税务分类对企业非常重要,不仅仅是为了保持合规。它影响企业的许多方面,包括税率、责任、运营灵活性和增长轨迹。它还影响企业与投资者、债权人和其他利益相关者的互动。某些税务状态可以使企业更容易筹集资金,但也可能带来运营复杂性或更高的税负。

如果您希望为您的企业在美国寻求特定的税务分类,您将需要提交税表 8832。

下面,我们将分享关于税表 8832 的关键信息:它是什么,它的作用,谁需要提交它,以及企业需要考虑的指南。

目录

- 什么是税表 8832?

- 谁需要提交税表 8832?

- 何时需要提交税表 8832?

什么是税表 8832?

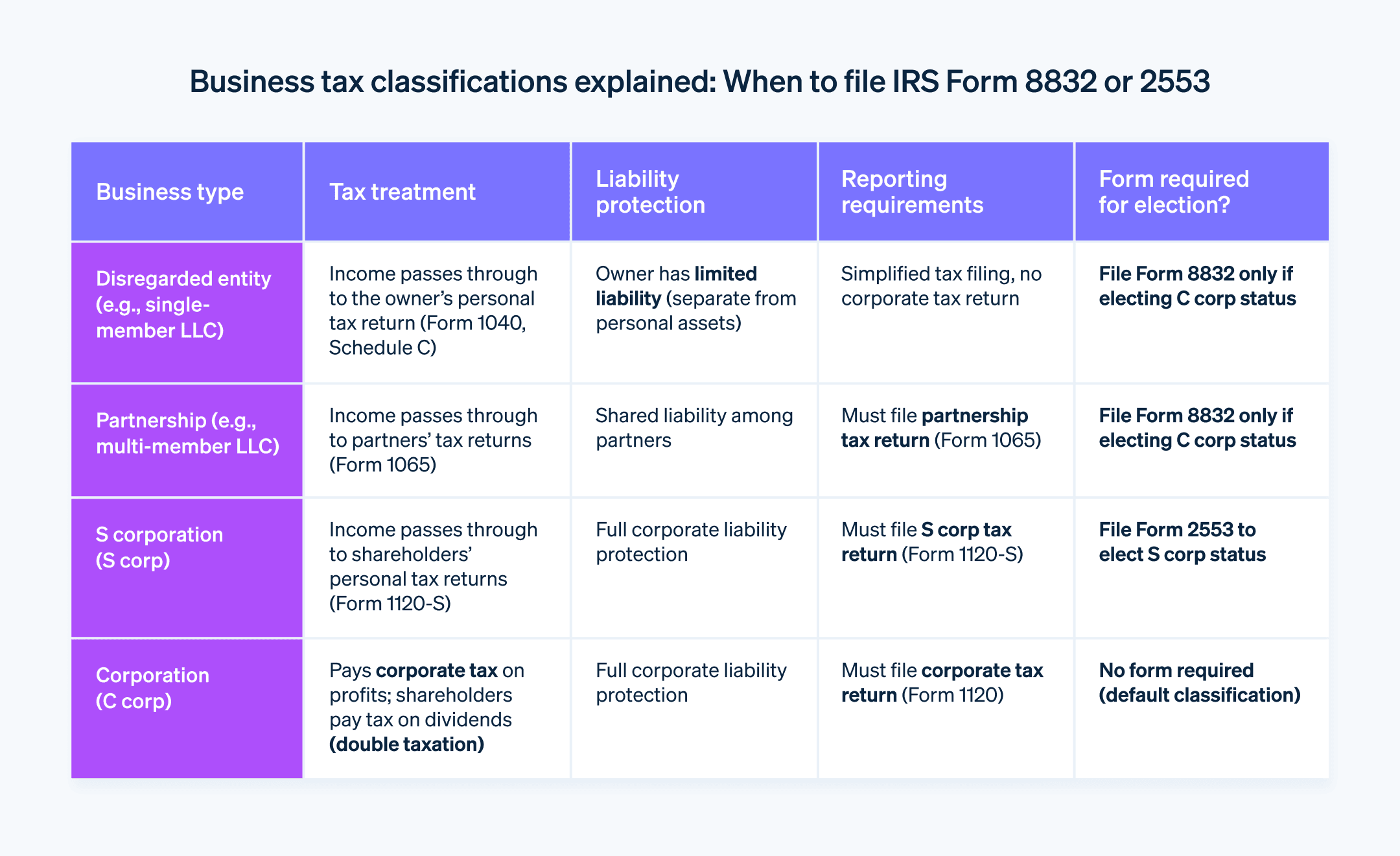

税表 8832 是一个文档,符合条件的企业需提交给美国国税局 (IRS),允许其选择如何在联邦税务方面进行分类。每种分类都有特定的资格标准。以下是企业在税表 8832 上可以选择的税务分类:

谁需要提交税表 8832?

