Wire transfers are a popular method of sending funds between two parties. More than 200 million wire transfers were sent in the US in 2024, up 9% from the previous year. Should wire transfers be part of your business’s strategy for sending and receiving money? Here’s what you need to know about how wire transfers work and potential pros and cons for your business.

What's in this article?

- What is a wire transfer?

- How do wire transfers work?

- Wire transfers vs. ACH transfers

- International wire transfers

- How long do wire transfers take?

- Are wire transfers safe?

- Can wire transfers be reversed or cancelled?

- Wire transfer fees

- Pros and cons of wire transfers for businesses

- How Stripe can help

What is a wire transfer?

A wire transfer is a way of moving funds electronically from one party to another, either directly, between two bank accounts, or from person to person. Wire transfers use a non-bank third-party wire transfer service, like MoneyGram or Western Union. Wire transfers are a fast, reliable, and secure way to move money domestically and internationally.

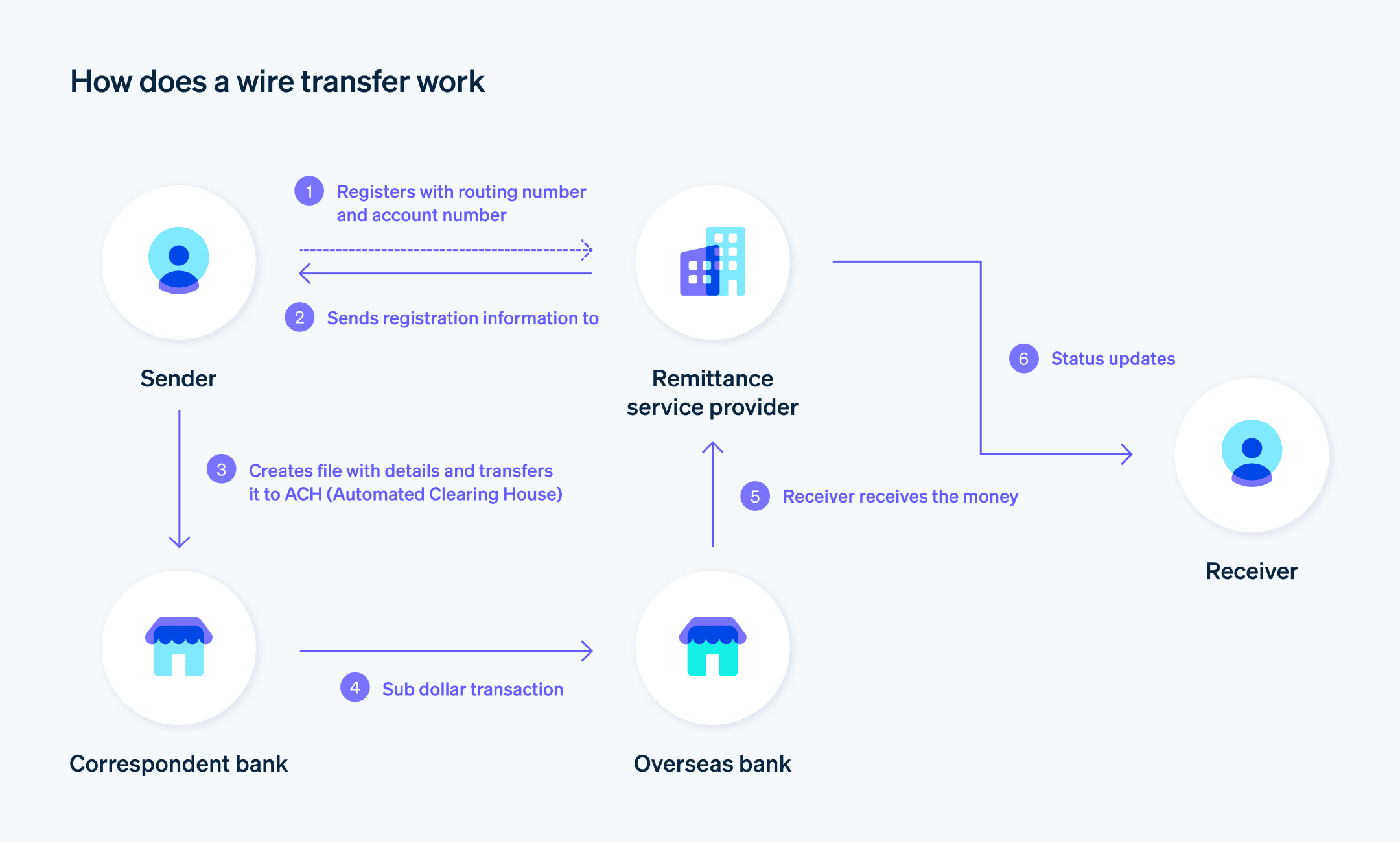

How do wire transfers work?

In conventional bank-to-bank wire transfers, funds are transmitted through wire networks. In the US, the Federal Reserve manages the Federal Reserve Wire Network (commonly known as Fedwire) that banks use to send and receive funds. The Fedwire is a real-time settlement system of central bank money that electronically facilitates transactions between financial institutions. Businesses, consumers, banks, and government agencies use this network to safely and quickly transfer funds.

Wire transfers are popular due to their ease and speed, and the Fedwire fields a great deal of transfer traffic. In 2024, there were more than 800,000 average daily transfers.

Account holders can initiate wire transfers directly through their banking institution. In order to send a wire transfer, the sender must provide the following information:

- Sender’s bank account number and ABA routing number

- Recipient’s name

- Recipient’s bank name

- Recipient’s bank account number and ABA routing number

- Recipient’s address

- Amount of money to be sent

Since a bank will only approve a transfer if the amount is covered by available funds, the recipient doesn’t have to wait for approval. In most cases, domestic wire transfers will leave your account the same day you request the transfer.

Wire transfers vs. ACH transfers

