The term “subscription” refers to a revenue model that lets customers access products and services for a fixed monthly fee. Key performance indicators (KPIs) are important for subscription business models to monitor the progress of the business, see whether it is moving in the right direction, and understand the company’s current position.

In this article, we introduce the different types of KPIs for subscriptions and explain some key points for setting KPIs.

What’s in this article?

- KPIs explained

- KPIs subscription businesses commonly use

- Key points for setting KPIs for subscription businesses

- Subscription KPI frequently asked questions (FAQs)

- Providing unique value and setting appropriate KPIs

KPIs explained

Companies use KPIs to measure and evaluate business performance to achieve defined goals. Many companies use KPIs, including subscription-based companies. It is important to set KPIs appropriate for the subscription business model, use them to understand the business’s current situation, and identify problems.

Differences between KPIs and KGIs

Key goal indicators (KGIs) are similar to KPIs. Both are important indicators for leading a business to success, but they have different meanings and roles.

- Key performance indicator (KPI): KPIs are indicators businesses use to quantitatively measure and evaluate the status of progress toward the intermediate processes necessary to achieve the final goals set out in the KGI. KPIs monitor each process until the company achieves its goal and show each department’s performance level.

- Key goal indicator (KGI): KGI is a numerical indicator of the ultimate goal for a business. Used together with intermediate KPIs, companies use KGIs mainly to set goals for sales, profits, and number of customers.

