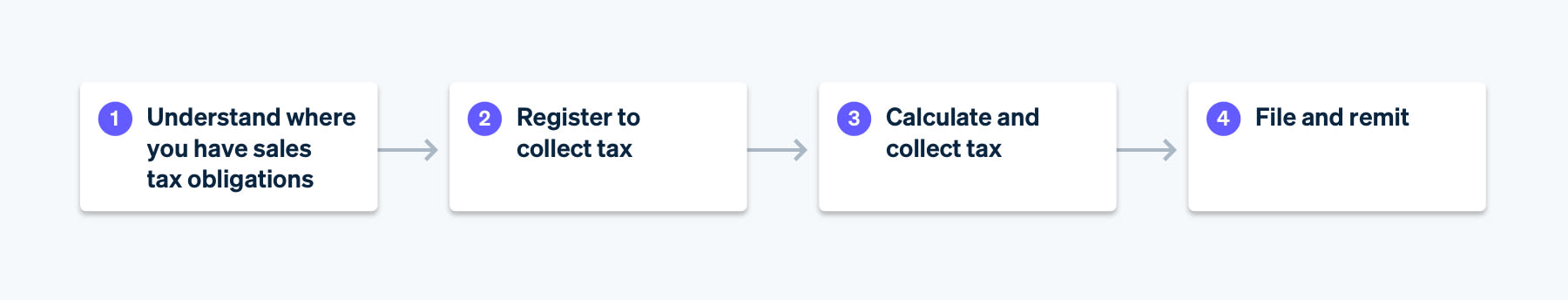

Um sicherzustellen, dass Ihr Unternehmen weiterhin steuerkonform bleibt, müssen Sie zunächst klären, wo Sie zur Erhebung von Steuern auf Ihre Umsätze verpflichtet sind und die Economic-Nexus-Gesetze einhalten. Anschließend müssen Sie das Verfahren zur Steuerregistrierung für die Sales Tax bei der zuständigen Steuerbehörde befolgen, den richtigen Steuerbetrag von Ihren Kundinnen und Kunden berechnen und einziehen und schließlich Ihre Steuererklärung einreichen und die eingezogenen Steuern an die zuständige Steuerbehörde überweisen.

Die ordnungsgemäße Erstellung und Einreichung Ihrer Steuererklärungen und die Überweisung der erhobenen Steuern kann kompliziert sein, da jeder US-Bundesstaat und andere lokale Steuerbehörden unterschiedliche Regeln haben, z. B. wie oft Sie die Steuererklärung einreichen müssen, welche Art von Informationen Sie angeben müssen, welches Formular Sie verwenden müssen, wie Sie Ihre Steuererklärung und Zahlung einreichen müssen und andere administrative Unterschiede.

In diesem Leitfaden finden Sie ausführliche Informationen zur Einreichung von Sales Tax-Erklärungen in den USA, einschließlich spezifischer Anweisungen für die Einreichung einer Sales Tax in den einzelnen US-Bundesstaaten.

Grundlagen der Einreichung und Überweisung

Die Verkaufssteuer ist eine indirekte Steuer. Indirekte Steuern gelten für den Verkauf von Waren oder Dienstleistungen, die von der Kundin oder vom Kunden an ein Unternehmen bezahlt werden, welches wiederum die erhobene Steuer an den Staat oder eine andere lokale Steuerbehörde abführen muss. Aus diesem Grund wird die Verkaufssteuer oft als „Durchlaufsteuer” bezeichnet. Die Steuer wird vom Kunden/von der Kundin bzw. vom Käufer/von der Käuferin an den Verkäufer/die Verkäuferin weitergegeben, der bzw. die die erhobene Steuer dann an die Steuerbehörde überweist. Es ist wichtig, sich daran zu erinnern, dass Sie als Unternehmen als Vertreter des Staates oder einer anderen lokalen Steuerbehörde fungieren, d. h. Sie halten die eingenommenen Steuergelder im Namen der Steuerbehörde und müssen den eingenommenen Betrag bei der Einreichung Ihrer Steuererklärung überweisen oder zahlen. Die Einreichung ist die Abgabe einer Verkaufssteuererklärung oder eines Berichts über Ihre Verkaufstätigkeit für einen bestimmten Zeitraum, während die Überweisung die Abgabe der eingenommenen Steuer an die zuständigen Regierungsbehörden ist.

