二维码在支付处理 领域越来越常见。截至 2022 年,全球二维码市场规模达 99.8 亿美元。展望未来,预计从 2023 年到 2030 年,该市场将以 16.9% 的复合年增长率 (CAGR) 增长。二维码的迅速兴起凸显了企业了解和实施这种流行的支付方式的重要性,这种支付方式提供简单、快速和安全的感应式支付。

移动设备使用量的激增和客户对数字支付技术的广泛采用是二维码支付的主要推动力。这种支付方式为企业提供了许多优势,包括具有成本效益的基础设施、加速的交易处理和高效的库存管理。了解二维码支付的运营、优势和最佳实施策略可以为企业在瞬息万变的零售市场中提供独特的优势。

下面我们将深入探讨二维码支付并探索其应用,包括企业如何有效地整合这些支付以改善他们在每个渠道上的支付体验。

目录

- 什么是二维码?

- 二维码的类型

- 二维码如何运作?

- 二维码如何用于支付?

- 企业如何使用二维码

- 如何生成付款二维码

什么是二维码?

二维码即快速响应码,是数字交易领域中使用的一种条形码,用于促进快速无缝的信息交换。在支付方面,二维码可以机器可读的形式表示交易信息,当客户使用智能手机或其他设备扫描时,无需手动输入数据就会启动支付流程。编码的信息可以表示详细信息,例如客户的账户凭据、交易金额或其他特定于付款的信息。这种交易数据的数字表示有助于简化支付流程,减少企业和客户完成交易所需的时间和精力。

二维码的类型

二维码可分为静态和动态两种主要类型。以下是有关每种类型的详细信息:

静态二维码

静态二维码包含固定信息,一旦生成代码就无法更改。数据直接存储在代码本身中,可以被无限多的用户访问,访问次数不受限制。通常,这些代码用于不需要新信息或更新信息的任务,例如共享网站 URL、WiFi 密码或联系方式。由于数据是固定的,因此更改编码信息的唯一方法是生成新的二维码。动态二维码

与静态二维码不同,动态二维码中存储的信息可以在代码生成后进行更改或更新。二维码本身不包含数据,但它是对存储数据的在线位置的引用。这样,企业就可以实时跟踪扫描情况,包括扫描二维码的准确时间、扫描地点和使用的设备。它还允许企业修改目标 URL,这对于需要跟踪指标和更新信息的营销活动非常有用。动态二维码的一个缺点是需要连接互联网才能检索存储的数据,而静态二维码则不需要。

每种类型的二维码都有其优点,适用于不同的应用。企业使用动态二维码是为了跟踪用户参与情况并方便更新信息,而静态二维码则适用于信息长期保持不变的情况。在下文中,我们将深入探讨企业使用二维码的不同方式。

二维码如何运作?

二维码包含独特的黑白方块图案的编码数据,通常通过智能手机或平板电脑摄像头读取二维码扫描仪。以下是更详细的解释:

编码

当信息转换为二维码时,该过程就开始了。此信息可能包括支付信息、URL、文本或其他数据。使用特定算法处理信息,以创建黑白方块图案。每个唯一模式对应于不同的字符或数据序列。

