SaaS platforms are often looking for ways to offer complementary services that add extra value for their customers. Supporting payments is a logical extension for many platforms—not only does it offer a more convenient customer experience, it also gives platforms a way to diversify their revenue streams by charging customers for payment features.

As with any new feature you add, your marketing and sales approach will determine its success. While the payment features themselves—and the integration experience—are critical, customer adoption depends on awareness, discoverability, and education. You’ll likely benefit from some organic adoption, but the right go-to-market strategy can increase the usage and revenue of your payment feature even more.

This guide covers the basics of marketing, selling, and growing online and in-person payments as a feature. We’ve distilled best practices across thousands of partners to help you launch faster and go to market more effectively. You’ll learn how SaaS businesses like Woo, Xero, and Intercom promote their online payments offering and how Lightspeed, Squire, and Shopmonkey market their in-person payments. We’ll also cover how Stripe can help.

Before you start investing in marketing and sales, make sure you’re offering a winning payment solution—one that you feel proud of and will provide value to your customers. If you have the right foundation and are offering the right features and benefits, your marketing and sales efforts will be that much easier.

For example, make sure that your payments solution:

- Offers an easy, seamless sign-up process. Ideally your payment provider has experience with your type of customer and can make the verification process easy and fast.

- Supports a variety of payment methods, such as debit and credit cards, digital wallets, and local payment methods.

- Covers every way your customers want to be paid, including online and in-person payments, invoicing, and recurring payments.

- Can expand to key markets on your platform, especially if your user base is global.

- Offers fraud prevention tools and other payment optimization tools.

This is just a brief overview of some of the most important features to include in your payments solution. For more information, read our guide to online payments.

Marketing your payments solution

Think of promoting your payments offering just like you would any other new feature on your platform. You first want to define your audience and messaging, create a cohesive brand and product experience, and leverage distribution channels to get your message in front of the right audience.

Here are five best practices for marketing your payments solution:

1. Define your message

Your marketing strategy and messaging should vary depending on your target customers. For example, it was important for the Intercom team to first understand how customers would use Stripe for online payments, then develop their messaging and go-to-market plan around those key benefits in a way that was clear and concise. For example, Intercom knew that their customers would need the ability to view and manage subscription payments while chatting in the Intercom Inbox, plus use billing and subscription information for renewal marketing. With these customer needs in mind, Intercom crafted value prop messaging, like: Answer customers’ questions faster or even anticipate their questions by viewing their payment details—like subscription plan, recent payments, and account balance—right alongside conversations in the Inbox and Get a clear picture of your customer base—and send them the right messages at the right times—by filtering, segmenting, and messaging customers based on their account balance, subscription plan, and more.

When looking at your own business, consider your customers and what’s important to them. For example:

- Small to medium-sized businesses care about quickly and easily signing up and getting started; speed of payouts; the ability to integrate with their logistical back-end (such as shipping, accounting, and tax software); and transparent, transaction-based pricing with no fixed or monthly fees. For in-person payments specifically, they want a fast, reliable in-store experience with a simple setup process. In addition, smaller companies may not be as familiar with the payments landscape nor understand which features could make the biggest impact to their business. Help fill this gap by focusing on educational content and messaging around payments, including details about how your solution handles security, compliance, and regulations (and why these things matter).

- Enterprise businesses value the details behind payment processing like network acceptance rates, fraud rates, and uptime. They also care about delivering exceptional in-store experiences that reflect their brand, with the ability to offer seamless omnichannel shopping—like allowing customers to buy something online and pick it up in the store. Larger customers will likely be switching payment providers, and your key messages need to compel them to make the change and adopt your solution. To help them make the switch, provide proof points that they’re making a safe and technology-forward choice.

- Retailers or sellers care about access to diverse payment methods (including in-person payments, digital wallets, and local payment methods) and fraud tools to protect them from chargebacks.

- Service providers care about speed of cash flow, a seamless quote-to-cash cycle, and in-person payments. These business owners are more likely to know their end customers, so fraud is less of an issue compared to other businesses.

Messaging will also vary depending on where your customers are in the buying journey. For example, are they switching from an existing provider or adopting an online payment solution for the first time? Were they using checks, a competitor payment service, or something else? Understanding this behavior will help you hone your messaging.

Once you have defined your messaging, make sure to highlight it across all marketing campaigns. For example, one of Shopmonkey’s key value props is its integrated online and in-person payments solution, which helps customers reconcile their books faster. They feature this messaging across all their marketing assets, like on their homepage or in dedicated email campaigns that showcase specific payment features that can improve their customers’ workflows.

