SEPA (単一ユーロ決済圏) システムを使用することで企業や顧客はヨーロッパ内でユーロ決済の送金や受領を簡単にすることができます。この記事は、電信送金の基礎知識のガイドを補完するもので、SEPA 送金について具体的に説明し、処理時間を中心に取り上げて、フランス企業がより適切に取引を管理できるようにします。

この記事の内容

- SEPA 送金の所要時間

- 口座振替の所要時間

- 即時送金: 有料の高速送金

- SEPA 送金を受領できない場合の対応について

SEPA 送金の所要時間

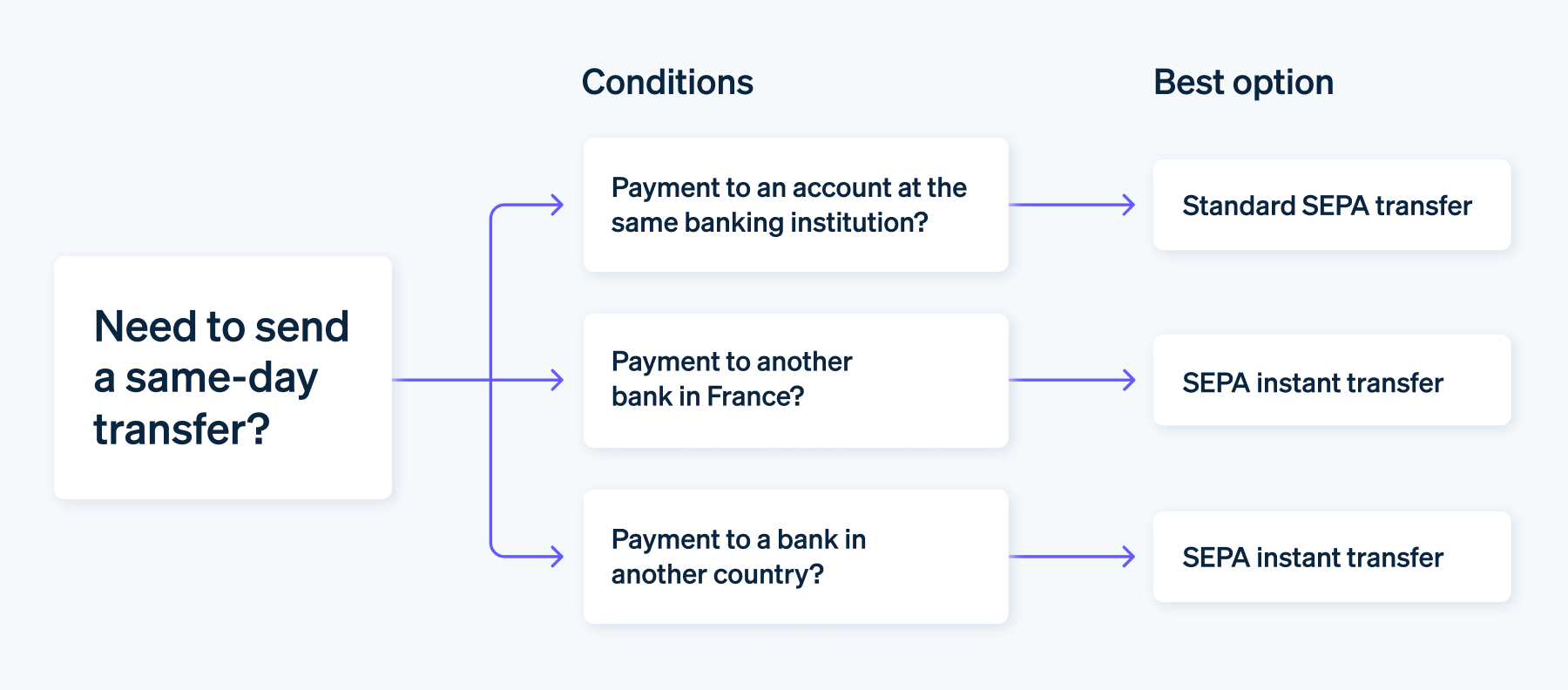

SEPA 送金の処理にかかる時間は、送金の開始日や送金先などのいくつかの要素によって異なります。通常、これらの取引には 最大 2 日かかるとされています。以下の表は主な種類と予想所要時間です。

