Companies today often struggle with slow, fragmented financial systems that can limit access to real-time data, delay transactions, and complicate integrations. Customers, on the other hand, demand faster, seamless experiences, which legacy infrastructure and closed networks often lack.

Open banking is changing the financial services industry, paving the way for innovations that are redefining how businesses and financial institutions interact. By enabling secure access to financial data, it allows businesses to streamline payments, improve financial decision-making, and offer more innovative services.

A 2023 Juniper Research report predicted that open banking payment transaction values will exceed $330 billion globally by 2027. The financial services market is transitioning from siloed operations to a more interconnected environment, where financial institutions and tech companies work together to offer broader services.

Yet, adoption remains complex—data privacy concerns, security risks, and inconsistent regulatory frameworks create challenges that businesses must consider carefully.

Here’s what you need to know about open banking, how it works, its benefits, and the challenges to consider.

What’s in this article?

- What is open banking?

- How does open banking work?

- 8 examples of open banking services

- Who uses open banking?

- Benefits of open banking

- Challenges of open banking

- How Stripe Financial Connections can help

What is open banking?

Open banking is a financial services model that allows third-party service providers to access consumer data from traditional banking systems through application programming interfaces (APIs). This model completely changes the way financial data is shared and accessed by increasing transparency, competition, and innovation.

Open banking can give consumers more control over their financial information and provide new services and applications. It allows businesses to gain access to real-time financial data, helping them streamline payment services, optimize banking products, and improve customer account management. For nonfinancial companies, this shift means they can offer customized financial services to their customers, make more data-driven decisions, and innovate in payments and account management. With better access to financial data, businesses can also simplify payment processes and generate new revenue streams.

With growing open banking initiatives and compliance requirements, such as the Payment Services Directive (PSD2) in the European Union, businesses are using open banking to offer more secure, efficient, and personalized financial experiences.

How does open banking work?

