QR-codes komen steeds vaker voor in de betalingsverwerking landschap. Vanaf 2022 werd de wereldwijde marktomvang voor QR-codes geschat op $ 9,98 miljard. Vooruitkijkend wordt verwacht dat deze markt tussen 2023 en 2030 zal groeien met een samengesteld jaarlijks groeipercentage (CAGR) van 16,9%. De snelle opkomst van QR-codes onderstreept hoe belangrijk het voor bedrijven is om deze populaire betaalmethode te begrijpen en te implementeren, een methode die eenvoud, snelheid en veilige contactloze betalingen.

De toename van het gebruik van mobiele apparaten en de wijdverbreide acceptatie van digitale betalingstechnologieën door klanten zijn belangrijke drijfveren voor QR-codebetalingen. Deze betaalmethode biedt bedrijven veel voordelen, waaronder kosteneffectieve infrastructuur, versnelde transactieverwerking en efficiënt voorraadbeheer. Inzicht in de werking, voordelen en optimale implementatiestrategieën van QR-codebetalingen kan bedrijven een duidelijk voordeel bieden in een snel veranderende retailmarkt.

Hieronder gaan we dieper in op betalingen met QR-codes en de toepassingen ervan, waaronder hoe bedrijven deze betalingen effectief kunnen integreren om hun betaalervaringen op elk kanaal te verbeteren.

Wat staat er in dit artikel?

- Wat is een QR-code?

- Soorten QR-codes

- Hoe werken QR-codes?

- Hoe worden QR-codes gebruikt voor betalingen?

- Hoe bedrijven QR-codes kunnen gebruiken

- Hoe QR-codes voor betalingen te genereren

Wat is een QR-code?

Een QR-code, of quick response code, is een soort streepjescode die in de digitale transactieruimte wordt gebruikt om de snelle en naadloze uitwisseling van informatie te vergemakkelijken. In de context van betalingen kunnen QR-codes transactie-informatie weergeven in een machinaal leesbare vorm, die, wanneer een klant deze scant met zijn smartphone of ander apparaat, een betalingsproces initieert zonder dat de klant handmatig gegevens hoeft in te voeren. De gecodeerde informatie kan details bevatten zoals de accountgegevens van de klant, het transactiebedrag of andere betalingsspecifieke informatie. Deze digitale weergave van transactiegegevens helpt het betaalproces te stroomlijnen, waardoor bedrijven en klanten minder tijd en moeite hoeven te besteden aan het voltooien van een transactie.

Soorten QR-codes

QR-codes kunnen worden onderverdeeld in twee hoofdtypen: statisch en dynamisch. Hier vind je meer informatie over elk type:

Statische QR-codes

Statische QR-codes bevatten vaste informatie die niet kan worden gewijzigd zodra de code is gegenereerd. De gegevens worden direct in de code zelf opgeslagen en zijn een onbeperkt aantal keren toegankelijk voor een onbeperkt aantal gebruikers. Meestal worden deze codes gebruikt voor taken waarvoor geen nieuwe of bijgewerkte informatie nodig is, zoals het delen van een website-URL, een wifiwachtwoord of contactgegevens. Aangezien de gegevens vastliggen, is de enige manier om de gecodeerde informatie te wijzigen, het genereren van een nieuwe QR-code.Dynamische QR-codes

In tegenstelling tot statische QR-codes kan de informatie die is opgeslagen in dynamische QR-codes worden gewijzigd of bijgewerkt nadat de code is gegenereerd. De QR-code zelf bevat niet de gegevens, maar is een verwijzing naar een online locatie waar de gegevens zijn opgeslagen. Hierdoor kunnen bedrijven de scan in realtime volgen, inclusief het exacte tijdstip waarop iemand de code heeft gescand, de locatie waar ze deze hebben gescand en welk apparaat ze hebben gebruikt. Het stelt het bedrijf ook in staat om de bestemmings-URL te wijzigen, wat handig is voor marketingcampagnes waarin het bijhouden van statistieken en het bijwerken van informatie belangrijk zijn. Een nadeel van dynamische QR-codes is dat ze een actieve internetverbinding nodig hebben om de opgeslagen gegevens op te halen, terwijl statische QR-codes dat niet doen.

