As online tools make it easier to connect with global customers, more and more businesses are selling overseas. In fact, a Stripe study from 2023 found that 66% of businesses were gearing up to sell in new countries. While it’s easier than ever to reach a global audience, online businesses are also faced with a new challenge: how do you address the diverse customer preferences of a global audience during the checkout experience? The way customers prefer to pay for goods or services online varies drastically based on where they are located. If you don’t create a relevant, familiar payment experience, you could cut off entire countries from your addressable market.

While the global payments landscape has become increasingly complex and fragmented, Stripe makes it easy for any type of business anywhere in the world to discover and accept popular payment methods with a single integration.

This guide helps you evaluate and identify the payment methods that are well-suited to your business model and customer preferences and offers an in-depth look at the payment methods Stripe supports.

1. The benefits of payment methods

Over the past decade, payment methods have evolved to support different consumer and business needs. Markets with high card penetration, such as the US and the UK, have seen a significant shift toward wallets like Apple Pay and Google Pay, which offer more security and convenience. Some markets, such as France and Japan, even have their own local card networks that help businesses reach more card users. In markets like Germany and Malaysia, where card use is much lower, bank-based methods are strongly preferred and trusted for online purchases. The banking networks in these markets typically offer a faster and more secure checkout experience where users can authorize a payment using their online banking credentials. Meanwhile, in economies with a large unbanked population, such as Mexico and Indonesia, popular payment methods allow customers to pay for online goods with cash using vouchers.

