Om du någonsin har fått din lön utbetalad genom direktinsättning eller betalat en elräkning direkt från ditt bankkonto med ditt konto- och clearingnummer, är du redan bekant med ACH-betalningar som privatperson. Men hur är det att ta emot ACH-betalningar som företag?

ACH är ett billigt, pålitligt och säkert sätt att behandla betalningar. Det gör det möjligt för kunder att köpa dyra varor utan att oroa sig för utgiftsgränser för kreditkort. Och för specifika typer av transaktioner och återkommande betalningar är ACH-överföringar ett enkelt sätt för företag att minska tiden och pengarna som spenderas på att behandla transaktioner.

Den här artikeln förklarar vad du behöver veta om ACH-betalningar – från hur ACH-överföringar fungerar till fördelarna med att acceptera ACH som betalningsmetod för ditt företag.

Vad innehåller den här artikeln?

- Vad står ACH för?

- Vad är ACH-betalningar?

- Hur lång tid tar ACH-överföringar?

- Vem använder ACH-betalningar?

- Vilka typer av ACH-transaktioner finns det?

- ACH-direktinsättning

- ACH-direktbetalning

- ACH-direktinsättning

- Hur ACH-betalningar fungerar

- Hur man gör en ACH-betalning

- Hur man tar emot ACH-betalningar som företag

- Vad kostar det att ta emot ACH-betalningar som företag?

- Hur skiljer sig ACH-betalningar från banköverföringar?

- Är ACH-överföring samma sak som EFT?

- Fördelar med ACH-betalningar för företag

Vad står ACH för?

ACH står för Automated Clearing House. Automated Clearing House är ett centraliserat amerikanskt finansiellt nätverk för banker och kreditföreningar för att skicka och ta emot elektroniska betalningar och penningöverföringar.

Vad är ACH-betalningar?

ACH-betalningar är överföringar av medel mellan konton hos olika finansinstitut med hjälp av ACH-nätverket.

ACH-nätverket administreras av National Automated Clearing House Association (Nacha), en oberoende organisation som ägs av en stor grupp banker, kreditföreningar och betalleverantörer. Nachas finansinstitut erbjuder ett sätt att överföra pengar direkt mellan konton hos olika banker, utan att använda papperscheckar, banköverföringar, kreditkort eller kontanter.

Hur lång tid tar ACH-överföringar?

Medan ACH-överföringar brukade ta i genomsnitt tre till fem arbetsdagar att nå sin destination, erbjuder ACH-nätverket för närvarande valet att behandla ACH-betalningar som antingen "samma dag", "nästa dag" eller "två dagar".

De flesta tror att ACH-överföringar är långsammare än andra elektroniska betalningsmetoder, men det är inte så längre. Den 19 mars 2021 ändrades Nachas verksamhetsregler till utökad åtkomst till ACH-transaktioner inom en dag, vilket möjliggör avräkning samma dag av de flesta ACH-transaktioner.

För direkta insättningar initierar de flesta arbetsgivare betalningar några dagar före lönedagen så att medlen är tillgängliga på mottagarnas konton senast kl. 9.00 den dagen.

Vem använder ACH-betalningar?

Under 2020 hanterade ACH-nätverket 26,8 miljarder betalningar. ACH-betalningar kan användas för en mängd olika transaktioner. Typer av ACH-betalningar inkluderar:

- Konsumenternas räkningar

- Skatteåterbäring

- Skattebetalningar

- Avgifter till pensions- och investeringskonton

- Kommersiella inköp

- Gåvor till välgörenhet

- Avgifter för högskoleundervisning

- Pengar som skickas mellan familj och vänner

Vilka typer av ACH-transaktioner finns det?

Det finns två kategorier av ACH-överföringar: direktinsättning och direktbetalning. Här är en översikt över skillnaderna mellan dem:

Direktinsättning med ACH

En direktinsättning är alla typer av överföringar från en statlig enhet eller ett företag till en konsument. Typer av direkta insättningar inkluderar:

- Anställdas löner

- Ersättningar från arbetsgivaren för kostnader i anslutning till arbetet

- Statliga förmåner

- Skatteåterbäring

- Livränta och räntebetalningar

Om du är bland de 93 % av amerikanerna som får sin lön genom direktinsättning, finns det en god chans att det skickas som en ACH-överföring. Om din lön delas automatiskt och sätts in på två eller flera konton när du får betalt, kallas det "delad insättning". Delade insättningar sker också via ACH-nätverket.