税表 8832 通常由那些希望更改美国国税局默认税务分类的企业提交。国内企业和某些外国企业都有资格提交此税表。根据美国小企业管理局的数据显示,截至 2023 年,美国有超过 3300 万家小企业。其中许多企业可能需要使用税表 8832 来选择它们的税务分类。

以下是可以考虑提交 8832 税表的特定业务结构类型:

有限责任公司 (LLC): 单一成员和多成员有限责任公司 都可以提交税表 8832,若它们希望作为 C 类公司征税,而非作为有限责任公司。

合作关系: 普通合伙企业、有限合伙企业和有限责任合伙企业可以提交税表 8832,选择作为 C 公司征税。

非法人团体: 信托或合作社等实体也可以提交此税表,若它们希望更改税务分类并作为公司征税。

某些外国企业: 某些外国企业有资格按照美国税法作为公司进行征税。这些实体可以提交税表 8832 以选择其税务分类。

尽管税表 8832 提供了选择税务分类的灵活性,但仍然有一些限制。某些法规和限制规定了选择过程,以确保企业遵守税法,并确保企业具有合法的商业目的。以下是这些法规和限制的详细说明:

资格限制

虽然许多企业可以更改其税务分类,但有些企业由于其业务性质受到限制,无法更改税务分类。以下是一些示例:

金融机构: 某些类型的金融机构,如银行,可能被法律要求以特定的商业结构运营。当这种要求适用时,它们无法选择不同的税务分类。

保险公司: 由于行业法规和收入性质,保险公司通常不能选择作为合伙企业征税。

国内国际销售公司 (DISC): DISC 是为鼓励美国出口而设立的专门实体。它们受特定规则和优惠的约束,包括必须作为 C 类公司征税。

60 个月限制规则

一旦企业通过提交税表 8832 选择了新的税务分类,它就受到 60 个月限制规则的约束。在做出这一选择后,企业通常不能在 60 个月内(即五年内)再次更改其税务分类。该规则旨在防止企业频繁更改其分类以利用税务优势。

然而,值得注意的是,60 个月规则存在例外情况。例如,如果企业是在事实错误的情况下做出选择,美国国税局可能允许在 60 个月之前进行更改。此规则的另一个例外是当企业的 50% 以上的所有权发生变更时;发生这种情况时,美国国税局可能允许更早的选举。

何时需要提交税表 8832?

提交税表 8832 的时间取决于多个因素,包括企业的目标、当前的分类以及任何结构或所有权的变化。以下是提交税表 8832 的一些常见情形以及每种情况所需的时间:

初始分类

新成立的企业,如果希望选择与 IRS 默认分类不同的税务分类,需要提交税表 8832。为了使选举从企业成立日期起生效,企业应在成立日期后的 75 天内提交税表。更改现有分类

现有企业如果希望更改其税务分类,也需要提交税表 8832。它应在请求的新分类生效日期之前的 75 天内提交税表。也可以在期望的生效日期后的 12 个月内提交税表,但这可能需要额外的文档或支持材料,才能被美国国税局接受。相关变更后

如果企业发生了“相关变更”,如所有权结构的变化导致默认分类发生改变,也可能需要提交税表 8832。必须在变更发生后的 75 天内提交税表,以便从该变化日起确立新的分类。60 个月期满后

如果一个实体之前已经提交过税表 8832 并希望再次更改其税务分类,必须在 60 个月期满后才能重新提交(除非适用例外情况)。在这种情况下,适用与更改现有分类相同的时间规则:税表应在期望生效日期前的 75 天内提交,或者在期望生效日期后的 12 个月内提交,具体需根据美国国税局的要求提供额外的文档或支持材料。纠正错误

如果一个实体错误地选择了错误的分类,或者之前提交的税表 8832 存在错误,企业应尽快采取纠正措施,重新提交正确的税表。美国国税局可能允许追溯性救济,但通常需要提供详细的解释和支持文件。

提交税表 8832 时,截止日期是一个关键因素。如果在期望生效日期前 75 天内,或者在期望生效日期后的 12 个月内提交税表以外的时间,美国国税局可能会自动拒绝该选举。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。