KPIs subscription businesses commonly use

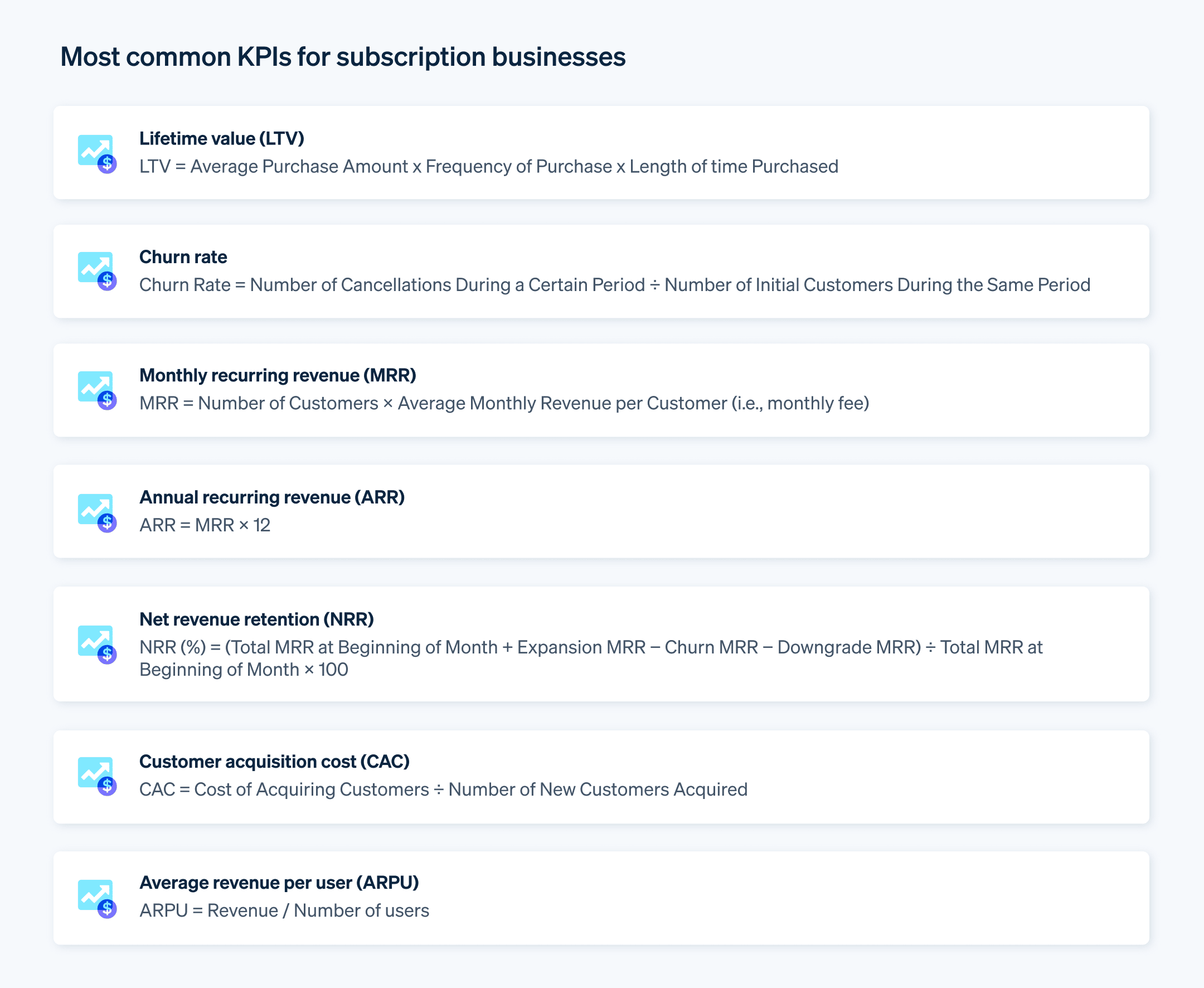

While we could say the same for any business, KPIs are also important for subscriptions. There are many different types of KPI. Below, we introduce some typical KPIs that can be used for subscription businesses.

Lifetime value (LTV)

LTV is the profit gained from a customer’s transactions with a company, from the start to the end of the relationship.

For subscriptions, the period of continuous purchase is from the start of the agreement to the cancellation of the agreement. The formula for calculating LTV is as follows:

LTV = Average Purchase Amount x Frequency of Purchase x Length of time Purchased

In the case of subscriptions—which are based on recurring transactions with customers—it is important to consider how long each customer continues to use the service and how often they make purchases. This is why LTV is an important KPI for subscriptions.

Churn rate

Churn rate—sometimes known as “cancellation rate”—is a KPI used in the customer success field; although, it varies depending on the industry and the scale of the business. Reducing the churn rate is key for any successful subscription business. This is because a significant decrease in customers due to churn would have a direct impact on revenues. The calculation method for the churn rate is simple:

Churn Rate = Number of Cancellations During a Certain Period ÷ Number of Initial Customers During the Same Period

For example, you could divide the number of cancellations in a month by the number of customers at the beginning of the month to find the churn rate.

Monthly recurring revenue (MRR)

MRR is revenue a company expects to receive every month. For subscriptions, it is the recurring payments a company expects to receive each month and is a key KPI used to compare the results of each month and forecast the business’s growth potential.

The basic calculation method for MRR is as follows:

MRR = Number of Customers × Average Monthly Revenue per Customer (i.e., monthly fee)

There are four types of MRR:

- New MRR: From new customers

- Expansion MRR: Gained through upgrades

- Downgrade MRR: Lost due to downgrades

- Churn MRR: Lost due to cancellation in the relevant month

It is important to understand which MRR is slowing down growth and then take action. Calculate the MRR for the current month as follows:

MRR for the Current Month = MRR for the Previous Month + (New MRR + Expansion MRR + Downgrade MRR + Churn MRR)

As explained later, net revenue retention (NRR) is based on each of the MRR values, excluding the new MRR.

Annual recurring revenue (ARR)

Just as you would calculate the MRR mentioned above each month, ARR refers to fixed sales that occur annually. Companies that have a small number of monthly B2B subscriptions or that have annual contracts as their standard generally use ARR rather than monthly subscriptions.

You can calculate ARR by multiplying MRR by 12. However, this calculation method has its limitations. For example, it does not include details such as the number of cancellations, upgrades, and downgrades. Therefore, it is best to consider other indicators as well.

Net revenue retention (NRR)

NRR shows increases and decreases in sales from existing customers, allowing you to see whether your business is growing or stagnating. You can calculate NRR using the following method that includes MRR values.

NRR (%) = (Total MRR at Beginning of Month + Expansion MRR − Churn MRR − Downgrade MRR) ÷ Total MRR at Beginning of Month × 100

If NRR exceeds 100% using the above calculation method, it shows the business is growing smoothly that month.

Customer acquisition cost (CAC)

CAC refers to the cost per person to acquire a new customer. Subscription businesses must acquire new customers to be successful. CAC is the cost effectiveness of the cost of acquisition (e.g., advertising costs, etc.).

