Tax classification is important for businesses, beyond maintaining compliance. It affects many aspects of a business, including tax rates, liability, operational flexibility, and growth trajectory. It influences how a business interacts with investors, creditors, and other stakeholders. Certain tax statuses can make it easier for a business to raise capital but might create operational complexities or higher taxes.

If you’re seeking one specific tax classification in the United States for your business, you’ll need to file Form 8832.

Below, we’ll share key information about Form 8832: what it is, what it does, who needs to file it, and which guidelines businesses need to consider.

What’s in this article?

- What is Form 8832?

- Who needs to file Form 8832?

- When do I need to file Form 8832?

What is Form 8832?

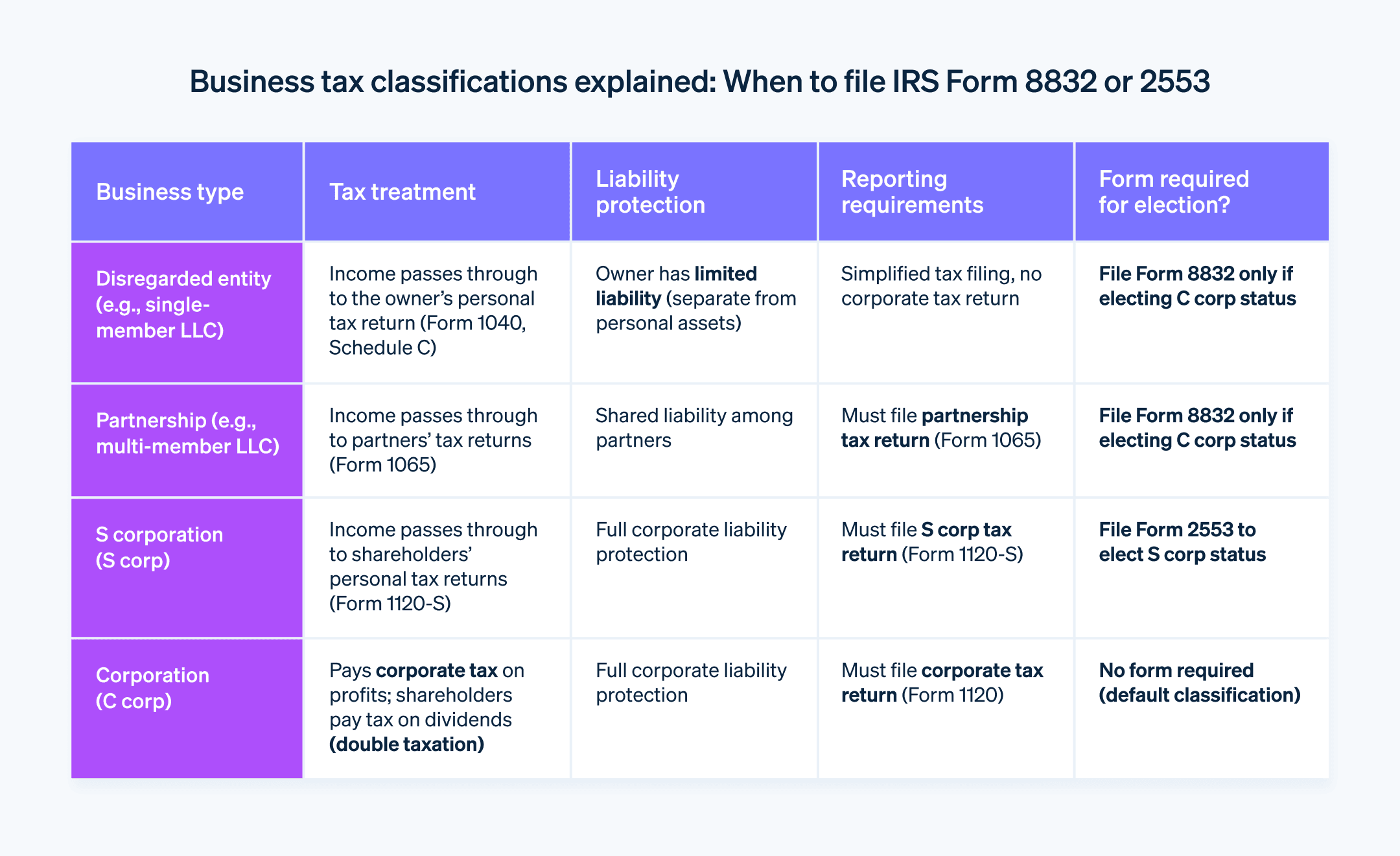

Form 8832 is a document that eligible businesses file with the US Internal Revenue Service (IRS) that allows them to choose how they will be classified for federal tax purposes. Each classification has specific criteria for eligibility. Here are the tax classifications businesses can choose on Form 8832:

Corporation: An entity can choose to be taxed as a corporation, including both C corporations and S corporations. Choosing to be treated as an S corp also requires a separate election via Form 2553.