Direktbetalning via ACH

Direktbetalning är en annan typ av elektronisk överföring av pengar via ACH-nätverket. Till skillnad från direktinsättningar, som kommer in på ditt konto, är direktbetalningar ACH-överföringar som du skickar ut från ditt konto, till exempel fakturabetalningar.

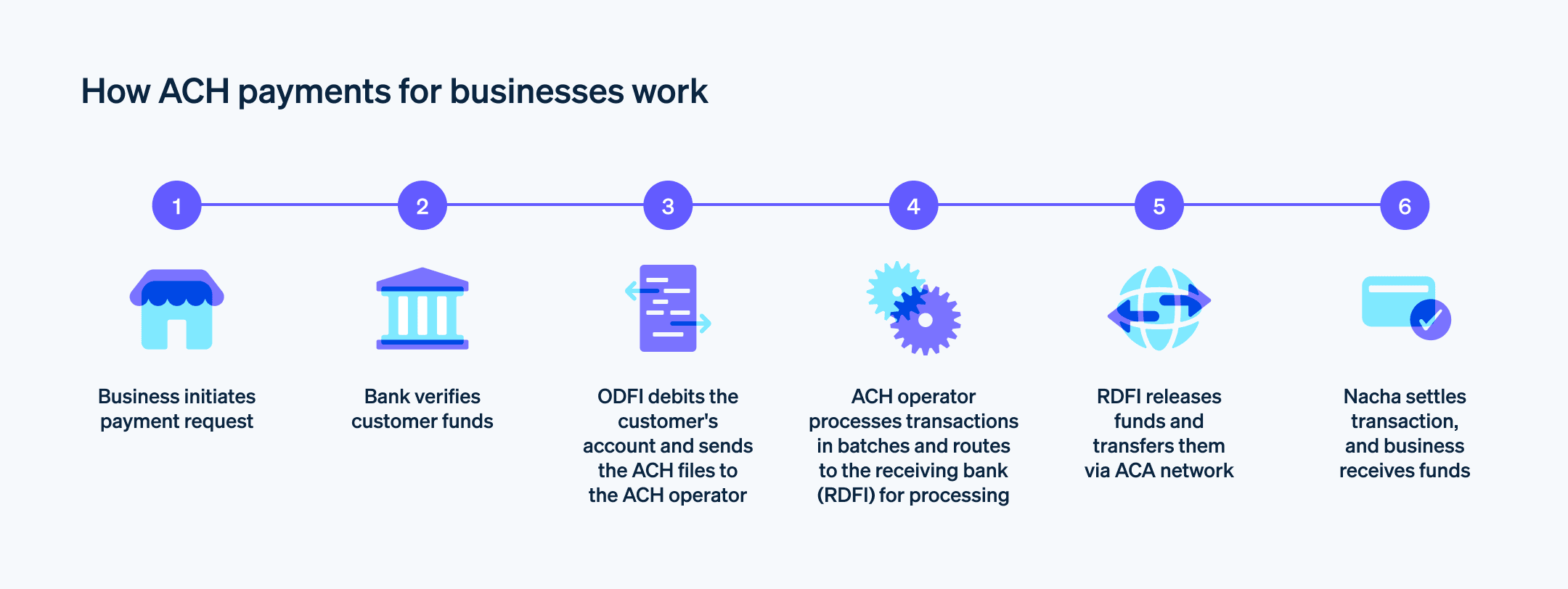

Så fungerar ACH-betalningar

Följande institutioner möjliggör ACH-betalningar:

National Automated Clearing House Association

Nacha är en statligt driven, opartisk organisation som ansvarar för driften av ACH-nätverket.Originating Depository Financial Institution (ODFI)

ODFI är det bankinstitut som utfärdar överföringsbegäran för ACH.Receiving Depository Financial Institution (RDFI)

RDFI är det bankinstitut som tar emot ACH-begäran.

ODFI skickar en begäran till RDFI om överföring av medel. De två bankinstituten stämmer av med varandra för att se till att det finns tillräckligt med pengar på det utgående kontot, och om det finns det går överföringen vidare.