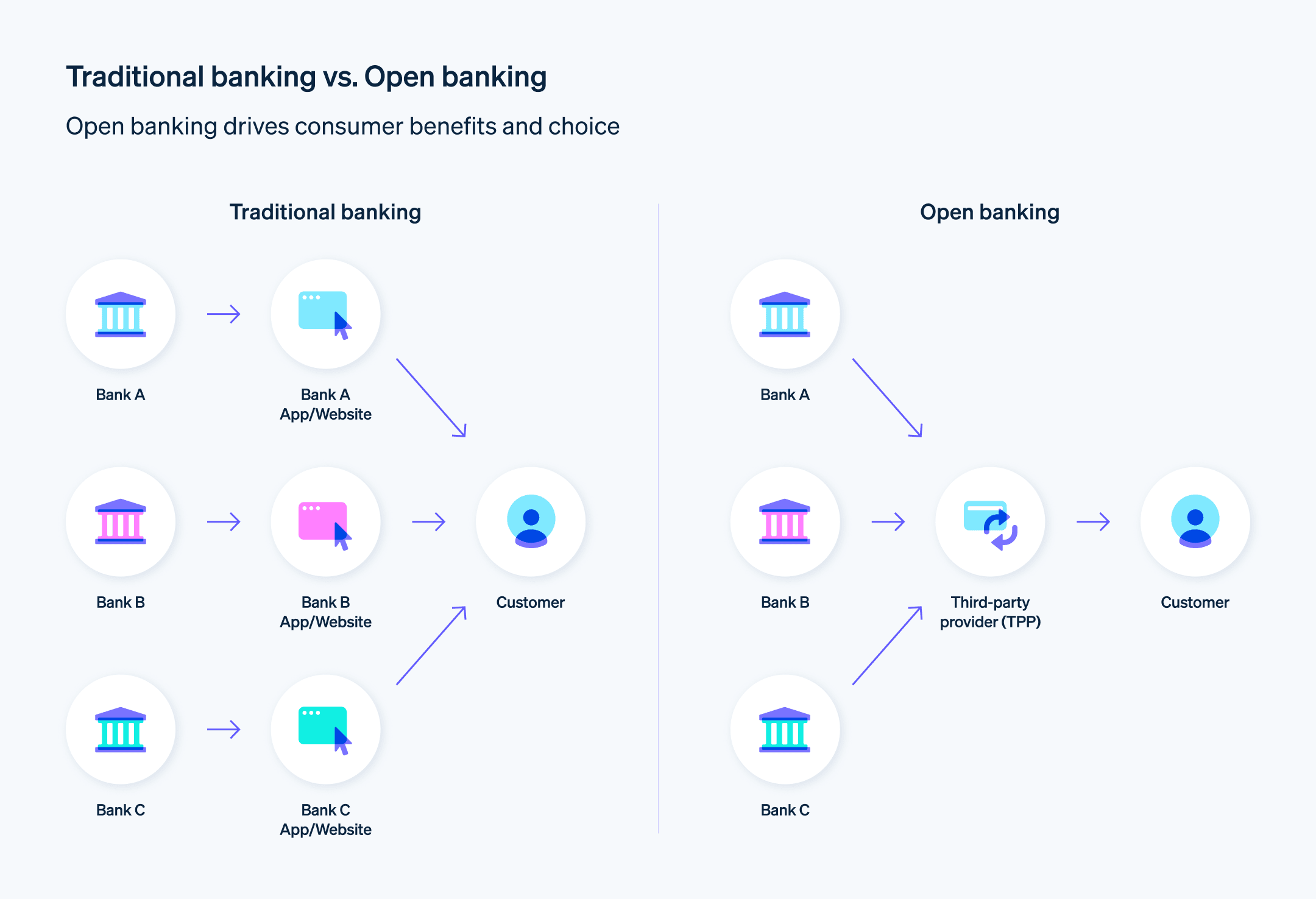

In traditional banking, data is often siloed within individual institutions, making it challenging for outside applications to interact directly with financial accounts. Open banking disrupts this by mandating standardized data formats and secure communication protocols. This creates a level playing field where third-party services can integrate with multiple banks under a common set of rules, regulations, and technical standards.

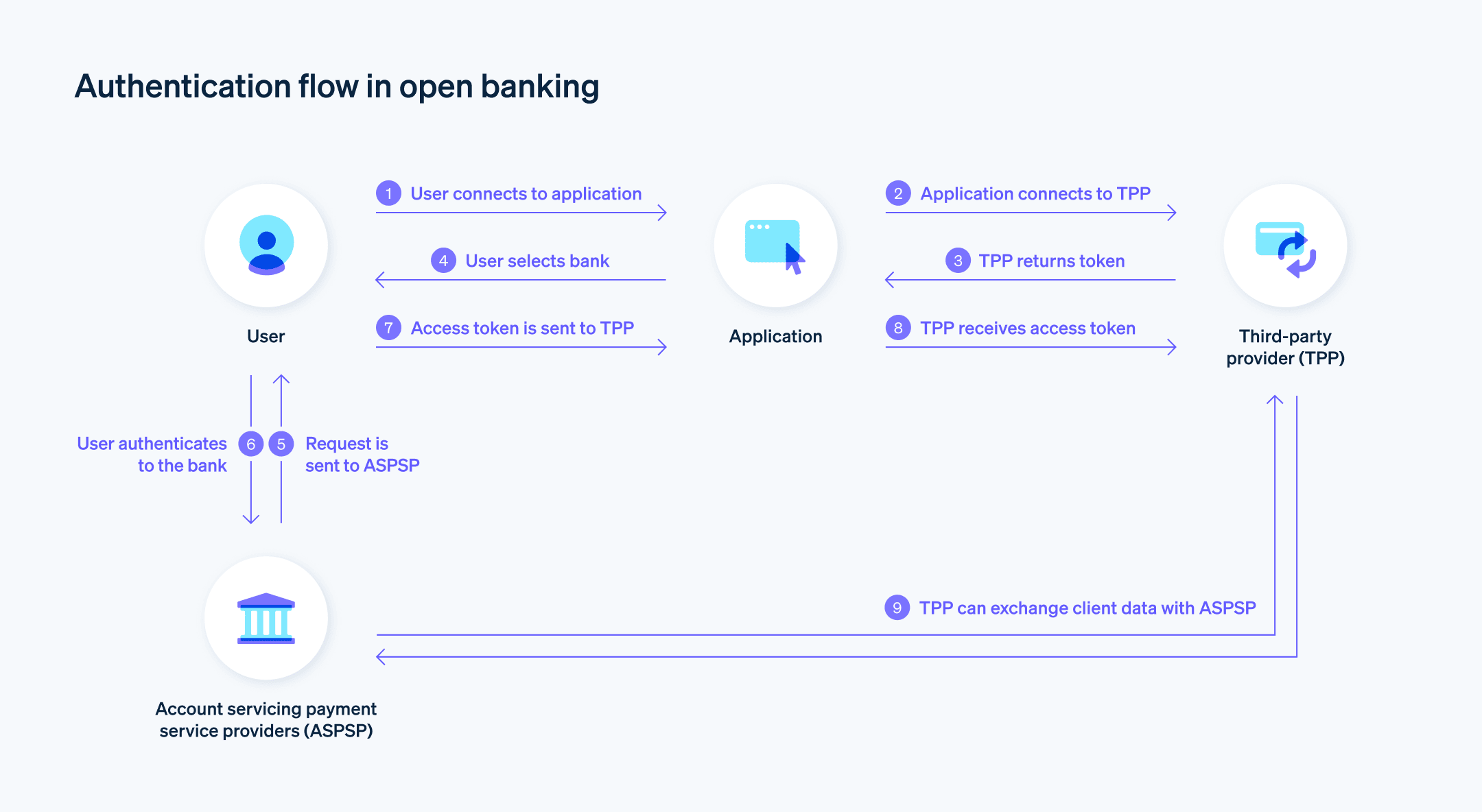

Open banking enables interoperable financial services by allowing third-party service providers to securely access customer data through APIs. These APIs facilitate the secure exchange of financial information between banks and authorized third-party providers.

