Summary

The 3D Secure standard—often known by its branded names like Visa Secure, Mastercard Identity Check, or American Express SafeKey—aims to reduce fraud and provide added security to online payments.

3D Secure 2 (3DS2) introduces “frictionless authentication” and improves the purchase experience compared to 3D Secure 1. It is the main card authentication method used to meet Strong Customer Authentication (SCA) requirements in Europe and a key mechanism for businesses to request exemptions to SCA.

Stripe supports 3D Secure 2 on our payments APIs, mobile SDKs, and Stripe Checkout.

A quick history of 3D Secure 1

Despite additional security measures, such as the Address Verification System (AVS) or the CVC verification used in some markets, credit and debit card payments can still be at a high risk of fraud. (In fact, it is because of this risk that customers have the ability to dispute fraudulent payments made with their card.)

To address this problem, card networks implemented the first version of 3D Secure in 2001. If you regularly buy items online, you may be familiar with the 3D Secure flow: You enter your card details to confirm a payment and are then redirected to another page where your bank asks you for a code or password to approve the purchase. Because the authentication page is co-branded by the card network, most customers are often more familiar with branded names for 3D Secure, such as Visa Secure, Mastercard Identity Check, or American Express SafeKey.

For businesses, the benefit of 3D Secure is clear: Requesting additional information lets you build in an extra layer of fraud protection and ensure that you only accept card payments from legitimate customers. As an added incentive, authenticating a payment with 3D Secure shifts the liability for chargebacks due to fraud from your business to your customer’s bank. This added protection is why 3D Secure is often applied to large purchases like airline tickets.

Unfortunately, the use of 3D Secure 1 also has some drawbacks: The additional step required to complete the payment adds friction to the checkout flow and can lead customers to abandon the purchase. Additionally, a number of banks still force their cardholders to create and remember their own static passwords to complete 3D Secure verification. These passwords are easy to forget, which can lead to higher rates of cart abandonment.

What’s different with 3D Secure 2

EMVCo, an organization made up of six major card networks, released a newer version of 3D Secure. 3D Secure 2 (also called EMV 3-D Secure, 3D Secure 2.0, or 3DS2) aims to address many of the shortcomings of 3D Secure 1 by introducing less disruptive authentication and a better user experience.

Frictionless authentication

3D Secure 2 allows businesses and their payment provider to send more data elements on each transaction to the cardholder’s bank. This includes payment-specific data like the shipping address, as well as contextual data, such as the customer’s device ID or previous transaction history.

The cardholder’s bank can use this information to assess the risk level of the transaction and select an appropriate response:

If the data is enough for the bank to trust that the real cardholder is making the purchase, the transaction goes through the “frictionless” flow and the authentication is completed without any additional input from the cardholder.

If the bank decides it needs further proof, the transaction is sent through the “challenge” flow and the customer is asked to provide additional input to authenticate the payment.

Although a limited form of risk-based authentication was already supported with 3D Secure 1, the ability to share more data using 3D Secure 2 aims to increase the number of transactions that can be authenticated without further customer input.

