Såddpengar – ofta kallat såddfinansiering eller startkapital – är en initial investering som entreprenörer eller grundare använder för att starta ett företag eller ett nytt projekt och täcka initiala driftskostnader. Denna typ av finansiering är vanligtvis en relativt liten mängd kapital, jämfört med andra källor till startfinansiering.

Såddpengar kan komma från en mängd olika källor. Dessa inkluderar grundarna själva, vänner och familj, Affärsänglaroch venturekapitalbolag för tidiga skeden. Hur mycket startkapital som krävs kan variera avsevärt beroende på verksamhetens karaktär och dess initiala behov. Såddpengar gör det möjligt för entreprenörer att gå från idéstadiet till en konkret verksamhet eller produkt. Därifrån kan de visa att deras verksamhet är genomförbar och har potential att locka till sig ytterligare investeringar.

Efter såddstadiet kan en startup ansöka om ytterligare finansieringsrundor – t.ex. Serie A, B och C – som vanligtvis omfattar större mängder kapital och kan komma från venturekapitalföretag, private equity eller andra investerare.

Nedan kommer vi att beskriva vad grundare i ett tidigt skede behöver veta om hur man samlar in såddpengar: var man ska söka dem, hur man väljer rätt finansieringskälla för specifika affärsmål, hur man avslutar affären och hur man spenderar såddpengar på ett klokt sätt.

Vad innehåller den här artikeln?

- Hur såddfinansiering skiljer sig från andra typer av finansiering

- Varför såddfinansiering är viktigt för startups

- Förberedelser för att samla in såddpengar

- Källor till såddpengar

- Hur man samlar in startkapital för en startup

- Hur man förhandlar om såddfinansiering med investerare

- Bästa praxis för hantering av såddpengar

Hur såddfinansiering skiljer sig från andra typer av finansiering

Startups går igenom olika stadier under sin livscykel. Även om varje utvecklingsstadium (och den finansieringsrunda som följer med det) kan variera mellan startups finns det allmänna egenskaper som definierar varje steg.

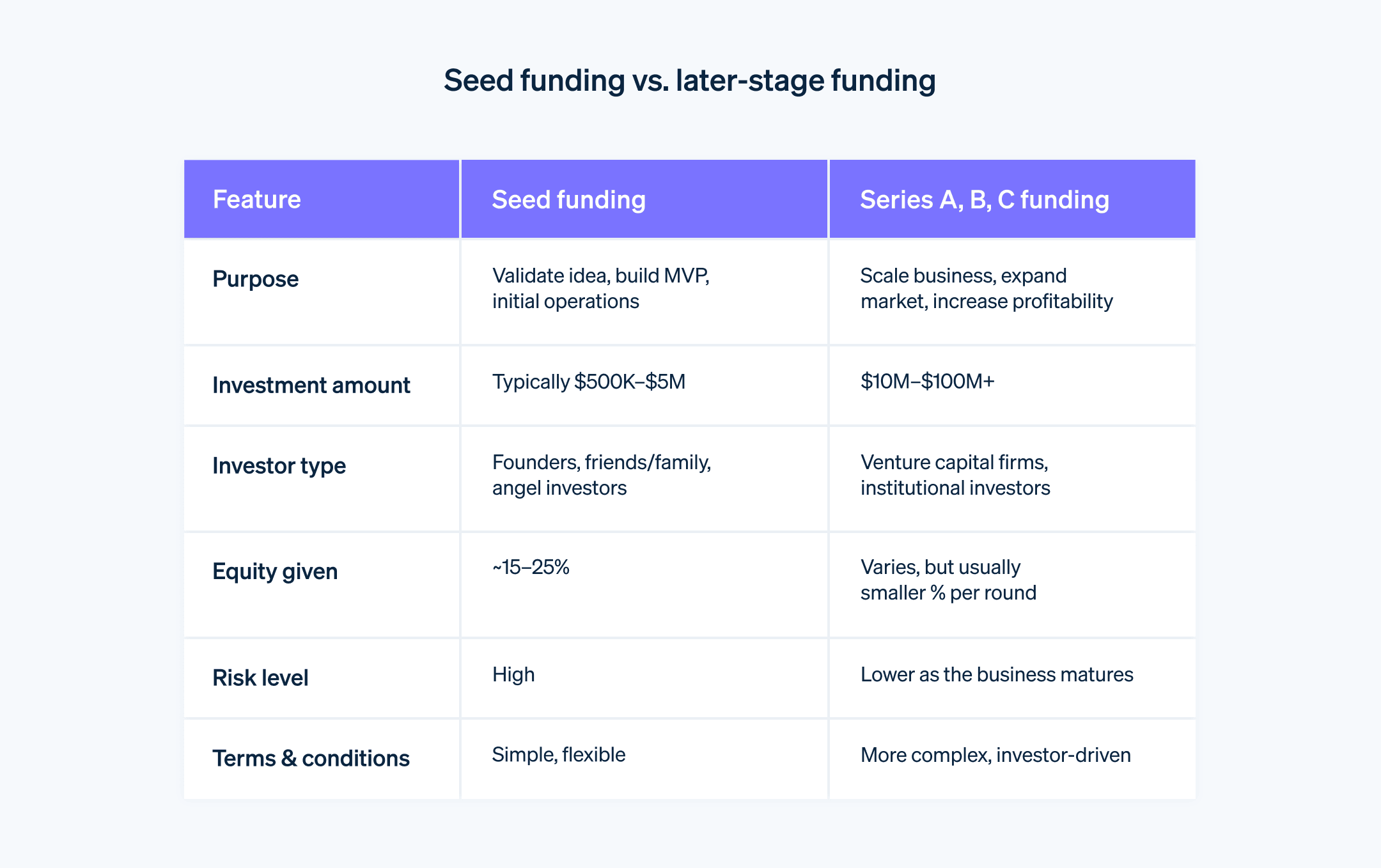

Såddstadiet är utan tvekan den mest volatila – och spännande – tiden för startups. Så här skiljer sig såddfinansiering från andra typer av finansiering som kan komma senare:

