As customer payment preferences continue to evolve, businesses must adapt their payment processing systems to stay competitive. By thoughtfully building their credit card processing systems, businesses can improve the customer experience, streamline operations, and access new growth opportunities.

Improperly setting up a credit card payment processing system can result in additional costs, operational inefficiencies, and increased vulnerability to payment fraud. It’s important to understand how credit card transaction processing works and how to set up a credit card processing system. Here’s what you need to know.

What’s in this article?

- What is credit card transaction processing?

- Credit card transaction processing: Key components

- How does credit card transaction processing work?

- Credit card transaction processing costs for businesses

- Why does credit card transaction processing matter for businesses?

What is credit card transaction processing?

Credit card processing occurs when electronic transactions involving credit cards are authorized, authenticated, and settled between the cardholder, the business, and their respective financial institutions. This process allows businesses to accept credit card payments for goods or services, facilitating easy and convenient transactions for both the business and the customer.

Credit card transaction processing: Key components

While credit card transactions are typically processed very quickly, what happens behind the scenes is complex. The process requires many components that collaborate with each other to ensure that funds move securely and efficiently.

Here’s an overview of the parties that participate in this process:

Cardholder

The cardholder is the individual who owns the credit card and uses it to make purchases for goods or services.Merchant

The merchant is the business or service provider that accepts credit card payments from customers in exchange for goods or services.Point-of-sale (POS) system

The POS system is the hardware and software the business uses to accept and process credit card transactions and includes terminals, card readers, and software applications.Payment gateway

The payment gateway is a service that securely transmits transaction information between the business’s POS system and the credit card processor.Credit card processor

The credit card processor, also called the “payment processor,” is a company that works with the card networks and issuing banks to authorize, authenticate, and settle credit card transactions on behalf of the business.Card networks

Card networks—such as Visa, Mastercard, American Express, and Discover—facilitate communication between the credit card processors and the issuing banks and set transaction rules and standards.Issuing bank

The issuing bank, also called the “issuer” or “card issuer,” is the financial institution that issues the credit card to the cardholder. It authorizes and approves transactions, and it provides the funds for the purchase.Acquiring bank

The acquiring bank, also known as the “acquirer” or “merchant bank,” is the financial institution that has a contractual relationship with the business to accept and process credit card transactions. It settles funds with the issuing bank and deposits the funds into the business’s account.