The APIs in open banking are typically categorized into three main types:

Data APIs: Provide read-only access to account information, balances, and transaction history.

Transaction APIs: Enable fund transfers, direct debits, and payment services.

Product APIs: Allow third parties to list financial products, rates, and terms. They’re often used for comparison websites or marketplaces.

By breaking down data barriers and enabling interoperability between platforms, open banking can accelerate innovation in the financial services industry by providing businesses with more market-driven initiative that benefits both businesses and customers.

8 examples of open banking services

Open banking is not one discrete product or service. Rather, it’s a framework within which any number of financial services can be enabled. This framework allows third-party service providers, banking apps, and other financial institutions to create innovative financial services that improve efficiency, security, and customer experience.

As open banking initiatives continue to evolve, the scope of financial services coming to market is expected to grow. Here are some of the ways open banking is currently used:

Payment initiation services: Retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. This method can lead to faster settlements, reduced transaction fees, and better security.

Account aggregation: Financial advisors and wealth management firms can pull in data from multiple customer accounts, giving them a more comprehensive view of a client’s financial status. This enables more accurate financial planning and personalized advice.

Automated budgeting: Businesses can offer their employees a smart expense management system that automatically categorizes and tracks spend from multiple bank accounts. This feature improves financial reporting and budget management.

Instant loans and credit scoring: Financial institutions and lenders can access real-time consumer data from open finance APIs to assess credit more accurately, speeding up loan approval processes.

Automated invoice reconciliation: Businesses can use open banking APIs to automate the process of matching invoices to transactions. This can minimize administrative work, reduce errors, and improve cash flow management.

Multibanking platforms: A corporation operating in multiple markets could consolidate its accounts from different banks into a single dashboard, making it easier to monitor global operations.

Personalized marketing: Retailers can analyze transaction data to provide targeted promotions or loyalty rewards that are directly relevant to an individual’s spending habits.

Real-time fraud detection: By analyzing transaction data instantaneously, businesses can detect unusual activity quicker than ever before to reduce the risk of financial loss.

Though these examples are just the start of what’s possible, they offer a glimpse into how open banking can change the financial services industry. As regulations and market-driven initiatives continue to evolve, third-party service providers and other financial institutions are exploring newer possibilities.

Who uses open banking?

Open banking completely restructures how businesses, financial providers, and customers access and use financial data. Within the open banking framework, there are new financial services that cater to nearly every customer and B2B segment. Here are some of the groups that are using open banking initiatives:

Individual customers: Customers use open banking to access a wide range of financial services through third-party applications. They can review their spending patterns, get highly personalized financial advice, or automate transactions such as bill payments.

Financial institutions: Traditional banks, credit unions, and other financial service providers use open banking to modernize their offerings and create better customer experiences. They also collaborate with smaller technology companies to bring innovative services to the market.

Fintech companies: Newer, technology-focused companies use the secure data-sharing features of open banking to create specialized services. These range from budgeting apps to complex financial management solutions for businesses.

Small and midsize businesses (SMBs): These organizations use open banking to automate various tasks, such as reconciling invoices with bank transactions and gaining a clearer picture of their financial status.

Regulatory bodies: The organizations that set and enforce financial rules find open banking useful for creating a standardized environment. This helps protect customers and ensure secure data handling practices within the financial services industry.

Ecommerce companies: Businesses selling products or services online can process transactions more directly, often bypassing traditional payment systems and reducing costs.

Accounting platforms: Financial software can access real-time transaction data, making it easier to manage accounts and reducing the need for manual data entry.

Software developers: With open banking APIs, software developers can create a range of beneficial services and tools for both individual customers and businesses, opening up new avenues for innovation.

Credit and lending institutions: These entities can make faster and more accurate decisions by accessing financial data quickly, optimizing loan provision and credit scoring procedures.

Open banking is creating a new wave of innovation in the financial sector, allowing third-party service providers to create banking products that improve data security, efficiency, and accessibility. As open banking regulations continue to evolve, the financial ecosystem will become more interconnected, benefiting customers and businesses alike.