Elk type QR-code heeft zijn voordelen en is geschikt voor verschillende toepassingen. Bedrijven gebruiken dynamische QR-codes omdat ze de betrokkenheid van gebruikers kunnen volgen en gemakkelijk informatie kunnen bijwerken, terwijl statische QR-codes handig kunnen zijn in scenario's waarin de informatie in de loop van de tijd hetzelfde blijft. Verderop gaan we dieper in op de verschillende manieren waarop bedrijven QR-codes gebruiken.

Hoe werken QR-codes?

QR-codes bevatten gecodeerde gegevens in een uniek patroon van zwart-witte vierkanten die kunnen worden gelezen door een QR-codescanner, meestal via de camera van een smartphone of tablet. Hier volgt een meer gedetailleerde uitleg:

Codering

Het proces begint wanneer de informatie wordt omgezet in een QR-code. Deze informatie kan bestaan uit betaalgegevens, URL's, tekst of andere gegevens. De informatie wordt verwerkt met behulp van een specifiek algoritme om een patroon van zwarte en witte vierkanten te creëren. Elk uniek patroon komt overeen met verschillende karakters of sequenties van gegevens.

Structuur

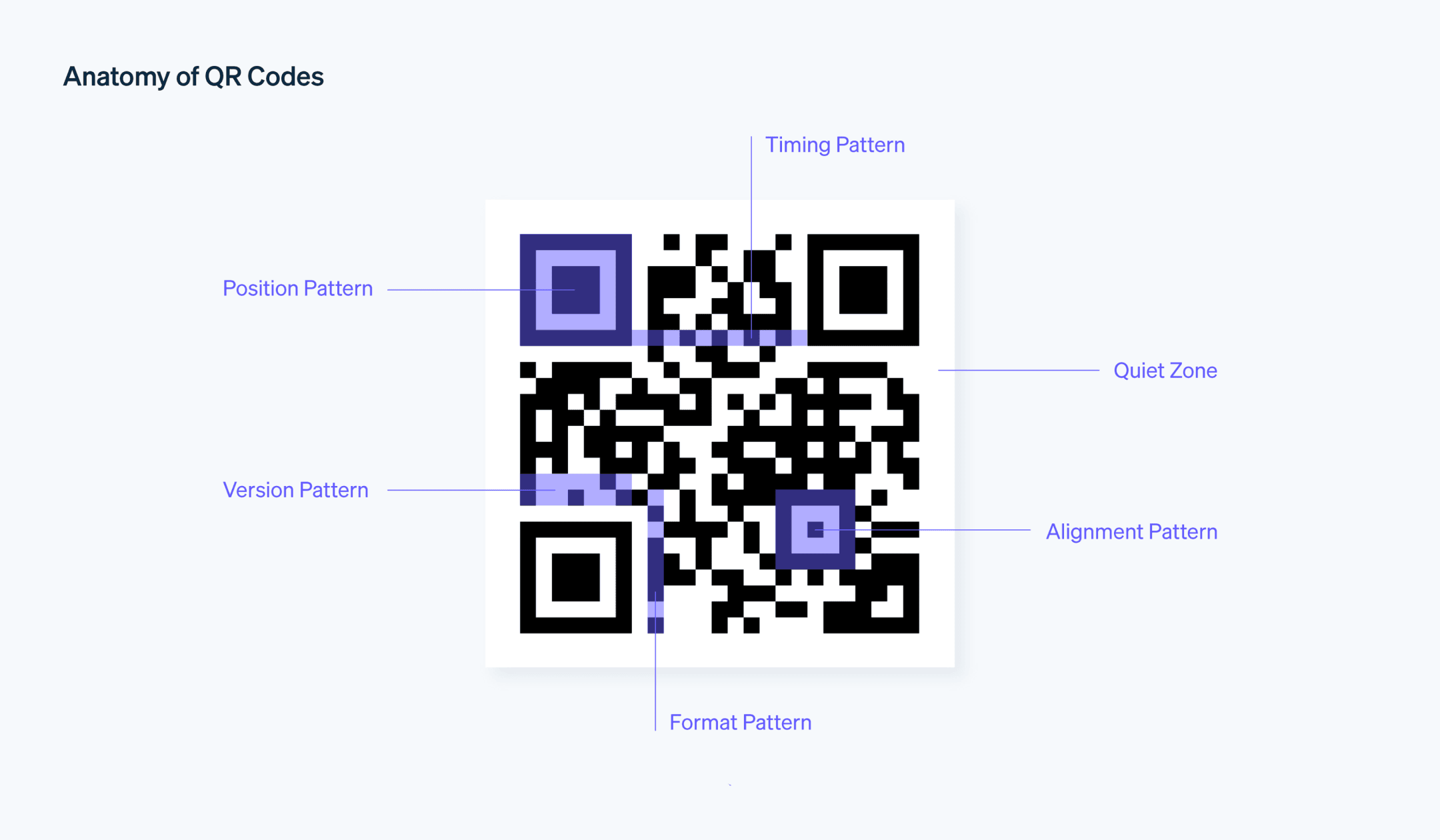

Een QR-code bestaat uit diverse secties, elk met een specifieke functie. Dit zijn bijvoorbeeld:

