureau de Proteção Financeira ao Consumidor (Consumer Financial Protection Bureau) instituiu um conjunto de regras para proteger os consumidores norte-americanos ao enviar dinheiro para fora do país. Essas normas incluem as seguintes medidas para reduzir os riscos ao consumidor:

Divulgações

As instituições financeiras que realizam remessas internacionais devem informar previamente ao cliente certos dados, como:- A taxa de câmbio, ou seja, o valor do dólar convertido na moeda do país para onde o dinheiro será enviado

- Todas as tarifas envolvidas, tanto da instituição de origem (ou empresa responsável pela transação) quanto dos intermediários e recebedores no exterior

- O valor final que será entregue ao destinatário, já descontadas as taxas e impostos

- A taxa de câmbio, ou seja, o valor do dólar convertido na moeda do país para onde o dinheiro será enviado

Recibo

Depois de realizar a transferência bancária, o remetente deve receber um comprovante contendo as seguintes informações:- Data prevista para que os recursos cheguem ao destino

- Prazo durante o qual a transação pode ser cancelada (normalmente 30 minutos)

- Instruções para efetuar o cancelamento

- Como enviar reclamações ou observações sobre a operação

- Data prevista para que os recursos cheguem ao destino

As regras também estabelecem como o agente do remetente deve entregar essas informações. Esse agente costuma ser o banco de origem ou uma empresa terceirizada que presta o serviço. É obrigatório fornecer os dados antes da transferência e o comprovante detalhado logo após sua execução.

Quanto tempo leva uma transferência bancária?

As transferências bancárias dentro do território nacional normalmente são processadas e concluídas no prazo de um dia útil. Porém, se a solicitação for feita no fim do dia de uma sexta-feira, é possível que os recursos só sejam entregues na segunda-feira seguinte (ou no próximo dia útil, caso a segunda seja feriado).

Transferências internacionais com origem nos Estados Unidos geralmente levam entre um e cinco dias úteis para chegar ao destino. O tempo adicional de processamento se deve, em parte, a exigências de segurança voltadas à prevenção de fraudes e lavagem de dinheiro. Além disso, essas operações frequentemente envolvem conversão cambial, o que também prolonga o prazo.

Transferências bancárias são seguras?

Transferências bancárias, bem como a própria rede de transferência, são amplamente consideradas seguras — desde que o remetente conheça a identidade do destinatário. As instituições que oferecem esse serviço são obrigadas a seguir regulamentações rigorosas.

Transferências bancárias podem ser revertidas ou canceladas?

Transferências bancárias geralmente não podem ser desfeitas após serem enviadas. No entanto, em operações internacionais, existe a possibilidade de cancelamento dentro de um prazo de até 30 minutos após o início, desde que o dinheiro ainda não tenha sido processado nem creditado.

Tarifas em transferências bancárias

Comparadas a outras formas de movimentar recursos, as transferências bancárias costumam ter custos mais elevados. Os valores cobrados variam conforme alguns critérios:

- Local de onde o dinheiro será enviado

- Destino dos recursos

- Se você é quem envia ou quem recebe os valores

Cada banco define suas próprias tarifas para transferências bancárias, mas geralmente cobra uma taxa fixa de cerca de US$ 25 para envios domésticos e entre US$ 35 e US$ 50 para transferências internacionais. Quem recebe os fundos também pode pagar uma taxa de US$ 10 a US$ 20, dependendo da instituição bancária utilizada.

Vantagens e desvantagens das transferências bancárias para empresas

As transferências bancárias são a escolha ideal para sua empresa? Avalie os seguintes pontos positivos e negativos:

Vantagens

Rapidez

Embora não sejam tão rápidas quanto pagamentos com cartão, as transferências bancárias estão entre os métodos eletrônicos mais velozes de movimentar dinheiro.Segurança

Esse tipo de transferência é considerado uma forma segura de enviar recursos entre duas partes.Confiabilidade

Exceto quando o remetente insere incorretamente os dados da conta do destinatário, as transferências bancárias chegam ao destino certo.

Desvantagens

Dificuldade para cancelar

Como essas transferências são liquidadas logo após serem iniciadas, é difícil revertê-las.Custo

O valor cobrado faz com que muitas empresas evitem adotar esse método como principal forma de transferir recursos.

Como a Stripe pode ajudar

O Stripe Payments permite que empresas configurem e aceitem mais de 100 formas de pagamento, incluindo transferências bancárias, e automatiza o processo de conciliação. A plataforma oferece uma solução de pagamentos integrada e global, capaz de atender desde startups em crescimento até grandes corporações, permitindo que aceitem pagamentos online, presencialmente e em diferentes países.

Com o Stripe Payments, sua empresa pode:

- Conciliar pagamentos automaticamente: Relacione facilmente transferências bancárias a um pagamento ou fatura específica por meio de um sistema de conciliação automatizada que utiliza contas bancárias virtuais individuais por cliente e ferramentas de diagnóstico.

- Simplificar reembolsos: Realize devoluções ou restituições de valores excedentes ao cliente com facilidade.

- Otimizar a experiência de finalização de compra: Crie um processo de pagamento fluido para seus clientes e economize milhares de horas de desenvolvimento utilizando interfaces de pagamento prontas e o Link, a carteira digital da Stripe.

- Unificar pagamentos online e presenciais: Estabeleça uma experiência comercial integrada entre os canais físicos e digitais, favorecendo a personalização do atendimento, o estímulo à fidelização e o aumento da receita.

- Aprimorar o desempenho dos pagamentos: Aumente os rendimentos utilizando ferramentas de pagamento configuráveis e intuitivas, incluindo proteção antifraude sem necessidade de programação e recursos avançados para melhorar a taxa de autorização.

- Avançar com rapidez em uma plataforma flexível e confiável: Desenvolva sua operação em uma plataforma criada para crescer com você, com 99,999% de disponibilidade e altíssimo padrão de confiabilidade no setor.

Saiba mais sobre como o Stripe Payments pode impulsionar seus pagamentos online e presenciais, ou comece agora.

O conteúdo deste artigo é apenas para fins gerais de informação e educação e não deve ser interpretado como aconselhamento jurídico ou tributário. A Stripe não garante a exatidão, integridade, adequação ou atualidade das informações contidas no artigo. Você deve procurar a ajuda de um advogado competente ou contador licenciado para atuar em sua jurisdição para aconselhamento sobre sua situação particular.