Businesses with tax obligations in Canada often have to navigate multiple levels of compliance. On top of the country-wide goods and services tax, businesses must also consider province-specific tax regulations. As your business grows, it’s important to also make sure that you stay up to date on your tax compliance obligations. This begins with properly registering to collect tax in all locations where you have tax obligations.

This guide will help you determine when it’s time to register to collect tax when selling into Canada so you can avoid the penalties and interest that come with noncompliance. It will also help non-resident businesses navigate the process of registering for tax in individual provinces. We’ll also share how Stripe can help you manage ongoing tax compliance.

What is the goods and services tax (GST) in Canada?

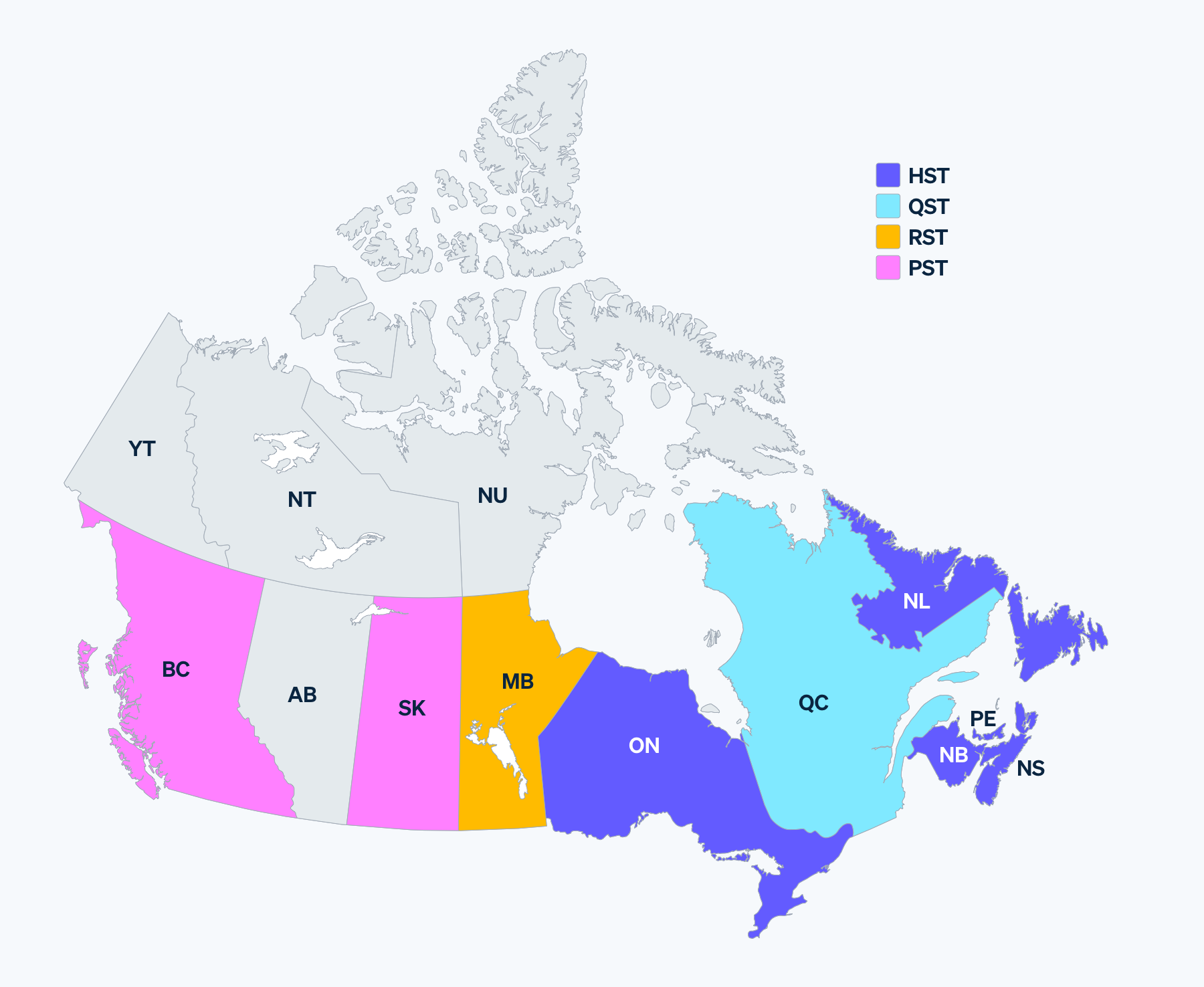

The Canadian tax system consists of federal and provincial taxes. The Goods and Services tax (GST) applies nationally. Five provinces—New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island—have coordinated their provincial sales taxes with the GST to implement the Harmonized Sales Tax (HST), which operates in the same way as the GST. Businesses in these provinces will only need to collect HST.

Separate provincial sales taxes (PST) are collected in British Columbia (BC), Manitoba, Québec, and Saskatchewan. In Québec, the PST is called Québec sales tax (QST). In Manitoba, the PST is called the retail sales tax (RST). In Saskatchewan and British Columbia, it is referred to as PST. Four provinces—Alberta, Northwest Territories, Nunavut, and Yukon—do not apply any provincial sales tax.

A map of the different provincial taxes in Canada. GST applies nationwide.

What is a GST number?

A goods and services tax (GST) number is a unique identifier issued by the Canadian Revenue Agency (CRA) that identifies businesses registered to collect and remit GST in Canada. The registration process is simple and straightforward, with registration available online through the CRA website.

Registering to collect tax in Canada

When to register

Canada has two distinct GST/HST registration regimes for many non-resident and digital‑economy businesses: the normal regime and the simplified regime. They differ mainly in who must register, how tax is reported, and whether input tax credits (ITCs) are available.

Normal registration is the traditional regime for Canadian‑resident businesses and non-residents “carrying on business” in Canada, as well as for certain non-residents that sell goods delivered in Canada.

Under the normal regime, a non-resident business supplying goods and services in Canada must register for federal Goods and Services Tax (GST) if they meet the following criteria:

- They provide taxable (including zero-rated) supplies in Canada in the course of carrying on business activity in Canada, and they are not a small supplier.