In den meisten Fällen ist Ihre Steuerzahlung (Überweisung) zum gleichen Zeitpunkt fällig wie Ihre Steuererklärungen und -berichte. Die Einreichung und die Überweisung gehen oft Hand in Hand, jedoch ist es wichtig zu beachten, dass es sich um zwei getrennte Vorgänge handelt.

Die Häufigkeit Ihrer Einreichung und Überweisung ist für Ihr Unternehmen einzigartig und wird vom Bundesstaat oder einer anderen lokalen Steuerbehörde festgelegt, wenn Sie sich für die Steuereinziehung verpflichten. Unternehmen mit hohem Geschäftsvolumen müssen häufigere Erklärungen einreichen als kleine Unternehmen. Daher kann sich die Häufigkeit Ihrer Erklärungen ändern, wenn Ihr Unternehmen wächst.

Einreichung einer Verkaufssteuererklärung

Die Einreichung einer Steuererklärung umfasst eine Zusammenfassung Ihrer Verkaufstransaktionen für den Berichtszeitraum, einschließlich der Beträge, die Sie von Ihren Kundinnen und Kunden eingezogen haben. Eine Steuererklärung enthält je nach den formalen Anforderungen detaillierte Informationen, darunter Ihre Bruttoverkäufe, Abzüge einschließlich nicht steuerpflichtiger und steuerbefreiter Verkäufe, steuerpflichtige Verkäufe und die Höhe der eingenommenen Steuern. Die gemeldeten Beträge müssen möglicherweise auch nach untergeordneten Zuständigkeitsbereichen oder nach Meldeort aufgeschlüsselt werden.

Jede staatliche oder lokale Steuerbehörde legt die spezifischen Details, das Format und die Häufigkeit fest, die für die Meldung und Einreichung von Steuern erforderlich sind. Einige US-Bundesstaaten verlangen beispielsweise, dass Unternehmen ihre Verkäufe nach Stadt, Bezirk oder Sondersteuerbezirk melden, wenn sie ihre Steuererklärung einreichen. Es gibt andere Bundesstaaten, die nur Informationen auf konsolidierter oder staatlicher Ebene benötigen. Genaue, detaillierte und aktualisierte Aufzeichnungen sind für die Einhaltung der Steuerkonformität von entscheidender Bedeutung und werden hilfreich sein, wenn es an der Zeit ist, eine Steuererklärung einzureichen oder im Falle einer Prüfung.

Wichtige Hinweise zur Einreichung

- Einreichungshäufigkeit: Die Einreichungshäufigkeit wird von den Steuerbehörden festgelegt und den Unternehmen mitgeteilt, wenn sie sich für die Steuererhebung registrieren. Die Einreichungshäufigkeit kann sich je nach Jahresumsatz und anderen Faktoren ändern. Möglicherweise müssen Sie monatlich, jährlich oder in einem anderen Rhythmus Steuern abführen.

- Steuererklärungen ohne Angaben: Auch wenn Sie in einem bestimmten Berichtszeitraum in einem bestimmten Gebiet keine Steuern erhoben haben, müssen Sie möglicherweise trotzdem eine Steuererklärung abgeben. Bereiten Sie sich darauf vor, die Steuererklärung bis zum Fälligkeitsdatum für jeden Berichtszeitraum einzureichen, unabhängig von den in diesem Zeitraum getätigten Verkäufen. Wenn Sie weiterhin keine Steuererklärungen einreichen, werden Sie möglicherweise von der Steuerbehörde darüber informiert, dass Sie nicht mehr zur Abgabe einer Steuererklärung verpflichtet sind. Bis Sie eine Änderung der Häufigkeit erhalten, sollten Sie sich an Ihren Zeitplan halten.