Benefits of open banking

Open banking provides businesses with a variety of opportunities to improve operations, comply more easily with regulations, and offer value-added services that can position them effectively for the future. Here’s how businesses can benefit from open banking:

Data-driven decision-making: Open banking allows businesses to obtain detailed financial data that can inform strategic choices, from risk assessment to investment planning. The depth of available information surpasses that of traditional financial statements in assessing investment opportunities and managing liquidity effectively.

Operational agility: Open banking offers accelerated data flow, expediting transactions and enabling quicker reconciliation. This speed improves cash flow management and fast-paced market conditions.

Interoperable collaboration: Open banking creates an environment where financial institutions and tech-driven companies can innovate jointly. This translates into a broader and more sophisticated service offering for business customers.

Optimized payment processes: Open banking APIs allow for more direct payment methods, often bypassing traditional gateways and resulting in lower transaction costs.

Regulatory alignment: Open banking frequently incorporates standardized protocols and strong data protection measures, helping businesses meet regulatory requirements more easily.

Customer personalization: Businesses can offer customized financial services to their customers, from specialized lending solutions to treasury services, all enabled by the rich data accessible via open banking.

Resource allocation: Simplified financial operations mean staff can focus on other areas of the business. Whether it’s automating reconciliation or smoothing out invoicing processes, open banking APIs can lead to more effective use of personnel.

Market penetration: Open banking can help businesses enter new markets, facilitated by partnerships with local fintech companies and easier access to customer data for localized customization.

Innovation catalyst: For businesses in the tech and financial sectors, open banking provides a dynamic way to offer new services that can be monetized, increasing revenue streams and customer retention.

By integrating third-party service providers and embracing open banking apps, businesses can stay competitive, improve operational efficiency, and deliver cutting-edge financial services.

Challenges of open banking

While open banking offers many benefits and opportunities for innovation, it also has challenges that businesses and financial institutions need to be aware of. From integration issues to security vulnerabilities and regulatory concerns, here are some of the potential drawbacks of open banking:

Inconsistent quality: Not all third-party service providers adhere to the same standards. While some services are excellent, others may have inconsistencies in quality, leading to service interruptions or unreliable data, or even security vulnerabilities causing operational difficulties and necessitating costly adjustments.

Integration issues: Combining multiple third-party services and APIs might cause unanticipated technical challenges due to compatibility issues. These complications often require specialized expertise and additional hours to troubleshoot, affecting operational timelines and potentially increasing costs.

Limited standardization: The absence of universal standards complicates the way services talk to each other. This lack of consistency may require manual intervention to ensure the systems are compatible and functional.

Regulatory hurdles: As open banking evolves, so do its regulations. Keeping up to date with these changes can be a resource-intensive task, requiring a dedicated internal team or external experts to help your business stay compliant. Failing to adapt can result in penalties or legal issues.

Accountability gaps: With various parties involved, determining fault in the case of an error or security breach is more complex. This ambiguity can slow down problem-solving and lead to prolonged downtimes or unresolved customer issues.

Hidden costs: Beyond API subscription fees, there may be hidden costs tied to compliance or technical adjustments. These expenses can mount over time, possibly offsetting any cost-saving benefits of open banking.

Dependency risks: Outsourcing core financial functions to third-party services puts businesses under their control, to some extent. Any change in their service availability or terms of use could necessitate an abrupt shift in the operations that use those services, which could become costly and time-consuming.

Market uncertainties: Open banking is still an evolving field, subject to changes in technology and public sentiment. These unpredictable factors could influence long-term strategies, making it challenging to plan with certainty.

Security vulnerabilities: Despite best efforts to keep systems safe, potential gaps in data protection and security protocols could be exploited. The repercussions of a data or other security breach could extend beyond financial loss to reputational damage, affecting customer trust and possibly leading to legal consequences.

The potential of open banking to elevate customer service and generate new revenue sources is not without added risks. Businesses should exercise prudence when adopting this technology and take stringent steps to safeguard security and privacy. With the right risk-mitigation measures, open banking initiatives can create lasting value while minimizing risks.

How Stripe Financial Connections can help

Stripe Financial Connections is a set of application programming interfaces (APIs) that allows you to securely connect to your customers’ bank accounts and retrieve their financial data, enabling you to build innovative financial products and services.

Financial Connections can help you:

- Simplify onboarding: Offer a seamless, instant bank account verification process that does not require manual identity and account verification.

- Access rich financial data: Retrieve comprehensive information about your customers’ bank accounts, including balances, transactions, and account details.

- Automate recurring payments: Enable your customers to securely link their bank accounts for recurring payments, improving payment success rates.

- Enhance risk management: Analyze customers’ financial data to make more informed decisions about credit, lending, and other financial products.

- Comply with regulations: Financial Connections helps you meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

- Innovate with confidence: Build new financial products and services on top of the secure, reliable Financial Connections infrastructure.

Learn more about how Financial Connections can help.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.