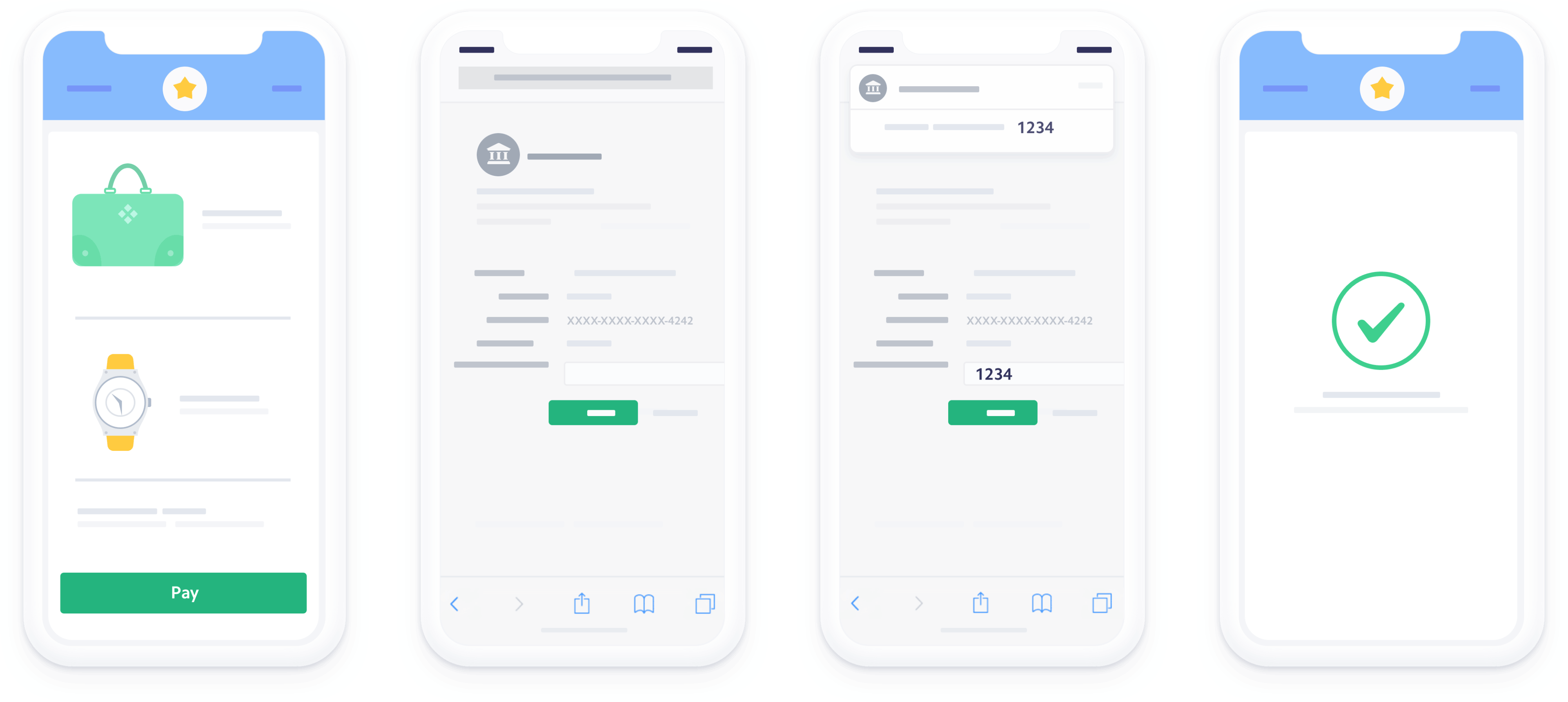

Example flow of authenticating a payment using 3D Secure 2 with fallback support for 3D Secure 1

Even if a transaction follows the frictionless flow, your business will benefit from the same liability shift that it does for transactions that pass through the challenge flow.

Better user experience

Unlike 3D Secure 1, 3D Secure 2 was designed after the rise of smartphones and makes it easier for banks to offer innovative authentication experiences through their mobile banking apps (sometimes referred to as “out-of-band authentication”). Instead of entering a password or receiving a text message, the cardholder can authenticate a payment through the banking app just by using their fingerprint or even facial recognition. We expect many banks to support these smoother authentication experiences with 3D Secure 2.

The second improvement in user experience is that 3D Secure 2 is designed to embed the challenge flow directly within web and mobile checkout flows—without requiring full page redirects. If a customer authenticates on your site or webpage, the 3D Secure prompt now by default appears in a modal on the checkout page (browser flow).

3D Secure 2 browser flow

If you’re building an app, mobile SDKs built for 3D Secure 2 let you build an “in-app” authentication flow and avoid browser redirects altogether.