- Ausnahmen: Unternehmen sollten Abzüge und Befreiungen berücksichtigen, wenn sie ihre Verkaufssteuererklärungen ausfüllen. Diese variieren je nach Standort, aber zu den gängigen Arten von Abzügen gehören Ausnahmen für den Wiederverkauf, steuerbefreite Produkte, Verkäufe, bei denen Steuern von Marktplatzvermittlern eingezogen wurden, und Verkäufe an befreite Organisationen. Nicht bei jedem Verkauf müssen Sie Steuern von Kundinnen und Kunden erheben, aber Sie sollten sich über diese Ausnahmen im Klaren sein, bevor Sie die Verkaufssteuererklärung abgeben.

- __ Bundesstaaten mit kommunaler Selbstverwaltung:__ In Bundesstaaten mit kommunaler Selbstverwaltung können einzelne Städte mit kommunaler Selbstverwaltung ihre eigene Verkaufssteuer erheben und ihre eigenen Steuerbemessungsgrundlagen festlegen. Diese Städte können ihre eigenen Steuerregeln festlegen, und Verkäufer/innen müssen unter Umständen zusätzliche Registrierungen und Einreichungen in diesen Gebieten vornehmen. Die folgenden Bundesstaaten sind Bundesstaaten mit kommunaler Selbstverwaltung: Alabama, Alaska, Arizona, Colorado und Louisiana.

Überweisung

Während bei der Einreichung die erhobene Steuer gemeldet wird, wird bei der Überweisung die erhobene Steuer an die bundesstaatliche oder lokale Steuerbehörde überwiesen. Ähnlich wie bei der Steuererklärung schreibt jede Steuerbehörde ihre eigene Methode und ihren eigenen Zeitplan für die Überweisung vor, die je nach Ihrem Umsatzvolumen an diesem Standort variieren können. In Connecticut beispielsweise variiert die Häufigkeit zwischen monatlich, vierteljährlich und jährlich, basierend auf der Gesamtsteuerschuld. Bis auf wenige Ausnahmen wird die Steuer in der Regel mit der Einreichung fällig.

- Fälligkeitstermine: Stellen Sie sicher, dass Ihre Steuerzahlungen fristgerecht eingereicht werden, um die Zahlung von Strafen und Zinsen zu vermeiden.

- Zahlungsmethoden: Einige Steuerbehörden erlauben nur elektronische Zahlungen wie ACH, EFT (Electronic Funds Transfer) oder Kredit- und Debitkartenzahlungen.

- Verlängerungen und Hilfsmaßnahmen: Wie schon in der Pandemie haben viele Bundesstaaten Steuererleichterungen eingeführt, um Unternehmen mehr Zeit für die Anmeldung und Abführung der Verkaufssteuer zu geben. Bei Naturkatastrophen oder anderen größeren Störungen ist dies gängige Praxis. Einzelheiten zu den Erleichterungen werden von der staatlichen Steuerbehörde bekannt gegeben.

Einreichung und Abführung von Verkaufssteuererklärungen nach Bundesstaat

Um Verkaufssteuern einzureichen und abzuführen, müssen Sie Erklärungen bei jeder Steuerbehörde einreichen, bei der Sie gemeldet sind und Steuern eingezogen haben. In den meisten Regionen sind die Online-Einreichung von Steuererklärungen und elektronische Zahlungen erforderlich. In einigen Regionen ist es Unternehmen jedoch auch möglich, ihre Dokumente physisch per Post zu versenden.

Alabama

Das Alabama Department of Revenue verlangt, dass Verkäufer/innen die Verkaufssteuer online einreichen und abführen. Sie können Ihre Steuererklärung online unter My Alabama Taxes (MAT) einreichen. Wenn Sie jedoch mehr als 750 USD in einer Zahlung abführen, müssen Sie in Alabama per elektronischer Überweisung (EFT) über My Alabama Taxes ONE SPOT bezahlen.

Alaska

Die Verkaufssteuer kann online bei der Alaska Remote Seller Sales Tax Commission eingereicht und abgeführt werden.

Arizona

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Arizona (in Arizona als „Transaction Privilege Tax“ bezeichnet) einzureichen und zu überweisen:

- Online-Einreichung beim Arizona Department of Revenue

- Die Einreichung per Post erfolgt mit dem Formular TPT-EZ, wenn Sie innerhalb des Bundesstaates ansässig sind, oder mit dem Formular TPT-2, wenn Sie außerhalb des Bundesstaates ansässig sind. Verkäufer/innen sind jedoch verpflichtet, ihre Steuererklärung online einzureichen und zu bezahlen, wenn ihre Steuerschuld im Vorjahr 1.000.000 USD oder mehr betrug.

