Anyone who buys goods or services in Germany usually pays value-added tax (VAT). Unlike private individuals, companies can get a refund on VAT from the German tax office as input tax. In this article, we discuss what input tax is and how it differs from VAT. We also explain the requirements for input tax deduction, how businesses record input tax, and when to claim it.

What’s in this article?

- What is input tax?

- What is the difference between input tax and VAT?

- What are the requirements for an input tax deduction?

- How do businesses record input tax?

- When can businesses claim input tax?

What is input tax?

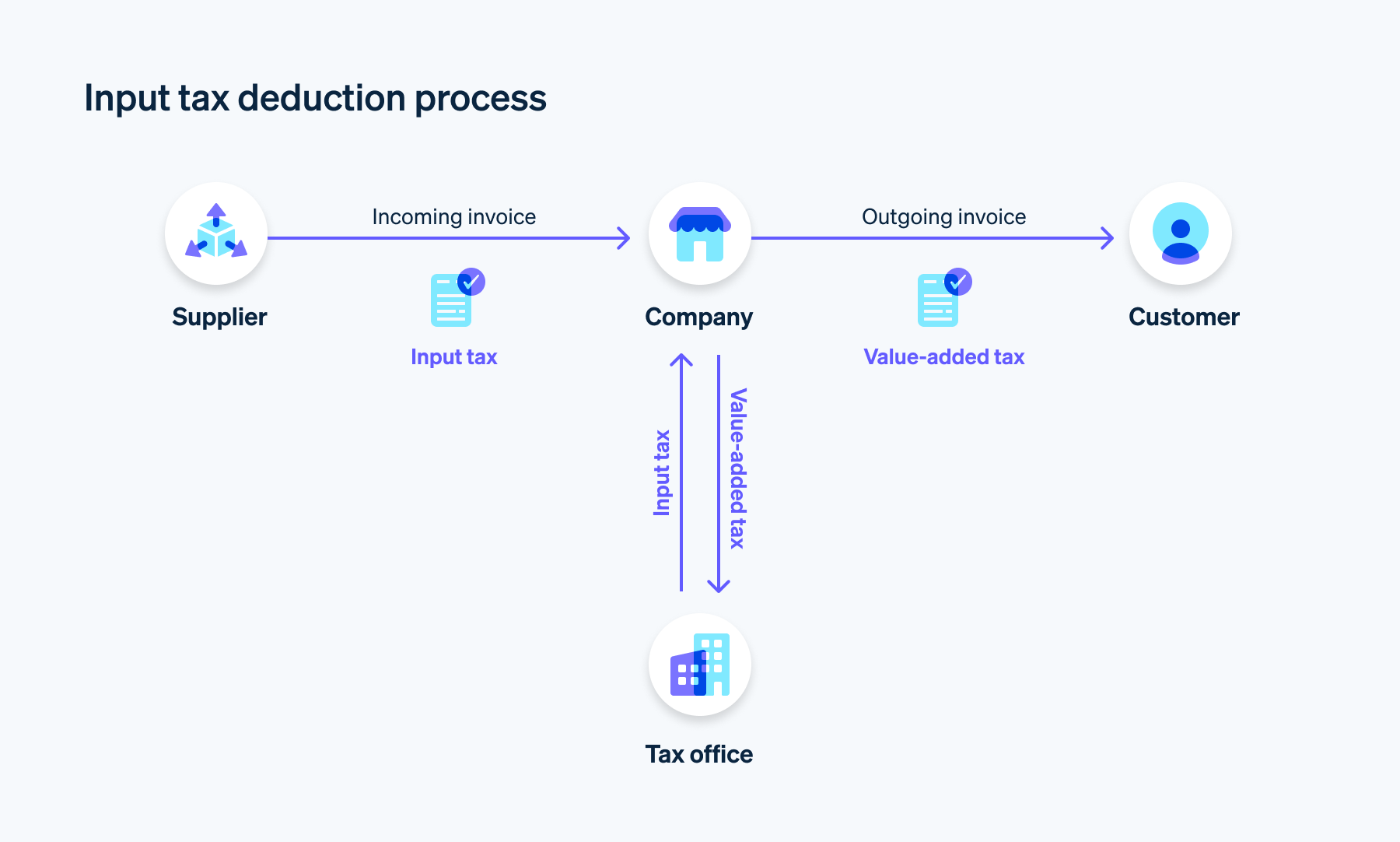

According to the German VAT Act (UStG), all companies that generate taxable sales collect VAT on deliveries and services, and pay it to the German tax office (Section 1, Paragraph 1, No. 1 of the UStG). At the same time, companies also pay VAT to their suppliers when they purchase goods or services. The tax authority calls this “input tax.”

For example, if a craft business buys a tool for €119, the gross amount includes €19 VAT. The company can claim a refund on this input tax and deduct it from its own VAT liability. This procedure is called “input tax deduction.” It ensures that VAT does not create an additional burden for companies. Ultimately, only the final customers pay VAT, while companies only pay it temporarily.

What is the difference between input tax and VAT?

The difference between input tax and VAT lies in their roles and functions within the VAT system. Companies act as intermediaries by collecting VAT from customers on their sales and simultaneously paying input tax on their purchases from other companies. The company can then deduct this input tax as a business expense from collected VAT so that it only pays the difference to the tax office. Therefore, input tax is the VAT that companies pay on purchases from other companies.

In principle, input tax is simply the business-to-business purchasing side of VAT, so the same tax rates apply: the standard tax rate of 19% and the reduced tax rate of 7%.

What are the requirements for an input tax deduction?

For a company to claim an input tax deduction, it must meet certain requirements of the UStG. For example, input tax deduction is only available to entrepreneurs (Section 2 of the UStG). This includes freelance professionals and sole proprietors, not small-scale entrepreneurs (Section 19 of the UStG).