Positioneringsmarkeringen

Drie grote vierkanten op de hoeken waarmee de scanner de QR-code en de oriëntatie ervan kan identificeren.Timingpatronen

Rijen en kolommen van afwisselend zwarte en witte vierkanten die worden gebruikt om de posities van afzonderlijke cellen te identificeren.Sleutels voor gegevens- en foutcorrectie

Gebieden waar de gecodeerde gegevens zich bevinden, samen met redundantie-bits. Dit zijn extra stukjes informatie die helpen bij het corrigeren van beschadigde of onvolledige codes.Scannen

De QR-code wordt gescand met een apparaat dat is uitgerust met een camera en een QR-codelezer, meestal een smartphone of tablet. De app gebruikt de camera om de code te fotograferen en interpreteert vervolgens het patroon van zwarte en witte vierkanten om ze weer om te zetten in de originele gegevens.

Gegevensextractie

De scanner decodeert de informatie die is ingesloten in de QR-code en voert de aangewezen actie uit, zoals het openen van een website, het weergeven van tekst of het starten van een betalingstransactie.

In het kader van betalingen codeert de QR-code meestal de rekeninggegevens van de klant en soms ook het bedrag van de betaling. Wanneer de klant de QR-code scant met zijn bank- of digitale wallet-app, leest de app de gecodeerde gegevens, worden de betalingsgegevens automatisch ingevuld en hoeft de klant alleen de transactie te bevestigen.

Hoe worden QR-codes gebruikt voor betalingen?

QR-codes zijn een populaire methode geworden om betalingen te doen, omdat ze gemakkelijk te gebruiken zijn en de mogelijkheid hebben om transactie-informatie te digitaliseren. Hier zijn enkele voorbeelden van hoe QR-codes worden gebruikt in verschillende handelsomgevingen voor betalingen:

Winkels

Traditionele fysieke winkels kunnen een statische QR-code weergeven bij de kassa voor versnelde fysieke betalingen. Als klanten klaar zijn om te betalen, scannen ze de code met een mobiele betaling app op hun smartphone, die de betalingsgegevens van de retailer invult en de klant vraagt het bedrag in te voeren dat hij zal betalen. Dit stroomlijnt het afrekenproces, waardoor er geen contant geld of fysieke betaalkaarten of creditcards nodig zijn.Restaurants en cafés

Vergelijkbaar met de manier waarop winkels QR-codes gebruiken, kunnen restaurants en cafés een QR-code op de rekening afdrukken of een QR-code op elke tafel plaatsen zodat klanten het menu kunnen scannen en bekijken, een bestelling kunnen plaatsen of hun maaltijden rechtstreeks vanaf hun telefoon kunnen betalen. Dit vermindert de noodzaak van tussenkomst van het bedienend personeel en versnelt het bestel- en betalingsproces.E-commerce

Online bedrijven kunnen QR-codes opnemen op de afrekenpagina van hun websites of in facturen die via e-mail worden verzonden. Klanten kunnen de QR-code scannen om de betaling te starten zonder dat ze de betaalgegevens handmatig moeten invoeren. Dit vereenvoudigt niet alleen het betalingsproces, maar verbetert ook de veiligheid door fouten bij het invoeren van gegevens tot een minimum te beperken.Peer-to-peer betalingen

Particulieren kunnen een QR-code genereren via hun bank of digitale wallet app die anderen kunnen scannen om ze geld te sturen. Dit is vooral handig in situaties zoals het verdelen van een rekening onder vrienden of het betalen van een lokale serviceprovider.Abonnementsdiensten

Bedrijven die diensten op abonnementsbasis kan QR-codes gebruiken om terugkerende betalingen. Een sportschool kan bijvoorbeeld een QR-code opnemen op de maandelijkse factuur van een lid. Het lid scant gewoon de code om de betaling te verwerken, in plaats van elke keer het handmatige proces te moeten doorlopen.Tickets voor evenementen

