在加拿大有纳税义务的企业往往需要遵守多个层面的规定。除了全国性的商品及服务税外,企业还必须考虑各省的具体税收法规。随着企业的发展,确保及时履行税务合规义务也很重要。首先要在有纳税义务的所有地区进行正确的税务注册。

本指南将帮助您确定在加拿大销售时何时需要注册收税,从而避免因不合规而产生的罚款和利息。它还将帮助非居民企业了解在各省进行税务注册的流程。我们还将分享 Stripe 如何帮助您管理持续的税务合规性。

什么是加拿大的商品及服务税 (GST)?

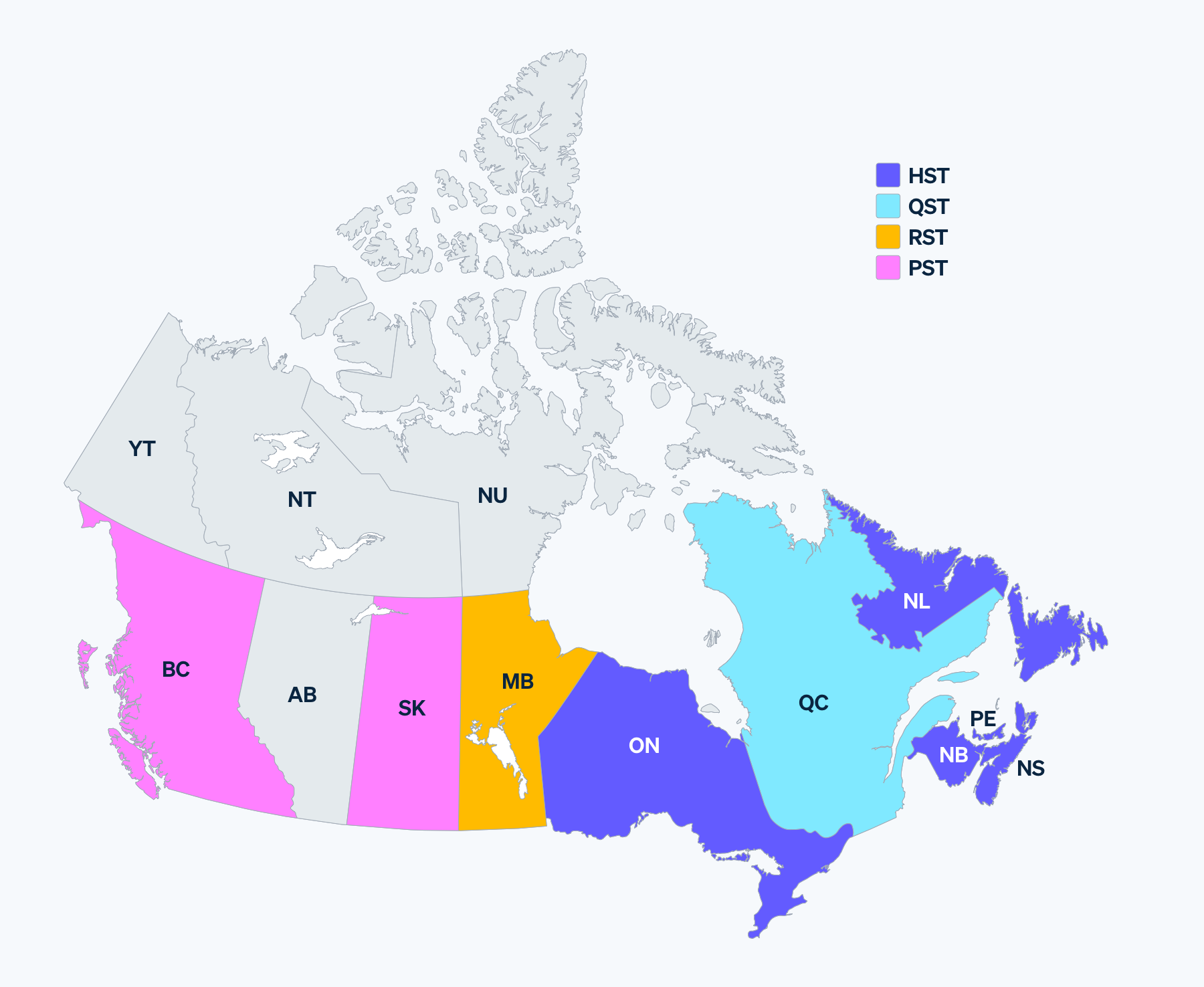

加拿大的税收制度由联邦税和省税组成。商品及服务税 (GST) 适用于全国。新不伦瑞克省、纽芬兰省和拉布拉多省、新斯科舍省、安大略省和爱德华王子岛省这五个省将本省的销售税与商品及服务税进行了协调,实施了统一销售税 (HST),其运作方式与商品及服务税相同。这些省份的企业只需征收 HST。

