Enligt den spanska skattemyndigheten (AEAT) ökade uppbörden av mervärdesskatt (moms) i Spanien med 1,6 % under 2023 och uppgick till 83,9 miljarder euro. Tillsammans med andra indirekta skatter utgör mervärdesskatten 14,5 % av de totala intäkter som uppbärs av staten, vilket är betydligt högre än bidragen från Spaniens autonoma regioner och andra källor. Det årliga belopp som tas ut varierar beroende på faktorer såsom vilken volym av sålda varor och tjänster som omfattas av någon av Spaniens momssatser.

I likhet med andra skatter tillämpas inte alltid samma momssats. Den tillämpliga skattesatsen beror på produkt- och tjänstekategorin. För de flesta varor och tjänster i Spanien är exempelvis den allmänna momssatsen 21 %. Om varor eller tjänster klassificeras som "nödvändiga" eller ”grundläggande" tillämpas dock den superreducerade momssatsen (4 %). Nedan förklarar vi hur den superreducerade momssatsen fungerar.

Vad innehåller den här artikeln?

- Vad är superreducerad moms?

- Hur man beräknar superreducerad moms

- Vilka produkter och tjänster beskattas med den superreducerade momssatsen?

- Jämförelse av superreducerad moms i Spanien och EU

- Tillfällig nedsättning av den superreducerade momsen

Vad är superreducerad moms?

Den superreducerade momssatsen gäller för en specifik grupp av varor och tjänster som säljs i Spanien, särskilt på fastlandet och Balearerna. Till skillnad från den allmänna momssatsen på 21 % är den superreducerade momssatsen i Spanien endast 4 %. Denna skattesats infördes 1993 och låg först på 3 % för att sedan höjas till 4 % 1995, där den ligger än idag. Syftet med denna momssats är att göra vissa viktiga varor och tjänster mer överkomliga, t.ex. läkemedel och rullstolar (en fullständig uppräkning finns nedan).

Det är värt att nämna att förutom den allmänna momsen och den superreducerade momsen tillämpar Spanien också en reducerad momssats på 10 % på vissa produkter och tjänster.

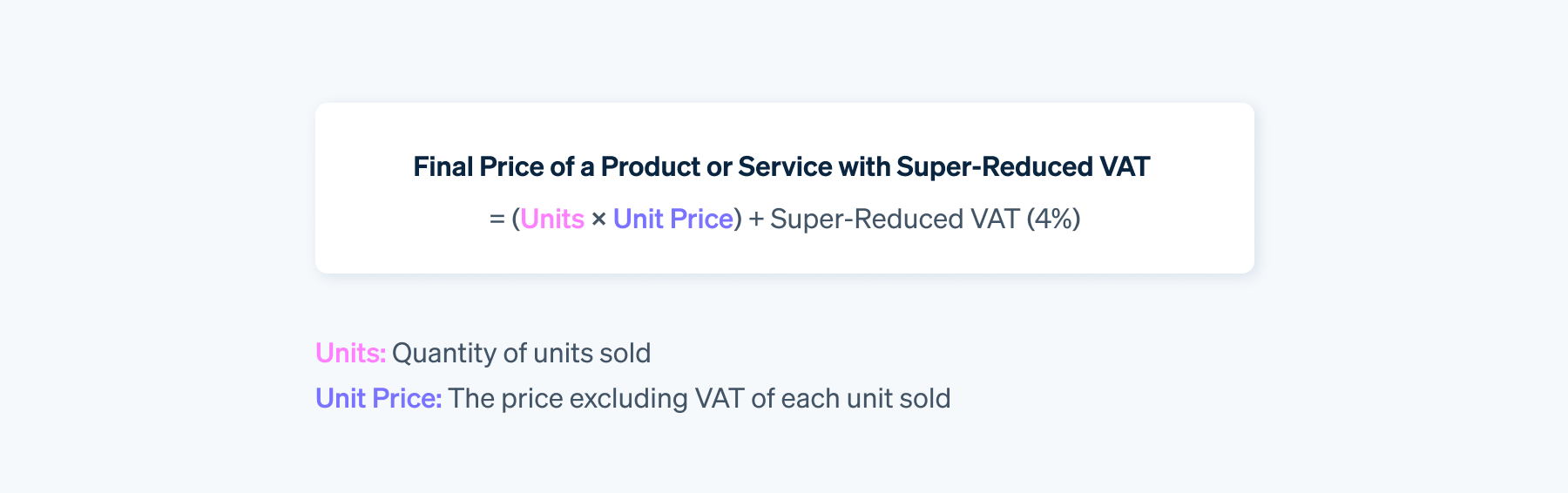

Hur man beräknar superreducerad moms

För att beräkna det superreducerade priset lägger man helt enkelt till en procentsats till grundpriset:

Exempel:

5 läkemedel (enheter) för 5 € styck (enhetspris): 5 × 5 € = 25 €

Superreducerad moms: 25 € x 4 % = 1 €

Slutpris: 25 € + 1 € = 26 €

Enklare uttryckt multipliceras beskattningsunderlaget med 1,04 (vilket motsvarar 100 % av underlaget plus den superreducerade momsen på 4 %). Resultatet blir detsamma:

25 € × 1,04 = 26 €

Om läkemedlen i det här exemplet beskattades med den vanliga momssatsen (21 %), skulle det totala priset bli 30,25 euro. Den superreducerade momsen innebär därför en besparing på 4,25 euro.