Voor evenementen zoals concerten en sportwedstrijden kunnen organisatoren een QR-code op het ticket plaatsen. Dit kan zowel dienen als aankoopbewijs en als toegangsmethode tot het evenement. Wanneer de klant het ticket online koopt, kan het bedrijf hem een QR-code sturen via e-mail of sms, die de tickethouder op zijn telefoon kan laten zien bij de locatie.Aanmoedigen van giften

Non-profitorganisaties kunnen QR-codes gebruiken om giften te vergemakkelijken. Door QR-codes op hun websites, sociale mediapagina's of op hun fysieke locaties te plaatsen, kunnen non-profitorganisaties het donateurs gemakkelijker maken om bij te dragen doordat donateurs de code kunnen scannen en met de betaalmethode van hun voorkeur kunnen betalen.

In al deze scenario's kunnen het gemak, de snelheid en de veiligheid van QR-codebetalingen de algehele klantervaring en operationele efficiëntie verbeteren. En met de toenemende populariteit van smartphones en digitale wallets zijn betalingen met QR-code toegankelijk voor een groeiend aantal klanten en bedrijven.

Hoe bedrijven QR-codes kunnen gebruiken

Bedrijven kunnen QR-codes op verschillende manieren gebruiken om de klantbetrokkenheid te vergroten, transacties te vereenvoudigen en de druk op de interne bedrijfsvoering te verminderen. Hier zijn enkele voorbeelden:

Contactloos betalen

Bedrijven kunnen QR-codes gebruiken voor contactloze betalingen, waardoor de klantervaring wordt verbeterd door een snelle, gemakkelijke en veilige manier van betalen te bieden. Een coffeeshop kan bijvoorbeeld een QR-code bij de balie weergeven, die klanten kunnen scannen met hun mobiele bank of digitale portemonnee, vervolgens het bedrag kunnen invoeren dat ze moeten betalen en de transactie kunnen bevestigen. Op dezelfde manier kan een e-commercewebsite een QR-code op de afrekenpagina bevatten die klanten kunnen scannen en voltooien zonder dat ze creditcardgegevens hoeven in te voeren.Productinformatie

QR-codes kunnen een directe link bieden naar uitgebreide productdetails die verder gaan dan wat doorgaans op de verpakking wordt vermeld. Een meubelverkoper kan bijvoorbeeld QR-codes gebruiken op prijskaartjes in de winkel. Klanten kunnen de code scannen om toegang te krijgen tot montage-instructies, recensies lezen, het product in een virtuele 3D-kamer bekijken of de beschikbaarheid van verschillende kleuren en stijlen controleren.Promoties en kortingen

Bedrijven kunnen QR-codes gebruiken om exclusieve promoties of kortingen aan te bieden. Een kledingwinkel zou bijvoorbeeld een QR-code in zijn etalage kunnen plaatsen, waardoor voorbijgangers de code kunnen scannen en toegang krijgen tot een tijdelijke aanbieding of een exclusieve kortingscode, wat een sterke stimulans is voor onmiddellijke aankopen.Klantenenquêtes en feedback

QR-codes kunnen het proces van het verzamelen van feedback van klanten stroomlijnen. Een restaurant kan bijvoorbeeld een QR-code op hun bonnetjes afdrukken, die klanten kunnen scannen om snel toegang te krijgen tot een formulier op hun smartphone en direct feedback te geven over hun eetervaring. Het restaurant kan deze feedback gebruiken om verbeterpunten te identificeren.Digitale menu's

In plaats van traditionele papieren menu's te gebruiken, kunnen restaurants QR-codes gebruiken voor digitale menu's. Een restaurant zou op elke tafel een QR-code kunnen plaatsen, die klanten kunnen scannen om het menu op hun smartphone te bekijken. Met de QR-code kan het restaurant het menu in realtime bijwerken, gedetailleerde ingrediëntenlijsten en zelfs klantrecensies van elk gerecht opnemen.Evenementregistratie

Bedrijven die evenementen organiseren, kunnen het registratie- of ticketingproces vereenvoudigen met behulp van QR-codes. Een kunstgalerie die een speciale tentoonstelling organiseert, kan bijvoorbeeld een QR-code gebruiken op posters die reclame maken voor het evenement. Mensen die geïnteresseerd zijn om deel te nemen, kunnen de code scannen om zich voor het evenement te registreren of hun digitale ticket rechtstreeks op hun telefoon ontvangen.Betrokkenheid bij sociale media

