Equity allocation among cofounders is a high-priority, deeply complex issue with significant implications for a startup’s future. Constructing equity arrangements that are arbitrary or inadequate can lead to serious challenges such as internal conflict, demotivation, and legal disputes. A Carta survey found that just 26% of startups have a single founder, meaning the remaining 74% must figure out how to divide equity among cofounders. Founders must approach equity allocation with a clear understanding of the factors at play and how different choices will affect future outcomes.

With stakes this high, the topic of equity division demands rigorous scrutiny and a well-thought-out strategy. A carefully designed equity split serves as a strong foundation for the startup, providing stability through various stages, including early financing rounds and potential exits. Here’s what cofounders should consider in the pursuit of an equity structure that fits their needs and preferences, both now and in the future.

What’s in this article?

- What is equity in a startup?

- Types of equity in startups

- Why does equity matter in a startup?

- How to split equity among cofounders

- Different ways to split equity among cofounders

What is equity in a startup?

Equity represents ownership in a startup, which is often granted through stock options or shares. For cofounders and team members who join the venture early, this ownership stake serves as both a financial incentive and a form of compensation for the risks and efforts associated with launching a new business. Equity stakes entitle their holders to a proportion of the company’s future profits and give them voting rights in company decisions, usually in correlation with the size of their ownership.

Types of equity in startups

Different forms of equity are tailored to different needs and constraints. Types of equity include:

Common stock: This is the most straightforward form of equity, which is generally reserved for founders and employees. It grants the holder voting rights and entitles them to a share of any dividends or exit proceeds.

Preferred stock: Preferred shares are often issued to investors and come with additional rights, such as priority in receiving dividends and assets in case of a liquidation event. This type of stock can also include antidilution protections.

Stock options: Options grant the right to purchase shares at a predetermined price (the strike price) within a specific time frame. These are usually allocated to employees and may come with various conditions.

Restricted stock units (RSUs): These are commitments to grant a set number of shares at a future date, contingent on certain conditions such as time-based vesting or achievement of performance metrics.

Warrants: Similar to options, warrants confer the right to purchase shares but are generally issued to investors rather than employees.

Convertible notes and SAFEs: These financial instruments convert into equity during a future funding round, typically at more favorable terms for the holder. A Simple Agreement for Future Equity (SAFE) grants the investor the right to receive shares at a later date, while convertible notes are company loans in which the debt converts to shares instead of being repaid.

Why does equity matter in a startup?

Within startups, equity is the backbone of incentive structures, driving both short-term actions and long-term strategic planning. Its importance extends far beyond the concept of ownership or potential monetary gains. Equity holds implications that touch every aspect of how the startup operates. Here are some key reasons why equity matters in the startup environment:

Motivation and retention

Equity aligns the interests of team members with the overall health and growth of the startup. This approach motivates individuals to invest maximum effort because their financial rewards are tied directly to the startup’s performance.Talent acquisition

Often, startups are unable to offer salaries comparable to those at established firms, so equity becomes a compelling alternative form of compensation to attract top-tier talent. For individuals attuned to the risk-reward dynamics of startups, an attractive equity package can offset lower salaries.Strategic decision-making

Those who hold equity possess voting rights (depending on the type of shares), influencing strategic decisions from fundraising to exit strategies. These rights enable stakeholders to shape the course of the startup in a profound way.Investor relations

Equity structures communicate information to potential investors about how the company values different contributions and risks. Well-structured equity arrangements can instill confidence by demonstrating that the startup has a coherent vision and a fair, deliberate approach to rewarding contributions.Exit opportunities

With liquidity events such as initial public offerings (IPOs) or acquisitions, equity holders stand to gain significantly. The allocation of equity can become an important part of these negotiations, affecting financial gains and also the governance and strategic direction of the company after an exit.Capital allocation and financial strategy

Equity is integral to the company’s financial architecture. The type of equity and associated rights can impact the startup’s ability to raise capital, allocate resources, and even service debt.Risk mitigation

For cofounders and early team members, the dilution of equity can be an inevitable part of scaling the business. Intelligent equity structuring that takes into account future funding rounds can mitigate excessive dilution, thereby balancing the introduction of new capital with the preservation of original stakeholders’ influence and financial gains.Operational flexibility

Different equity instruments come with varying degrees of operational obligations and financial benefits, offering tactical leeway in governance and decision-making. For example, instruments such as convertible notes or SAFEs can defer valuation discussions until a more opportune time, providing the startup with valuable operational flexibility.Tax planning

Knowledgeable stakeholders use equity as a means for efficient tax planning. From the timing of exercising stock options to structuring the sale of shares, astute planning can reduce tax burdens and enhance financial gains (although this varies by jurisdiction).