I det här skedet sammanställer ODFI en fil med all viktig information om begäran om överföring, inklusive:

- Transaktionstyp (kredit eller debet)

- Clearingnummer

- Kontonummer

- Belopp som ska överföras

ODFI samlar alla ACH-överföringsförfrågningar inom en viss tidsperiod i en batch och skickar batchen med filer till en ACH Operator, som sedan skickar filerna till RDFI. Banken från vilken medlen tas ut släpper sedan pengarna, som reser via ACH-nätverket för att deponeras på destinationskontot.

RDFI, trots att det har ”receiving” (mottagande) i sitt namn, är inte alltid den bank som tar emot ACH-betalningsmedlen – den får en begäran om att initiera överföring av medel via ACH-nätverket. ODFI, den institution där begäran om medel har sitt ursprung, tar ofta emot pengarna i slutändan. Tänk på ”ursprunglig” (mottagande) och ”receiving” (mottagande) med hänvisning till ACH-begäran, inte medlen själva.

Nacha buntar ihop alla överföringar som går genom ACH-nätverket inom en given tidsperiod – vanligtvis sex timmar eller så under arbetsdagar – och avräknar varje bunt med flera intervall under dagen.

Hur man gör en ACH-betalning

ACH-betalningar kan initieras via de flesta finansinstituts medlemsportaler online eller via telefon. Den enda information du vanligtvis behöver är beloppet som skickas och mottagarens clearing- och kontonummer.

Så tar du emot ACH-betalningar som företag

Stegen för att ta emot ACH-betalningar för ditt företag är:

- Skaffa ett bankkonto för ditt företag, om du inte redan har ett. Om du har ett handelskonto hos en betalleverantör kan du förmodligen ta emot betalningar via dem också.

- Uppdatera ditt betalningsflöde att tillåta ACH-betalningar, eftersom de vanligtvis inte ingår i standardutbudet av onlinebetalningsalternativ. Din handelstjänsteleverantör kan vägleda dig om det bästa sättet för att göra detta.

- Ge dina kunder ett medgivande, vilket är ett dokument där man erhåller deras samtycke till att ditt företag initierar en ACH-begäran från deras bank.

- Samla in kundkontouppgifter och initiera ACH-begäran. Även om kunder kan initiera ACH-betalningar, kommer företaget oftast att göra detta.

Stripe-kunder kan initiera ACH-direktbetalningar som betalningsmetod. En kund tillhandahåller sin bankkontoinformation och företaget kan dra medel direkt från kontot, antingen för ett engångsköp eller en återkommande betalning. För företag som använder Stripe kan dessa ACH-debiteringar hanteras i Dashboard.

Vissa betalleverantörer, som Stripe, erbjuder ytterligare tjänster relaterade till ACH-betalningar, till exempel möjligheten att använda mikroinsättningar. Mikroinsättningar är mycket små summor pengar (vanligtvis några cent) som skickas till ett bankkonto och sedan dras tillbaka med hjälp av ACH-nätverket för att verifiera kontoinformationen innan några riktiga transaktioner görs.

Vad kostar det att ta emot ACH-betalningar som företag?

Kostnaden för att använda ACH-betalningar varierar beroende på vilken leverantör du använder för att behandla betalningarna. ACH Payments hos Stripe kostar 0,80 %, med ett tak på 5,00 USD, utan månadsavgifter. Så en betalning på 100,00 USD skulle medföra en avgift på 0,80 USD. Alla betalningar över 625,00 USD skulle kosta 5,00 USD. Den här prismodellen är särskilt användbar om du rutinmässigt debiterar kunder stora belopp på återkommande basis.

Om du använder Stripes tjänster för kontovalidering, t.ex. Financial Connections, kan ytterligare avgifter tillkomma. Se Stripes sida medpriser för mer information.

Hur skiljer sig ACH-betalningar från banköverföringar?