Arkansas

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Arkansas einzureichen und abzuführen:

- Online-Einreichung beim Arkansas Taxpayer Access Point (ATAP).

- Die Einreichung per Post erfolgt mit dem Formular ET-1. Um diese Methode zu nutzen, müssen Sie sich unter 501-682-7104 an das Arkansas Department of Finance and Administration wenden. Das Formular ET-1 wird Ihnen dann per Post zugestellt.

Kalifornien

Verkäufer/innen haben zwei Möglichkeiten, ihre kalifornische Verkaufssteuer einzureichen:

- Online über das California Department of Tax and Fee Administration.

- Per Post unter Verwendung des kalifornischen Kurzformulars – Sales and Use Tax Return. Sie müssen online bezahlen, wenn Ihre geschätzte monatliche Steuerschuld 10.000 USD oder mehr beträgt.

Colorado

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Colorado einzureichen:

- Online-Einreichung beim Colorado Department of Revenue.

- Einreichen per Post unter Verwendung des Formulars Form DR-0100 und Übersendung des Formulars an das Colorado Department of Revenue.

Connecticut

Die Verkaufssteuer muss online beim Connecticut Department of Revenue Services eingereicht und abgeführt werden.

District of Columbia

Verkäufer/innen haben zwei Möglichkeiten für die Einreichung und Abführung ihrer Verkaufssteuer in Washington, DC:

- Online-Einreichung bei MyTax DC.

- Einreichung per Post unter Verwendung eines der drei Formulare:

- Formular für jährliche Einreichungen: Formular FR-800A

- Formular für vierteljährliche Einreichungen: FR-800Q

- Formular für monatliche Einreichungen: FR-800M

- Formular für jährliche Einreichungen: Formular FR-800A

Florida

Verkäufer/innen haben zwei Möglichkeiten für die Einreichung und Abführung ihrer Verkaufssteuer in Florida:

- Online-Einreichung beim Florida Department of Revenue.

- Einreichung per Post unter Verwendung des Formulars Form DR-15.

Georgia

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Georgia einzureichen und abzuführen:

- Online-Einreichung beim Georgia Department of Revenue.

- Einreichung per Post unter Verwendung des Formulars ST-3.

Hawaii

Hawaii hat keine traditionelle Verkaufssteuer. Stattdessen gibt es eine allgemeine Verbrauchssteuer „GET“ (General Excise Tax). Die GET ist keine Steuer auf einen Verkauf, die vom Käufer/von der Käuferin gezahlt wird, sondern eine Steuer für das „Recht, im Bundesstaat Hawaii Geschäfte zu tätigen“, die vom Verkäufer/von der Verkäuferin erhoben wird. In Hawaii ist ein/e Verkäufer/in für die Abführung von GET verantwortlich, unabhängig davon, ob sie/er GET für eine Transaktion erfasst oder nicht. Verkäufer/innen dürfen GET jedoch an Kundinnen und Kunden weitergeben, und deshalb werden Sie, wenn Sie einen Kauf auf Hawaii tätigen, wahrscheinlich einen kleinen Prozentsatz des Verkaufs auf Ihrer Quittung sehen, um die GET abzudecken. Weitere Informationen finden Sie hier. Verkäufer/innen können ihre Hawaii-GET online bei Hawaii Tax Online einreichen und abführen.

Idaho

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Idaho einzureichen und abzuführen:

- Online-Einreichung beim Idaho State Tax Commission's Taxpayer Access Point (TAP).

- Einreichung per Post mit Formular 850. Der staatliche Steuerkommissar muss Ihnen ein personalisiertes 850-Formular zusenden.

Illinois

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Illinois einzureichen und abzuführen:

- Online-Einreichung unter MyTax Illinois.

- Einreichung per Post unter Verwendung des Formulars ST-1.

Indiana

Verkäufer/innen können ihre Verkaufssteuer für Indiana online beim Indiana Department of Revenue einreichen und überweisen.