The elements of equity can be an important tool in negotiations, in setting growth strategies, and in deciding exit pathways. For instance, negotiating for more voting rights or antidilution provisions can give a cofounder or employee a stronger position in future fundraising rounds or acquisition talks. Beyond representing only the percentage of ownership, the specific type and terms of equity are tactical levers for power and profit within the startup environment.

How to split equity among cofounders

Deciding how to allocate equity among cofounders is a complex decision with long-lasting implications. Here are some factors to consider:

1. Skill sets and contributions

Different founders bring different strengths and capabilities to the table. One founder might have the technical skills to build the product, while another might excel at market strategy and customer acquisition. Quantify the value of these contributions, both current and future, in relation to the company’s objectives.

2. Time commitment

Not all founders work full time. Some may hold another job and work on the startup during off hours and on weekends, while others may be able to commit themselves fully from Day 1. Consider the time each founder can give to the venture, today and in the foreseeable future.

3. Financial investment

Some founders may provide essential starting capital for the company, which could justify a different equity stake.

4. Business connections and credibility

Access to valuable networks can be a significant asset. A cofounder’s ability to provide introductions to key players in the industry or potential clients can substantially accelerate growth.

5. Past and future roles

Consider what each founder has already contributed and what roles they will fill moving forward. Someone who brought an invaluable asset early on may not be as involved later, and the equity split should reflect this continuum of involvement.

6. Tolerance for risk

Different founders may have different appetites for risk, which affect their willingness to make key, high-stakes decisions for the business. This factor can influence how much control each cofounder should have, something that can be reflected in their equity stake.

7. Vesting schedules

While the idea of a vesting schedule is not tied directly to the initial equity split, it can be helpful to consider this when making big decisions. Understanding that stakes might be subject to change based on certain conditions allows for a more flexible yet controlled approach to equity allocation.

8. Exit strategy preferences

Different founders may have divergent views on the business’s endgame. Whether the ultimate goal is a quick acquisition or long-term growth will affect the value each founder brings and their respective fair equity share.

9. Legal implications

Consider the legal responsibilities each founder will take on. Regulatory compliance, fiduciary responsibilities, and other legal matters may fall heavier on some than others, which could warrant a different share of equity.

10. Emotional and psychological factors

Emotional intelligence, strong personal relationships, and the ability to maintain a positive work environment are important but often overlooked skills that a founder can bring to a startup. A founder’s contributions to team morale can also be a factor in equity allocation.

11. Opportunity costs

Consider what each founder is giving up to join the startup. The loss of a high-paying job or another significant opportunity can be factored into the equity equation.

There’s no fixed, one-size-fits-all solution to equity distribution because the “right” equity strategy is one that reflects a startup’s unique needs and circumstances. No two founding teams operate the same way, and every founder has their own set of priorities around what they’re hoping to get out of the experience—financially or otherwise. The bottom line is there’s no way to arrive at the right outcome without undergoing a careful and thoughtful exercise that takes into account the nuances of your venture and team.

