Digital wallets – also known as e-wallets – have become a key payment method in France for both online and in-store transactions.

Juniper Research forecasts that by 2029, two-thirds of the global population – about 5.6 billion people – will adopt digital wallets. To support digital wallets successfully, it's important for businesses to understand how they work and their benefits.

If you run a business in France, here's what you need to know about digital wallets, including how to start supporting them as a payment method.

What's in this article?

- What is a digital wallet?

- What are digital wallets used for?

- How digital wallets work

- The main digital wallets in France

- Are digital wallets secure?

- Why businesses should accept digital wallets as a payment method

- How to start accepting digital wallets as a payment method

- What are the costs associated with digital wallet payments?

What is a digital wallet?

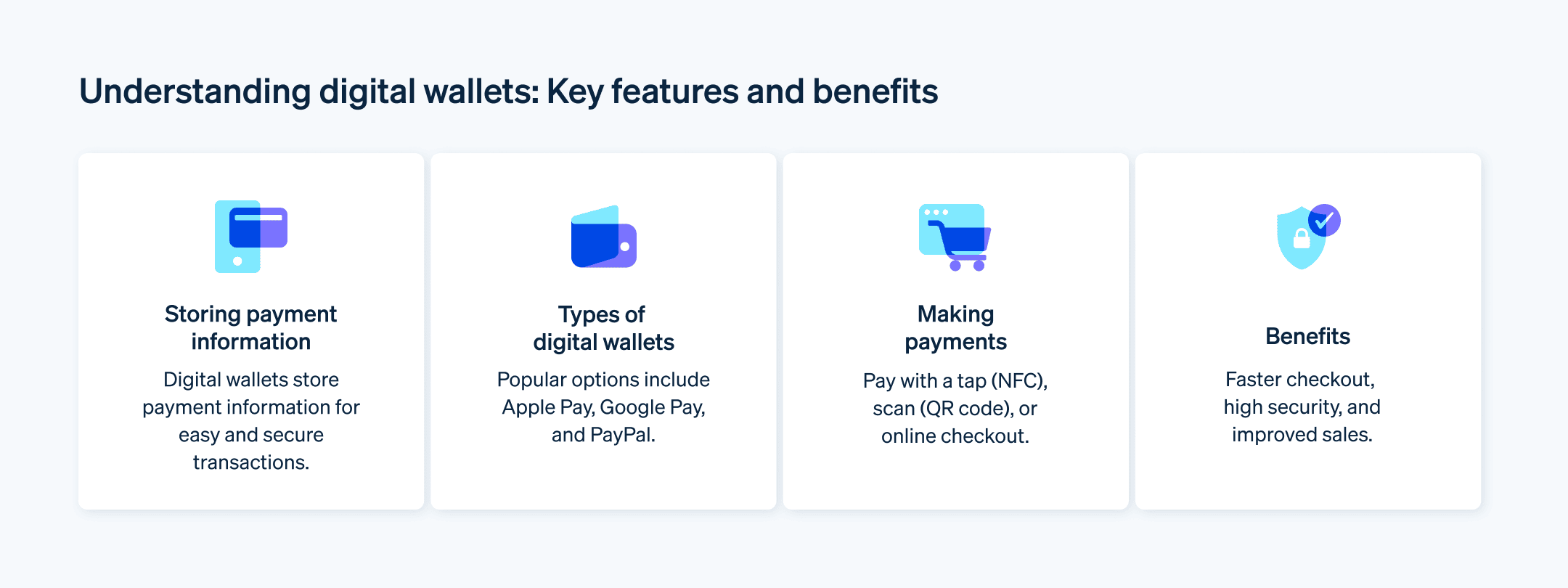

A digital wallet is a mobile application that stores payment details, such as credit card numbers. It allows customers to make payments directly from a mobile device (e.g. a smartphone or smartwatch) without using a physical card. It's not necessary to enter your card and billing details manually, which can make online payments easier and faster.

Digital wallets are also known as e-wallets, electronic wallets, mobile wallets, and virtual wallets.

What are digital wallets used for?

Digital wallets are primarily used for secure storage of information related to various payment methods, such as bank cards, credit cards, and bank accounts.

In addition to payment methods, digital wallets can also store:

- Gift cards, coupons, and store loyalty cards

- Driving licences, train tickets, and boarding passes

- Tickets to events, such as performances or concerts

- Health insurance cards, identification (ID) cards, and proof of vaccination

Apps that support both online and in-person payments include PayPal, Venmo, and Cash App. Increasingly, French banks and credit card companies have begun integrating their own digital wallet solutions into their mobile apps.

How digital wallets work

Digital wallets rely on various contactless technologies or quick response (QR) codes to communicate with payment terminals. This enables fast and secure data exchanges and allows payments to be made without using a physical card.

