根据西班牙税务局 (AEAT) 的数据,西班牙在 2023 年收取的增值税 (VAT) 增长了 1.6%,达到了 839 亿欧元。与其他间接税一起,增值税占西班牙国家总收入的 14.5%,大大超过了西班牙自治区和其他来源的贡献。每年收取的金额会根据例如适用的西班牙增值税税率的商品和服务销售量等因素而有所不同。

与其他税收一样,并不是所有情况下都应用相同的增值税百分比。适用的税率取决于产品和服务的类别。例如,西班牙大多数商品和服务的增值税一般税率为 21%。然而,如果这些商品或服务被归类为“必需”或“基本”产品或服务,则适用超级减税增值税税率 (4%)。以下是我们将要解释的超级减税增值税税率的工作原理。

目录

- 什么是超级减税增值税?

- 如何计算超级减税增值税

- 哪些产品和服务适用超级减税增值税税率?

- 西班牙与欧盟的超级减税增值税比较

- 超级减税增值税的临时降税

什么是超级减税增值税?

超级减税增值税税率适用于西班牙特定类别的商品和服务,尤其是在本土和巴利阿里群岛。与一般的 21% 增值税税率不同,西班牙的超级减税增值税税率仅为 4%。该税率于 1993 年引入,最初为 3%,并于 1995 年提高至 4%,至今保持不变。此税率旨在使某些必需商品和服务更具负担能力,如药品和轮椅(完整列表如下)。

值得注意的是,除了普通增值税和超级减税增值税外,西班牙还对一些商品和服务适用 10% 的减税增值税税率。

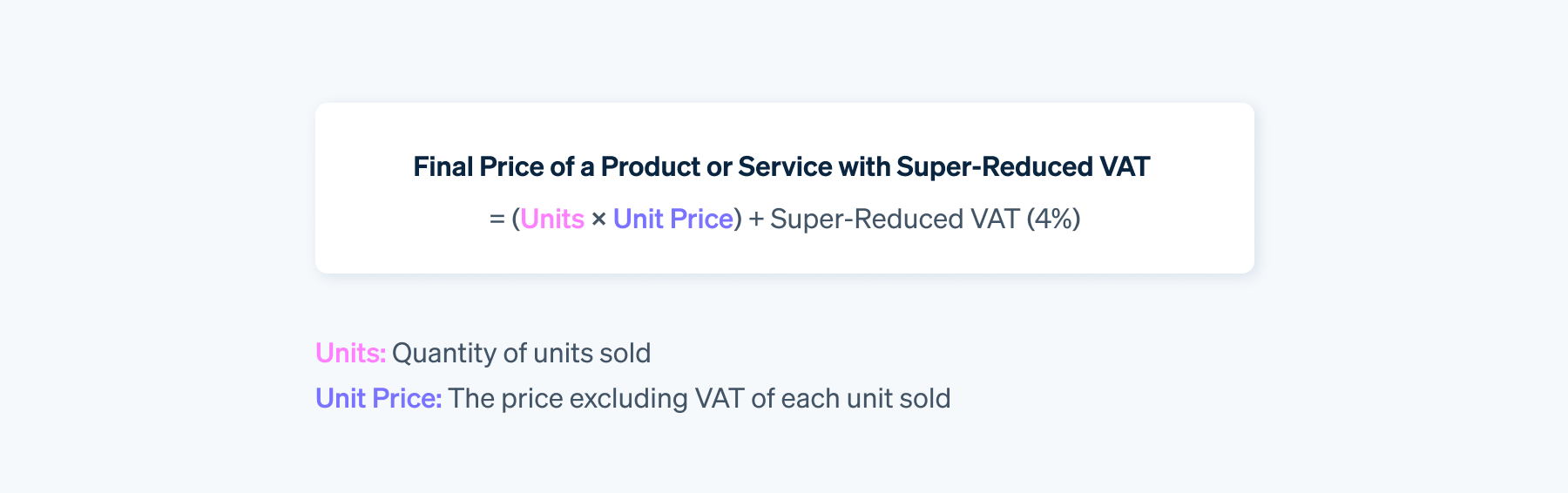

如何计算超级减税增值税

要计算超级减税增值税价格,只需将一个百分比加到基本价格上:

