If you’ve ever received a paycheck through direct deposit or paid a utility bill directly from your bank account using your account and routing numbers, you’re already familiar with ACH payments as an individual. But what about accepting ACH payments as a business?

ACH is an inexpensive, reliable, and secure way to process payments. It allows customers to purchase high-priced items without worrying about credit card spending limits. And for specific types of transactions and recurring payments, ACH transfers are an easy way for businesses to reduce the time and money spent on processing transactions.

This article will explain what you need to know about ACH payments—from how ACH transfers work to the benefits of accepting ACH as a payment method for your business.

What’s in this article?

- What does ACH stand for?

- What are ACH payments?

- How long do ACH transfers take?

- Who uses ACH payments?

- What types of ACH transactions are there?

- ACH Direct Deposit

- ACH Direct Payment

- ACH Direct Deposit

- How ACH payments work

- How to make an ACH payment

- How to accept ACH payments as a business

- What does it cost to accept ACH payments as a business?

- How are ACH payments different from wire transfers?

- Is an ACH transfer the same thing as an EFT?

- Benefits of ACH payments for businesses

What does ACH stand for?

ACH stands for Automated Clearing House. The Automated Clearing House is a centralized US financial network for banks and credit unions to send and receive electronic payments and money transfers.

What are ACH payments?

ACH payments are transfers of funds between accounts at different financial institutions, using the ACH network.

The ACH network is administered by the National Automated Clearing House Association (Nacha), an independent organization owned by a large group of banks, credit unions, and payment processing companies. Nacha financial institutions provide a way to directly transfer money between accounts at different banks, without the use of paper checks, wire transfers, credit cards, or cash.

How long do ACH transfers take?

While ACH transfers used to take an average of three to five business days to reach their destination, the ACH network currently offers the choice to process ACH credits as either “same-day,” “next-day,” or “two-day” payments.

Most people think that ACH transfers are slower than other electronic payment methods, but that’s less true than it used to be. On March 19, 2021, changes to Nacha’s operating rules expanded access to same-day ACH transactions, allowing for same-day settlement of most ACH transactions.

For direct deposits, most employers initiate payments a few days before payday so the funds are available in recipients’ accounts by 9:00 a.m. that day.

Who uses ACH payments?

In 2020, the ACH network processed 26.8 billion payments. ACH payments can be used for a wide range of transactions. Types of ACH payments include:

- Consumer bills

- Tax refunds

- Tax payments

- Retirement and investment account contributions

- Commercial purchases

- Charity donations

- College-tuition payments

- Funds sent between family and friends

What types of ACH transactions are there?

There are two categories of ACH transfers: direct deposit and direct payment. Here is an overview of the differences between them:

ACH Direct Deposit

A direct deposit is any kind of transfer from a government entity or business to a consumer. Types of direct deposits include:

- Employee payroll

- Reimbursements from an employer for work-related expenses

- Government benefits

- Tax refunds

- Annuity and interest payments

If you’re among the 93% of Americans who receive their paychecks through direct deposit, there’s a good chance it’s being sent as an ACH transfer. If your paycheck is automatically split and deposited into two or more accounts when you get paid, that’s called “split deposit.” Split deposits also happen via the ACH network.

ACH Direct Payment

Direct payment is another type of electronic funds transfer through the ACH network. Unlike direct deposits, which come into your account, direct payments are ACH transfers you send out of your account, such as bill payments.