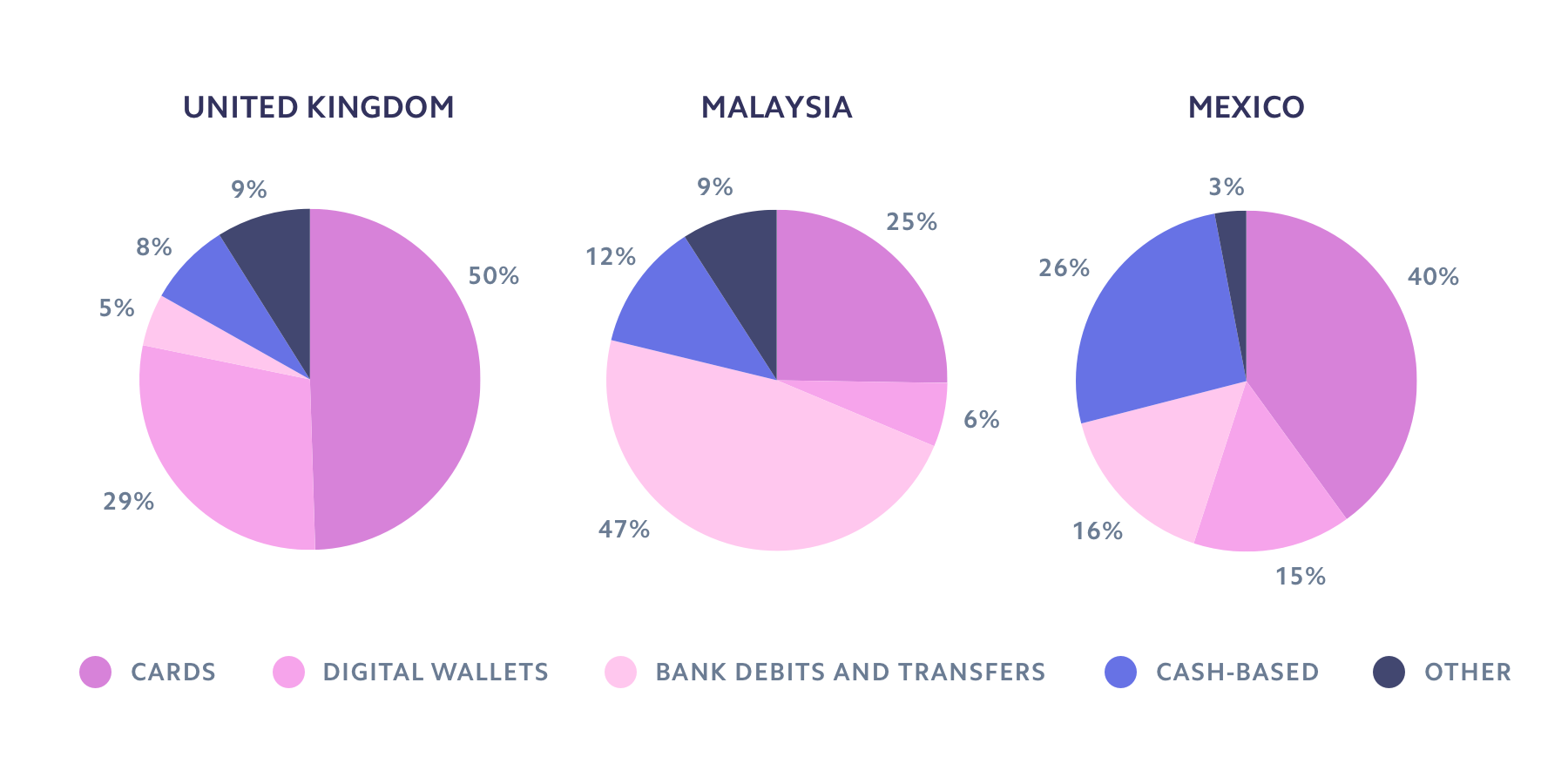

These graphs show how payment method preferences vary across countries.

By accepting payment methods that are both preferred by your customers and relevant for your business model, you can:

Reach more customers globally: As you expand into new regions, accepting local payment methods may be necessary to capture the total market opportunity. For example, 54% of online transactions in China involve wallets such as Alipay or WeChat Pay, and 20% use the local card network China UnionPay. Without supporting these payment methods, you may risk missing out on the substantial and growing buying power of Chinese consumers.

Increase conversion: Up to 13% of shoppers abandon their cart if their preferred payment option isn’t available. Surfacing the right mix of payment options to customers can meaningfully increase the chances that they’ll successfully complete a purchase.

Reduce fraud and disputes: Anticipate and manage the risks associated with accepting online payments by choosing payment methods that match your risk preferences. As a general rule, the better the level of customer authentication, the lower the likelihood of fraudulent and disputed payments.

Optimize your transaction costs: Payment methods have inherently different cost structures. Depending on your business model and where your customers are located, certain payment methods may or may not be relevant.

2. Choosing the right payment methods for your business

Whether you want to improve conversion in your domestic market or expand globally, surfacing relevant payment methods to your customers is key. But, depending on the nature of your transactions and where your customers are located, certain payment methods may or may not be relevant.

This section covers the eight major payment method families and specific considerations based on your business model: ecommerce and marketplaces, on-demand services, SaaS and subscription businesses, or professional services. If you are a B2B platform that enables your users to accept payments, your relevant payment methods depend on the business model of your users (for example, if your users have a SaaS business model, refer to section 2.3 below on SaaS and subscription businesses).

|

Description

|

Supports recurring payments

|

Supports refunds

|

Supports disputes

|

Payment confirmation

|

|

|---|---|---|---|---|---|

|

Cards

|

Cards are linked to a debit or credit account at a bank. To complete a payment online, customers enter their card information at checkout. | Yes | Yes | Yes, highest dispute rate | Immediate |

|

Wallets

|

Wallets are linked to a card or bank account, but can also store monetary value. Wallets typically require customer verification (e.g., biometrics, SMS, passcode) to complete a payment. | Yes | Yes | Yes, lower dispute rate than cards | Immediate |

|

Bank debits

|

Bank debits pull funds directly from your customer’s bank account. Customers provide their bank account information and typically agree to a mandate for you to debit their account. | Yes | Yes | Yes, lowest dispute rate | Delayed |

|

Bank redirects

|

Bank redirects add a layer of verification to complete a bank debit payment. Instead of entering their bank account information, customers are redirected to provide their online banking credentials to authorize the payment. | No, but Stripe supports recurring for some methods by converting to direct debit | Yes | No | Immediate |

|

Bank transfers

|

Credit transfers allow customers to push funds from their bank account to yours. You provide customers with the bank account information they should send funds to. | No | Yes | No | Delayed |

|

Buy now, pay later

|

Buy now, pay later is a growing category of payment methods that offers customers immediate financing for online payments, typically repaid in fixed installments over time. | No | Yes | Yes, most methods will take on fraud risk | Immediate |

|

Cash-based vouchers

|

With cash-based vouchers, customers receive a scannable voucher with a transaction reference number that they can then bring to an ATM, bank, convenience store, or supermarket to complete the payment in cash. | No | No | No | Delayed |

|

Real-time payments

|

Enable your customers to pay almost instantly, 24/7 directly from their bank accounts, wallets, or other funding source, which helps increase speed and conversion—all at a low cost to your business. | No | Yes | No | Immediate |