Bedrijven kunnen QR-codes gebruiken om hun volgers op sociale media te laten groeien en de betrokkenheid van klanten te vergroten. Een lokale boetiek kan een QR-code in hun tassen of bonnen opnemen die linkt naar hun Instagram-profiel, die klanten kunnen scannen om de boetiek op Instagram te volgen en op de hoogte te blijven van nieuwkomers, verkopen en evenementen.Voorraad bijhouden

Bedrijven kunnen QR-codes intern gebruiken om de voorraad te beheren. Een productiebedrijf kan bijvoorbeeld QR-codes gebruiken op afzonderlijke onderdelen of producten. Het personeel kan de codes bij elke stap van het productie- of verzendproces scannen, waardoor realtime tracking en voorraadupdates mogelijk zijn.

Elk van deze voorbeelden laat zien hoe QR-codes meerdere doelen kunnen dienen in verschillende aspecten van een bedrijf, van het verbeteren van de klantbetrokkenheid en transactie-efficiëntie tot het stroomlijnen van interne activiteiten. Hun veelzijdigheid en gebruiksgemak maken ze tot een krachtig hulpmiddel in het huidige digitale zakelijke landschap.

QR-codes voor betalingen genereren

Het genereren van QR-codes voor betalingen is een eenvoudig proces, maar de exacte stappen kunnen variëren, afhankelijk van het betalingsplatform of de betalingsdienst die je gebruikt. Hieronder staan de basisstappen voor het genereren van een QR-code voor betalingen:

Kies een betalingsdienstaanbieder: Kies een betaaldienstverlener (PSP) die betalingen met een QR-code ondersteunt. Deze keuze kan ook afhangen van je regio en de algemene behoeften van je bedrijf. Je betaaldienstverlener kan een bankinstelling zijn, een digitale walletdienst zoals Apple Pay, of een speciaal betaalplatform zoals Stripe.

Maak een handelaarsaccount aan: Je hebt een handelaarsaccount bij de gekozen dienstverlener. Dit account wordt gekoppeld aan de QR-code en ontvangt de betalingen. Als je al een account hebt, kun je daar gebruik van maken; Zo niet, dan moet je er een maken. Sommige aanbieders, waaronder Stripe, vereisen niet dat bedrijven een handelaarsaccount openen, aangezien deze providers die functionaliteit bieden.

Toegang tot de functie voor het genereren van QR-codes: Log in op je account op het platform van de serviceprovider en zoek naar de functie waarmee je een QR-code kunt genereren. Meestal kun je dit vinden in het gedeelte over betalingen of tools van het platform.

Betalingsgegevens invoeren: Het platform zal je vragen om betalingsgegevens in te voeren. Dit kan je handelaars-ID, het specifieke account waarnaar betalingen moeten worden gericht en mogelijk een vast transactiebedrag als de QR-code voor een specifiek product of een specifieke dienst is.

Genereer de QR-code: Nadat je de nodige gegevens heeft ingevoerd, klik je op de knop "genereren". Het platform maakt een unieke QR-code die is gekoppeld aan de betalingsinformatie die je hebt ingevoerd.

Test de QR-code: Voordat je de QR-code implementeert, moet je deze testen door de code te scannen en na te gaan of het juiste betaalproces wordt geactiveerd en of betalingen naar de juiste rekening worden geleid.

Implementeer de QR-code: Na het testen kan de QR-code worden weergegeven bij je verkooppunt, op je website, op ontvangstbewijzen of facturen, of op een andere manier worden gebruikt die aansluit bij je betalingsstrategie.

Het is belangrijk om veiligheidsoverwegingen in gedachten te houden bij het gebruik van QR-codes voor betalingen. Gebruik altijd vertrouwde en veilige betalingsplatforms en zorg ervoor dat je QR-codes worden weergegeven of verspreid op een manier die het risico op sabotage of ongeoorloofde wijzigingen minimaliseert.

Voor meer informatie over hoe bedrijven QR-codes kunnen gebruiken met Stripe Payment Links, lees er hier.

De inhoud van dit artikel is uitsluitend bedoeld voor algemene informatieve en educatieve doeleinden en mag niet worden opgevat als juridisch of fiscaal advies. Stripe verklaart of garandeert niet dat de informatie in dit artikel nauwkeurig, volledig, adequaat of actueel is. Voor aanbevelingen voor jouw specifieke situatie moet je het advies inwinnen van een bekwame, in je rechtsgebied bevoegde advocaat of accountant.