Value-added tax (VAT) groups provide a beneficial solution for companies with strong financial, economic, or organizational connections. Effective January 1, 2023, VAT grouping simplifies tax obligations. A single representative manages all VAT-related processes with the tax authorities. This article covers all the details of this arrangement.

What’s in this article?

- VAT groups explained

- How to create a VAT group

- Members of a VAT group

- Duration of a VAT group

- VAT group advantages

- VAT group disadvantages

- How to dissolve a VAT group

VAT groups explained

A VAT group consists of legally separate but closely connected companies that choose to operate under a single VAT structure. While the fundamental principle for forming one remains the same, the specific requirements and eligibility conditions might differ from one jurisdiction to another.

This status enhances reporting procedures but is limited to businesses subject to VAT and permanently established in France. Generally, three main definitions exist of what constitutes a link between companies.

Financial connections

A financial control relationship exists when one company directly or indirectly holds more than 50% of another’s voting rights or capital. Members of the VAT group can exercise this control through various methods, primarily by owning shares in a holding company.

This could apply to a mutual or cooperative bank, a prudential organization, a joint social security group, or an umbrella company.

Economic connections

Economic connections occur when multiple companies share the same main activity, engage in complementary functions that support one another, or carry out operations that serve the group’s common interests.

For example, a major French retail organization with numerous stores across France could use the VAT grouping system. This would allow them to simplify VAT declarations, reduce administrative costs associated with internal transactions, and improve cash flow via more efficient VAT recovery.

Organizational connections

Organizational connections refer to companies’ legal or de facto subordination to a shared management structure. Official documents or day-to-day practices can demonstrate this subordination. Lastly, the coordination of activities between companies also indicates an organizational connection.

Companies sharing the same premises, administrative services, or equipment illustrate organizational connections within the VAT group.

How to create a VAT group

The VAT group scheme is a voluntary option that companies can register for. They must express their intention to form a group and appoint a representative to benefit from this arrangement.

The process

When registering, the group representative must provide detailed information to the tax authorities, including the representative’s identity, the company names of all members, their registered offices, a formal agreement signed by each member’s legal representative, and their intracommunity VAT numbers.

They must then provide this information to the relevant corporate tax office.

Deadlines

To qualify for the VAT group scheme, companies must formally declare their intention to form a committee by filing an option with the tax authorities before October 31 of the preceding year. Membership in the group is contingent upon meeting all legal criteria as of January 1 of the enrollment year.

The group must report its composition in an annual declaration submitted by January 10 of each year. If entities in the integration process meet the membership conditions within the required timeframe, this declaration can contain them.