Using CAC, you can check how much it costs to acquire customers and what volume of sales is required to recover any investment spent on acquiring customers.

CAC is calculated as follows:

CAC = Cost of Acquiring Customers ÷ Number of New Customers Acquired

Average revenue per user (ARPU)

In a business that generates revenue through continued use, such as a subscription, ARPU is an important indicator for measuring profitability and growth potential.

Companies can calculate ARPU by dividing revenue by the number of users.

To improve APRU, you need to increase customer satisfaction and loyalty. To achieve this, you should prioritize actions and strategies that focus on customer success, such as service quality and customer support.

Key points for setting KPIs for subscription businesses

When it comes to KPIs for subscription businesses, you need to set effective KPIs and align goals across the entire organization so they are evaluated together.

Financial KPIs

The success of a subscription business lies in its ability to grow and expand as well as in its ability to secure ongoing revenue. For subscriptions, many of the services provided require up-front investment, so it is important to set finance-based KPIs to make it easier to recover funds. LTV, MRR, ARR, churn rate, CAC, and ARPU are key KPIs to keep in mind for subscription businesses.

Customer success KPIs

Customer success refers to efforts to support customers to have the best possible experience, using products and services to address their concerns.

The main difference between customer success and passive customer support—which simply responds to customer inquiries as they come in—is customer success requires active efforts to engage with customers. Note that the setting of KPIs based on customer success is something you should do before the customer signs or renews their agreement.

LTV is also an important KPI in customer success to establish long-term relationships with customers and improve the profitability of a business. It’s also important for business owners to monitor upsell, cross-sell, and churn rates. Upsell rate is the percentage of customers who switch to a higher-level plan with additional features. Cross-sell rate is the percentage of customers who sign up for complementary products and services in addition to their original plan.

Net Promoter Score (NPS) and onboarding completion rates are also helpful. NPS is a metric that quantifies customer loyalty in terms of trust, attachment, and support for products and services. The onboarding completion rate is the percentage of new customers who understand the service, start using it, and reach a state where they can use it on their own without any problems.

Subscription KPI frequently asked questions (FAQs)

How many people are considering cancelling their subscriptions?

Nyle Inc. announced the results of a survey on subscription service use in Japan conducted in February 2024, which showed that “nearly 70% of people have considered cancelling their subscription services.” The survey included responses from 605 men and women between their teens and 60s.

What is the average monthly subscription fee per person?

The same survey also showed that “75% of all subscriptions cost less than 3,000 JPY per month.” Of these, the most common range was ¥1,000–¥3,000 (31.4%), followed by ¥500–¥1,000 (27.1%) and less than ¥500 (16.5%).

How do you calculate the profits of a subscription business?

The general method for calculating profit is:

Sales – Cost of Sales = Profit

Note that “cost of sales” in subscriptions refers to initial and running costs related to operating the service. You can calculate subscription sales as follows:

Sales = Total Number of Customers x Fee per Customer

The “total number of customers” in the above calculation includes both new and existing customers. However, acquiring new customers and increasing the retention rate for existing customers (by reducing churn rate) are the only ways to increase profits. You might also want to consider adding optional services to increase the monthly subscription fee.

Providing unique value and setting appropriate KPIs

In this article, we introduced some of the most common types of KPIs for subscriptions. Customer success outcomes include lower churn rates, customer retention, increased average order value, and increased new customer acquisition. To achieve these results, it is important to set KPIs that will help you understand your company’s current position.

Owners of subscription businesses should understand the value subscriptions provide and set KPIs suitable for their company’s services. In addition to the KPIs introduced here, there are also various other KPIs used for subscriptions, such as regular profit margin (RPM) and growth efficiency index (GEI). It is a good idea to be aware of changes in user needs and to keep KPIs under review as you monitor market trends.

For subscriptions, it is also important to have a secure online payment environment customers can use with confidence. For example, business owners aiming to start up a subscription service business can use a specialized continuous payment processing system called Stripe Billing to provide various subscription-related functions, such as regular billing to customers, payment methods, and a deposit management system. Companies can design a subscription plan that meets the needs of their business lines and streamline and optimize all subscription-related administrative tasks.

Many expect the number of subscription-based businesses to continue growing. Improve your services for your customers by focusing on efficient management and upgrading your payment operations.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.