- They make taxable supplies of admissions in Canada for a place of amusement, a seminar, an activity, or an event held in Canada (even if they are a small supplier).

- They host a convention in Canada and more than 25% of the delegates are residents of Canada (even if they are a small supplier).

A business qualifies as a small supplier if their worldwide taxable supplies are $30,000 or less in any single calendar quarter and in the last four consecutive calendar quarters.

As of July 1, 2021, there are special rules for digital economy businesses. Non-resident businesses that sell taxable digital products or services and other Canadian entities that are not registered under the normal GST/HST regime are required to register if their revenue exceeds $30,000 CAD over any 12-month period. Such businesses may use a simplified GST/HST registration procedure. A business required to be registered under the simplified GST/HST can voluntarily apply to register for normal GST/HST, if it meets certain conditions.

Businesses may want to register for the simplified GST/HST because it makes it easier to report and remit the GST/HST collected. Here are a few benefits to the simplified registration process:

- You do not need to provide the tax administration with the security deposit that is normally required from non-residents who register for GST/HST.

- Payments (remittances) are made on a quarterly basis, based on your calendar quarter reporting period. For businesses not using the simplified registration process, filing frequencies vary depending on turnover.

- You are able to apply for authorization to make those payments in a qualifying foreign currency.

- The net tax you would be required to calculate and report is simplified since you would not be allowed to claim input tax credits (ITC).

How to register to collect tax in Canada

Before you collect GST and other Canadian taxes, you need to register with the appropriate tax authority. You can register under the simplified GST/HST online. To register under the normal GST/HST regime (including for a non‑resident convention organizer), use the CRA’s standard business registration portal.

It’s important to keep in mind that businesses might not meet the tax registration threshold at the country level but still need to register to collect provincial taxes.

If you’ve exceeded the tax threshold in Canada and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting taxes. Do not begin collecting tax until you have properly registered.

Registering to collect tax in British Columbia

When to register

BC requires businesses making taxable sales of goods or services in the province, including software and telecommunication services, to register for PST collection if their gross revenue from all taxable and exempt sales to BC customers was more than $10,000 in the previous 12 months or is expected to exceed that amount in the next 12 months.