不列颠哥伦比亚省 (BC)、马尼托巴省、魁北克省和萨斯喀彻温省分别征收省级销售税 (PST)。在魁北克省,PST 被称为魁北克销售税 (QST)。在马尼托巴省,PST 被称为零售税 (RST)。在萨斯喀彻温省和不列颠哥伦比亚省,它被称为 PST。阿尔伯塔省、西北地区、努纳武特地区和育空地区这四个省不征收任何省级销售税。

加拿大各省税收地图。商品及服务税适用于加拿大全国。

什么是 GST 号码?

商品及服务税 (GST) 号码是加拿大税务局 (CRA) 颁发的唯一标识符,用于识别在加拿大注册收取和汇付商品及服务税的企业。注册程序简单明了,可通过 CRA 网站在线注册。

在加拿大注册收税

何时注册

加拿大针对多数非居民及数字经济企业设有两种不同的商品及服务税/统一销售税注册制度:常规制度与简易制度。二者主要差异体现在注册主体资格、纳税申报方式以及进项税抵免 (ITC) 的适用性。

常规注册制度是加拿大居民企业及在加“开展业务”的非居民企业适用的传统制度,同时也适用于在加拿大交付商品的特定非居民企业。

根据常规制度,在加拿大供应商品与服务的非居民企业若符合以下标准,必须注册联邦商品及服务税 (GST):

- 该等企业在加拿大开展业务活动过程中提供应税(包括零税率)供应,且不属于小型供应商范畴。

- 该等企业在加拿大为娱乐场所、研讨会、活动或赛事提供入场资格的应税供应(即使属于小型供应商亦不例外)。

- 该等企业在加拿大主办会议且参会代表超过 25% 为加拿大居民(即使属于小型供应商亦不例外)。

若企业在任意单个日历季度及过去四个连续日历季度内,全球应税供应总额不超过 3 万加元,则符合小型供应商资格。

自 2021 年 7 月 1 日起,数字经济企业适用特殊规定。销售应税数字产品或服务的非居民企业,以及未按常规商品及服务税/统一销售税制度注册的其他加拿大实体,若其 12 个月内收入超过3万加元,必须完成注册。此类企业可采用简易商品及服务税/统一销售税注册程序。符合特定条件的简易商品及服务税/统一销售税注册企业,亦可自愿申请转为常规商品及服务税/统一销售税注册。

企业可选择简易商品及服务税/统一销售税注册,因其能简化税款申报与缴纳流程。该注册方式具有以下优势:

- 您无需向税务管理部门提供通常要求非居民注册商品及服务税/统一销售税时缴纳的保证金。

- 采用简易注册程序的企业须按日历季度进行支付(税款缴纳)。而未选择简易注册的企业,其申报频率将根据营业额有所不同。

- 企业可申请使用符合条件的外币进行税款支付。

- 由于不可申报进项税税额减免 (ITC),您需计算并申报的净税额将大幅简化。

加拿大税务登记指南

在征收商品及服务税及其他加拿大税项前,需向相应税务机关完成登记。您可通过在线渠道办理简易商品及服务税/统一销售税注册。若需按常规商品及服务税/统一销售税制度登记(包括非居民会议主办方),请使用加拿大税务局标准商业登记门户。

需特别注意:企业可能未达到国家级税务登记门槛,但仍需注册申报省级税费。

若您已超过加拿大税务起征点且担心面临罚款与欠税风险,建议咨询税务专家获取指导。完成登记后即可开始代征税款,但务必在完成合规登记后方可启动代征程序。

在不列颠哥伦比亚省注册收税

何时注册

不列颠哥伦比亚省规定,在该省销售应税商品或服务(包括软件和电信服务)的企业,如果在过去 12 个月中向不列颠哥伦比亚省客户销售的所有应税和免税商品或服务的总收入超过 10,000 加元,或预计在未来 12 个月中将超过这一金额,则必须登记缴纳 PST。

鉴于联邦商品及服务税的门槛和各省的门槛,卖家必须保存准确、清晰的收入记录,以确保收取正确的税款。例如,如果不列颠哥伦比亚省的卖家销售额超过 10,000 加元但低于 30,000 加元(商品及服务税起征点),则无需注册征收商品及服务税,只需注册征收 PST。但是,如果卖家预计未来 12 个月的收入将超过联邦税起征点,则必须注册 GST/HST。