3D Secure 1: mobile authentication flow with browser redirect

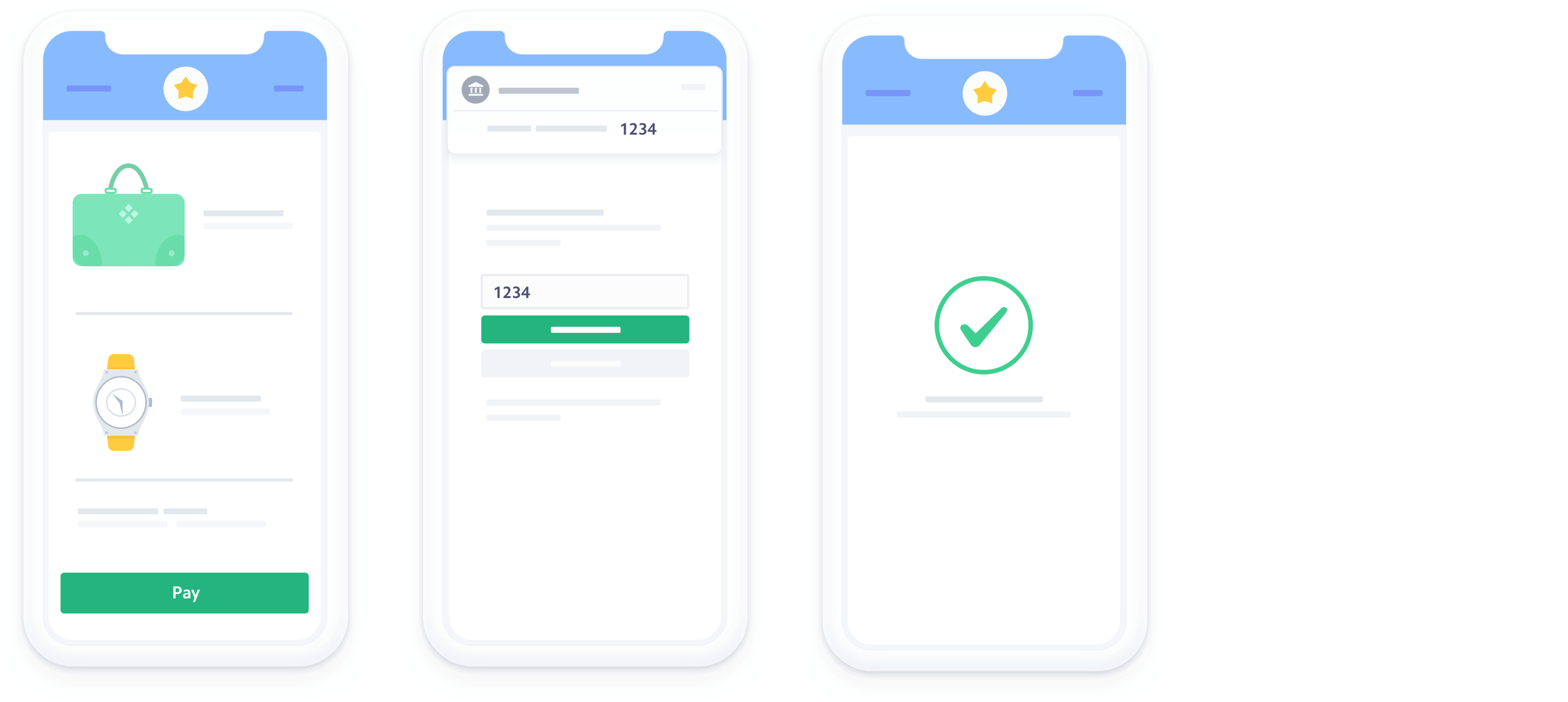

3D Secure 2: improved mobile authentication flow within the app

3D Secure 2 and Strong Customer Authentication

The enforcement of Strong Customer Authentication (SCA) makes 3D Secure 2 all the more important if you are doing business in Europe. As this regulation requires you to apply more authentication on European payments, the improved user experience of 3D Secure 2 can help reduce the negative impact on conversion.