Given the federal GST threshold and the individual province thresholds, sellers must keep accurate, clear revenue records to ensure they are collecting the right taxes. For example, if a seller in BC has sales over $10,000 but under $30,000 (the GST threshold), they are not required to register to collect GST, only PST. However, if the seller expects revenue to exceed the federal tax threshold in the next 12 months, they are required to register for GST/HST.

How to register to collect tax in British Columbia

Before you collect PST, you need to register with the appropriate taxing authority. You can register to collect PST online.

If you’ve exceeded the tax threshold in Canada and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting taxes. Do not begin collecting tax until you have properly registered.

Registering to collect tax in Manitoba

When to register

Canadian businesses outside of Manitoba and businesses in foreign countries that deliver tangible personal property to Manitoba or solicit and accept sales in the province must register to collect RST. Effective December 1, 2021, Manitoba expanded its taxing authority to include sales of digital services made by out-of-province sellers. Anyone who operates an online accommodation platform or online sales platform or provides streaming services must be registered to collect RST. Since there are no economic nexus thresholds for out-of-province sellers, they must be registered from the first sale.

How to register to collect tax in Manitoba

Before you collect RST, you need to register with the appropriate taxing authority. You can register to collect RST online.

If you’ve exceeded the tax threshold in Canada and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting taxes. Do not begin collecting tax until you have properly registered.

Registering to collect tax in Saskatchewan

When to register

Canadian businesses outside of Saskatchewan and non-Canadian businesses that make retail sales for use or consumption in Saskatchewan must register to collect PST. There is no economic nexus threshold for non-residents in Saskatchewan, meaning that PST of 6% needs to be collected from the first transaction. This guidance applies to a variety of digital products, such as digital audio and video downloads, software, software services, and cloud-based services.

How to register to collect tax in Saskatchewan

Before you collect PST, you need to register with the appropriate taxing authority. You can register to collect PST online via this link.

If you’ve exceeded the tax threshold in Canada and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting taxes. Do not begin collecting tax until you have properly registered.

Registering to collect tax in Québec

When to register

Non-residents selling into Québec may register under either the specified or the general system. The following categories of non-resident sellers are required to use the specified system if their taxable sales in Québec exceed $30,000 CAD in a 12-month period:

- Sellers outside Canada that sell incorporeal movable property or services in Québec

- Sellers outside Québec that sell corporeal movable property, incorporeal movable property, or services to Québec consumers

How to register to collect tax in Québec

Before you collect QST, you need to register with the appropriate taxing authority. You can register to collect QST online.

If you’ve exceeded the tax threshold in Canada and are concerned you owe penalties and back taxes, we recommend you contact a tax expert for guidance. Once you register, you can begin collecting taxes. Do not begin collecting tax until you have properly registered.

How Stripe Tax can help

Stripe helps marketplaces build and scale powerful global payments and financial services businesses with less overhead and more opportunities for growth. Stripe Tax reduces the complexity of global tax compliance so you can focus on growing your business. It automatically calculates and collects sales tax, VAT, and GST on both physical and digital goods and services in all US states and in 100 countries. Stripe Tax is natively built into Stripe, so you can get started faster—no third-party integration or plug-ins are required.

Stripe Tax can help you:

- Understand where to register and collect taxes: See where you might need to collect taxes based on your Stripe transactions. After you register, you can switch on tax collection in a new state or country in seconds. You can start collecting taxes by adding one line of code to your existing Stripe integration or add tax collection to Stripe’s no-code products, such as Invoicing, with the click of a button.

- Register to pay tax: If your business is in the US, let Stripe manage your tax registrations, and benefit from a simplified process that prefills application details—saving you time and simplifying compliance with local regulations. If you’re located outside the US, Stripe partners with Taxually to help you register with local tax authorities.

- Automatically collect sales tax: Stripe Tax calculates and collects the amount of tax owed. It supports hundreds of products and services, and it is up-to-date on tax rule and rate changes.

- Simplify filing and remittance: With our trusted global partners, users benefit from a seamless experience that connects to your Stripe transaction data—letting our partners manage your filings so you can focus on growing your business.

Learn more about Stripe Tax.