公司和客户可通过 SEPA(单一欧元支付区)系统在欧洲范围内轻松发送和接收欧元付款。本篇文章是我们的转帐详解指南的补充,特别研究了 SEPA 转帐,重点关注处理时间,以帮助法国公司更好地管理交易。

目录

- SEPA 转账需要多长时间?

- 直接借记需要多长时间?

- 即时转账:快速但需付费

- 未收到 SEPA 转账:应采取的措施

SEPA 转账需要多长时间?

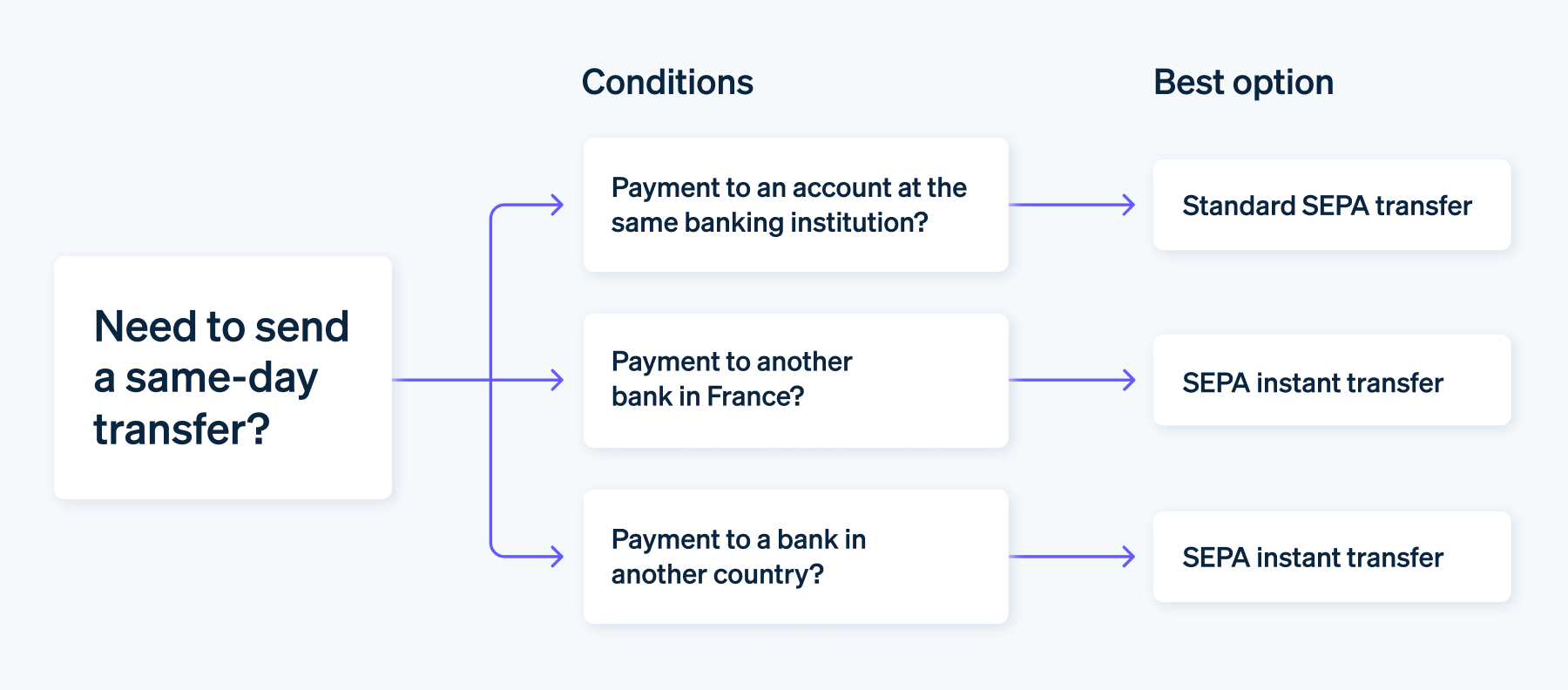

SEPA 转账的处理时间取决于多个因素,如发起日期和转账目的地。一般来说,这些交易需要最多两天,但下表详细说明了主要类型及其预期时限。

|

转移类型

|

处理时间

|

|---|---|

| 同银行转账 | 立即 |

| 转账到外部银行账户 | 1 到 3 个工作日 |

| 转移到欧洲经济区 | 4 个工作日 |

同一银行内的转账处理时间

对于同一法国银行(如法国巴黎银行)账户之间的转账,标准 SEPA 转账处理时间快得惊人。在某些情况下,资金几乎可以立即存入收款人的账户。

工作日下午 6:00 之前发起的转账通常当天处理完毕。下午 6:00 之后或周末发起的转账将在下一个工作日处理。

外部 SEPA 转账的处理时间

不同银行之间的 SEPA 贷记转账 - 无论是在法国国内还是在法国与另一个 SEPA 国家/地区之间 - 都适用标准化处理时间,通常为一到三个工作日。

例如,法国巴黎银行客户向在法国兴业银行或德国银行开立的账户转账,需要遵循同样的程序。

国际转账处理时间

在 SEPA 区内但在欧元区外向冰岛、列支敦士登、摩纳哥、挪威、圣马力诺和瑞士等泛欧洲经济区内的账户转账,通常需要更长的处理时间。虽然这些交易可能需要长达四个工作日才能到达收款人的账户,但它们仍然比传统的国际转账快得多。

直接借记需要多长时间?

此处的时间适用于单笔贷记划拨(SEPA 贷记划拨,即 SCT)。对于 SEPA 直接借记,使用 SEPA 授权设置支付需要额外的两到三天时间。

授权一经设定,同一法国银行账户之间的标准交易可即时完成。对于外部账户和国际账户,转账将在授权中指定的日期完成。

即时转账:快速但需付费

为了满足日益增长的快速金融交易需求,最大限度地缩短转账时间,欧洲中央银行于 2017 年推出了 SEPA 即时贷记转账。

这种支付服务已被越来越多的银行所采用,最高可支持 10 万欧元以内即时转账,通常不超过 10 秒钟。它还全年全天候提供服务。

这种可用性可确保受益人立即收到资金,尽量减少转账延迟。不过,除了通常的银行手续费外,使用该项服务通常还需支付额外费用,一般为 1 欧元左右。

使用 Stripe Payments 的预配置接口可简化 SEPA 转账管理。有 100 多种付款方式可供选择,企业可在考虑处理时间的同时有效管理交易。

SEPA 转账未收到:应采取的措施

SEPA 转账被拒绝可能有多种原因。最常见的原因是收款人的银行信息有误。IBAN、BIC 或账户持有人姓名中的错字可能会阻止交易。

假设转账期限到期,而资金在三个工作日内没有到达受益人的账户。在这种情况下,最好同时联系您的银行和对方银行,以确定问题所在并找到解决方案。

通过交易质询,任何企业都可以将拒绝或欺诈性转账通知其银行。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。