2. Create a brand identity

Consider creating a brand identity for your payments offering, and incorporate your payment provider’s brand to establish your solution as trusted and credible. Your payment provider’s brand can help convey that your platform is secure, global, compliant, and built on the latest technology. For example, Intercom features the Stripe logo alongside its own logo on online payments–related marketing materials.

You could also incorporate your payment provider’s brand directly into your naming strategy. If a platform called Rocket Ride built its payments product with Stripe, it could brand its payment solution as “Stripe Payments from Rocket Ride” or “Rocket Ride Payments powered by Stripe.”

3. Consider a staged rollout to gather insights

If you’re not sure how customers will react to your messaging, brand identity, or payments experience, start by introducing only a small number of customers to your payments solution to gather learnings before rolling it out to everyone.

Woo took this approach when it first launched its online payments feature WooPayments, initially introducing it as an invitational beta. The controlled participation allowed the team to observe customer and store behavior, work through new scenarios, and conduct pointed outreach when appropriate. The insights from the invitational beta allowed them to confidently launch to broader audiences three months later and with a few strong customer showcases that highlighted the product’s positive impact on Woo merchants’ businesses.

When they did launch, they developed a marketing strategy to feature WooPayments across the website. The team anchored the WooPayments landing page in the main site navigation and invested in search ads, resulting in a 10x boost in traffic to the payments page overnight. And in the first month post-launch, marketing banners and hero placements on the Woo Marketplace drove almost a third of payments page traffic.

4. Integrate payments into the customer experience

To streamline the user experience, your payments solution should be the default for any customer who signs up for an ecommerce or payments software package. Customers shouldn’t have to complete extra steps or hunt down this option on their own—make it as easy as possible for them to learn about and adopt your solution. This applies to your whole customer experience: promote your payment solution anywhere your users are, from the payments page to the dashboard to feature pages.

For Xero, in-app messaging in the dashboard has performed especially well. In February 2016, the team launched its first in-app communication to help boost awareness and drive engagement of its online Stripe payments service. They saw a 1,000% increase in the number of Stripe connections that month compared to the average of the previous six months. They continue to optimize their in-app communication to ensure they reach the right customers at the right time with the right message.

An example of an in-app notification from Xero.

5. Experiment with owned and paid channels

Take advantage of the marketing channels at your disposal to reach your target customers. Owned channels, like your emails, blog, social media accounts, website, and dashboard, are free and easy to experiment with. Other channels are more costly, like paid retargeting, paid search, or display ads, requiring a dedicated budget to pursue. Test different approaches to see what works best for your audience.

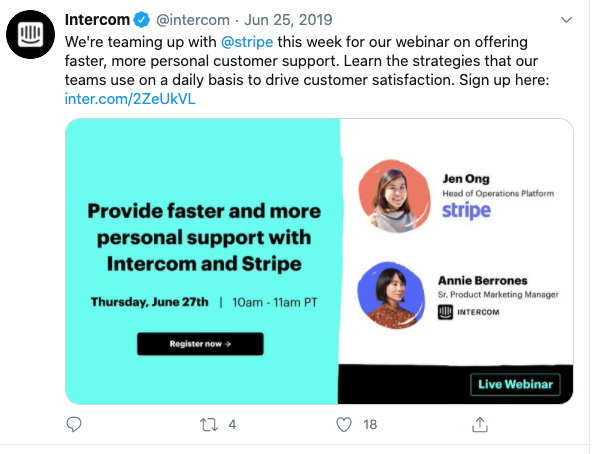

Intercom leverages a variety of marketing channels to consistently reiterate the value of its Stripe payments offering. They have run dedicated webinars and highlighted the payments app in blog posts and on Twitter. When running these digital campaigns, Intercom always tries to work with partners to develop a strong joint narrative. By focusing on a combined value proposition for their mutual customers, they’re able to tell a more compelling story and reach a larger audience with the same amount of work.

Selling your payments solution

Lean on your sales team to source new business and close deals that include your payments solution. This is more than just incorporating your payment features in the sales narrative—you also want to ensure that the sales team is well trained on the functionality, has the right sales materials, and understands how payments-related goals connect to team priorities and incentives. If you don’t have a sales team, or are leaning more heavily on self-serve customer acquisition, consider investing in marketing automation to nurture your prospects with a series of emails that educate them on your solution and drive them to sign up on your site.

Here are four best practices for selling your payments solution:

1. Sell to the right prospects

To best communicate the value of payments to potential customers, you need to put your payments offering in the right context. For example, articulating how you can solve additional user pain points will make it easier for your customers to view payments as a built-in feature.

Don Hartley, the senior director of payments at Squire, recommends refinining your sales message.