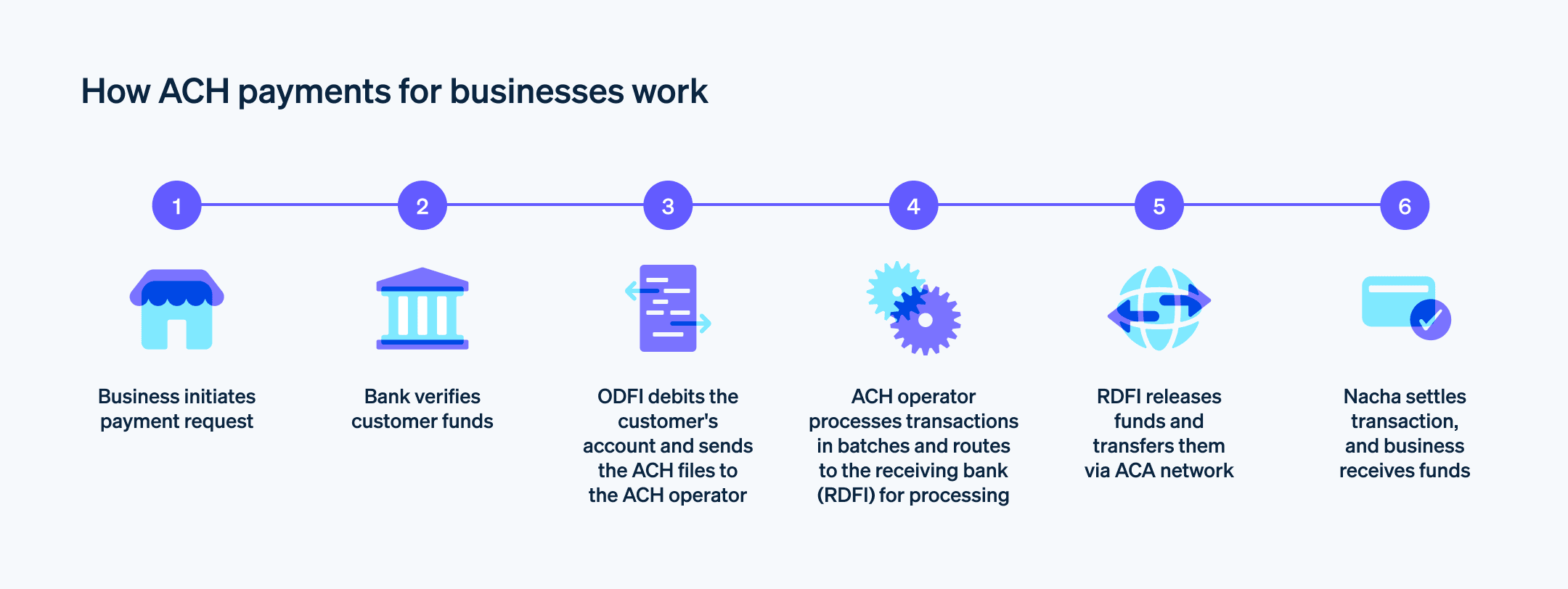

How ACH payments work

The following institutions are involved in making ACH payments happen:

National Automated Clearing House Association

Nacha is a government-run, nonpartisan organization responsible for operating the ACH network.Originating Depository Financial Institution (ODFI)

The ODFI is the banking institution that issues the ACH transfer request.Receiving Depository Financial Institution (RDFI)

The RDFI is the banking institution that receives the ACH request.

The ODFI sends a request to the RDFI to transfer funds. The two banking institutions check in with each other to make sure there are enough funds in the outgoing account, and if there are, the transfer goes forward.

At this point, the ODFI puts together a file with all the key information about the transfer request, including:

- Transaction type (credit or debit)

- Routing numbers

- Account numbers

- Amount to be transferred

The ODFI gathers all ACH transfer requests within a given period of time into a batch and sends the batch of files to an ACH operator, which then sends the files to the RDFI. The bank from which the funds are being withdrawn then releases the funds, which travel via the ACH network to be deposited into the destination account.

The RDFI, despite having “receiving” in its name, is not always the bank that receives the ACH payment funds—it receives a request to initiate funds transfer via the ACH network. The ODFI, the institution where the request for funds originates, often receives the money in the end. Think of “originating” and “receiving” in reference to the ACH request, not the funds themselves.

Nacha bundles all of the transfers going through the ACH network within a given window of time—usually six hours or so during business days—and settles each bundle at multiple intervals throughout the day.

How to make an ACH payment

ACH payments can be initiated through most financial institutions’ online member portals or over the phone. The only information you usually need is the amount being sent and the recipient’s routing and account numbers.

How to accept ACH payments as a business

The steps to accept ACH payments for your business are:

- Get a bank account for your business, if you don’t already have one. If you have a merchant account with a payment processing provider, you can probably accept payments through them, too.

- Update your payment flow to allow for ACH payments, since they are not typically part of the standard range of online payment options. Your merchant service provider can direct you on the best way to do this.

- Present your customers with a mandate, which is a document obtaining their consent for your business to initiate an ACH request from their bank.

- Collect customer account details and initiate the ACH request. Although customers can initiate ACH payments, most often the business will do this.