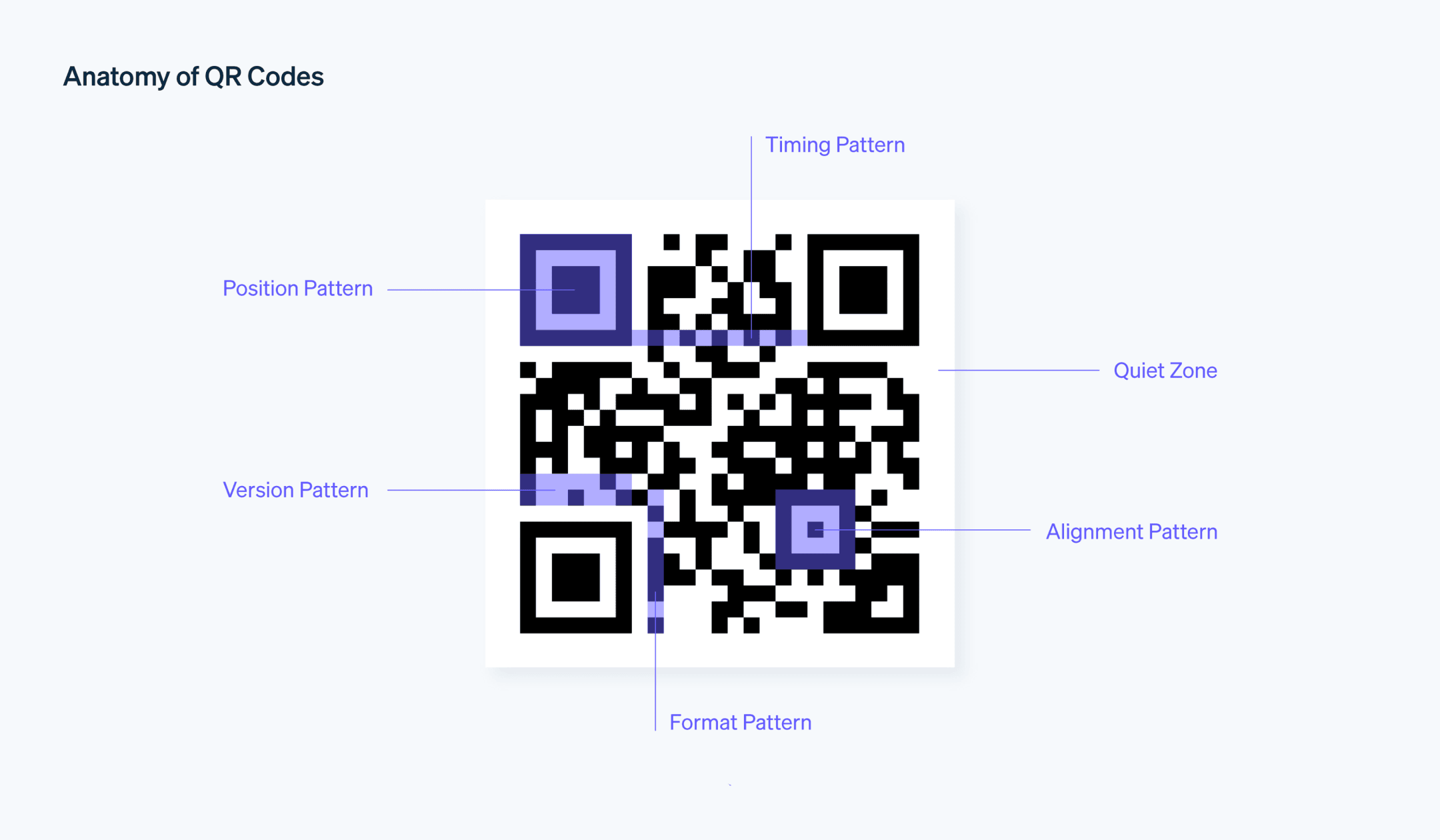

结构

二维码分为几个区域,每个区域都有特定的功能。这些包括:

定位标记

拐角处有三个大方块,可让扫描仪识别二维码及其方向。时序模式

黑白交替方块的行和列,用于标识单个单元格的位置。数据和纠错键

编码数据所在的区域,以及冗余位,冗余位是帮助更正损坏或不完整代码的额外信息。扫描

使用配备摄像头和二维码阅读器应用程序的设备(通常是智能手机或平板电脑)扫描二维码。该应用程序使用相机拍摄代码,然后解读黑白方块的图案,将它们转换回原始数据。

数据提取

扫描仪对二维码中嵌入的信息进行解码,并执行指定的操作,例如打开网站、显示文本或发起支付交易。

通常,在付款上下文中,二维码会对客户的账户详细信息进行编码,有时还会对付款金额进行编码。当客户使用他们的银行或数字钱包应用程序扫描二维码时,该应用程序会读取编码数据,自动填写支付信息,客户只需确认交易。

二维码如何用于支付?

二维码已成为一种流行的支付方式,因为它易于使用,并能将交易信息数字化。以下是如何在不同的商业环境中使用二维码进行支付的几个示例:

零售店

传统实体零售店可以在收银台显示静态二维码,以加快当面支付 的速度。当客户准备付款时,可使用智能手机上的移动支付 应用,该应用会填写零售商的支付信息并提示客户输入他们将支付的金额。这简化了结账流程,消除了对现金或实物借记卡或信用卡的需求。餐厅和咖啡馆

与零售店使用二维码的方式类似,餐馆和咖啡馆可以在账单上打印二维码或在每张桌子上放置二维码,供顾客扫描和查看菜单、下订单或直接从手机上支付餐费。这就减少了服务员的干预,加快了点餐和付款流程。电商

线上企业可以在其网站的结账页面或通过电子邮件发送的发票中包含二维码。客户可以扫描二维码发起付款,而无需手动输入支付信息。这不仅简化了支付流程,而且通过更大限度地减少数据输入错误来增强安全性。点对点支付

个人可以通过银行或数字钱包 应用生成二维码,其他人可以扫描该二维码向他们汇款。这在朋友之间分摊账单或向当地服务提供商付款等情况下特别有用。订阅服务

提供订阅服务 的公司可以使用二维码来简化经常性付款。例如,健身房可以在会员的月度发票上包含二维码。会员只需扫描代码即可处理付款,而不需要每次都经过手动流程。活动票务

对于音乐会和体育比赛等活动,组织者可以在门票上嵌入二维码。这既可以作为购买证明,也可以作为参加活动的一种方式。当客户线上购买门票时,企业可以通过电子邮件或短信向他们发送二维码,持票人可以在会场的手机上出示该二维码。捐赠活动