Syfte och användning

Såddfinansiering syftar i första hand till att omvandla en idé till en livskraftig affärsidé. Detta inkluderar ofta att genomföra marknadsundersökning, utveckla produkten och bygga ett team. Senare finansieringsrundor – som serie A, B eller C – fokuserar däremot mer på att skala upp verksamheten, utöka marknadsräckvidden, förbättra produkten eller komma in på nya marknader.Belopp

Generellt sett är det belopp som samlas in under såddstadiet mycket mindre jämfört med senare finansieringsrundor. Det genomsnittliga såddstadiet under första kvartalet 2023 bestod bara av 3,6 miljoner dollar, jämfört med en genomsnittlig serie A-runda på 18,7 miljoner dollar. Det räcker vanligtvis för att ge bevis på konceptet eller nå en viktig milstolpe. När startupen växer och visar sin potential kan den locka till sig större investeringar i efterföljande rundor.Typ av investerare

Såddfinansiering kommer ofta från grundarna själva, vänner, familj och affärsänglar. Det här är individer eller grupper som är villiga att ta en risk på en idé i ett mycket tidigt skede. I senare skeden lockas däremot institutionella investerare, t.ex. venturekapitalbolag, som investerar större summor pengar i mer etablerade företag med en dokumenterad meritlista. Venturekapitalbolag investerade 671 miljarder dollar i 38 644 affärer globalt 2021, vilket representerar större affärer än den genomsnittliga såddrundan.Equity och värdering

Under såddstadiet kanske värderingen av startupen inte är väl etablerad ännu. Som ett resultat kan investerare få betydande equity för en relativt liten summa pengar. I senare skeden, när företagets värdering ökar, kommer det att ge bort mindre delar equity för större mängder kapital. Varje affär är annorlunda, men som en allmän regel bör grundare planera att sälja ungefär 20 % equity under såddrundan.Risk och belöning

Såddfinansiering anses vanligtvis ha högre risk eftersom affärsmodellen och marknadslämpligheten kanske inte är helt testad. Men det finns potential för hög belöning, eftersom tidiga investerare ofta får en mer betydande aktieandel. När startupen mognar och går in i senare finansieringsrundor minskar risken, och det gör även den potentiella belöningen i form av equity.Villkor

Såddfinansieringsavtal innehåller vanligtvis färre villkor jämfört med senare finansieringsrundor. När startups växer och attraherar mer sofistikerade investerare, ökar komplexiteten i finansieringsavtalen vanligtvis, och villkoren blir strängare.

Varför såddfinansiering är viktigt för startups

Även om varje finansieringsrunda är viktig, kan såddfinansiering ha större inverkan för startups än framtida investeringsrundor – även om investeringen ofta är mindre. Såddfinansiering kan påverka en startups bana genom att:

Validera verksamhetens idé

Såddfinansiering ger det nödvändiga kapitalet för att validera en startups koncept. Det här steget handlar om att bevisa att det finns ett marknadsbehov av produkten eller tjänsten, vilket är viktigt för att locka framtida investerare. Utan såddfinansiering skulle många idéer aldrig gå vidare.Bygga grunden

Detta startkapital gör det möjligt för startups att starta viktiga verksamheter, anställa viktiga teammedlemmar och påbörja den inledande produktutvecklingen.Hjälpa tidig tillväxt och utveckling

Med såddfinansiering kan nystartade företag fokusera på tidig tillväxt, att förfina sin produkt eller tjänst och att etablera en kundbas. Denna tidiga tillväxt visar potentialen för skalbarhet och långsiktig framgång.Attrahera framtida finansieringsmöjligheter

En framgångsrik såddrunda tar in kapital och validerar startupen hos framtida investerare. Det leder ofta till mer omfattande finansieringsrundor som serie A, eftersom det visar att startupen har gått vidare från konceptstadiet och har en livskraftig, växande verksamhet.Skaffa partners och mentorer

Investerare i såddstadiet tillför ofta mer än bara kapital; De kan vara ovärderliga källor till rådgivning, branschkontakter och mentorskap. Den här vägledningen kan vara användbar för att navigera i de tidiga utmaningarna med att driva en startup.Tillåta flexibilitet och autonomi

Såddfinansiering kommer vanligtvis med färre villkor jämfört med senare omgångar. Startups har större frihet att experimentera och byta riktning om det behövs i detta skede, utan pressen från storskaliga investerarförväntningar och intrikata avtal.Etablera trovärdighet

Såddfinansiering ses ofta som en godkännandestämpel, vilket ökar startupens trovärdighet i kundens, partners och framtida investerares ögon. Det är ett tecken på att kunniga individer eller enheter tror på startupens potential.

