LLCs and S corps are two of the most common business entities in the US. However, small business owners are often unsure whether an LLC or S corp is the best fit—especially regarding tax advantages, legal protections, and administrative requirements. With so many entrepreneurs opting for one of these two structures, it’s important to understand the differences between LLCs and S corps in order to choose the best option for your business.

Here’s a detailed explanation of the key differences between LLCs and S corps, including what you need to know to decide which structure is right for your business.

What’s in this article?

- What is an LLC?

- What is an S corp?

- What is the difference between an S corp and an LLC?

- Can an LLC be an S corp?

- Can an S corp own an LLC?

- When do LLCs vs. S corps make the most sense?

- How to choose between an LLC and an S corp

- How Stripe can help

What is an LLC?

LLC, or “limited liability company,” is a type of business entity that combines the limited liability protection of a corporation with the flexibility and tax benefits of a partnership. Forming an LLC establishes a business as a separate legal entity from its owners, who are called members, meaning they are not personally responsible for the debts and obligations of the business.

LLC members pay self-employment taxes on their earnings. Alternatively, an LLC can elect to be taxed as a corporation, which may offer different tax advantages depending on the business structure.

What is an S corp?

An S corporation (S corp) is a business structure that is typically more appropriate for small and medium-sized businesses that want to avoid the double taxation that can occur with a traditional corporation.

In an S corp, the company’s income, deductions, and credits pass through to the shareholders’ personal tax returns, and the company itself does not pay federal income tax. This means that the shareholders of the S corp are only taxed once on their share of profits at their personal income tax rates—rather than twice, as a company and as shareholders.

To be eligible for S corp status, a business must meet specific IRS requirements, such as:

- Having no more than 100 shareholders

- Being organized as a domestic corporation

- Allowing only US citizens or resident aliens as shareholders

- Issuing one class of stock (i.e., no preferred stock)

- Meeting all S corp election filing requirements with the IRS

S corps are a popular choice for businesses that want the liability protection of a corporation but prefer to be taxed like a partnership or sole proprietorship. However, S corps require more administrative work, such as filing annual reports and meeting payroll tax obligations for owner-employees.

What is the difference between an S corp and an LLC?