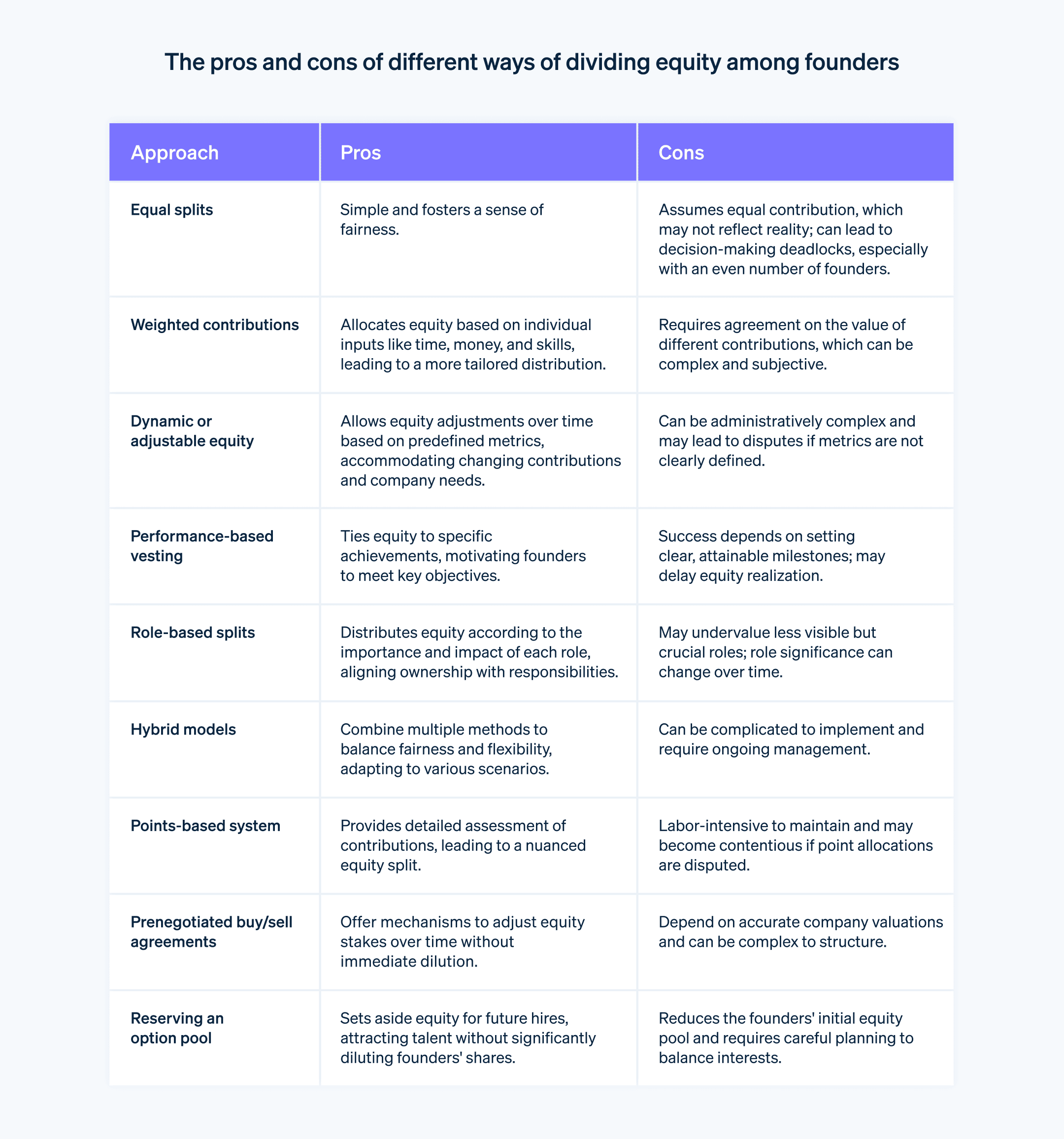

Different ways to split equity among cofounders

Just as there’s no fixed way to decide how much equity a cofounder is entitled to, there’s no single structure by which equity can be arranged and distributed among founders. Here are some of the most common ways cofounders organize and manage their equity breakdown:

Equal splits

Although it might seem like the fairest method, splitting equity evenly among all founders brings its own set of challenges. It assumes each founder will contribute equally to the company’s growth, which might not hold true over time. Moreover, this method can create governance issues, especially when the number of cofounders is even, leading to deadlocks in decision-making.Weighted contributions

This method attempts to quantify each founder’s input, such as time commitment, financial investment, and skill set. It then splits equity proportionally based on these weighted contributions. This method allows for a more nuanced allocation, but it requires a comprehensive assessment and agreement on the different types of contributions’ value.Dynamic or adjustable equity

With this method, the founders agree on a set of metrics or key performance indicators that will influence the equity distribution over time. These metrics can include revenue milestones, customer acquisition rates, or product development goals. The equity split adjusts automatically based on these predetermined metrics. This model provides the flexibility to account for changes in contribution levels, market conditions, or strategic direction.Performance-based vesting