Förbereda sig för att samla in såddpengar

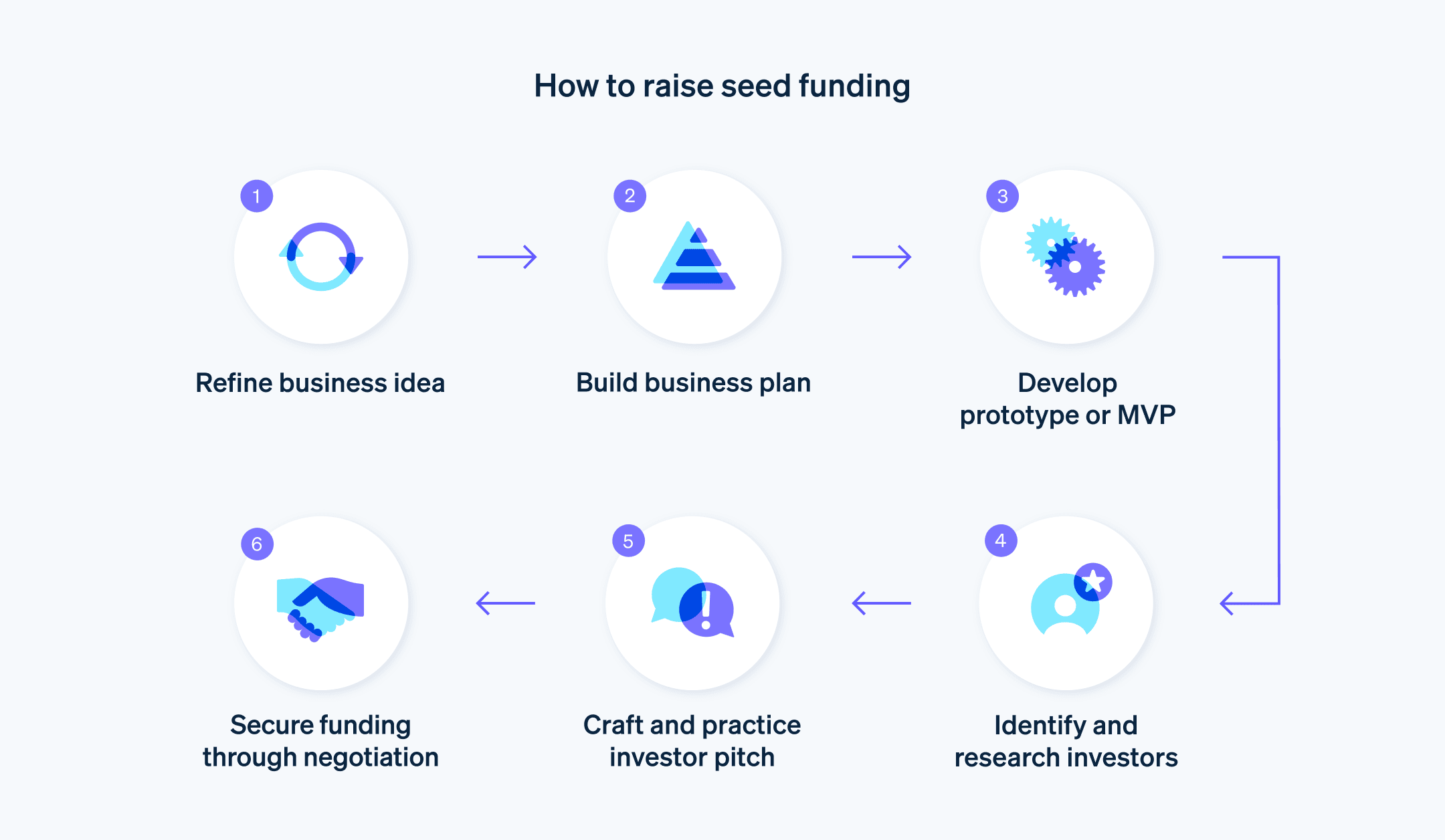

Startups måste göra mycket förberedande arbete innan de når ut till sina första potentiella investerare för såddfinansiering. Det här behöver du göra i början av insamlingsprocessen:

Förfina din företagsidé

Innan du kontaktar investerare, se till att din affärsidé är tydlig, innovativ och tillgodoser ett genuint marknadsbehov. Detta innebär att genomföra grundliga marknadsundersökningar, förstå din målgrupp och utveckla ett unikt värdeerbjudande.Formulera en solid verksamhetsplan

En välstrukturerad affärsplan bör beskriva din affärsmodell, marknadsanalys, operativ strategi, finansiella prognoser och långsiktiga mål. Detta dokument kommer att vara en färdplan för ditt företag och ett övertygande verktyg för potentiella investerare.Utveckla en prototyp eller en MVP

Om tillämpligt, utveckla en prototyp eller en MVP (Minimum Viable Product). Denna konkreta representation av din idé visar investerare att du har passerat det konceptuella stadiet och har något som fungerar och kan testas på marknaden.Bygg ett starkt team

Investerare investerar inte bara i idéer – de investerar i människor. Sätt ihop ett team med olika färdigheter och erfarenheter. Att visa att du har ett kompetent team på plats kan avsevärt öka investerarnas förtroende för din startup.Integrera ekonomisk planering