Iowa

Verkäufer/innen können ihre Verkaufssteuer in Iowa online beim Iowa Department of Revenue.

Kansas

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Kansas einzureichen und abzuführen:

- Online beim Kansas Department of Revenue. Wenn Sie dieses System noch nie verwendet haben, müssen Sie sich möglicherweise an das Kansas Department of Revenue wenden, um Ihren Zugangscode zu erhalten.

- Verkäufer/innen sollten das Formular ST-36 für die Einreichung per Post verwenden. Das Formular CT-9U kann ebenfalls verwendet werden.

Kentucky

Verkäufer/innen können ihre Verkaufssteuer in Kentucky online beim Kentucky Department of Revenue einreichen und abführen.

Louisiana

Je nachdem, über welche Art von Lizenz ein/e Verkäufer/in verfügt und ob es sich um Fernabsatz handelt oder ob er/sie in Louisiana ansässig ist, muss er eine der folgenden drei Möglichkeiten für die Einreichung wählen:

- Online über E-Parish.

- Online über Remote Sellers Filing.

- Online auf der Website des Louisiana Taxpayer Access Point.

Maine

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Maine einzureichen und abzuführen:

- Online-Einreichung über das Maine Tax Portal.

- Einreichung per Post unter Verwendung des Formulars ST-7

Maryland

Verkäufer/innen können ihre Verkaufssteuer in Maryland online auf der Comptroller of Maryland Website einreichen und abführen.

Massachusetts

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Massachusetts einzureichen und abzuführen:

- Online-Einreichung beim Massachusetts Department of Revenue. Unternehmen mit einer Steuerschuld von mehr als 5.000 USD müssen diese Methode zur Einreichung verwenden.

- Einreichung per Post unter Verwendung des Formulars ST-9.

Michigan

Verkäufer/innen können ihre Verkaufssteuer für Michigan online beim Michigan Treasury Online einreichen und überweisen.

Minnesota

Verkäufer/innen haben zwei Möglichkeiten für die Einreichung und Abführung ihrer Verkaufssteuer in Minnesota:

- Online-Einreichung beim Minnesota Department of Revenue.

- Telefonisch unter 1-800-570-3329. Wenn Sie jedoch im Steuerjahr (1. Juli bis 30. Juni) eine Verkaufs- und Gebrauchssteuerschuld von 10.000 USD oder mehr haben, müssen Sie alle Steuern ab dem nächsten Kalenderjahr elektronisch zahlen.

Mississippi

Verkäufer/innen können ihre Verkaufssteuer in Mississippi online beim Mississippi Department of Revenue einreichen und abführen.

Missouri

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Missouri einzureichen und abzuführen:

- Online-Einreichung beim Missouri Department of Revenue. Wenn die Einreichung von außerhalb des Bundesstaates erfolgt, wählen Sie „Vendor's Use Tax“ (Gebrauchssteuer des Anbieters). Verkäufer/innen mit hohem Absatzvolumen, die im vergangenen Steuerjahr Zahlungen in Höhe von 8.000 USD oder mehr geleistet haben, müssen ihre Steuererklärung online einreichen. In einigen Fällen müssen Quartalszahler/innen unter Umständen auch online bezahlen.

- Einreichung per Post unter Verwendung des Formulars 53-1. Das Missouri Department of Revenue stellt Ihnen dieses Formular aus. Sie erhalten keine Rücksendungen in Papierform per Post, wenn Sie das Formular zuvor elektronisch eingereicht haben, es sei denn, Sie wenden sich an die Behörde und beantragen zukünftige Rücksendungen in Papierform.

Nebraska

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Nebraska einzureichen und abzuführen:

- Online-Einreichung beim Nebraska Department of Revenue. Die Zahlung erfolgt über Nebraska E-Pay.

- Einreichung per Post unter Verwendung des Formulars 10.

Nevada

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Nevada einzureichen und abzuführen:

- Online-Einreichung beim Nevada Department of Taxation.

- Einreichung per Post unter Verwendung des Formulars TXR-01.01c.

New Jersey

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in New Jersey einzureichen und abzuführen:

- Online-Einreichung beim New Jersey Tax Portal.