Stripe customers can initiate ACH Direct Debits as a payment method. A customer provides their bank account information, and the business is able to pull funds directly from their account, either for a one-time purchase or a recurring payment. For businesses using Stripe, these ACH debits can be managed in the Dashboard.

Some payment processing providers, like Stripe, offer additional services related to ACH payments, such as the option to use microdeposits. Microdeposits are very small amounts of money (usually a few cents) that are sent to a bank account and then pulled back using the ACH network, to verify the account details before any real transactions are attempted.

What does it cost to accept ACH payments as a business?

The cost to use ACH payments varies depending on the provider you use to process payments. ACH payments on Stripe cost 0.80%, capped at $5.00, with no monthly fees. So a $100.00 payment would incur an $0.80 fee; any payments above $625.00 would cost $5.00. This pricing model is especially useful if you routinely charge customers large amounts on a recurring basis.

If you use Stripe’s account validation services, such as Financial Connections, additional fees may apply. See Stripe’s Pricing page for more details.

How are ACH payments different from wire transfers?

While both ACH payments and wire transfers involve moving funds between accounts at different financial institutions, they have four key distinctions:

|

ACH transfers

|

Wire transfers

|

|

|---|---|---|

|

Network

|

National Automated Clearing House Association (Nacha) | Fedwire Funds Service |

|

Speed

|

1-4 days | A few hours up to 2 days |

|

Geography

|

The US and Puerto Rico | International |

|

Cost

|

Usually free, otherwise a few dollars |

Domestic: up to $35

International: $35-50 |

Network

ACH payments use the Nacha network to travel from the issuing account to the receiving account. Wire transfers use the Fedwire Funds Service.

Speed

Historically, wire transfers were usually faster than ACH transfers, but that’s not the case anymore due to changes to Nacha’s rules. Transfer times differ due to how the ACH and Fedwire networks respectively settle out transfers.

The ACH network processes payments virtually around the clock—23 ¼ hours every business day, to be exact. Payments sent through the ACH network are settled—meaning moved to their destination account—four times a day. Payments can be sent as late as 2:15 a.m. ET for settlement at 8:30 a.m. ET. Three additional Same-Day ACH processing schedules exist throughout the day.

Payments are settled on business days when the Federal Reserve’s settlement service is open. Currently, the Federal Reserve’s settlement system closes every business day at 6:30 p.m. ET, and after Friday, it reopens on Monday at 7:30 a.m. ET (or Tuesday if Monday is a federal holiday).

Geography

ACH transfers are available within the US only, but wire transfers can be sent internationally.

Cost

ACH transfers typically cost less than wire transfers.

Is an ACH transfer the same thing as an EFT?

EFT stands for “electronic funds transfer.” It’s an umbrella term that encompasses both ACH and wire transfers. You could call an ACH transfer an EFT, but not all EFTs are ACH transfers. Wire transfers are an example. ACH payments specifically use the Automated Clearing House network, which is not true of other types of EFTs.

Benefits of ACH payments for businesses

ACH payments are not a logical or convenient payment method for very quick transactions, such as buying a cup of coffee or paying for a meal at a restaurant, because it takes time to send and receive ACH transfers and authorize payment. Faster payment methods like card payments and digital wallets allow businesses to authorize purchases in seconds, which is preferable for most day-to-day transactions.

ACH transfers are most often used in situations where, in the past, customers might have paid with a paper check. Here are a few benefits of ACH payments:

Cost and time savings

ACH payments have several advantages over paper checks and credit cards. They’re electronically transmitted, which means they’re faster than paper checks and less likely to get lost in transit. Credit card payments and wire transfers both tend to be more costly than ACH payments. For businesses, this can add up to significant savings over time.

Security

Nacha has strict security regulations for any institution or organization involved with ACH transactions. This includes banks, businesses, and third-party processors who work with ACH payments. Among Nacha’s rules is a requirement that all sensitive information (e.g., bank account numbers) needs to be encrypted. As a result, ACH payments tend to be quite secure against fraud.

Easy bookkeeping

Paying for business expenses via ACH transfer can streamline your business bookkeeping. You’ll have to reconcile payments issued from every source—bank accounts, credit cards, etc.—and reconciliation will be easier if you consolidate payments to initiate from your primary business bank account. And because ACH payments go directly from one bank account to another, and most banks give you the ability to set up recurring payments, this payment method is an easy choice for automating many recurring business expenses.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.