Ha en tydlig förståelse för hur mycket finansiering du behöver och hur du planerar att använda den. Var redo att förklara din finansiella modell och dina prognoser och visa en tydlig väg till lönsamhet eller tillväxt.Skapa en investerarpitch

Utveckla en övertygande pitch som kortfattat förklarar din affärsidé, marknadsmöjlighet, team och ekonomi. Din pitch bör vara engagerande, tydlig och kortfattad för att locka potentiella investerares uppmärksamhet.Identifiera potentiella investerare

Undersök och identifiera potentiella investerare som passar bra för din startup. Det kan röra sig om affärsänglar, venturekapitalbolag, inkubatorer eller acceleratorer. Förstå deras investeringstes och portfölj för att anpassa ditt tillvägagångssätt.Nätverka och bygg relationer

Börja bygga relationer inom startupmiljön. Delta i branschevenemang, gå med i startupgrupper och engagera dig på plattformar där du kan träffa potentiella investerare och mentorer.Säkerställ juridisk och regelmässig efterlevnad

Se till att din startup följer alla juridiska och regelmässiga krav. Detta kan innefatta bolagsbildning, att ordna varumärkesskydd eller följa andra branschspecifika bestämmelser.Förbered för due diligence

Investerare kommer att genomföra grundlig due diligence innan de investerar. Organisera alla dina juridiska, ekonomiska och affärsmässiga dokument så att de är redo för granskning.

Källor till såddpengar

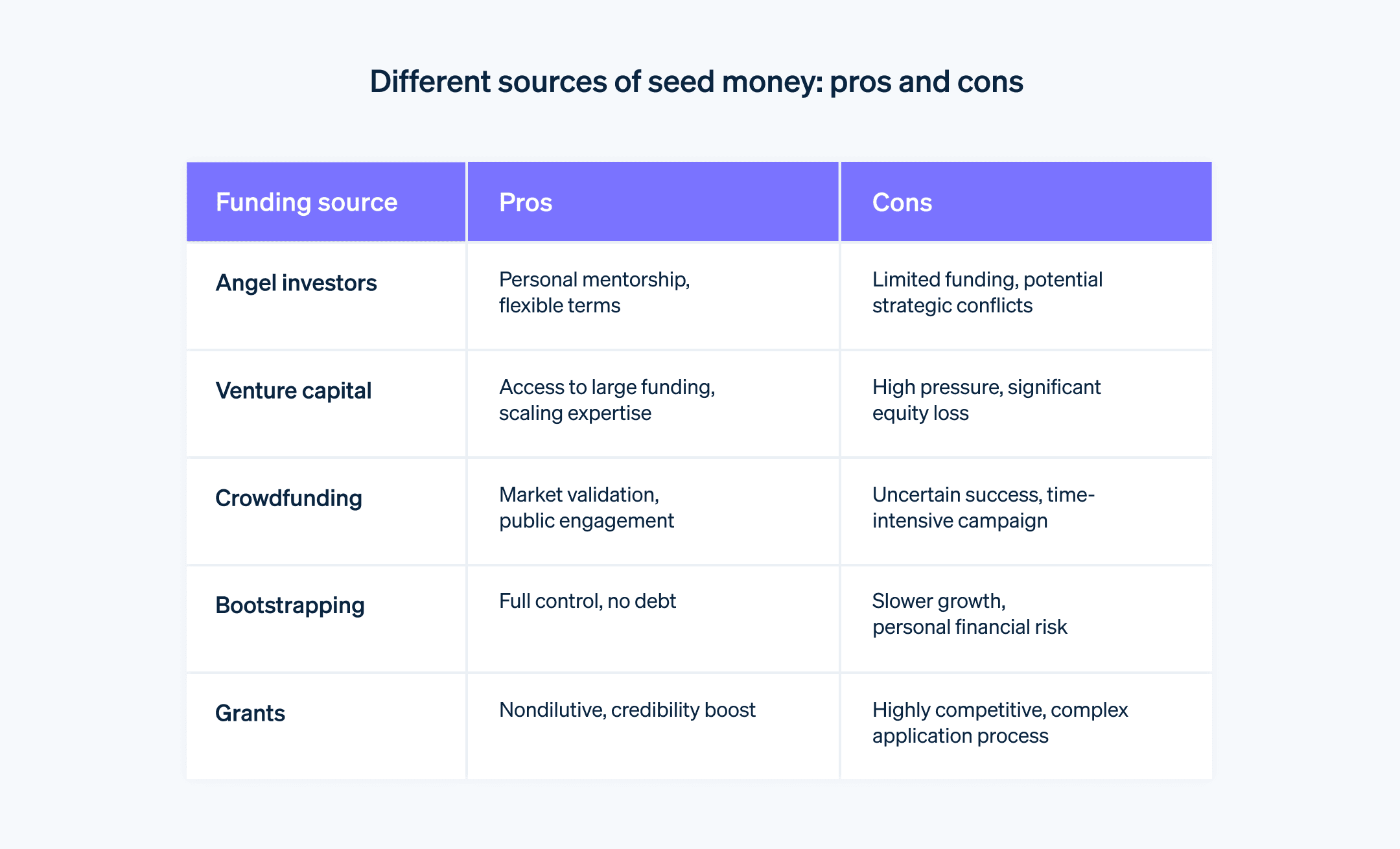

Var tidig finansiering kommer ifrån kommer att påverka den första fasen av startupens liv, och det kommer potentiellt att påverka dess framtid. Detta beror främst på betydande skillnader i villkoren för olika finansieringsavtal och vilken typ av relation grundarna kommer att ha med investerarna.