- Einreichung per Post unter Verwendung des Formulars ST-50

New Mexico

Es ist wichtig zu wissen, dass New Mexico keine Verkaufssteuer erhebt. Stattdessen gibt es eine Bruttoeinnahmensteuer („Gross Receipts Tax“). Diese Steuer wird von allen Personen erhoben, die in New Mexico geschäftlich tätig sind. In fast allen Fällen gibt der/die Unternehmer/in die Steuer entweder gesondert oder als Teil des Verkaufspreises an den/die Verbraucher/in weiter. Weitere Informationen finden Sie hier. Verkäufer/innen haben zwei Möglichkeiten, ihre Bruttoeinnahmensteuer in New Mexico einzureichen und abzuführen:

- Online-Einreichung unter Verwendung von E-File.

- Einreichung per Post unter Verwendung der Steuererklärung Gross Receipts Tax Return.

New York

Verkäufer/innen können ihre Verkaufssteuer in New York online beim New York Department of Taxation and Finance einreichen und abführen.

North Carolina

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in North Carolina einzureichen und abzuführen:

- Online-Einreichung beim North Carolina Department of Revenue.

- Einreichung per Post unter Verwendung dieses Steuererklärungsformulars.

North Dakota

Verkäufer/innen können ihre Verkaufssteuer in North Dakota online über den North Dakota Taxpayer Access Point (TAP) einreichen und abführen.

Ohio

Verkäufer/innen können ihre Verkaufssteuer in Ohio online beim Ohio Department of Taxation einreichen und abführen.

Oklahoma

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Oklahoma unter OK Tap einzureichen und abzuführen.

Pennsylvania

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Pennsylvania einzureichen und abzuführen:

- Online-Einreichung beim Pennsylvania Department of Revenue.

- Telefonische Einreichung unter 1-800-748-8299.

Rhode Island

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Rhode Island einzureichen und abzuführen:

- Online-Einreichung bei der Rhode Island Division of Taxation.

- Die Bezahlung kann per Post unter Verwendung der Steuererklärung Rhode Island Streamlined Sales Tax Return erfolgen. Verkäufer/innen müssen online eine Steuererklärung einreichen und die Steuer entrichten, wenn ihre Steuerschuld im Vorjahr 200 USD oder mehr betrug.

South Carolina

Verkäufer/innen können ihre Verkäufe in South Carolina online beim South Carolina Department of Revenue einreichen und abführen.

South Dakota

Verkäufer/innen können ihre Verkaufssteuer für South Dakota online beim South Dakota Department of Revenue einreichen und abführen.

Tennessee

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Tennessee einzureichen und abzuführen:

- Online-Einreichung beim Tennessee Department of Revenue.

- Einreichung per Post unter Verwendung des Formulars SLS-450.

Texas

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Texas einzureichen und abzuführen:

- Online-Einreichung auf der TxComptroller eSystems site.

- Einreichung per Post unter Verwendung der Steuererklärung Texas sales and use tax return.

Utah

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Utah einzureichen und abzuführen:

- Online-Einreichung beim Utah Taxpayer Access Point (TAP).

- Verkäufer/innen können sich auch für die Einreichung per Briefpost entscheiden. Nach Erteilung einer Verkaufssteuer-Lizenz sendet die Steuerbehörde jedem/jeder Verkäufer/in eine personalisierte Steuererklärung zu, es sei denn, der/die Verkäufer/in hat sich gegen den Erhalt von Steuererklärungen in Papierform entschieden. Wenn ein/e Verkäufer/in keine Rücksendung in Papierform erhält, liegt es in der Verantwortung des Verkäufers/der Verkäuferin, leere Formulare zu beschaffen, alle entsprechenden Rücksendeformulare einzureichen und die Steuern bis zum Fälligkeitsdatum abzuführen. Alle relevanten Formulare sind auf der Website des Bundesstaates aufgeführt.

Vermont

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Vermont einzureichen und abzuführen:

- Online-Einreichung über das myVTax portal.

- Einreichung per Post und Senden der Zahlung an: Vermont Department of Taxes PO Box 1779, Montpelier, VT 05601-1779.