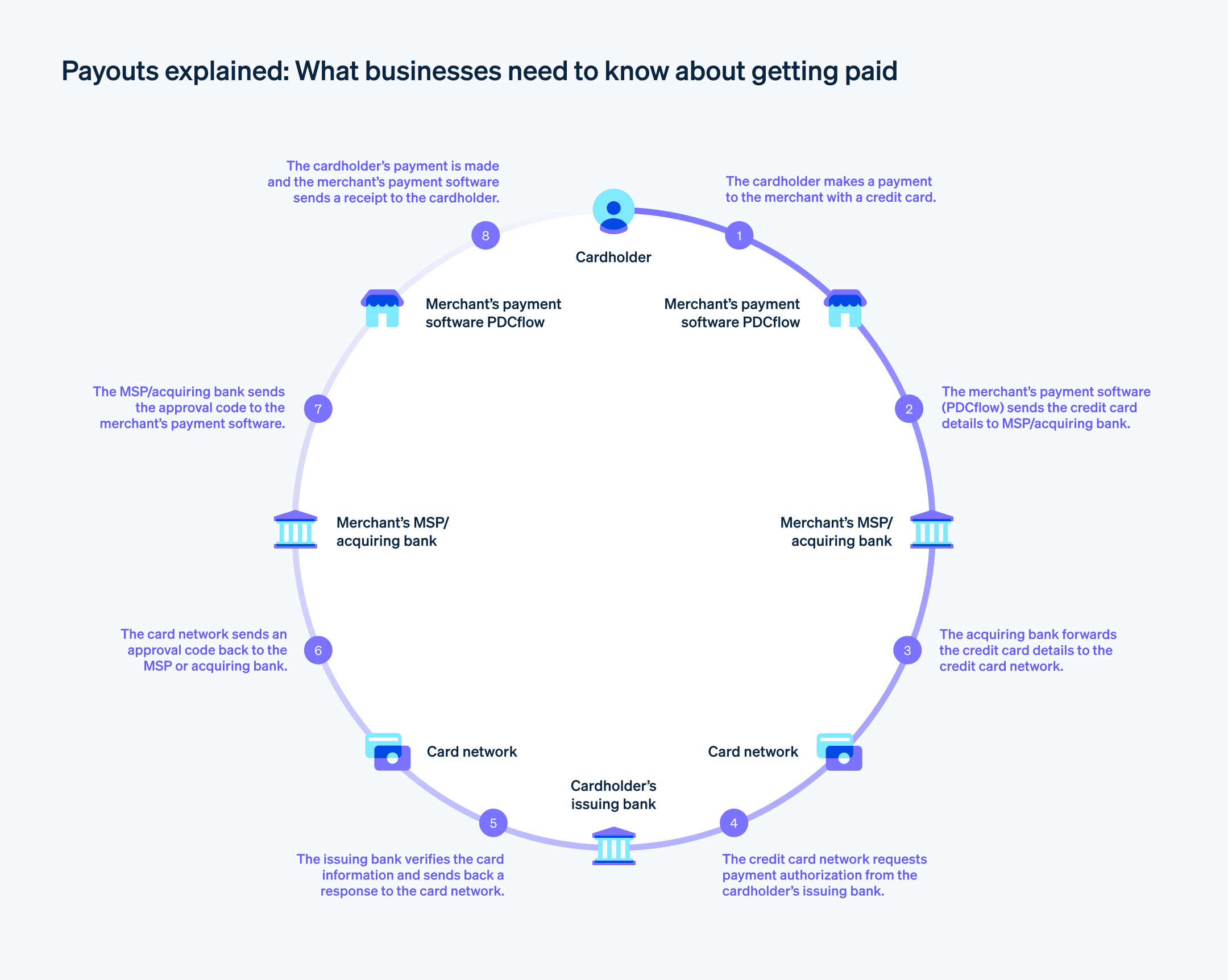

How does credit card transaction processing work?

Credit card transaction processing varies depending on where a transaction takes place and what type of card is used. For example, an online credit card transaction will be initiated in a different way than an in-person card transaction. Similarly, an in-person transaction will work differently if the credit card is stored in a digital wallet compared to an in-person transaction where the customer uses a physical card.

But even with these smaller variations, the overall credit card transaction process is mostly consistent across different types of transactions. Here’s a simplified overview of how the process works:

1. Initiation

The cardholder provides their credit card information to the business. For in-person transactions, this means swiping, inserting, or tapping their card. For online transactions, this means entering the card details manually or selecting a card from their stored payment methods.

2. Data transmission

The business’s POS system or payment gateway captures the transaction details and securely transmits this information to the credit card processor.

3. Authorization request

The credit card processor forwards the transaction data to the appropriate card network, which then routes the authorization request to the issuing bank.

4. Approval or decline

The issuing bank verifies the cardholder’s account, checking for sufficient funds and any potential fraud or security issues. Based on this evaluation, the bank either approves or declines the transaction and communicates this decision to the card network, which relays the information to the credit card processor.

5. Authorization response

The credit card processor sends the authorization response—either an approval or a decline code—to the business’s POS system or payment gateway. If the transaction is approved, the business can complete the sale and provide the goods or services to the customer.

6. Settlement

At the end of the day, the business submits the batch of all approved transactions to the credit card processor for settlement. The processor also forwards the transaction details to the respective card networks.

7. Funds transfer

The card networks coordinate with the issuing banks to transfer the funds for each transaction to the acquiring bank, which receives the funds in the merchant account. The acquiring bank then transfers the funds into the business’s regular business bank account, minus any processing fees. This entire process usually takes 1–3 business days.

8. Cardholder billing

The issuing bank adds the transaction amount to the cardholder’s account balance and includes it in the monthly statement. The cardholder is responsible for paying the credit card bill according to the terms and conditions of their card agreement.

Credit card transaction processing costs for businesses

Credit card transaction processing costs can vary depending on the type of credit card, the transaction volume, and the individual payment processor. Businesses need to understand these costs to make informed decisions and minimize payment processing expenses.