Furthermore, input tax deduction is only possible for taxable transactions, and if the service or delivery takes place within the scope of business activities and exclusively for the operational purpose of the company. Additionally, businesses can only claim this deduction if they retain the service or delivery from another taxable company. The other taxable company must issue a proper invoice. To prove VAT was paid, invoices from third parties must contain all mandatory information (Section 14 of the UStG).

You can find detailed information on the requirements in our article on input tax deduction.

How do businesses record input tax?

When a company buys goods or services, the VAT—which can later be claimed as input tax—is usually shown on the supplier’s invoice together with the purchase cost. To correctly deduct paid input tax, businesses must record incoming invoices in the accounting system.

For example, if a company purchases goods worth €10,000, an input tax of 19% (i.e., €1,900), is due. The liabilities amount to a total of €11,900, which the company must pay to its suppliers. From there, the input tax should be posted to a special input tax account. This will show the company’s claim against the tax office from the input tax deduction. In this way, the input tax account is an asset account that grows over time.

When can businesses claim input tax?

Companies can claim input tax as part of their preliminary VAT returns and annual VAT returns. The input tax deduction enables them to offset the VAT other companies charge against the VAT they collect. This difference is their VAT liability.

For the calculation, companies use the relevant sum of all VAT amounts and the sum of all input tax amounts. Then, they can calculate VAT liability on the basis of the agreed fees or the fees received (Sections 16 and 20 of the UStG) using the following formula:

VAT Collected − Deductible Input Tax = VAT Liability

Companies must submit preliminary VAT returns monthly or quarterly—depending on the amount of VAT paid in the previous calendar year (Section 18, Paragraph 1 of the UStG). At the end of the year, companies subject to VAT must also submit an annual VAT return to the tax office. This includes VAT collected, deductible input tax, and final VAT liability for the entire year.

If you need help with the calculation, try Stripe Tax: Tax lets you automatically determine the correct tax amount. You can also see at a glance which purchases and sales have been subject to VAT. In this way, you always have an overview of the input tax that you can claim and the expected VAT liability. You can easily export all VAT transactions with Tax and then use them for calculations.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.