El sistema SEPA (Zona Única de Pagos en Euros) permite a las empresas y a los clientes enviar y recibir pagos en euros fácilmente dentro de Europa. Para complementar nuestra guía sobre envíos de fondos, este artículo examina específicamente las transferencias SEPA y se centra en los tiempos de procesamiento para ayudar a las empresas francesas a gestionar mejor sus transacciones.

¿De qué trata este artículo?

- ¿Cuánto tarda en realizarse una transferencia SEPA?

- ¿Cuánto tarda en realizarse un adeudo directo?

- Transferencias instantáneas: rápidas pero con comisiones

- Transferencia SEPA no recibida: qué debes hacer

¿Cuánto tarda en realizarse una transferencia SEPA?

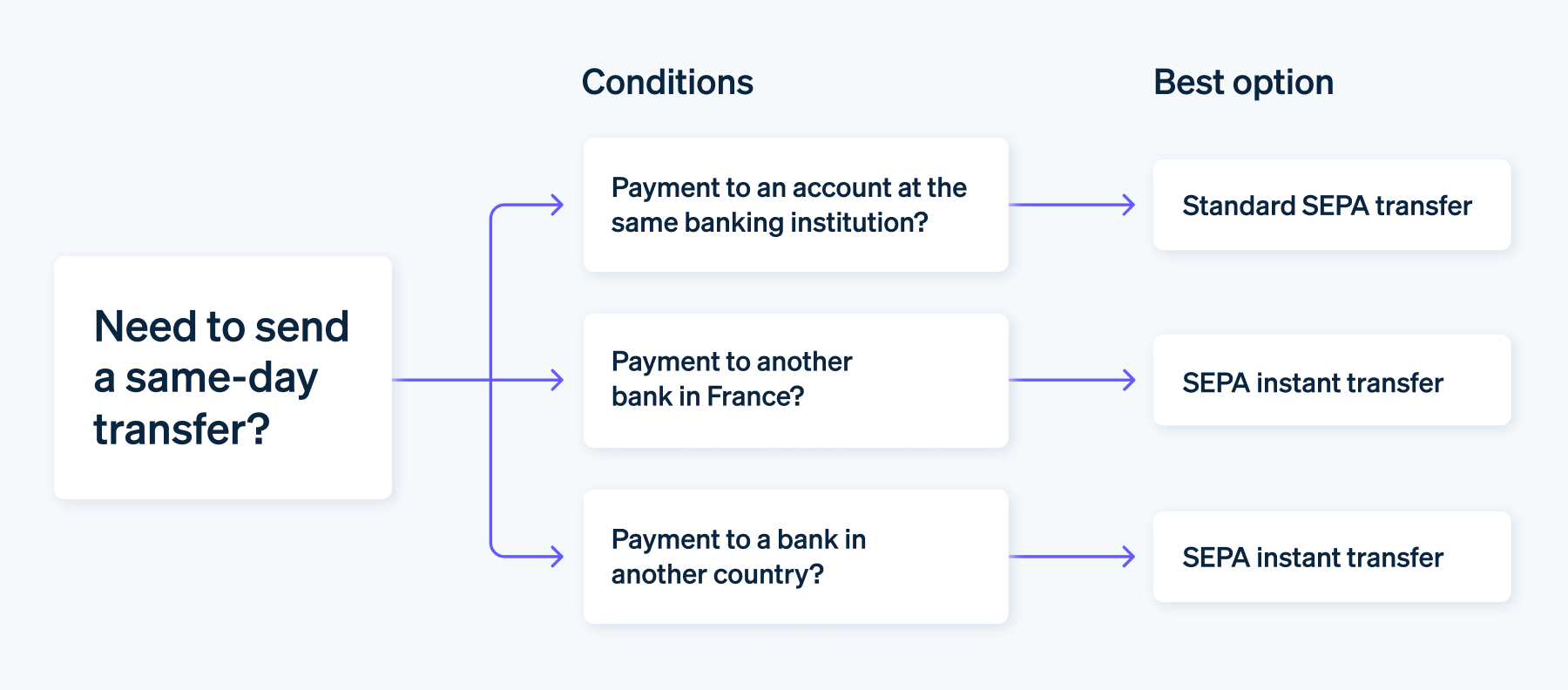

El tiempo de procesamiento de una transferencia SEPA depende de varios factores, como la fecha de inicio y el destino de la transferencia. Por lo general, estas transacciones tardan hasta dos días, pero en la siguiente tabla se detallan los tipos principales y sus plazos previstos.