Here are the main types of credit card transaction processing costs:

Interchange fees

The cardholder’s issuing bank charges interchange fees for each credit card transaction. Interchange fees are typically a percentage of the transaction amount, plus a fixed fee per transaction. The exact interchange fee depends on the type of card, the business’s industry, and how the card is used in the transaction; for instance, whether the customer swipes the credit card or enters their card information manually.Assessment fees

Card networks often charge assessment fees for the use of their payment infrastructure. These fees are usually a small percentage of the transaction amount and can vary depending on the card network and the transaction volume.Processor markup

Credit card processors and merchant services providers charge a markup fee for their services, which include handling authorization, settlement, and communication with card networks and banks. This markup can be a percentage of the transaction amount, a per-transaction fee, or a monthly fee. For information about Stripe’s fee structure, go here.Payment gateway fees

For online transactions, businesses may need to use a payment gateway, which securely transmits transaction information between the business’s website and the credit card processor. Typically, payment gateway providers charge a monthly fee or a per-transaction fee for their services.Terminal and equipment fees

Businesses may need to invest in POS terminals, card readers, or other equipment to accept credit card payments. These costs can cover purchasing or leasing the equipment, as well as ongoing maintenance and software update fees.Setup and activation fees

Some credit card processors charge a one-time fee for setting up the merchant account and activating the processing service.Monthly and annual fees

Some processors charge monthly or annual fees for account maintenance, reporting, and access to additional features or services.Chargeback and retrieval fees

If a customer disputes a transaction, the processor may charge the business a fee for the chargeback process. Retrieval fees may also apply if the business needs to provide transaction documentation to the issuing bank. Different merchant services providers have different ways of addressing these types of fees. For example, Stripe offers Chargeback Protection, which covers all costs associated with chargebacks and waives any fees.PCI compliance fees

To ensure the security of cardholder data, businesses need to comply with the Payment Card Industry Data Security Standard (PCI DSS). Some processors charge a fee for PCI compliance, while others include it in their service offering.

Businesses should carefully compare processing costs for different providers and choose the most cost-effective solution that meets their needs. Negotiating rates and fees, as well as maintaining a low chargeback ratio and adhering to PCI DSS guidelines, can help businesses minimize their credit card transaction processing costs.

Why does credit card transaction processing matter for businesses?

Credit card transaction processing directly impacts a business’s ability to provide convenient and secure payment options for customers, which can affect sales, customer satisfaction, and overall growth. Finding the optimal credit card processing system offers several benefits in these areas, including:

Enhanced customer experience

By offering a simple, convenient credit card payment experience, businesses can meet the evolving needs of their customers, leading to increased customer satisfaction and loyalty. The benefits are even greater with a unified commerce model, where businesses integrate all sales channels, data, and backend systems into a single, seamless platform.Increased sales and revenue

Credit card payments can boost sales for businesses by lowering the barriers that customers face when making a purchase. Generally, customers spend more when using credit cards compared to cash. Accepting credit cards also enables businesses to accept payments in different currencies without needing to deal with conversion, further expanding their market reach.Improved cash flow

Credit card transactions are typically settled and deposited into the business’s bank account within 1–3 business days, resulting in faster access to funds compared to other payment methods such as checks.Secure and compliant transactions

A strong credit card processing system helps protect both the business and its customers from fraud and data breaches by adhering to security standards such as PCI DSS. This compliance is important for safeguarding sensitive customer information and maintaining trust.Competitive advantage

Accepting credit card payments and providing a simple payment experience can give businesses a competitive edge over competitors that do not offer these options, helping them attract more customers and increase their market share.Cost optimization

By carefully selecting the right credit card processor and negotiating favorable rates and fees, businesses can streamline operations, minimize processing expenses, and maximize their cost margins.Access to valuable data and insights

Credit card processors often provide detailed transaction data and reports, allowing businesses to track sales, identify trends, and make data-driven decisions that can optimize their operations and marketing strategies.Reduced risk

By accepting credit cards, businesses can minimize the risks associated with handling large amounts of cash, such as theft, loss, or mismanagement.Adaptability

A thoughtfully designed credit card processing system enables businesses to embrace flexibility and adapt to new payment technologies, such as contactless payments or digital wallets, helping them stay ahead of industry trends and cater to evolving customer preferences.

Setting up a credit card processing system in a strategic way enables businesses to access these benefits and create a more robust, adaptable foundation for growth and stability.

Working with a strong payment processing provider will help ensure that your credit card transaction processing system is tailored to your needs while allowing you to provide a secure, efficient, and compliant customer experience. A payment processing provider such as Stripe can simplify the setup process and give your business direct access to its expertise in managing credit card transactions. To learn more about how Stripe helps businesses with credit card transaction processing, start here.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.