Wire transfers and ACH transfers are popular types of electronic funds transfers (EFTs) that send and receive funds without using paper money, physical checks, or credit cards. Both rely on a third-party network to move money between accounts at different financial institutions.

But wire transfers and ACH transfers are not interchangeable and have some key differences:

1. They use different networks

ACH transfers use the Automated Clearing House (ACH), a centralised US financial network, to transmit funds between accounts. It’s administered by the National Automated Clearing House Association (Nacha), an independent organisation owned by a large group of banks, credit unions, and payment processing companies. Wire transfers, on the other hand, move through the Fedwire.

2. Wire transfers are typically faster

Wire transfers, which are settled in real time, can take anywhere from a few hours up to two business days to process and are usually faster than ACH transfers. ACH transfers typically take one to four business days—although same-day ACH settlements are increasing.

3. Wire transfers usually cost more

ACH transfers are either free or cost just a few dollars, while domestic wire transfers can cost up to $35. International wire transfers can cost between $35 and $50.

4. Wire transfers can send money internationally

ACH transfers are only available for use with US-based bank accounts. Wire transfers can be used for both domestic and international transfers.

|

ACH transfers |

Wire transfers |

|

|---|---|---|

|

Network |

National Automated Clearing House Association (Nacha) |

Federal Reserve Wire Network, also known as the Fedwire |

|

Speed |

1 – 4 days |

A few hours up to 2 days |

|

Cost to send |

Usually free, otherwise a few pounds |

Domestic: up to $35 |

International wire transfers

International wire transfers are also known as “remittance transfers” or “international money transfers,” both terms for EFTs sent from someone in the US to a person or business in another country. In October 2012, the Consumer Financial Protection Bureau adopted a set of rules to protect American consumers when they send money abroad. These regulations include the following provisions to reduce consumer risk:

Disclosures

Financial institutions that send remittance transfers are required to disclose certain information to consumers first, including:- The exchange rate, which is the value of the original currency (in this case, US dollars) in the local currency of the country where the transfer will be sent