“Most platforms that offer in-person transactions will sell to anyone and everyone, but that is a mistake. Instead, you need to focus on where you can offer the most value and be the best possible partner. That usually means going after a specific type of customer,” said Don.

Squire followed this same strategy with its business model. It offers an all-in-one SaaS platform for barbershops, allowing them to manage appointments; integrate in-person payments with booking software, registers, and card readers; and pay out barbers. The sales team has a very defined set of customers to target, and based on past success, Squire feels confident they can add value and make an impact for the barbershops they serve.

2. Offer robust training sessions

Make sure that the sales team is trained on your payments solution. Are they familiar with the basic features? Do they know what the benefits are and how to sell it to users? They’ll also need to be prepared to answer common questions and handle any objections.

Intercom ensures that its sales team understands the Stripe online payments experience by creating images, GIFs, and videos showing how Stripe works within the context of its customers’ existing workflows. They also conduct training sessions so sales reps can ask questions and gain a deeper understanding of Stripe’s capabilities and the value it provides to customers.

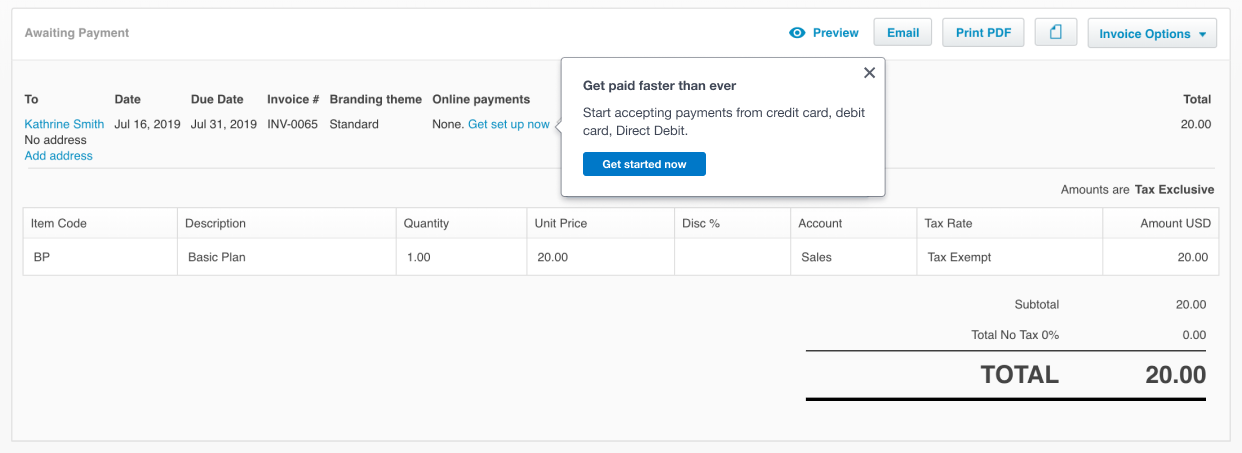

An image showing how Stripe integrates with Intercom’s business messenger.

3. Create the right sales collateral

Not only does your sales team need to know how to talk about your payment solution, they also need sales collateral to complement their presentations or to send as follow-up to customers.

For example, Xero arms its sales and customer experience teams with product playbooks, regional pitch decks, partner flyers, demo videos, and FAQs to ensure they have the right resources to position their online payments products to their customers.

An example of payments-related sales collateral from Xero.

Depending on your business and target audience, consider creating different versions of collateral based on customer personas (like a technical audience, a finance audience, etc.) so your message can be very targeted and specific.

You can also check with your payment provider to see if it offers ready-to-use sales collateral that you can add your brand to and distribute.

4. Add payments-related sales goals and incentives

Incorporate your payments offering into your team’s goals and incentive structure. Consider adding additional performance bonuses for selling payments if you can identify the incremental value of a payments user. In other words, how much additional revenue does a payments user bring to your business, and can that accommodate an increase in budget to spend on bonuses? When calculating the value of a payments user, don’t forget to consider the associated retention benefits, as payments is often a “sticky” feature that can motivate customers to stay with your platform longer.

Growing your payments solution

As more and more customers adopt your payments offering, make sure you have the right infrastructure to support their customer service inquiries, track metrics, and define success.

1. User experience and incentives

SaaS platforms that offer in-person payments have to juggle additional steps in the onboarding process: getting the right hardware in customers’ hands and educating them on how to use it. While this can pose some logistical challenges, it also offers an opportunity to create a superior onboarding experience.

Lightspeed Commerce Inc. is a one-stop commerce platform with a fully integrated point of sale (POS) and payment processing solution, Lightspeed Payments. Their goal is to make it as easy as possible for retailers and restaurateurs to get up and running. As a result, Lightspeed has optimized their onboarding process by:

- Offering special promotions like lower software fees or free hardware to incentivize customers to use Lightspeed Payments.