|

送金のタイプ

|

処理時間

|

|---|---|

| 同一銀行内での送金 | 即時 |

| 外部の銀行口座への送金 | 1 ~ 3 営業日 |

| 欧州経済領域 (EEA) への送金 | 4 営業日 |

同一銀行内での送金処理時間

BNP パリバなど、フランスの同じ銀行の口座間では、標準的な SEPA 送金の処理が非常に敏速に行われます。特定の条件においては、受取人の口座にほぼ即時入金されます。

平日の 18:00 以前に開始された送金は、通常、同日中に処理されます。18:00 以降または週末に開始された場合は、翌営業日に処理されます。

外部 SEPA 送金の処理時間

異なる銀行間 (フランス国内の銀行またはフランスと他の SEPA 加盟国の銀行との間) の SEPA クレジットトランスファーの処理時間は標準化されており、通常は 1 ~ 3 営業日の範囲です。

たとえば、BNP パリバの顧客がフランスのソシエテジェネラルで開設した口座やドイツの銀行に送金する場合も、同じ手順で行われます。

国際送金の処理時間

通常、SEPA 域内のユーロ圏外の地域 (アイスランド、リヒテンシュタイン、モナコ、ノルウェー、サンマリノ、スイスなど、広域の欧州経済領域) の口座への送金は処理にかかる時間が長くなります。この場合、取引が受取人の口座に届くまでに最大 4 営業日かかる可能性がありますが、従来の国際送金と比較するとはるかに敏速です。

口座振替の所要時間

ここで言う時間は、1 回の口座振替 (SEPA クレジットトランスファー、すなわち SCT) に適用されます。SEPA ダイレクトデビットの場合、SEPA 同意書を使用した支払いの設定には、さらに 2 〜 3 日かかります。

同意書が設定されると、フランスの同じ銀行の口座間の標準取引は即座に行われます。外部口座および国際口座の場合、送金は同意書で指定された日付に行われます。

即時送金: 有料の高速送金

欧州中央銀行 (ECB) は、スピーディーな金融取引のニーズの高まりに対応し、送金時間をできるだけ短縮するために、2017 年に SEPA 即時クレジットトランスファーを開始しました。

この決済サービスは銀行での採用が進み、最大 100,000 ユーロの資金をほぼ瞬時に、通常は 10 秒未満で送金できます。また、24 時間年中無休で利用できます。

このように可用性が高いため、受益者は送金の遅延を最小限に抑えて、資金をすぐに受け取ることができます。しかし、多くの場合、通常の銀行手数料に加えて、通常は約 1 ユーロの追加料金がかかります。

SEPA 送金の管理は、Stripe Payments の事前設定済みのインターフェースを使用することで簡単にできます。100 種類以上の決済手段が利用できるため、企業は処理時間を考慮しながら取引を効率的に管理できます。

SEPA 送金を受領できない場合の対応について

SEPA 送金は、さまざまな理由で拒否されることがあります。最も発生しがちなエラーは、受取人の銀行口座情報が原因で発生します。IBAN、BIC、口座名義人の名前に入力ミスがあると、取引がブロックされる場合があります。

送金期限が切れ、3 営業日以内に受取人の口座に資金が届かないとします。その場合は、銀行とカード発行会社の銀行の両方に連絡して問題を特定し、解決策を見つけることをお勧めします。

取引に異議を申し立てることで、どの企業も銀行に送金の拒否や不正な送金を知らせることができます。

この記事の内容は、一般的な情報および教育のみを目的としており、法律上または税務上のアドバイスとして解釈されるべきではありません。Stripe は、記事内の情報の正確性、完全性、妥当性、または最新性を保証または請け合うものではありません。特定の状況については、管轄区域で活動する資格のある有能な弁護士または会計士に助言を求める必要があります。