NFC technology

Near-field communication (NFC) typically supports contactless payments, such as Tap to Pay. This technology allows devices – such as smartphones, smartwatches, and some bank cards – to send payment information to card readers and terminals without the need for physical contact.

MST technology

Magnetic secure transmission (MST) allows smartphones to send an encrypted signal that works like the magnetic strip on a debit or credit card. MST-enabled digital wallets send encrypted payment data to the card reader when the device is held near it or tapped on it.

QR codes

QR codes are matrix barcodes that can be scanned using a mobile device's camera to initiate a data transfer. They can be used to make payments with digital wallets.

The main digital wallets in France

Various digital wallets are available in France, where around 67% of people use them for payments and storing important information. Most leading international digital wallets – including Apple Wallet, Google Wallet, and Samsung Wallet – are available in France, along with a range of homegrown applications.

Made-in-France digital wallets

On the French market, local digital wallet applications have emerged, including:

- Wero: A European digital wallet that replaced Paylib in France in 2024

- Sumeria: Launched by the startup Lydia and facilitates payments

- Lyf: Developed by BNP Paribas and Carrefour and is offered in France

Crypto wallets

Digital wallets are used with traditional money, while crypto wallets are designed specifically for cryptocurrencies. French unicorn Ledger allows individuals to store and use crypto assets securely. International crypto wallets – such as CoolWallet and Zengo – are also popular in France.

Pre-paid digital wallets

Pre-paid digital wallets are virtual accounts businesses can use to store funds for future payments. Unlike traditional wallets, which are connected to bank accounts or credit cards, prepaid digital wallets are preloaded with a specific amount of money.

Non-payment digital wallets

Digital wallets will soon support ID cards in France. All EU countries will be required to offer their citizens a digital identity wallet as of 2026. Accepting European digital identity wallets from other EU countries will eventually become standard practice.

Are digital wallets secure?

Digital wallets are a secure payment method, largely due to the encryption and tokenisation of all transaction data. Instead of sending the customer's actual bank account or card number, the digital wallet generates a one-time code (i.e. token) made up of random numbers and sends it to the card reader.

If the business or payment provider experiences a security breach, digital wallet payments are more secure than traditional card payments because the actual card number isn't communicated.

To confirm payments, digital wallet apps also typically integrate extra security layers, such as facial recognition or personal identification numbers (PINs). Compared to card-based transactions, digital wallets rank among the most secure payment methods.

Why businesses should accept digital wallets as a payment method

If you operate a business, it's important to consider supporting digital wallets, as they are becoming increasingly popular. According to a 2024 study, the use of digital wallets is on the rise in France, with 38% of people using them to pay for purchases. There are also other benefits for businesses in France:

Easy, convenient use: Digital wallets can make payments more efficient for businesses and customers, reduce wait times, and boost sales. Customers can experience smoother payments.

Increased sales: Digital wallets can make checkout frictionless, which can help boost conversion rates and revenue. Offering a transparent payment process supporting multiple payment methods – including digital wallets – can remove obstacles that might deter customers from completing a purchase.

Higher mobile conversion rates: Customers might abandon mobile purchases when they have to take out their payment cards and enter details manually. Using a digital wallet can eliminate this lengthy process.

Advanced security: Digital wallets are significantly more secure than other card-based payment options. Tokenisation offers superior security and lowers the risk of credit card fraud. Because they are so secure, digital wallets can help businesses cut operating costs and expenses related to fraud claims and payment disputes.

How to start accepting digital wallets as a payment method

Accepting digital wallets requires a specific setup for online and in-store payments. Most payment service providers (PSPs) already offer the hardware and software needed to support digital wallet transactions. Here's how to accept various types of digital wallet payments:

In person: Businesses need NFC-enabled point-of-sale (POS) terminals or card readers. This is the basic requirement to support contactless digital wallet payments in physical stores. Most current payment terminals – including Stripe Terminal – allow businesses to accept digital wallet payments.

On the internet: If your business already accepts online payments, verify that your PSP supports digital wallets.

Via mobile: Make sure your PSP supports digital wallets as a mobile payment option. Customers can confirm the purchase using fingerprints, facial recognition, mobile codes, or digital wallet apps.

Stripe Payments allows you to deliver a seamless customer experience and save thousands of development hours. It supports over 125 payment methods, including Link, Stripe's digital wallet.

What equipment do businesses need to support digital wallets?

Businesses need an NFC-enabled card reader and a POS software solution compatible with this payment method.

Most online platforms and marketplaces are already set up to accept a range of digital wallets. Typically, no additional steps are needed to enable digital wallet payments.

What are the costs associated with digital wallet payments?

Accepting digital wallet payments generally costs about the same as processing bank card transactions. Businesses are usually charged a percentage of the transaction amount, and a flat fee or monthly fee might be included.

Typically, a basic hardware upgrade is all that's needed to start accepting digital wallet payments.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accuracy, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent lawyer or accountant licensed to practise in your jurisdiction for advice on your particular situation.