- Carrying all the hardware that customers may need and shipping it directly to them.

- Investing in in-house subject matter expertise (like a dedicated support team for Lightspeed Payments) to onboard payments customers as quickly as possible.

- Building out a robust content strategy to educate prospective and current customers about in-person payment processing, different options, and how Lightspeed can help.

Lightspeed Payments’ investment in in-person payments education has been particularly impactful. Lightspeed’s continuous education on payments as well as their promotion within Lightspeed’s customers has paid off: In their 2021 fiscal year, Lightspeed’s transaction-based revenue increased by 195%.

2. Service and support

All customers, especially new users, will likely have questions about how to navigate the payments dashboard, respond to chargebacks, and more. Your payment provider should be able to help by offering ready-made answers to common questions and sharing tutorials and demos. In some cases, your payment provider may offer customer support to your users. If so, ensure they offer 24x7 global phone, email, and chat support to be fully effective.

Like the sales team, your support team should also have access to detailed training and resources to learn about your payments solution and be able to respond to these questions.

Woo invested in three primary initiatives to help its Happiness Engineers (the customer support team) learn about WooPayments:

- Held a series of live video sessions with the team across time zones. This allowed support team members to see a product demo, ask questions, and hear how to communicate the product benefits.

- Set up “shared stores” with WooPayments already enabled for support team members to simulate customer issues and test solutions while working with customers.

- Created a robust, searchable library of documentation ahead of the launch, both for the support team’s own use and also as a ready, sharable set of resources to aid in customer interactions.

3. Success metrics

To help inform ongoing growth plans, look at key metrics to understand what has worked well and identify areas of improvement. Some metrics that our partners commonly track include:

- Payments volume

- Payments users

- Monthly active users

- Payments volume per active user

- New payments sign-ups

- Retention

- Revenue from payments

- Long-term value of your payments customers vs. your non-payments (software only) customers

- Percentage of total customers that are payments customers

How Stripe can help

Platforms of all sizes—from new startups to public companies like Shopify—use Stripe Connect to accept money, pay out to third parties, and monetize payments.

Stripe Connect can help you create your own payments service and grow your platform’s revenue, and we have the tools to help make your service more successful.

Create your own payments offering with Stripe Connect

Stripe offers an all-in-one solution for online payments, point-of-sale payments, platform money movement, and fast payouts. With Stripe Connect, you can quickly launch a payments service, collect a portion of each transaction, and customize payments pricing for your customers.

You can also monetize a variety of products, such as invoicing, subscription billing, or in-person payments—all from one unified integration. Offering these services allows you to make your platform more compelling for your customers and process more total volume on your platform, which will increase your revenue.

Stripe can also help you manage your payments offering. We can provide 24x7 customer support to your customers, including phone, email, and chat support. In addition, Stripe can help you manage the financial and credit risk of your customers by covering any losses accrued by your accounts. Both these features are available if you use Stripe with Standard accounts.

Make your payments service more successful by joining the Stripe Partner Program

Our partners build technology and software to bring more businesses online, enable new types of businesses, and help them work more effectively. We’ve designed the Stripe Partner Ecosystem to help accelerate and amplify your impact.

The Stripe Partner Ecosystem includes a marketing toolkit that contains resources to help with your marketing and sales efforts. You’ll get access to:

- Pre-launch resources to help prepare your marketing, sales, and support teams with an educational payments guide, a Stripe pitch deck and training video, co-branded one-pagers, and customer FAQ templates.

- Launch resources to announce your Stripe integration and set you up for growth. These resources include messaging documents; a media kit with a blog template, social card, and PR announcement; a co-branded “About Stripe” webpage to explain Stripe to your customers; a listing in Stripe’s partner directory for referral traffic; and a Stripe Verified Partner Badge.

- To help you create always-on marketing campaigns, you’ll have access to 28 short videos that cover the most popular Stripe features and setup questions, including configuring the Stripe Dashboard, managing payouts, navigating financial reports, and an introduction to fraud and disputes prevention. A co-branded referral form enables you to send your high-volume leads to Stripe for pricing reviews, and a support escalation form allows you to highlight time-sensitive questions directly to the Stripe team.

To help you get the most out of the marketing toolkit, Stripe also includes a brand guide with examples of how to use these resources and where to find brand assets and product images.

We hope this guide gave you a high-level overview of how to market and sell your payments offering and how Stripe can help.

For more information on the Stripe partner program and how to join, click here. If you want to start enabling your customers to accept payments, sign up for an account.