Virginia

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Virginia einzureichen und abzuführen:

- Einreichung und Abführung über den Virginia Department of Taxation’s VATAX Online Service for Business.

- Einreichung per Post unter Verwendung des Formulars ST-1.

Washington

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in Washington einzureichen und abzuführen:

- Online-Einreichung beim Washington Department of Revenue.

- Sie können verschiedene Formulare für die Einreichung und Bezahlung per Post verwenden.

West Virginia

Verkäufer/innen haben zwei Möglichkeiten, die Verkaufssteuer in West Virginia einzureichen und abzuführen:

- Online-Einreichung unter MyTaxes.

- Einreichen per Post unter Verwendung des Formulars CST200CU.

Wisconsin

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Wisconsin einzureichen und abzuführen:

- Online-Einreichung beim Wisconsin Department of Revenue.

- Einreichung per Post unter Verwendung des Formulars Form ST-12.

Wyoming

Verkäufer/innen haben zwei Möglichkeiten, ihre Verkaufssteuer in Wyoming einzureichen und abzuführen:

- Online-Einreichung unter Verwendung des Wyoming Internet Filing System for Businesses (WYIFS).

- Einreichung per Post unter Verwendung des Formulars 41-1.

So kann Stripe Tax Sie unterstützen

Stripe hilft Marktplätzen, leistungsstarke globale Zahlungs- und Finanzdienstleistungen zu entwickeln und zu skalieren, dabei Betriebskosten zu sparen und sich so neue Wachstumsmöglichkeiten zu erschließen. Stripe Tax vereinfacht Ihre globale Steuerkonformität, damit Sie sich ganz auf Ihr Unternehmenswachstum konzentrieren können. Denn Stripe Tax berechnet und erhebt automatisch die auf materielle und digitale Güter und Dienstleistungen anfallende Verkaufssteuer, Umsatzsteuer oder GST – und zwar in sämtlichen US-Bundesstaaten und 100 Ländern weltweit. Stripe Tax ist nativ in Stripe integriert und erleichtert Ihnen so den Start. Sie müssen keinerlei Drittanbieterprodukte oder Plugins integrieren.

Stripe Tax unterstützt Sie bei Folgendem:

- Ermittlung steuerlicher Melde- und Erhebungspflichten: Erfahren Sie, wo Sie auf Ihre Stripe-Transaktionen Steuern erheben müssen. Nach der Registrierung können Sie innerhalb von Sekunden die Steuererhebung in einem neuen Bundesstaat oder Land aktivieren. Sie können mit der Steuererhebung beginnen, indem Sie Ihrer bestehenden Stripe-Integration eine Codezeile hinzufügen oder die Steuererhebung zu den codefreien Produkten von Stripe, wie z. B. Invoicing, mit einem Klick auf eine Schaltfläche hinzufügen.

- Registrierung zur Steuerzahlung: Wenn Ihr Unternehmen in den USA ansässig ist, überlassen Sie Stripe die Verwaltung Ihrer Steuerregistrierungen und profitieren Sie von einem vereinfachten Verfahren, bei dem die Antragsdaten vorausgefüllt werden – das spart Ihnen Zeit und vereinfacht die Einhaltung lokaler Vorschriften. Wenn Sie außerhalb der USA ansässig sind, arbeitet Stripe mit Taxually zusammen, um Ihnen bei der Registrierung bei den lokalen Steuerbehörden zu helfen.

- Automatische Erhebung der Umsatzsteuer: Stripe Tax berechnet und erhebt den geschuldeten Steuerbetrag. Die Anwendung unterstützt Hunderte von Produkten und Dienstleistungen und ist hinsichtlich Steuerregelungen und Steuersatzänderungen auf dem neuesten Stand.

- Vereinfachung der Steuererklärung und -abführung: Dank unserer vertrauenswürdigen globalen Partner profitieren Nutzer/innen von einer nahtlosen Erfahrung, die mit Ihren Stripe-Transaktionsdaten verbunden ist. Unsere Partner verwalten Ihre Steuererklärungen, damit Sie sich ganz auf das Wachstum Ihres Unternehmens konzentrieren können.

Erfahren Sie mehr über Stripe Tax