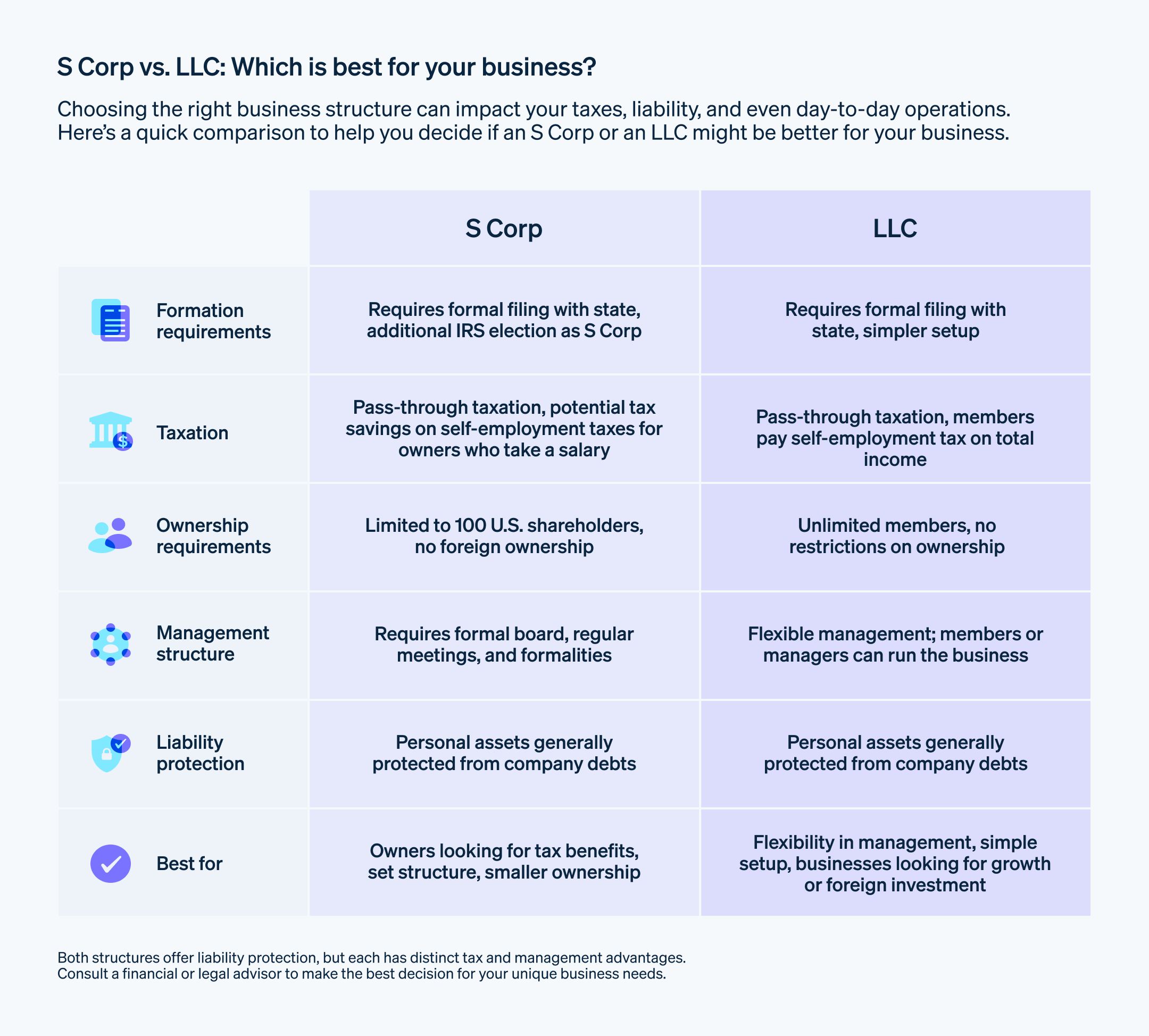

The choice of whether to organize as an S corporation or an LLC depends on the specific needs and goals of the business owners. While both S corporations and LLCs provide limited liability protection to their owners, their tax treatment, ownership structure, and management requirements differ significantly.

Here’s an overview of the key differences between these two options:

Taxation

By default, LLCs are pass-through entities, meaning profits and losses pass through to owners’ personal tax returns. However, LLCs can elect to be taxed as a corporation (C corp or S corp) if desired. S corps are always pass-through entities, meaning they avoid double taxation at the corporate level. However, S corps can provide tax savings on self-employment taxes by allowing owner-employees to take part of their income as distributions, which are not subject to payroll taxes.Ownership

S corporations restrict shareholders to US citizens or residents, and there can be no more than 100 total shareholders. LLCs have no such restrictions. Additionally, S corporations can issue only one class of stock, while LLCs can have multiple classes of ownership interests.Management

LLCs offer more flexibility around management structure, since they can be managed either by the owners (“member managed”) or by a designated manager (“manager managed”). S corporations are required to have a board of directors, designate officers, and hold regular board and shareholder meetings.Formalities

S corporations generally have more formalities and reporting requirements compared to LLCs, such as needing to hold regular meetings and maintain corporate records. However, some states require LLCs to submit annual reports and fees.

Can an LLC be an S corp?

Yes, an LLC can elect to be taxed as an S corp. This allows the business to benefit from the pass-through taxation that S corps enjoy while maintaining the flexibility and limited liability protection of an LLC. To qualify for S corp taxation, the LLC must meet certain requirements, including having no more than 100 shareholders (all of whom are US citizens or residents), having only one class of stock, and meeting certain restrictions on the types of shareholders and types of stock that can be issued.

While an LLC can elect to be taxed as an S corp, it’s still classified as an LLC under state law and must comply with all the requirements and regulations governing LLCs in the state where it’s registered. Companies that opt for S corp taxation might also have to follow additional regulations and requirements of S corps, such as:

- Filing annual reports with state and federal agencies

- Maintaining accurate business records

- Following payroll tax rules for owner-employees

- Adhering to shareholder and stock class restrictions

It can get complicated, which is why it’s important to work with a tax attorney and accountant to be sure your business complies with IRS regulations and state requirements.

Can an S corp own an LLC?

Yes, an S corp can own shares in other corporations or own interests in other types of businesses, including LLCs. If an S corp owns an LLC, the LLC is considered to be a separate legal entity, and the S corp’s ownership interest in the LLC is treated as a business asset of the S corp. The S corp will report its ownership interest in the LLC on its tax return, and any income or losses generated by the LLC will flow through to the S corp and be reported on the S corp’s tax return.

In this scenario, the S corp would be considered the parent company or holding company of the LLC, and the LLC would be a subsidiary or wholly owned subsidiary of the S corp. The S corp would have the power to make decisions and take actions on behalf of the LLC, as well as the responsibility for any liabilities or debts incurred by the LLC. This structure can provide tax benefits and liability protection while also keeping business entities legally distinct.