|

Action |

Deadline |

|---|---|

|

Prepare documents |

No later than October 31 of the year preceding the start date |

|

File option with tax authorities |

October 31 |

|

Meet conditions |

January 1 |

|

Submit membership list |

January 10 |

Members of a VAT group

The representative

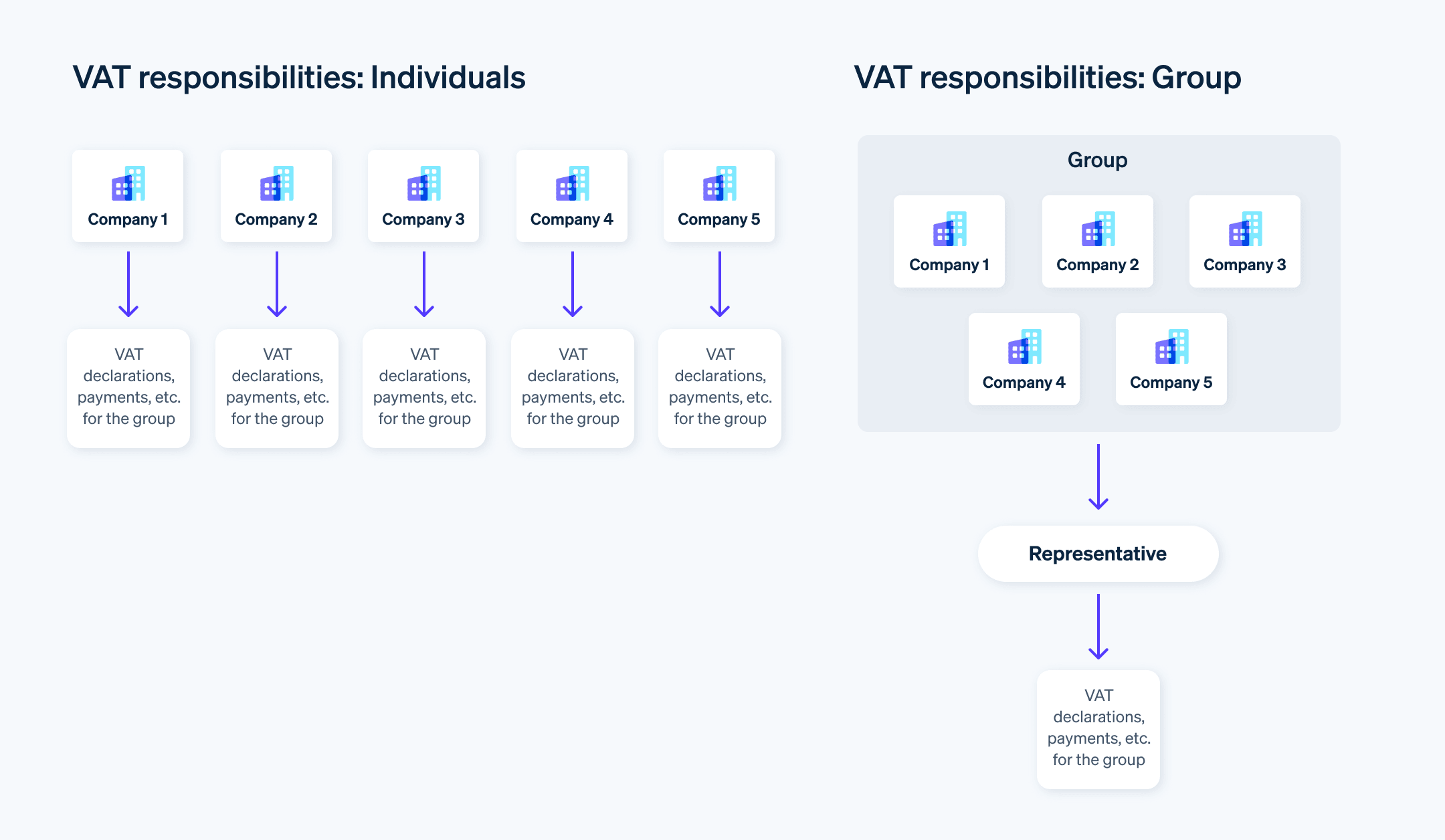

The VAT group representative is the sole point of contact with the tax authorities for all VAT-related matters, including declarations, payments, and refund claims.

Other members

Starting January 1 of the first year the option begins, VAT group members are exempt from all individual VAT reporting obligations. The group representative then assumes these duties.

They are jointly and severally liable for VAT. If one member defaults, the tax authority might require the others to pay the entire debt, similar to joint and several liability under law or contract.

These group members retain liability for their VAT obligations related to transactions conducted before joining or after leaving the group.

Duration of a VAT group

A VAT group’s minimum duration is three years. During this period, the list of members remains fixed and cannot be altered, except if one fails to meet the enrollment conditions.

If a company that meets the required conditions and is already on the list, it could join the group during this period. Conversely, a member’s departure occurs automatically starting the month after they no longer meet the criteria.

The group’s legal representative must report any changes in membership to the tax authorities. It is important to note that a member admitted to the group during the initial period can leave at the end.

Joining the group

The composition of the VAT group might change after the initial three-year period. A new company looking to join must meet the legal conditions and obtain the express consent of the group representative.

They must inform the tax authorities of any changes in membership, providing an updated list of members signed by the new entrants. These changes become effective on January 1 of the year following the request.

Leaving the group

A member can leave the group with the representative’s consent, provided they give notice by October 31 before the year they wish to leave. They must notify the tax authorities of any departure. For instance, a member who joins after 2 months can leave after 2 years and 10 months, at the close of the initial period.

VAT group advantages

A VAT group will have its own VAT number. The anticipated impact on businesses is positive, especially regarding members’ cash flow, since intragroup transactions are not subject to VAT. Among other benefits, this group offers:

- Simplified administration: Having a single VAT number for the entire group significantly reduces the administrative workload associated with its declarations.

- Improved cash flow: VAT exemption on internal transactions allows for more effective cash flow management.

- Tax optimization: Consolidating VAT payments and minimizing the number of declarable transactions simplifies and enhances the company’s tax management.

- Flexibility: The ability to adjust the group’s composition ensures alignment with the company’s needs.

- Improved competitiveness: Members benefit from efficient procedures and lower costs.

With Stripe Tax, a group can manage and fulfill its VAT obligations using various tools that automate administrative tasks and minimize the risk of errors.

VAT group disadvantages

Group members remain jointly and severally liable for VAT payments and tax penalties. In other words, if one fails to fulfill its obligations, the tax authorities could hold the others responsible for paying the entire debt. This financial risk can be significant. Other disadvantages include:

- Increased management complexity: Strict internal controls and precise accounting are key to ensuring proper VAT management at the group level.

- Loss of autonomy: Group-wide decisions regarding VAT might influence individual business choices.

- Risk of tax audit: The entire group could be subject to a single tax audit, increasing the likelihood of scrutiny and penalties in cases of noncompliance.

How to dissolve a VAT group

Voluntary dissolution

A VAT group’s dissolution can be voluntary or automatic. Voluntary dissolution requires the agreement of all members. They must wait for at least three calendar years, from January 1 to December 31, before it can dissolve. Once dissolved, it no longer enjoys the tax advantages linked to this status. The legal representative must then inform the tax authorities of the dissolution.

Mandatory dissolution

The tax authority automatically dissolves a VAT group if all its members cease to meet the required economic, financial, or organizational conditions. Dissolution takes effect immediately, regardless of how much time has passed since the group was initially formed.

If only one member remains due to others’ voluntary or involuntary departure, the tax authority automatically dissolves the group.

However, it is the responsibility of the group representative to notify the relevant tax office promptly.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.