Under this structure, equity vests when specific objectives are accomplished. Unlike a traditional time-based vesting schedule, performance-based vesting ties equity to measurable outcomes. For example, a founder responsible for technology might decide on a setup in which equity vests when they reach certain product development milestones.Role-based splits

Here, equity is divided according to the roles each founder assumes. This structure often categorizes roles into different tiers, each with its own equity range. For instance, a CEO might receive a larger equity stake compared to a CTO or COO based on the perceived value of that role in achieving the company’s goals.Hybrid models

In some cases, a combination of methods can be effective. For example, an initial equity split can be determined through weighted contributions, but with a clause that enables dynamic adjustments based on specific performance metrics.Points-based system

Some startups opt for a points-based system, in which each founder earns points for their contributions, responsibilities, and risks. These points are then used to calculate each founder’s percentage of equity. This system adds valuable granularity, but it can be labor-intensive to maintain.Prenegotiated buy/sell agreements

Another option is to have prenegotiated buy/sell agreements that specify conditions under which a founder can increase their equity stake by purchasing shares from the company or other founders. This provides a mechanism to adjust equity based on ongoing valuations and contributions without diluting ownership unnecessarily.Reserving an option pool

While this method doesn’t affect the founder equity split directly, an option pool can provide the flexibility to bring in key hires without overly diluting the founders’ stakes. The size of this pool and the terms under which options are granted are matters of strategic importance.

Each method for allocating equity has its own advantages and disadvantages. The most effective approach is one that is tailored to the specific needs and circumstances of the startup. Document all agreements carefully, taking into account future scenarios such as new funding rounds, exits, or changes in founder involvement. Consider seeking legal and financial advice to help craft an equity agreement that serves the long-term interests of all stakeholders.

How Stripe Atlas can help

Stripe Atlas sets up your company’s legal foundations so you can fundraise, open a bank account, and accept payments within two business days from anywhere in the world.

Join 75K+ companies incorporated using Atlas, including startups backed by top investors like Y Combinator, a16z, and General Catalyst.

Applying to Atlas

Applying to form a company with Atlas takes less than 10 minutes. You’ll choose your company structure, instantly confirm whether your company name is available, and add up to four cofounders. You’ll also decide how to split equity, reserve a pool of equity for future investors and employees, appoint officers, and then e-sign all your documents. Any cofounders will receive emails inviting them to e-sign their documents, too.

Accepting payments and banking before your EIN arrives

After forming your company, Atlas files for your EIN. Founders with a US Social Security number, address, and cell phone number are eligible for IRS expedited processing, while others will receive standard processing, which can take a little longer. Additionally, Atlas enables pre-EIN payments and banking, so you can start accepting payments and making transactions before your EIN arrives.

Cashless founder stock purchase

Founders can purchase initial shares using their intellectual property (e.g., copyrights or patents) instead of cash, with proof of purchase stored in your Atlas Dashboard. Your IP must be valued at $100 or less to use this feature; if you own IP above that value, consult a lawyer before proceeding.

Automatic 83(b) tax election filing

Founders can file an 83(b) tax election to reduce personal income taxes. Atlas will file it for you—whether you are a US or non-US founder—with USPS Certified Mail and tracking. You’ll receive a signed 83(b) election and proof of filing directly in your Stripe Dashboard.

World-class company legal documents

Atlas provides all the legal documents you need to start running your company. Atlas C corp documents are built in collaboration with Cooley, one of the world’s leading venture capital law firms. These documents are designed to help you fundraise immediately and ensure your company is legally protected, covering aspects like ownership structure, equity distribution, and tax compliance.

A free year of Stripe Payments, plus $50K in partner credits and discounts

Atlas collaborates with top-tier partners to give founders exclusive discounts and credits. These include discounts on essential tools for engineering, tax, finance, compliance, and operations from industry leaders like AWS, Carta, and Perplexity. We also provide you with your required Delaware registered agent for free in your first year. Plus, as an Atlas user, you’ll access additional Stripe benefits, including up to a year of free payment processing for up to $100K in payments volume.

Learn more about how Atlas can help you set up your new business quickly and easily, and get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.