Medan både ACH-betalningar och banköverföringar innebär att medel flyttas mellan konton hos olika finansinstitut, har de fyra viktiga skillnader:

|

ACH-överföringar

|

Banköverföringar

|

|

|---|---|---|

|

Nätverk

|

National Automated Clearing House Association (Nacha) | Fedwire Funds Service |

|

Tid

|

1–4 dagar | Ett par timmar upp till 2 dagar |

|

Geografi

|

USA och Puerto Rico | Internationella |

|

Kostnad

|

Vanligen gratis, annars ett par dollar |

Inhemska: upp till 35 USD

Internationella: 35–50 USD |

Nätverk

ACH-betalningar använder Nacha-nätverket för att resa från det utfärdande kontot till det mottagande kontot. Banköverföringar använder tjänsten Fedwire Funds.

Hastighet

Historiskt sett var banköverföringar vanligtvis snabbare än ACH-överföringar, men så är det inte längre på grund av ändringar i Nachas regler. Överföringstiderna skiljer sig åt på grund av hur ACH- respektive Fedwire-nätverken avräknar överföringar.

ACH-nätverket behandlar betalningar praktiskt taget dygnet runt – 23 1/4 timmar varje arbetsdag, för att vara exakt. Betalningar som skickas via ACH-nätverket avräknas, vilket innebär att de flyttas till destinationskontot, fyra gånger om dagen. Betalningar kan skickas så sent som kl. 02:15 ET för avräkning kl. 08:30 ET. Det finns ytterligare tre bearbetningsscheman för ACH under dagen.

Betalningar avräknas på arbetsdagar när Federal Reserves avräkningstjänst är öppen. För närvarande stänger Federal Reserves avräkningssystem varje arbetsdag kl. 18.30 ET, och efter fredag öppnar det igen på måndag kl. 7.30 ET (eller tisdag om måndag är en federal helgdag).

Geografi

ACH-överföringar är endast tillgängliga inom USA, men banköverföringar kan skickas internationellt.

Kostnad

ACH-överföringar kostar vanligtvis mindre än banköverföringar.

Är ACH-överföring samma sak som EFT?

EFT står för "elektronisk överföring av pengar" (electronic funds transfer). Det är ett paraplybegrepp som omfattar både ACH och banköverföringar. Du kan kalla en ACH-överföring en EFT, men inte alla EFT är ACH-överföringar. Banköverföringar är ett exempel. ACH-betalningar använder specifikt Automated Clearing House-nätverket, vilket inte är fallet för andra typer av EFT:er.

Fördelar med ACH-betalningar för företag

ACH-betalningar är inte en logisk eller bekväm betalningsmetod för mycket snabba transaktioner, som att köpa en kopp kaffe eller betala för en måltid på en restaurang, eftersom det tar tid att skicka och ta emot ACH-överföringar och godkänna betalning. Snabbare betalningsmetoder som kortbetalningar och digitala plånböcker gör att företag kan godkänna inköp på några sekunder, vilket är att föredra för de flesta dagliga transaktioner.

ACH-överföringar används oftast i situationer där kunder tidigare kunde ha betalat med en papperscheck. Här är några fördelar med ACH-betalningar:

Kostnads- och tidsbesparingar

ACH-betalningar har flera fördelar jämfört med papperscheckar och kreditkort. De överförs elektroniskt, vilket innebär att de är snabbare än papperscheckar och mindre benägna att försvinna under transporten. Kreditkortsbetalningar och banköverföringar tenderar båda att vara dyrare än ACH-betalningar. För företag kan detta leda till betydande besparingar över tid.

Säkerhet

Nacha har strikta säkerhetsbestämmelser för alla institutioner eller organisationer som är involverade i ACH-transaktioner. Detta inkluderar banker, företag och tredjepartsleverantörer som arbetar med ACH-betalningar. Bland Nachas regler finns ett krav på att all känslig information (t.ex. bankkontonummer) måste krypteras. Som ett resultat tenderar ACH-betalningar att vara ganska säkra mot bedrägerier.

Enkel bokföring

Att betala för företagskostnader via ACH-överföring kan effektivisera din affärsbokföring. Du måste stämma av betalningar från alla källor – bankkonton, kreditkort o.s.v. – och avstämningen blir enklare om du konsoliderar betalningar som ska initieras från företagets primära bankkonto. Och eftersom ACH-betalningar går direkt från ett bankkonto till ett annat, och de flesta banker ger dig möjlighet att ställa in återkommande betalningar, är den här betalningsmetoden ett enkelt val för att automatisera många återkommande företagsutgifter.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.