Partnership: Entities with two or more members can opt to be taxed as a partnership.

Disregarded entity: A business with a single owner can choose to be a “disregarded entity,” meaning it will be ignored for federal tax purposes and its activities will be reported on the owner’s personal tax return.

Who needs to file Form 8832?

Form 8832 is generally filed by businesses that wish to change their default tax classification as assigned by the IRS. Domestic businesses and certain foreign businesses are eligible to file this form. According to the US Small Business Administration, there are over 33 million small businesses in the US as of 2023. Many of these could potentially use Form 8832 to elect how they are taxed.

Here are the specific types of business structures that might consider filing Form 8832:

Limited liability companies (LLCs): Both single-member and multimember LLCs can file Form 8832 if they want to be taxed as a C corporation rather than as an LLC.

Partnerships: General partnerships, limited partnerships, and limited liability partnerships can file Form 8832 to elect to be taxed as a C corporation.

Unincorporated associations: Entities such as trusts or cooperatives can also file this form if they wish to change their tax classification and be taxed as corporations.

Certain foreign businesses: Some foreign businesses are eligible to be treated as a corporation for tax purposes. These entities can file Form 8832 to select their tax classification under US tax law.

While Form 8832 offers flexibility in choosing a tax classification, there are some limitations. Certain regulations and restrictions govern the election process to ensure businesses comply with tax laws and that legitimate business purposes are being served. Here’s more detail on what those regulations and restrictions entail:

Eligibility restrictions

While many businesses can change their tax classification, others are restricted from doing so based on the nature of their business. Here are a few examples:

Financial institutions: Certain types of financial institutions, such as banks, might be required by law to operate under a specific business structure. When this requirement applies, they are not eligible to elect a different tax classification.

Insurance companies: Insurance companies are often restricted from choosing to be taxed as partnerships due to industry regulations and the nature of their income.

Domestic International Sales Corporations (DISCs): DISCs are specialized entities created to encourage exports from the US. They are governed by particular rules and benefits, including that they must be classified as a C corporation for tax purposes.

The 60-month limitation rule

Once a business has elected a new classification by filing Form 8832, it is subject to the 60-month limitation rule. After making this election, the business is typically restricted from filing forms to make another classification change for 60 months, or five years. The rule prevents businesses from exploiting frequent changes to their classification for tax advantages.

However, it’s important to note that there are exceptions to the 60-month rule. For example, if a business made its election under a mistake of fact, the IRS might permit a change sooner than 60 months. Another exception to this rule is when more than 50% of the ownership of a business changes; when this occurs, the IRS may allow an earlier election.

When do I need to file Form 8832?

When to file Form 8832 depends on several factors, including the business’s goals, its current classification, and any changes to its structure or ownership. Here are some common scenarios for filing Form 8832 and the timing required for each:

Initial classification

A newly formed business that wants to elect a different tax classification from the default set by the IRS will need to file Form 8832. To make the election effective from the date of the business’s inception, businesses should submit the form within 75 days of its formation date.Changing an existing classification

An existing business seeking to change its tax classification will also need to file Form 8832. It should file the form within the 75-day period prior to the requested effective date of the new classification. It can also file the form up to 12 months after the desired effective date, but this may require additional documentation or support to be accepted by the IRS.Following a relevant change

If a business undergoes a “relevant change,” like a shift in ownership structure that alters the default classification, this may also require the entity to file Form 8832. It must submit the form within 75 days of the occurrence of this change to establish a different classification from the date of the change onward.Post-60-month period

If an entity has previously filed Form 8832 and wishes to change its tax classification again, it may file again after 60 months have passed (unless an exception applies). In this case, the same timing rules apply as for changing an existing classification: the form should be filed in the 75-day period prior to the requested effective date or 12 months after the desired effective date, subject to additional documentation or support as dictated by the IRS.Correcting mistakes

If an entity mistakenly selects the wrong classification or if there is an error in its previously filed Form 8832, it should take corrective action as soon as possible by filing a new, correct form. The IRS may allow for retroactive relief, but this typically requires a detailed explanation and supporting documentation.

Deadlines are a key component of filing Form 8832. Filing outside the 75-day window before or the 12-month window after the desired effective date may lead to the IRS automatically denying the election.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.