When do LLCs vs. S corps make the most sense?

Both LLCs and S corporations offer advantages and drawbacks, depending on specific business needs. Here are some situations when you might choose one over the other for your business:

If you care about:

- Flexibility in ownership, management structure, and tax status, you might prefer an LLC. LLCs can be owned by one or more people, can be managed by the owners or by a designated manager, and can be taxed either as a pass-through entity or a corporation.

- Minimizing reporting requirements, you might prefer an LLC. LLCs generally have fewer formalities and reporting requirements than S corps, which can make them easier—and less expensive—to manage.

- Self-employment taxes, you might prefer an S corp. LLC owners must pay self-employment taxes on all profits, which can be higher than the taxes paid by S corp shareholders. S corp owners can avoid some self-employment taxes by paying themselves a salary and accessing additional profits as distributions, which are not subject to self-employment taxes.

- Extending the lifespan of your business, you might prefer an S corp. In some states, LLCs have a limited lifespan and may need to be dissolved after a certain period of time or after a specific event, such as the death of an owner.

- Access to capital, you might prefer an S corp. Compared to S corps, LLCs may have limited options for raising capital, such as through stock offerings or taking on investors. S corps have restrictions on who can be a shareholder and how many shareholders the corporation can have, which can make this structure attractive to smaller businesses that want to limit the number of owners.

How to choose between an LLC and an S corp

It’s important to do your research and due diligence before committing to a business structure. Consider the options for ownership structure, management, taxation, and liability protection. Think holistically about your business and long-term business objectives. Which aspects of each structure feel the most important to you, as an owner?

Here are simple steps to help you decide between an LLC and an S corporation:

- Evaluate your business needs: Consider the type of business you run, the number of owners or shareholders you have, the industry you operate in, and your long-term goals for the business.

- Understand the tax implications: Compare the tax advantages and disadvantages of each structure. These include pass-through taxation for LLCs and S corps, self-employment taxes for LLCs, and the potential for tax savings with S corps. There are benefits and drawbacks with either option, so the specifics of your business will dictate which is right for you.

- Consider liability protection: Both LLCs and S corps offer limited liability protection for owners, but LLCs may provide more flexibility in terms of personal asset protection—especially if the business has multiple owners.

- Compare management structures: Think about the level of management control and flexibility you need, including whether you want to be actively involved in running the business or prefer to hire a designated manager.

- Understand the compliance requirements: Both LLCs and S corps have specific requirements that must be met, including rules about filing paperwork, holding regular meetings, and maintaining accurate records. Consider the time and resources needed to comply with these regulations.

- Seek professional advice: Before making a decision, consult with a qualified attorney or accountant who can help you understand the legal and tax implications of each structure. They can help you make an informed decision.

How Stripe can help

Stripe Atlas makes it simple to form an LLC or C corp and set up your company so you’re ready to charge customers, hire your team, and fundraise as quickly as possible.

Applying to Atlas

It takes less than 10 minutes to apply. You’ll choose your company structure (LLC, C corporation, or subsidiary) and pick a company name. Our instant company name checker will tell you if it’s available before you submit your application. You’ll add an address and phone number, and review and sign your legal documents in one click. Founders are eligible for a free virtual address for one year.

Forming the company in Delaware

Atlas will review your application and file your formation documents in Delaware within one business day. All Atlas applications include expedited 24-hour processing by the state, for no extra fee. Atlas charges $500 for your formation and your first year of registered agent services (a state compliance requirement), and $100 each following year to maintain your registered agent.

Getting your IRS tax ID (EIN)

After Atlas finishes forming your company in Delaware, it will file for your company’s IRS tax ID, known as an EIN. Founders who provide a US-based address, phone, and Social Security number are eligible for expedited processing; all other users will receive standard processing. For standard orders, Atlas calls the IRS to retrieve the EIN for you, using real-time IRS data to determine when your filing is likely to be available. You can read more about how Atlas retrieves your EIN.

Partner perks and discounts

Atlas partners with various third-party tools to offer special pricing and promotions to users. It offers discounts on engineering, tax, finance, compliance, and operations tools, from companies including OpenAI and Amazon Web Services. Atlas also partners with Mercury to provide automatic onboarding using your Atlas company information, so you can start banking even faster. And Atlas users can also access discounts on other Stripe products, including up to one year of free payment processing.

Read our Atlas guides for startup founders, learn more about how Atlas can help you set up your new business quickly and easily, and get started today.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.