Innan du aktivt börjar söka såddpengar från någon källa bör du noga väga dina alternativ. Se till att du väljer en finansieringskälla som maximerar de fördelar du värdesätter mest samtidigt som du minimerar de nackdelar och risker du är mest ovillig mot. Här är en översikt över potentiella finansieringskällor för såddfinansiering:

Investeringar från affärsänglar

Vad de är: Affärsänglar är välbärgade individer som tillhandahåller kapital för att starta ett företag, vanligtvis i utbyte mot konvertibla skulder eller eget kapital. De är ofta själva företagare eller pensionerade företagsledare.

Lämplighet: Perfekt för startups i tidiga skeden som behöver vägledning och nätverksmöjligheter.

Fördelar

Personlig uppmärksamhet och mentorskap

Flexibla villkor och mindre formella processer

Värdefulla möjligheter till nätverkande

Nackdelar

Begränsad finansieringskapacitet

Kan ha mindre affärsmannaskap jämfört med professionella investerare

Möjliga konflikter i affärsinriktning eller strategi

Venturekapitalbolag:

Vad de är: Riskkapitalbolag är yrkesgrupper som hanterar gemensamma investeringar i startups med hög tillväxt i utbyte mot equity.

Lämplighet: Bäst för startups med hög tillväxtpotential och en tydlig väg till betydande intäkter och lönsamhet.

Fördelar

Tillgång till betydande kapital

Expertis inom uppskalning av företag

Starka nätverksmöjligheter

Nackdelar

Rigorös granskningsprocess och konkurrenskraftigt

Förlust av viss kontroll och equity

Press att leverera hög tillväxt och avkastning

Crowdfunding

Vad det är: Crowdfunding innebär att man samlar in små summor pengar från ett stort antal människor, vanligtvis online.

Lämplighet: Lämpligt för konsumentfokuserade startups, innovativa produkter eller företag med en intressant historia eller social vinkel.

Fördelar

Tillgång till en bred publik

Validering av affärsidén

Finansiering utan utspädningseffekt (i de flesta fall)

Nackdelar

Tidskrävande och osäkert

Kräver övertygande marknadsföring

Kan innebära exponering av immateriella rättigheter

Självfinansiering

Vad det är: Självfinansiering, eller bootstrapping, är när entreprenörer startar ett företag med lite kapital, förlitar sig på personliga tillgångar och företagets intäkter.

Lämplighet: Bäst för företag som kan startas med minimalt kapital och grundare som vill ha full kontroll.

Fördelar

Full kontroll över verksamheten

Ingen utspädning av eget kapital

Uppmuntrar en slimmad verksamhet och uppfinningsrikedom

Nackdelar

Begränsade resurser kan hindra tillväxt

Personlig ekonomisk risk

Kan vara långsamt att skala upp

Bidrag

Vad de är: Bidrag är icke återbetalningspliktiga medel eller produkter som bidragsgivare – ofta en statlig myndighet, ett företag, en organisation eller en stiftelse – betalar ut till en mottagare.

Lämplighet: Lämpligt för forskningsinriktade, sociala, utbildningsmässiga eller miljövänliga startups, eller de i specifika branscher som gynnas av bidragsprogram.

Fördelar

Finansiering utan utspädningseffekt:

Ger trovärdighet

Kan finansiera specifika projekt

Nackdelar

Mycket konkurrenskraftiga och stränga kriterier

Ofta begränsad i omfattning och skala

Tidskrävande ansökningsprocess

Hur man samlar in startkapital för en startup

När du känner dig säker på vilka finansieringskällor du ska använda dig av, är det här hur du kan strategiskt närma dig dem:

Om du söker investeringar från affärsänglar

Identifiera lämpliga affärsänglar

Undersök och identifiera investerare vars intressen är i linje med din startup med hjälp av ditt nätverk, register över affärsänglaroch branschevenemang. Hitta änglar som förstår och brinner för din bransch och vision.Skapa en övertygande pitch

Din pitch ska tillhandahålla en övertygande berättelse om din startup, med betoning på problemet du löser och din vision. Stöd den här berättelsen med marknadsanalys, finansiella prognoser och en detaljerad affärsplan.Bygg relationer

Se varje interaktion som en möjlighet att bygga en långsiktig relation. Delta i genuina samtal, värdera deras råd och var mottaglig för feedback. Observera att du söker en partner – inte bara en finansiär.Var förberedd för djupgående diskussioner

Var redo att formulera din långsiktiga vision och hur investerarens expertis och nätverk kan bidra till din tillväxt.Förhandla fram rättvisa villkor

Förhandlingar med affärsänglar ger ofta mer flexibilitet. Kommunicera dina behov tydligt och var beredd att förstå och tillgodose investerarens förväntningar och perspektiv.Använd dig av relationen till fullo

När en ängel har investerat kan du använda dennes erfarenhet och nätverk till din startups fördel. Håll dem uppdaterade och involverade i viktiga beslut och förvandla investeringen till en samarbetsresa.