- All fees, including fees from the bank (or other entity) that initiates the transfer, and those of receiving and intermediary agents abroad

- The final amount of money that will be delivered, minus fees and taxes

- The exchange rate, which is the value of the original currency (in this case, US dollars) in the local currency of the country where the transfer will be sent

Receipt

After initiating the wire transfer, the sender must receive a receipt that includes the following information:- When the funds are expected to arrive at their destination

- Cancellation window during which the sender can cancel the transaction (usually 30 minutes)

- Steps that the sender can take to cancel the transaction

- How to submit complaints and other feedback related to the transfer

- When the funds are expected to arrive at their destination

The rules also mandate how the sender’s agent must deliver the aforementioned items. This agent is usually the sender’s bank or third-party wire transfer company. They must provide the sender with disclosures before sending the transfer and the itemised receipt after the transfer is complete.

How long do wire transfers take?

Domestic wire transfers are typically processed and delivered within one business day. But if the transfer is initiated late in the day on a Friday, it’s possible the funds won’t be delivered until the following Monday (or the next business day, if Monday is a public holiday).

International wire transfers originating in the US usually take one to five business days to reach their destination. The extra processing time is partly due to additional security requirements aimed at decreasing the risk of fraud and money laundering. Additionally, these transfers frequently involve currency conversions, which adds to the processing time.

Are wire transfers safe?

Wire transfers and the wire network itself are widely considered to be secure, as long as you know the party you’re sending funds to. Institutions that provide wire transfer services must follow strict rules and regulations.

Can wire transfers be reversed or cancelled?

Wire transfers usually cannot be reversed once they’ve been sent. International wire transfers can sometimes be cancelled within 30 minutes of initiation, provided the funds haven’t already been processed and deposited.

Wire transfer fees

Compared to other methods of moving funds, wire transfers are relatively expensive. The cost varies depending on a few factors:

- Where the transfer is initiated

- Where the funds are being sent

- Whether you’re the sender or receiver

Different financial institutions charge different amounts to initiate wire transfers, but most cost a flat fee of $25 to send money to another person in the US and $35 – $50 to send money internationally. Depending on their bank, a wire transfer recipient might need to pay $10 – $20 to receive the funds.

Pros and cons of wire transfers for businesses

Are wire transfers the right choice for your business? Consider these pros and cons:

Pros

Fast

While wire transfers aren’t as speedy as card payments, they are one of the fastest ways to transfer funds electronically.Secure

Wire transfers are a secure way to move funds between parties.Reliable

Unless the sender inputs the recipient’s account information incorrectly, wire transfers will go to the right place.

Cons

Hard to cancel

Because wire transfers are settled soon after being initiated, they’re difficult to cancel.Expensive

The cost dissuades many businesses from using wire transfers as their primary funds-transfer method.

How Stripe can help

Stripe Payments enables businesses to set up and accept 100+ payment methods, including wire transfers, and makes reconciliation automatic. It provides a unified, global payments solution that helps any business – from scaling startups to global enterprises – accept payments online, in person, and around the world.

Stripe Payments can help you:

- Reconcile payments automatically: Easily reconcile wire transfers to a specific payment or invoice with an automatic reconciliation engine that uses virtual bank accounts for each customer and tools for troubleshooting.

- Simplify refunds: Make refunds or return excess funds to the customer.

- Optimise your checkout experience: Create a frictionless customer experience and save thousands of engineering hours with prebuilt payment UIs and Link, Stripe’s digital wallet.

- Unify payments in person and online: Build a unified commerce experience across online and in-person channels to personalise interactions, reward loyalty, and grow revenue.

- Improve payments performance: Increase revenue with a range of customisable, easy-to-configure payment tools, including no-code fraud protection and advanced capabilities to improve authorisation rates.

- Move faster with a flexible, reliable platform for growth: Build on a platform designed to scale with you, with 99.999% uptime and industry-leading reliability.

Learn more about how Stripe Payments can power your online and in-person payments, or get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.