Vilka produkter och tjänster beskattas med den superreducerade momssatsen?

Den superreducerade momssatsen kan endast tillämpas på dessa varor och tjänster:

- Läkemedel: Detta inkluderar endast läkemedel som används av människor.

- Fysiska medier: För att tidskrifter, böcker och tidningar ska omfattas av momssatsen på 4 % måste minst 10 % av inkomsten komma från försäljningen av publikationen. Intäkter från andra relaterade källor, till exempel reklam, får inte överstiga 90 % av de totala intäkterna. Publikationer som helt och hållet består av reklaminnehåll omfattas inte av denna momssats.

- Fordon som stöder rörlighet: Det handlar bland annat om fordon för personer med nedsatt rörlighet eller funktionsnedsättning.

- Medicintekniska produkter: Specifikt implantat, proteser och rullstolar faller under denna kategori.

- Artiklar för personlig vård: Detta inkluderar kondomer och absorberande hygienprodukter (t.ex. trosskydd, bindor etc.).

- Statligt subventionerade bostäder (VPO): Den superreducerade momssatsen gäller både för köp av en subventionerad fastighet och för uthyrning där avtalet innehåller en option att köpa fastigheten vid ett senare tillfälle.

- Anhörigvård: Detta inkluderar tjänster som begärs av personer i beroendeställning (även kallat "teleassistans").

När du säljer en vara eller tjänst kan du bara tillämpa den superreducerade momssatsen om den finns med på den angivna listan. Annars begår du en oegentlighet som kan leda till momspåföljder.

För att säkerställa att du alltid tillämpar rätt skattesats kan det vara mycket fördelaktigt att använda ett automatiseringsverktyg som Stripe Tax, som automatiskt beräknar och tar ut moms på din försäljning. Med Stripe Tax kan du dessutom generera rapporter om den skatt du tagit ut för att effektivisera dina skattedeklarationer och hålla dig uppdaterad om momsförändringar i de mer än 50 länder där det är tillgängligt (se undantag här).

Jämförelse av superreducerad moms i Spanien och EU

Skillnaderna mellan EU-länderna handlar både om vilka produkter som varje land väljer att beskatta enligt den superreducerade skattesatsen samt vilken skattesats som tillämpas. Spanien ligger till exempel på en måttlig nivå, medan andra länder har högre eller lägre nivåer. I listan nedan har vi inkluderat den superreducerade momsen i Spanien tillsammans med fyra andra EU-medlemsländer för jämförelse:

- Spanien: 4 %

- Italien: 4 %

- Frankrike: 2,1 %

- Portugal: 6 %

- Polen: 5 %

Observera att vissa EU-länder, till exempel Tyskland, inte har någon superreducerad momssats. I vissa territorier finns det med andra ord endast två momssatser: den generella momssatsen och den reducerade.

Tillfällig nedsättning av den superreducerade momsen

För att mildra effekterna av den ekonomiska krisen i Spanien har regeringen genomfört flera tillfälliga sänkningar av den superreducerade momssatsen. Den 1 januari 2023 införde regeringen åtgärder mot inflationen och avskaffade bland annat den superreducerade momssatsen på baslivsmedel, på bland annat följande:

- Bröd

- Vetemjöl special

- Ägg

- Ost

- Mjölk från djur

- Naturliga spannmål

- Frukt och grönsaker

- Knölar och baljväxter

Sedan dessa åtgärder hade införts sänktes momssatsen på dessa livsmedel från 4 % till 0 %, vilket innebär att kunderna bara behöver betala skatteunderlaget.

Den 25 juni 2024 sammanträdde ministerrådet och godkände förlängningen och utvidgningen av de gällande åtgärderna, i enlighet med kungligt lagdekret 4/2024. Genom detta nya ändringsförslag lades olivolja till i förteckningen över produkter med tillfälligt momsundantag.

För att se till att stabilitetspakten efterlevs i alla EU:s medlemsstater har Europeiska kommissionen utfärdat ett direktiv där man uppmanar till ett gradvis tillbakadragande av de åtgärder som införts för att motverka effekterna av den ekonomiska krisen. Från och med 2025 förväntas den superreducerade momssatsen återgå till standardskattesatsen på 4 % för samtliga produkter och tjänster som anges ovan.

Momssatsen kan variera beroende på politiska, sociala och ekonomiska omständigheter. Vi rekommenderar därför att du kontrollerar de aktuella mervärdesskattesatserna från en källa som AEAT, där det även anges vilka specifika undantag som har en momssats på 0 % eller 5 %.

Innehållet i den här artikeln är endast avsett för allmän information och utbildningsändamål och ska inte tolkas som juridisk eller skatterelaterad rådgivning. Stripe garanterar inte att informationen i artikeln är korrekt, fullständig, adekvat eller aktuell. Du bör söka råd från en kompetent advokat eller revisor som är licensierad att praktisera i din jurisdiktion för råd om din specifika situation.