Om du söker investeringar från venturekapitalbolag

Identifiera rätt venturekapitalbolag

Undersök och rikta in dig på venturekapitalbolag som har en historia av att investera i din bransch och ditt affärsskede. Använd ditt nätverk, databaser på nätet och branschevenemang för att hitta riskkapitalbolag med en investeringstes som är i linje med din startups mål och behov.Förbered en detaljerad pitchpresentation

Din pitchpresentation bör vara omfattande och datadriven och visa upp affärsmodell, marknadsstorlek, konkurrenslandskap, produkt, team och ekonomiska prognoser. Venturekapitalbolag letar efter skalbara företag med hög tillväxtpotential, så lyft fram dessa aspekter på ett övertygande sätt.Visa på dragkraft och marknadslämplighet

Venturekapitalbolag investerar vanligtvis i startups med viss marknadsdragkraft eller -validering. Presentera eventuella bevis på kundintresse, intäkter, tillväxtmätvärden eller partnerskap som visar din startups marknadslämplighet och potential för tillväxt.Förstå och förbered dig för rigorös due diligence

Var redo för en grundlig due diligence-process. Detta kommer att inkludera en djup analys av er ekonomi, juridiska frågor, er affärsmodell, marknadsundersökningar och teamets bakgrund. Organisera alla era dokument och all information för att effektivisera denna process.Förhandla om villkor och värdering

Var beredd på tuffa förhandlingar om värdering och villkor. Förstå din startups värdering och var redo att diskutera och motivera den. Bekanta dig med vanliga villkor för venturekapitalbolag och överväg de långsiktiga konsekvenserna av dessa för ditt företag.Bygg en relation och kommunicera dina mål

Även om venturekapitalbolag främst är fokuserade på avkastning, är det också viktigt att bygga en relation med dem. Kommunicera din långsiktiga vision och hur deras finansiering, nätverk och expertis kan hjälpa dig att nå dina mål.

Om du använder crowdfunding för att få in såddpengar

Välj rätt plattform

Välj en crowdfundingplattform som är i linje med din startups produkt eller tjänst. Olika plattformar vänder sig till olika typer av projekt och målgrupper, så välj en som passar din målmarknad och typ av erbjudande – oavsett om det är equity, belöningar eller donationsbaserad crowdfunding.Skapa en övertygande kampanj

Din kampanj ska berätta en övertygande historia om din startup, varför den är viktig och vad som gör den unik. Använd engagerande bilder och ett tydligt, övertygande språk. Videor kan vara särskilt effektiva för att förmedla ditt budskap och knyta an känslomässigt till potentiella finansiärer.Bestäm dig för realistiska mål och belöningar

Sätt upp ett finansieringsmål som återspeglar vad du behöver för att föra ditt projekt framåt, på ett sätt som är uppnåeligt baserat på din målgruppsstorlek. För belöningsbaserad crowdfunding bör du utforma attraktiva, genomförbara belöningar som ger incitament till bidrag utan att överanstränga dina resurser.Marknadsför din kampanj

Använd sociala medier, ditt personliga nätverk och communityforum för att tillkännage din kampanj. Uppdatera dina finansiärer och din publik regelbundet om dina framsteg för att skapa kontinuerligt engagemang.Interagera med dina finansiärer

Behandla dina finansiärer som mer än bara finansiärer – de är dina tidiga supportrar och potentiella framtida kunder. Interagera med dem under hela kampanjen genom att ge uppdateringar, svara på kommentarer och visa uppskattning för deras stöd.Planera för tiden efter kampanjen

Ha en tydlig plan för vad som händer efter kampanjen. Detta inkluderar att uppfylla belöningar, fortsätta kommunikationen med finansiärer och bygga vidare på kampanjens framgång för att få ytterligare dragkraft och synlighet.

Om du får in dina såddpengar via självfinansiering

Hantera din ekonomi på ett smart sätt

Prioritera ekonomisk försiktighet och budgethantering. Minimera kostnaderna och återinvestera vinsten i verksamheten. Håll din privata ekonomi och företagsekonomi åtskilda för att upprätthålla tydlig bokföring och undvika onödiga ekonomiska komplikationer.Fokus på kassaflöde

Kassaflödet är nyckeln i självfinansiering. Utveckla en affärsmodell som genererar konsekventa intäkteroch håll ett öga på kassaflödeshanteringen för att upprätthålla och växa din affärsverksamhet.Använd befintliga resurser

Använd tillgängliga resurser till sin fulla potential. Detta inkluderar dina färdigheter, ditt nätverk och dina befintliga tillgångar. Hitta billiga eller kostnadsfria verktyg och tjänster som kan stödja din affärsverksamhet.Väx gradvis

Självfinansiering innebär ofta långsammare tillväxt. Fokusera på gradvis, hållbar tillväxt snarare än snabb expansion. Detta försiktiga tillvägagångssätt gör att du kan bygga en solid grund för ditt företag utan att överanstränga dina resurser.Implementera ett kundcentrerat arbetssätt

Eftersom extern finansiering inte påverkar riktningen för din startup kan du anpassa ditt företag efter kundernas behov och feedback. Använd detta till din fördel genom att bygga starka kundrelationer och anpassa dina erbjudanden efter marknadskraven.Plan för att skala upp

Ha en tydlig strategi för att skala upp ditt företag. När vinsten växer kan du återinvestera i områden som kommer att erbjuda de mest betydande fördelarna – till exempel produktutveckling, marknadsföring eller anställning av nyckelpersonal.