2.1. For ecommerce and marketplaces

Recommended: Cards; wallets; bank redirects; buy now, pay later; real-time payments

While frictionless checkout experiences are vital for any business model, its importance is magnified for ecommerce and marketplaces. Customers expect streamlined payment experiences—ones that give them what they want, when they want it. The right set of payment methods not only offers payment flexibility and convenience to maximize conversion but also reduces fraud and increases transaction speed.

Cards are the most commonly used payment method, and it’s important that you support all relevant card brands to optimize conversion and costs. Wallets and bank redirects can also help increase conversion by allowing customers to use stored payment information (the added verification also lowers the possibility of disputes). Wallets, like cards, are a reusable payment method—customers provide their payment details once, and if that information is stored, they don’t need to share any additional information for future payments. This enables you to offer one-click checkout experiences. Real-time payments enable customers to pay almost instantly from their bank accounts, wallets, or other funding sources, which help increase speed and conversion at a low cost. If you sell high-value goods, consider buy now, pay later payment options, which allow your customers to customize their payment terms and break up purchases into smaller installments.

In many large markets with low card use, such as Brazil, Mexico, and Indonesia, customers prefer to pay with cash-based vouchers and bank transfers, which don’t support immediate payment confirmation or native refunds. This can create challenges for ecommerce businesses that typically rely on real-time payment notifications to manage their shipping flows or refunds to promote customer loyalty. Stripe can help global businesses cater to these customers by enabling automated refund experiences and faster notifications for payment types that don’t typically support these features.

2.2. For on-demand services

Recommended: Cards, wallets, real-time payments

With instant fulfillment at the heart of the customer experience, on-demand services need to encourage conversion—often on mobile—while managing fraud risk. Consider focusing on payment methods that offer immediate confirmation that the transaction was successful, such as cards, wallets, and real-time payments. These payment options also allow you to store customer payment details on file and enable one-tap confirmations, shortening the checkout experience. While wallets typically have the same transaction cost as cards, they are more secure since authentication is required to complete payment, lowering fraud and dispute rates.

It’s still important to consider the local context, as payment methods with more friction may be trusted and preferred to pay for on-demand services or add top-ups to customers’ app balance.

2.3. For SaaS and subscription businesses

Recommended: Cards, wallets, bank debits

If you manage recurring revenue and want to optimize your checkout experience for ongoing transactions, it’s important to consider whether or not payment details can be stored on file and reused. The ability to reuse a customer’s payment credentials allows you to initiate payments on a custom schedule, without requiring any action by your customers. Cards, wallet, and bank debit payments are all reusable—customers only need to provide their card number or bank account details once. And, for customers who prefer to use bank redirects such as iDEAL or Bancontact, Stripe makes it possible to use these methods for recurring payments by converting them into direct debits.

In addition, many SaaS and subscription companies face involuntary churn issues, where customers intend to pay for a product but their payment attempt fails due to expired cards, insufficient funds, or outdated card details. In fact, 9% of subscription invoices fail on the first charge attempt due to involuntary churn. Stripe Billing can help manage recurring declines for cards, in addition to supporting many of the most relevant payment methods for increasing recurring payment conversion (for example, because bank account information doesn’t expire, accepting bank debits can increase retention).

While accepting reusable payment methods is beneficial to the business, it’s also important to consider local expectations regarding recurring billing. For example, in markets like Brazil and Indonesia, it’s common to send recurring invoices or reminders for customers to initiate each payment. (Stripe Billing makes it easy to accommodate both recurring charges and invoicing.)

