Das SEPA-System (Single Euro Payments Area) ermöglicht es Unternehmen und Kundinnen/Kunden, innerhalb Europas Zahlungen in Euro zu senden und zu empfangen. Ergänzend zu unserem Leitfaden mit Erläuterungen zu Überweisungen befasst sich dieser Artikel speziell mit SEPA-Überweisungen. Der Schwerpunkt liegt auf den Bearbeitungszeiten, um französischen Unternehmen bei der besseren Verwaltung ihrer Transaktionen zu helfen.

Worum geht es in diesem Artikel?

- Wie lange dauert eine SEPA Überweisung?

- Wie lange dauert eine Lastschrift?

- Sofortüberweisungen: Schnell, aber gebührenpflichtig

- SEPA-Überweisung nicht erhalten: Was ist zu tun

Wie lange dauert eine SEPA-Überweisung?

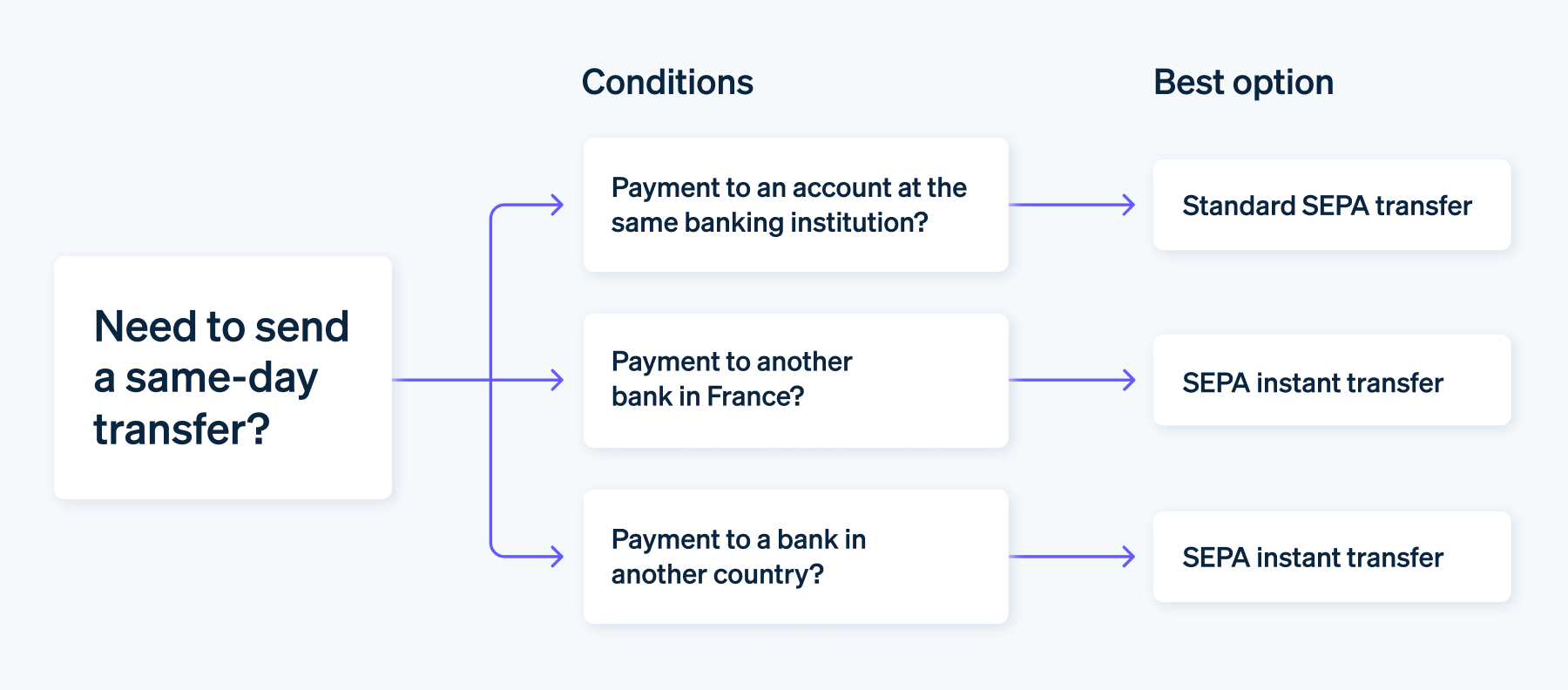

Die Bearbeitungszeit für eine SEPA-Überweisung hängt von mehreren Faktoren ab, wie z. B. dem Datum der Einleitung und dem Ziel der Überweisung. In der Regel dauern diese Transaktionen bis zu zwei Tage. In der folgenden Tabelle sind jedoch die wichtigsten Arten und ihre voraussichtlichen Zeitrahmen aufgeführt.

|

Überweisungstyp

|

Verarbeitungszeit

|

|---|---|

| Bankinterne Überweisung | Sofort |

| Überweisung an externes Bankkonto | 1 bis 3 Werktage |

| Überweisung in den Europäischen Wirtschaftsraum (EWR) | 4 Werktage |

Bearbeitungszeit für Überweisungen innerhalb derselben Bank

Die Standard-Bearbeitungszeiten für SEPA-Überweisungen können unglaublich schnell sein, wenn es sich um Überweisungen zwischen Konten bei derselben französischen Bank handelt, wie z. B. BNP Paribas. Unter bestimmten Bedingungen können Gelder dem Konto des Empfängers/der Empfängerin beinahe sofort gutgeschrieben werden.