Om du söker bidrag

Gör efterforskningar om relevanta bidrag

Identifiera bidrag som är i linje med din startups bransch, uppdrag eller teknik. Använd databaser på nätet, myndigheters webbplatser och branschpublikationer för att hitta bidrag som passar bra för din affärsmodell och dina mål.Förstå bidragskraven

Läs noga igenom behörighetskriterierna, ansökningskraven och tidsfristerna för varje bidrag. Bidrag har ofta mycket specifika krav och mål, så se till att din startup och ditt förslag är i linje med dessa.Skapa ett detaljerat förslag

Inkludera ett grundligt och övertygande förslag i din ansökan. Beskriv tydligt din affärsidé, dess inverkan, hur bidragspengarna kommer att användas och de förväntade resultaten. Formulera dig tydligt och kortfattat och följ alla specifika riktlinjer som bidraget gav.Visa inverkan och innovation

Många bidrag fokuserar på att finansiera projekt som driver innovation, social påverkan eller tekniska framsteg. Framhäv hur din startup uppfyller dessa kriterier och ge bevis på potentiell inverkan och innovation.Inkludera budget och finansplan

Inkludera en detaljerad budget som visar hur bidragsmedlen ska fördelas. Visa ekonomiskt ansvar och en tydlig förståelse för hur finansieringen kommer att främja ditt projekt.Förbered för uppföljning och rapportering

Var beredd på uppföljning om din ansökan beviljas. Detta kan innefatta att tillhandahålla lägesrapporter, finansrapporter eller bevis på uppnådda milstolpar i enlighet med bidragsvillkoren.

Hur man förhandlar om såddfinansiering med investerare

Potentiella investerare kommer att förhandla för egen räkning eller på uppdrag av investerarna i deras fond. Så här gör du för att framgångsrikt förespråka dig själv under förhandlingen:

Förstå investerarens perspektiv

Investerare letar efter avkastning på sin investering. De kanske älskar din idé, men i slutändan bedömer de risk kontra belöning. Att inse detta kommer att hjälpa dig att formulera dina argument och förstå deras kontrapunkter.Förstå ditt värde

Innan du går in i någon förhandling, ha en tydlig förståelse för din startups värdering. Utöver siffrorna inkluderar detta ditt företags potential, marknaden och hur mycket du redan har uppnått. Var beredd på att försvara din värdering med data och förtroende.Lyssna på investeraren

Bra förhandling har sina rötter i effektiv kommunikation. Detta innebär att aktivt lyssna på vad investeraren säger och svara eftertänksamt. Det handlar inte om att driva din agenda – det handlar om att hitta en gemensam grund och ett avtal som gynnar båda parter.Var beredd att lämna förhandlingarna

En av dina största styrkor i alla förhandlingar är viljan att gå därifrån. Det betyder inte att du ska vara konfrontativ, utan snarare att du ska vara bestämd om vad du behöver för att din startup ska lyckas. Om en investerares villkor undervärderar ditt företag eller inte stämmer överens med din vision, var beredd att säga nej.Var flexibel, inom rimliga gränser

Även om det är viktigt att veta vad du vill ha, kan det vara en dealbreaker att vara för rigid. Ha tydliga gränser, men var flexibel inom dina gränser. Detta kan innebära att förhandla om equity, investeringens struktur eller andra villkor.Värdera långsiktiga relationer

Kom ihåg att du potentiellt går in i en långsiktig relation med din investerare. Närma dig förhandlingar med respekt och en önskan om partnerskap. Målet är inte bara att säkra finansiering, utan också att bygga en relation som kommer att stödja din startups tillväxt.Var uppmärksam på detaljerna

Var uppmärksam på villkoren för avtalet – inte bara rubriksiffrorna. Detta inkluderar att förstå klausuler som likvidationspreferenser, bestämmelser om utspädningsskydd och styrelsens rättigheter. Det är ofta värt att få juridisk rådgivning för att säkerställa att du till fullo förstår konsekvenserna av dessa villkor.Kommunikation efter förhandlingen

Efter en framgångsrik förhandling bör du upprätthålla öppna kommunikationslinjer med dina investerare. Att hålla dem informerade och involverade (i lämplig grad) kan bygga en stark, pågående relation.

Bästa praxis för hantering av såddpengar

När du har säkrat din såddfinansiering måste du bestämma hur du använder den. Nedan listar vi viss bästa praxis:

Prioritera utgifter baserat på din företagsplan

Börja med att se över din affärsplan. Du bör i första hand allokera medel till de områden som driver företagets tillväxt och utveckling, enligt beskrivningen i din affärsplan. Detta kan inkludera produktutveckling, marknadsundersökningar eller nyckelanställningar. Genom att följa din affärsplan säkerställer du att du använder dina medel för att uppnå specifika, strategiska mål.Undvik onödiga utgifter

Var sparsam utan att kompromissa med kvaliteten. Detta innebär att noggrant överväga varje utgift och undvika onödiga utgifter. Välj till exempel funktionella, kostnadseffektiva kontorsutrymmen snarare än lyxiga lokaler. Observera att varje sparad dollar är en dollar som kan investeras i områden som direkt bidrar till tillväxt.Investera smart i talangfulla medarbetare

Ditt team är din mest värdefulla tillgång. Anställ skickliga personer som delar din vision och är engagerade i startupens framgång. Var dock försiktig med hur du utökar ditt team. Överanställning för tidigt kan snabbt göra slut på dina resurser.Fokus på produktutveckling och marknadslämplighet