The 3D Secure 2 protocol itself also allows payment providers like Stripe to request exemptions to SCA and skip authentication for low-risk payments altogether. Payments that require SCA will need to go through the “challenge” flow, whereas transactions that can be exempted from SCA can be sent through the “frictionless” flow. However, it’s worth noting that if the payment provider requests an exemption for payments requiring SCA and the transaction passes through the “frictionless” flow, it doesn’t benefit from the liability shift.

How does Stripe support 3D Secure 2?

Stripe supports the 3D Secure 2 browser flow on our payments APIs and Checkout, letting you dynamically apply 3D Secure to high-risk payments to protect your business from fraud. We will apply 3D Secure 2 when it’s supported by the cardholder’s bank and fall back on 3D Secure 1 when the new version isn’t supported yet.

If you’re building a mobile application, our iOS and Android SDKs let you build an in-app authentication flow to offer a “native” authentication experience and avoid redirecting your customers outside of your application. Even if the cardholder’s bank doesn’t yet support 3D Secure 2, our mobile SDKs will dynamically fall back to showing 3D Secure 1 in a webview embedded within your application.

Learn more about our payments APIs, mobile SDKs, or Stripe Checkout to get started with 3D Secure 2.

|

MIT

|

For merchant-initiated transactions (MITs), SCA only has to be applied at the setup of the mandate, but not for subsequent MITs. An eight-week unconditional refund right—similar to SEPA Direct Debits—is introduced for MITs. |

|---|---|

|

MOTO

|

For Mail Order Telephone Order (MOTO) transactions, only the initiation of a payment transaction needs to be nondigital in order for that transaction to be exempt from SCA. |

|

Dynamic linking

|

Elements of SCA that dynamically link the transaction to a specific amount and payee should be used for electronic payment transactions in which a payment is placed through a payer’s device using proximity technology (e.g., near-field communication, or NFC) and the application of SCA requires the use of the internet on the payer’s device. |

|

Account information services

|

For PSPs providing account information services under open banking, SCA is only required on the occasion of the first data access. However, SCA is required when customers access aggregated account data on the account information service provider’s domain, at least every 180 days. |

|

Tokenization

|

Tokenization requires the application of SCA when the cardholder is actively involved in the tokenization process (e.g., when enrolling or replacing a card in a wallet or card-on-file solution). |

|

Transaction monitoring

|

The European Banking Authority will issue Regulatory Technical Standards for payment service providers’ use of transaction monitoring, including through environmental and behavioral characteristics (e.g., customer location or spending habits). This underpins the use of SCA exemptions for transactions that pose a low level of risk (i.e., Transaction Risk Analysis exemptions). |

|---|---|

|

SCA exemptions

|

The EBA is also mandated to develop further Regulatory Technical Standards on SCA requirements and exemptions, taking into account a risk-based approach and the use of technology. |

|

Two-factor authentication

|

The new rules suggest that the factors used for two-factor authentication under SCA do not need to belong to different categories, as long as their independence is fully preserved. This could allow customers to authenticate using two passwords, or a fingerprint and face ID. |

|

Accessibility

|

PSPs have to offer different ways of performing SCA, such as through SMS, that do not depend on the possession of a smart device. |

|

Liability for TSPs

|

Liability is attributed to technical service providers (TSPs) and operators of payment schemes in case of failure to support the application of SCA. This is to ensure increased cooperation among all players involved in performing SCA. |

|---|---|

|

Outsourcing

|

Payment service providers that rely on TSPs for the provision and verification of SCA elements have to enter into outsourcing agreements with these TSPs. The EBA will set out requirements for these outsourcing agreements. |