非营利组织可以使用二维码来促进捐赠。通过将二维码放置在他们的网站、社交媒体页面或他们的实体位置,非营利组织可以通过允许捐赠者扫描二维码并使用他们喜欢的支付方式付款,从而让捐赠者更方便地进行捐赠。

在所有这些场景中,二维码支付的便捷性、速度和安全性可以提升整体客户体验和运营效率。而且,随着智能手机和数字钱包的日益普及,越来越多的客户和企业可以使用二维码支付。

企业如何使用二维码

企业可以通过多种方式使用二维码来提高客户参与度、简化交易并减轻内部运营压力。例如:

感应式支付

企业可以使用二维码启用感应式支付,通过提供快速、简单和安全的支付方式来增强客户体验。例如,一家咖啡店可以在柜台展示一个二维码,客户可以用手机银行或数字钱包扫描二维码,然后输入他们需要支付的金额,并确认交易。同样,电商网站 可以在结账页面上添加一个二维码,供客户扫描并完成付款,而无需输入信用卡详细信息。产品信息

除了包装上通常列出的信息外,二维码还能直接链接到全面的产品详细信息。例如,家具零售商可以在店内的价格标签上使用二维码。客户可以通过扫描二维码获取组装说明、阅读评论、在三维虚拟房间中查看产品,或查看不同颜色和款式的供应情况。促销和折扣

企业可以使用二维码提供独家促销或折扣。例如,一家服装零售商可以在其橱窗中放置一个二维码,让路人扫描二维码即可获得限时优惠或独家折扣码,从而有力地刺激顾客立即购买。客户调查和反馈

二维码可以简化收集客户反馈的过程。例如,餐厅可以在收据上打印二维码,顾客可以扫描二维码以快速访问智能手机上的表格,并提供有关其用餐体验的即时反馈。餐厅可以使用这些反馈来确定需要改进的地方。数字菜单

餐厅可以使用二维码制作数字菜单,而不是使用传统的纸质菜单。餐厅可以在每张桌子上放置一个二维码,顾客可以扫描二维码在智能手机上查看菜单。二维码将允许餐厅对菜单进行实时更新,并包括详细的成分表,甚至每道菜的顾客评论。活动注册

举办活动的企业可以使用二维码简化注册或票务流程。例如,举办特别展览的艺术画廊可以在宣传该活动的海报上使用二维码。有兴趣参加的人可以扫描代码注册活动或直接通过手机接收他们的数字门票。社交媒体参与

企业可以使用二维码来增加他们的社交媒体关注度并提高客户参与度。当地精品店可以在购物袋或收据中加入二维码,链接到他们的 Instagram 个人主页,顾客可以扫描二维码在 Instagram 上关注精品店,随时了解新品、销售和活动信息。跟踪库存

企业可以在内部使用二维码来管理库存。例如,制造公司可以在单个零件或产品上使用二维码。员工可以在制造或运输过程的每个步骤扫描代码,从而实现实时跟踪和库存更新。

这些例子都展示了二维码如何在企业的不同方面发挥多种作用,从提高客户参与度和交易效率到简化内部运营。二维码的多功能性和易用性使其成为当今数字商业领域的有力工具。

如何生成付款二维码

生成用于支付的二维码是一个简单的过程,但具体步骤可能会因您使用的支付平台或服务而异。以下是生成付款二维码的基本步骤:

选择支付服务商:选择支持二维码支付的支付服务商 (PSP)。此选择可能还取决于您所在的地区和整体业务需求。您的支付服务商可以是银行机构、数字钱包服务(如 Apple Pay)或专用支付平台(如 Stripe)。

创建商家账户:您需要在选定的服务商处开设一个商家账户。该账户将关联到二维码并接收付款。如果您已经有一个账户,则可以直接使用;如果没有,则需要创建一个。包括 Stripe 在内的一些提供商不要求企业开设商家账户,因为这些提供商提供该功能。

访问二维码生成功能:在服务商的平台上登录您的账户,然后查找允许您生成二维码的功能。通常,您可以在平台的付款或工具部分找到它。

输入支付信息:平台会提示您输入支付信息。这可能包括您的商家 ID,付款应定向到的特定账户,如果二维码是针对特定产品或服务的,则可能设定交易金额。

生成二维码:输入必要的详细信息后,点击“生成”按钮。该平台将创建一个与您输入的付款信息相关联的唯一二维码。

测试二维码:在部署 QR 代码之前,对其进行测试,方法是扫描该代码并确认它能触发正确的支付流程,而且付款会定向到正确的账户。

部署二维码:经过测试后,二维码可以显示在您的销售点、您的网站、收据或发票上,或以符合您的支付策略的任何其他方式使用。

使用二维码付款时,请务必牢记安全注意事项。一定要使用可信和安全的支付平台,并确保二维码的展示或分发方式能最大限度地降低篡改或未经授权更改的风险。

要了解企业如何将二维码与 Stripe Payment Links 结合使用,请点击此处 阅读相关信息。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。