Använd en betydande andel av dina såddpengar för att förfina din produkt eller tjänst. Detta inkluderar investeringar i utvecklings-, testnings- och feedbackmekanismer för att säkerställa att ditt erbjudande uppfyller marknadens behov och är konkurrenskraftigt.Var strategisk kring marknadsföring och kundvärvning

Investera i kostnadseffektiva, riktade marknadsföringsstrategier. Fokusera på kanaler som ger högst avkastning på investeringen och följ noga resultatet av dina marknadsföringskampanjer.Upprätthåll en kassareserv

Behåll en del av dina såddpengar som en kassareserv. Detta kan vara användbart för oförutsedda utgifter eller om företaget stöter på en tuff period. En reserv kan ge dig flexibiliteten och tryggheten att ta dig an utmaningar med mindre ekonomisk stress.Övervaka kassaflödet noga

Övervaka regelbundet ditt kassaflöde för att säkerställa att din startup förblir ekonomiskt sund och justera dina utgifter vid behov.Återinvestera vinsterna i företaget

Om din startup börjar generera vinst, överväg att återinvestera en betydande del i verksamheten. Denna återinvestering kan driva på ytterligare tillväxt och minska behovet av ytterligare extern finansiering.Be om råd från mentorer eller ekonomiska rådgivare

Tveka inte att söka råd från mentorer eller finansiella rådgivare. Deras erfarenhet och perspektiv kan vara ovärderliga för att hjälpa dig att fatta sunda ekonomiska beslut.Var redo att ändra riktning

Var flexibel och redo att ändra din strategi om det behövs. Startupmiljön är dynamisk, och förmågan att anpassa dina utgifter som svar på marknadsfeedback eller nya möjligheter kan påverka din framgång.

Så här kan Stripe Atlas hjälpa till

Stripe Atlas skapar ditt företags juridiska grund så att du kan samla in pengar, öppna ett bankkonto och ta emot betalningar från var som helst i världen inom två dagar.

Anslut dig till de över 75 000 företag som startats med hjälp av Atlas, inklusive startup-företag som stöds av toppinvesterare som Y Combinator, a16z och General Catalyst.

Ansök till Atlas

Att ansöka om att bilda ett företag med Atlas tar mindre än tio minuter. Du väljer din företagsstruktur, får bekräftelse omedelbart om ditt företagsnamn är tillgängligt och lägger till upp till fyra medgrundare. Du bestämmer också hur du delar upp aktier, skapar en reserv av eget kapital för framtida investerare och anställda, utser ledamöter och e-signerar sedan alla dina dokument. Alla medgrundare får e-postmeddelanden som bjuder in dem att e-signera sina dokument också.

Ta emot betalningar och banktjänster innan ditt EIN anländer

När du har startat ditt företag ansöker Atlas om ditt EIN. Grundare med socialförsäkringsnummer, adress och mobiltelefonnummer i USA är berättigade till snabb behandling av IRS, medan andra får standardbehandling, vilket kan ta lite längre tid. Dessutom aktiverar Atlas pre-EIN-betalningar och -banktjänster så att du kan börja ta emot betalningar och göra transaktioner innan ditt EIN anländer.

Kontantfritt aktieköp för grundare

Grundare kan köpa initiala aktier med hjälp av sina immateriella rättigheter (t.ex. upphovsrätt eller patent) istället för kontanter, med köpebevis som sparas i Atlas Dashboard. Dina immateriella rättigheter måste vara värda högst 100 USD för att kunna använda den här funktionen. Om du äger immateriella rättigheter över det värdet bör du rådgöra med en advokat innan du fortsätter.

Automatisk deklaration för val av skatt enligt 83(b)

Grundare kan lämna in en 83(b)-ansökan om val av skatt för att sänka skatten på personliga inkomster. Atlas lämnar in den åt dig – oavsett om du är en amerikansk grundare eller inte – med USPS Certified Mail och spårning. Du får en undertecknad 83(b)-ansökan och ett deklarationsbevis direkt i Stripe Dashboard.

Juridiska dokument för företag i världsklass

Atlas tillhandahåller alla juridiska dokument du behöver för att börja driva ditt företag. Atlas C corp-dokument är utformade i samarbete med Cooley, en av världens ledande advokatbyråer för venturekapital. Dessa dokument är utformade för att hjälpa dig att skaffa kapital omedelbart och säkerställa att ditt företag är juridiskt skyddat, vilket omfattar aspekter som ägarstruktur, aktiefördelning och efterlevnad av skatteregler.

Ett kostnadsfritt år med Stripe Payments, plus 50 000 USD i partnerkrediter och rabatter

Atlas samarbetar med partner på högsta nivå för att ge grundare exklusiva rabatter och krediter. Dessa inkluderar rabatter på viktiga verktyg för teknik, skatt, ekonomi, efterlevnad och verksamhet från branschledare som AWS, Carta och Perplexity. Vi ger dig också kostnadsfritt agenten som är registrerad i Delaware som du behöver under det första året. Som Atlas-användare får du dessutom tillgång till ytterligare Stripe-förmåner, inklusive upp till ett års gratis betalningsbehandling för upp till 100 000 USD i betalningsvolym.

Läs mer om hur Atlas kan hjälpa dig att starta ditt nya företag snabbt och enkelt och komma igång redan idag.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.