如何在不列颠哥伦比亚省注册收税

在收取 PST 之前,您需要向有关税务机关注册。您可以在线注册收取 PST。

如果您在加拿大的纳税额已超过起征点,并担心自己欠下罚款和需要补税,我们建议您联系税务专家寻求指导。注册后,即可开始收税。在正确注册之前,请勿开始收税。

在马尼托巴省注册收税

何时注册

向马尼托巴省交付有形个人财产或在该省招揽和接受销售的马尼托巴省以外的加拿大企业和外国企业必须注册以征收 RST。自 2021 年 12 月 1 日起,马尼托巴省扩大了征税范围,将省外卖家的数字服务销售也纳入征税范围。任何经营在线住宿平台或在线销售平台或提供流媒体服务的人都必须注册以征收 RST。由于省外卖家没有经济关联门槛,因此他们必须从首次销售开始注册。

如何在马尼托巴省注册收税

在征收 RST 之前,您需要在相应的税务机关注册。您可以在线注册征收 RST。

如果您在加拿大的纳税额已超过起征点,并担心自己欠下罚款和需要补税,我们建议您联系税务专家寻求指导。注册后,即可开始收税。在正确注册之前,请勿开始收税。

在萨斯喀彻温省注册收税

何时注册

萨斯喀彻温省以外的加拿大企业和在萨斯喀彻温省进行零售以使用或消费的非加拿大企业必须注册以征收 PST。萨斯喀彻温省对非居民没有经济关联门槛,这意味着需要从第一笔交易开始征收 6% 的 PST。该指南适用于各种数字产品,如数字音频和视频下载、软件、软件服务和基于云的服务。

如何在萨斯喀彻温省注册收税

在征收 PST 之前,您需要在相应的税务机关注册。您可以通过此链接在线注册以征收 PST。

如果您在加拿大的纳税额已超过起征点,并担心自己欠下罚款和需要补税,我们建议您联系税务专家寻求指导。注册后,即可开始收税。在正确注册之前,请勿开始收税。

在魁北克注册收税

何时注册

在魁北克销售的非居民可以在指定系统或一般系统下注册。以下类别的非居民卖家如果在 12 个月内于魁北克的应税销售额超过 30,000 加元,则必须使用指定系统:

- 在魁北克省销售无形动产或服务的加拿大境外卖家

- 向魁北克省消费者出售有形动产、无形动产或服务的魁北克省以外的卖家

如何在魁北克注册收税

在收取 QST 之前,您需要向相关税务机关注册。您可以在线注册征收 QST。

如果您在加拿大的纳税额已超过起征点,并担心自己欠下罚款和需要补税,我们建议您联系税务专家寻求指导。注册后,即可开始收税。在正确注册之前,请勿开始收税。

Stripe Tax 如何提供帮助

Stripe 助力交易市场以更低成本构建并扩展全球支付与金融服务业务,开拓更广阔的增长机遇。Stripe Tax 显著简化全球税务合规复杂度,让您专注业务发展。该系统全自动计算并征收全美各州及 100 个国家/地区的实体与数字商品服务相关的销售税、增值税及商品及服务税。该功能原生内置于 Stripe 平台,无需第三方集成或插件即可快速启用。

Stripe Tax 可帮助您:

- 了解在哪里注册和收税:基于 Stripe 交易数据,研判需代征税费的地区。您可以在几秒钟内在新的州或国家/地区开启税费代收功能。您可以通过在现有的 Stripe 集成中添加一行代码来开始收税;也可以向 Stripe 的无代码产品(例如 Invoicing)添加税费代收功能。

- 注册缴纳税款:如果您的企业位于美国,可以让 Stripe 代为管理税务注册事宜,享受预填申请详情的简化流程——为您节省时间,简化当地法规合规流程。如果您位于美国境外,Stripe 将与 Taxually 合作,帮助您在当地税务机关完成登记。

- 自动收取销售税:Stripe Tax 能自动完成应纳税额的计算与收取,支持数百种产品与服务,并实时同步全球税规与税率更新。

- 简化申报和上缴流程:通过与我们可信赖的全球合作伙伴的合作,用户可以体验到与您的 Stripe 交易数据无缝链接,我们的合作伙伴会帮助您管理申报事宜,让您能够专注于发展业务。

了解有关 Stripe Tax 的更多信息。