|

Tipo de transferencia

|

Tiempo de procesamiento

|

|---|---|

| Transferencia dentro del mismo banco | Inmediata |

| Transferencia a una cuenta bancaria externa | De 1 a 3 días hábiles |

| Transferencia al Espacio Económico Europeo | 4 días hábiles |

Tiempo de procesamiento de transferencias dentro del mismo banco

Los tiempos de procesamiento de transferencias SEPA estándar pueden ser increíblemente rápidos cuando se realizan entre cuentas en el mismo banco francés, como BNP Paribas. En determinadas condiciones, los fondos se pueden abonar en la cuenta del destinatario casi de inmediato.

Las transferencias iniciadas antes de las 18:00 h de lunes a viernes generalmente se procesan el mismo día. Después de las 18:00 h o los fines de semana, se gestionarán el siguiente día hábil.

Tiempos de procesamiento para transferencias SEPA externas

Los tiempos de procesamiento de las transferencias de SEPA entre diferentes bancos, ya sea dentro de Francia o entre Francia y otro país SEPA, están estandarizados y suelen oscilar entre uno y tres días hábiles.

Por ejemplo, una transferencia iniciada por un cliente de BNP Paribas a una cuenta abierta en Société Générale en Francia o en un banco en Alemania sigue los mismos procedimientos.

Tiempos de procesamiento de transferencias internacionales

Las transferencias dentro de la zona SEPA pero fuera de la zona del euro (a cuentas del Espacio Económico Europeo más amplio, como Islandia, Liechtenstein, Mónaco, Noruega, San Marino y Suiza) suelen tardar más en procesarse. Aunque estas transacciones pueden tardar hasta cuatro días hábiles en llegar a la cuenta del beneficiario, siguen siendo mucho más rápidas que las transferencias internacionales tradicionales.

¿Cuánto tarda en realizarse un adeudo directo?

Los tiempos aquí se aplican a las transferencias de crédito individuales (transferencia de crédito SEPA o SCT). En el caso de los adeudos directos SEPA, la configuración del pago con el mandato SEPA tarda dos o tres días más.

Una vez que se establece el mandato, las transacciones estándar entre cuentas en el mismo banco francés son instantáneas. Para cuentas externas e internacionales, la transferencia se produce en la fecha especificada en el mandato.

Transferencias instantáneas: rápidas pero con comisiones

Para satisfacer la creciente necesidad de agilizar las transacciones financieras y minimizar los tiempos de transferencia, el Banco Central Europeo lanzó en 2017 la transferencia de crédito instantánea SEPA.

Este servicio de pago, cada vez más adoptado por los bancos, permite transferir fondos de hasta 100.000 € de forma casi instantánea, normalmente en menos de 10 segundos. También está disponible las 24 horas del día todos los días del año.

Esta disponibilidad garantiza que el beneficiario reciba los fondos de inmediato, con un retraso mínimo en la transferencia. Sin embargo, a menudo incluye una comisión adicional, que generalmente es de alrededor de un euro, además de las comisiones bancarias habituales.

La gestión de las transferencias SEPA se simplifica con las interfaces preconfiguradas de Stripe Payments. Al contar con más de 100 métodos de pago disponibles, las empresas pueden gestionar las transacciones de forma eficiente teniendo en cuenta los tiempos de procesamiento.

Transferencia SEPA no recibida: qué debes hacer

Se puede rechazar una transferencia SEPA por varias razones. Los errores más comunes surgen de los datos bancarios del destinatario. Un error tipográfico en el IBAN, el BIC o el nombre del titular de la cuenta puede bloquear la transacción.

Supongamos que el límite de transferencia vence y los fondos no han llegado a la cuenta del beneficiario en el plazo de tres días hábiles. En ese caso, lo mejor es contactar tanto con tu banco como con el banco del emisor para determinar el problema y encontrar una solución.

Al impugnar una transacción, cualquier empresa puede notificar a su banco si se ha rechazado una transferencia o si ha sido fraudulenta.

El contenido de este artículo tiene solo fines informativos y educativos generales y no debe interpretarse como asesoramiento legal o fiscal. Stripe no garantiza la exactitud, la integridad, la adecuación o la vigencia de la información incluida en el artículo. Busca un abogado o un asesor fiscal profesional y con licencia para ejercer en tu jurisdicción si necesitas asesoramiento para tu situación particular.