示例:

*5 副药(单位),每副 5 欧元(单价):5 × 5 欧元 = 25 欧元

超级减税增值税:25 欧元 × 4% = 1 欧元

最终价格:25 欧元 + 1 欧元 = 26 欧元

更简单地说,这个计算是将应税基数乘以 1.04(代表基本价格的 100% 加上 4% 的超级减税增值税)。结果是相同的:

*25 欧元 × 1.04 = 26 欧元

在这个例子中,如果药品按标准增值税税率 (21%) 征税,则总价格为 30.25 欧元。因此,超级减税增值税节省了 4.25 欧元。

哪些产品和服务适用超级减税增值税税率?

超级减税增值税税率仅适用于以下商品和服务:

- 药品: 仅包括人类使用的药物。

- 实物媒介: 对于杂志、书籍和报纸,必须至少有 10% 的收入来自该出版物的销售,才能适用 4% 的增值税税率。来自广告等其他相关来源的收入不能超过总收入的 90%。完全由广告内容组成的出版物不符合此增值税税率。

- 移动支持工具: 包括为行动不便人士 (PRM) 或残疾人士提供的车辆。

- 医疗设备: 特别是植入物、假肢和轮椅属于这一类。

- 个人护理用品: 包括避孕套和吸收性卫生产品(如卫生护垫、卫生巾等)。

- 政府补贴住房 (VPO): 超级减税增值税税率适用于购买政府补贴住房以及包含购买选项的租赁合同。

- 依赖性护理服务: 包括由依赖性人员(也称为“远程协助”)请求的服务。

当您销售商品或服务时,只有当它们符合指定清单时,才可以适用超级减税增值税税率。否则,您将犯下不规范行为,可能会导致增值税处罚。

为了确保您始终应用正确的税率,使用像 Stripe Tax 这样的自动化工具会非常有帮助,它可以自动计算和收取您的销售增值税。此外,Stripe Tax 还允许您生成关于税收的报告,以简化税务申报,并随时更新其在 50 多个国家/地区的税率变化(查看例外)。

西班牙与欧盟的超级减税增值税比较

欧盟国家之间的差异包括每个国家/地区选择按超级减税税率征税的产品,以及税率百分比。例如,西班牙的税率处于中等水平,而其他一些国家的税率更高或更低。以下是我们列出的西班牙超级减税增值税税率,以及其他四个欧盟成员国的税率,供参考:

- 西班牙:4%

- 意大利:4%

- 法国:2.1%

- 葡萄牙:6%

- 波兰:5%

请注意,在一些欧盟国家/地区,例如德国,没有超级减税增值税税率。换句话说,某些地区只有两种增值税税率:一般税率和减税税率。

超级减税增值税的临时降税

为了缓解西班牙经济危机的影响,政府实施了几项超级减税增值税税率的临时降税措施。2023 年 1 月 1 日,政府推出了反通胀措施,包括取消对基本食品的超级减税增值税税率,包括:

- 面包

- 面包粉

- 鸡蛋

- 奶酪

- 动物奶

- 天然谷物

- 水果和蔬菜

- 块茎和豆类

实施这些措施后,这些食品的增值税税率从 4% 降至 0%,意味着顾客只需支付应税基数。

2024 年 6 月 25 日,部长理事会召开会议,批准了现有措施的延长和扩展,具体内容见皇家法令法案 4/2024。这一新修订案将橄榄油添加到临时免征增值税的产品清单中。

为了确保所有欧盟成员国遵守稳定与增长公约,欧洲委员会发布了一项指令,呼吁逐步撤销为应对经济危机影响而出台的措施。预计从 2025 年起,所有上述产品和服务的超级减税增值税税率将恢复为标准的 4%。

增值税百分比可能会因政治、社会和经济环境的变化而有所不同。因此,我们建议您通过像 AEAT 这样的来源检查当前的增值税税率,其中还列出了适用 0% 或 5% 增值税税率的具体例外情况。

本文中的内容仅供一般信息和教育目的,不应被解释为法律或税务建议。Stripe 不保证或担保文章中信息的准确性、完整性、充分性或时效性。您应该寻求在您的司法管辖区获得执业许可的合格律师或会计师的建议,以就您的特定情况提供建议。