2.4. For professional services

Recommended: Cards, bank debits, bank transfers, real-time payments

If you offer professional services or wholesale products, even a single payment failure or dispute could result in significant revenue loss. The ability to securely and successfully accept large payments can protect your business and can be solved, in part, by invoicing your customers so they have more flexibility to initiate payment when funds are available. Historically this has often meant asking customers to send checks. You can also send a hosted invoice with built-in support for cards and bank methods to minimize payment failure and automate payment tracking and reconciliation. Real-time payment methods that allow customers to pay almost instantly from their bank accounts, wallets, or other funding sources are another increasingly popular option in Asia and Latin America. They have a low risk of fraud and disputes, as they require customer authentication.

In addition, bank transfers are a secure, nondisputable payment option that is often preferred for very large payments. Credit transfer funds are deposited directly into your account once the payment has been confirmed. Credit transfers also require your customers to initiate the payment, adding an extra level of authentication and security. And, because contracts are typically in place before payment, it’s less important that your business initiates the payment and more important that payments don’t fail and can’t be disputed. While tracking and reconciliation for credit transfers can be difficult, Stripe generates virtual bank account numbers to keep your company’s banking details private and automatically reconcile incoming payments with outstanding invoices.

This table summarizes relevant payment methods supported on Stripe by business model.

3. How Stripe can help

Companies of all sizes and from around the world use Stripe to accept multiple payment methods and simplify global operations. Stripe is actively adding new payment methods with the goal of enabling businesses to accept any payment method in the world with a single integration. Stripe offers:

Seamless integration options for all business models: The entire Stripe product suite comes with built-in global payment support, so you can create localized payment experiences regardless of your business model. Stripe’s Payments API makes it easy to support multiple payment methods through a single integration. This leaves you with a unified and elegant integration that involves minimal development time and remains easy to maintain, regardless of which payment methods you choose to implement.

Supporting a localized and compliant payments experience for global customers is even easier with Stripe’s Optimized Checkout Suite, which includes prebuilt UIs Checkout, Elements, and Payment Links. With the Optimized Checkout Suite, you can turn on popular payment methods from the Stripe Dashboard and then use Stripe’s machine learning algorithm to dynamically show customers the most relevant ones you’ve enabled based on transaction amount, browser, currency, and other signals. All prebuilt payment UIs are also able to trigger 3D Secure and can handle European SCA requirements by dynamically applying card authentication when required by the cardholder’s bank.

Recurring revenue businesses can use Stripe Billing to manage subscription logic and invoices and give customers the ability to pay their invoices with bank debits or other preferred payment methods. Platforms and marketplaces can use Stripe Connect to accept money and pay out to third parties. Your sellers or service providers benefit from the same streamlined Stripe onboarding and get instant access to select payment methods.

Simple payment method setup: Stripe allows you to quickly add and scale global payment method support without filling out multiple forms with the same information or following one-off onboarding processes. You can also enable certain international payment methods without having to set up a local entity, bank account, or Stripe account.

No-code payment method testing and management: Experiment with new payment methods by running an A/B test to understand impact and set custom rules—all while offloading maintenance and eligibility requirements to Stripe right from the Stripe Dashboard.

Expanded payment method capabilities: Stripe can fill in certain gaps in payment method capabilities and expand their supported use cases. For example, bank redirects such as iDEAL or Bancontact don’t normally support recurring payments. However, Stripe converts these payment methods into direct debits so customers can use them to pay for subscription services.

Unified monitoring and reporting: Payments made with any payment method appear in the Stripe Dashboard, reducing operational complexity and allowing for lightweight financial reconciliation. This enables you to develop standardized processes for typical operations such as fulfillment, customer support, and refunds. And, because Stripe abstracts away the complexity of dealing with each payment method provider, you also benefit from one single point of escalation and accountability on disputes or other exceptions that may arise when dealing with diverse payment methods.

For more information on supporting payment methods with Stripe, read our docs or contact our sales team. To start accepting payments right away, sign up for an account.

4. More about payment methods

Based on your customer’s geography and your business model, identify relevant payment methods to integrate by reviewing a comprehensive list of Stripe-supported payment options. You can also see which payment methods are available for your account by visiting the Dashboard.