Überweisungen, die werktags vor 18:00 Uhr beginnen, werden in der Regel noch am selben Tag bearbeitet. Bei Beginn nach 18:00 Uhr oder am Wochenende werden sie am nächsten Werktag bearbeitet.

Bearbeitungszeiten für externe SEPA-Überweisungen

Die Bearbeitungszeiten für SEPA-Überweisungen zwischen verschiedenen Banken – entweder innerhalb Frankreichs oder zwischen Frankreich und einem anderen SEPA-Land – sind standardisiert und liegen in der Regel zwischen einem und drei Werktagen.

Beispielsweise kommt bei einer Überweisung, die von einem Kunden/einer Kundin der BNP Paribas-Bank auf ein Konto bei der Société Générale in Frankreich oder auf ein Konto bei einer Bank in Deutschland getätigt wird, das gleiche Verfahren zur Anwendung.

Bearbeitungszeiten für internationale Überweisungen

Überweisungen innerhalb des SEPA-Raums, aber außerhalb des Euroraums – auf Konten im Europäischen Wirtschaftsraum wie Island, Liechtenstein, Monaco, Norwegen, San Marino und der Schweiz – dauern in der Regel länger. Bei diesen Transaktionen kann es bis zum Eingang auf dem Empfängerkonto bis zu vier Werktage dauern, aber sie sind deutlich schneller als herkömmliche internationale Überweisungen.

Wie lange dauert eine Lastschrift?

Die hier angegebenen Zeiten gelten für einmalige Überweisungen (SEPA-Überweisung oder SCT). Beim SEPA-Lastschriftverfahren dauert die Einrichtung der Zahlung über das SEPA-Mandat zwei bis drei Tage zusätzlich.

Sobald das Mandat eingerichtet ist, werden Standardtransaktionen zwischen Konten bei derselben französischen Bank sofort ausgeführt. Bei externen und internationalen Konten erfolgt die Überweisung an dem im Mandat angegebenen Datum.

Sofortüberweisungen: Schnell, aber gebührenpflichtig

Um dem wachsenden Bedarf an schnellen Finanztransaktionen gerecht zu werden und die Überweisungszeiten zu minimieren, hat die Europäische Zentralbank 2017 die SEPA-Sofortüberweisung eingeführt.

Mit diesem Zahlungsdienst, der zunehmend von Banken eingesetzt wird, können Gelder von bis zu 100.000 € fast sofort überwiesen werden – in der Regel in weniger als 10 Sekunden. Zudem ist er rund um die Uhr verfügbar, an jedem Tag des Jahres.

Durch diese Verfügbarkeit wird sichergestellt, dass Begünstigte das Geld sofort und mit minimaler Übertragungsverzögerung erhalten. Oft fällt jedoch neben zu den üblichen Bankgebühren eine zusätzliche Gebühr an, in der Regel etwa ein Euro.

Die Verwaltung von SEPA-Überweisungen wird durch die vorkonfigurierten Schnittstellen von Stripe Payments vereinfacht. Mit über 100 verfügbaren Zahlungsmethoden können Unternehmen Transaktionen effizient verwalten und dabei die Bearbeitungszeiten berücksichtigen.

SEPA-Überweisung nicht empfangen: Was ist zu tun

Eine SEPA-Überweisung kann aus verschiedenen Gründen abgelehnt werden. Die häufigsten Fehler ergeben sich aus der Bankverbindung des Empfängers/der Empfängerin. Ein Tippfehler in der IBAN, BIC oder im Namen des Kontoinhabers/der Kontoinhaberin kann die Transaktion blockieren.

Angenommen, das Überweisungslimit läuft ab und das Geld ist nicht innerhalb von drei Werktagen auf dem Konto der Zahlungsempfänger/innen eingegangen. In diesem Fall wenden Sie sich am besten sowohl an Ihre Bank als auch an die Bank des Ausstellers/der Ausstellerin, um das Problem zu ermitteln und eine Lösung zu finden.

Durch Anfechtung einer Transaktion kann jedes Unternehmen seine Bank über eine abgelehnte oder betrügerische Überweisung informieren.

Der Inhalt dieses Artikels dient nur zu allgemeinen Informations- und Bildungszwecken und sollte nicht als Rechts- oder Steuerberatung interpretiert werden. Stripe übernimmt keine Gewähr oder Garantie für die Richtigkeit, Vollständigkeit, Angemessenheit oder Aktualität der Informationen in diesem Artikel. Sie sollten den Rat eines in Ihrem steuerlichen Zuständigkeitsbereich zugelassenen kompetenten Rechtsbeistands oder von einer Steuerberatungsstelle einholen und sich hinsichtlich Ihrer speziellen Situation beraten lassen.